Nigeria: Gas is the new oil [NGW Magazine]

When the Buhari administration began in 2016, its focus was on diversifying the economy to make it less reliant on oil. Five years down the line, and it appears the administration is finally ready to take the plunge, as Muhammadu Buhari is settling down after being elected for a second term.

Maintaining foreign direct investment (FDI) in Nigeria’s gas sector is one of the goals that the Buhari administration has set itself, as the country has more gas than oil.

This neglect of gas partly explains the delays in approving the construction of the seventh train at Nigeria LNG, and the debottlenecking of the others. The project only received the green light late last year. NLNG’s managing director Tony Attah expressed his frustration at how long it was taking Nigeria to capitalise on its gas resources, estimated by BP at 5.5 trillion m3 proven.

“Nigeria was number 4 in the rankings of LNG suppliers but we are slipping down the tanks because of countries increasing their LNG capacity,” he said. NLNG launched its sixth train more than a decade ago. The country should be constructing its 12th rather than its seventh train by now, Attah said.

“It is time for gas. Beyond the changing energy mix, we have seen countries like Qatar ride on the back of gas to development,” he explained. “Nigeria has ridden on the back of oil for far too long. We think it is time for Nigeria to ride on gas. The best time to develop our gas resources in Nigeria is yesterday. The next best time is NOW,” he concluded.

Nigeria ‘a major draw for FDI’

According to the United Nations Conference on Trade and Development (Unctad) 2019 World Investment Report, Nigeria is Africa’s third largest host economy for FDI in Africa, after Egypt and Ethiopia. And its hydrocarbons and energy are chiefly what attract investors.

In October 2016, the Buhari administration introduced the ‘Seven Big Wins’ concept, which would transform the country from an oil-based economy to a gas-based economy. This would be achieved by developing gas infrastructure; commercialising gas that is now flared; implementing a gas market framework; and maximising the use of gas in order to develop the national economy.

Of all these, the Nigerian Gas Flare Commercialisation Programme (NGFCP) is the most prominent, although it has not yet been fully implemented. The realities on ground have conflicted with the theory, leading to delays in the timeline.

However, as a part of the NGFCP, the Buhari administration has successfully instituted the National Oil Spill Detection and Response Agency (Nosdra) Gas Flare Tracker system, which shows reliable data on how much gas is being flared in various states around the country.

Nigeria’s minister of state for petroleum resources, Timipre Sylva, told reporters at a recent press conference in the national capital Abuja that the Buhari administration will advance its earlier goals, starting with the long-awaited signing of the Petroleum Industry Governance Bill (PIGB) by June this year, intended to root out corruption.

In his first official media appearance since assuming office in August 2019, Sylva assured Nigerians that the bill, which encompasses issues on governance, host communities, tax and administration provisions, would be signed into law later this year.

This is long overdue: the International Energy Agency (IEA) pointed out in 2019 that the bill would be crucial to underpinning national gas policy. Its implementation will foster gas-to-power projects and the extension of the gas network to industrial hubs in Nigeria.

The PIB, an all-encompassing piece of legislation when first introduced in 2008, was supposed to be a game-changer. It was meant to significantly impact the regulation and administration of Nigeria’s oil and gas sector.

Since the fourth quarter of 2019, the ninth National Assembly – the Senate and House of Representatives – have worked towards harmonising the bill, so that it can be presented once again for presidential signature.

Buhari had declined to approve it in August 2018, as he disagreed with some of the constitutional and legal issues. In 2019, the government adopted the National Policy on Methanol Fuel Production Technology, which is now in its first phase of implementation. The federal government is also collaborating with Delta State in the South-South region to establish the $10mn Kwale Industrial Park.

But in December 2019, Senator Ahmad Lawan, Nigeria’s current senate president, said Nigeria’s petroleum industry was stagnating for lack of fundamental reform.

“Our oil and gas-related committees are, therefore, expected to work hard to take the lead in our determination to reform this vital sector. It is the desire, indeed the design of this Senate that, the Petroleum Industry Bill is passed before the end of 2020,” he said. According to the IEA, Nigeria loses as much as $15bn every year that the bill is not enacted.

The PIB seeks to empower institutions and not individuals, take away bad governance which leads to inefficiency, ineffectiveness, rent-seeking tendencies, inequity, secrecy and corruption in Nigeria's petroleum industry.

The PIB failed to be passed into law for 17 years, because of its size and the inability of various stakeholders to agree on all the fundamentals that the law was supposed to address.

Timipre Sylva has also indicated that the Buhari administration will focus on developing gas-based industries as a way of increasing capacity in the industry. Power generation, industrial heating, fertiliser and petrochemical manufacturing all use gas, and it is also used as feedstock for steel manufacturing.

New rules for third-party access

Sylva also said the Buhari administration will focus on using more gas: Nigeria has the largest gas resources on the continent, but not enough value is being extracted from them. The Buhari administration will put factors in place this year to enable this.

“In fact, currently, recognising the potential of our enormous natural gas resources and the unprecedented growth in domestic gas demand, the federal government of Nigeria through the ministry of petroleum resources over the years has championed various interventions to stimulate gas utilisation and monetisation,” he said.

He told an industry summit February 10 that new regulations for gas transportation, aimed at expanding the fuel’s use and incentivising private investment in pipelines, would help reduce flaring, Reuters reported.

The rules are expected to lead to greater connectivity within Nigeria’s gas network, and enforce third-party access to pipelines, the minister said. They will “drive gas commercialisation” and apply to all contracts between pipeline operators and users, he said.

The objective is to establish “open and competitive access to Nigeria’s gas infrastructure,” and existing agreements with pipeline operators must adapt to the new framework within six months.

Nigeria’s pipeline projects

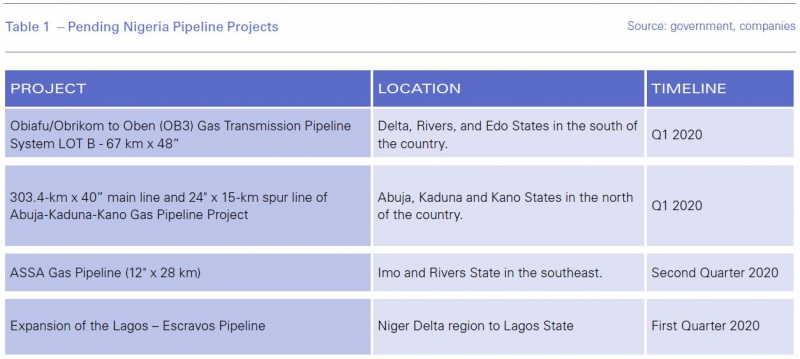

Since the Buhari administration came into power, it has, in collaboration with the state Nigerian National Petroleum Corporation and other energy partners, started four gas pipeline projects (see table).

In terms of power generation, some experts have advocated for a liberalisation of the sector, so businesses can generate and distribute power. In his 2020 New Year address, Buhari said the government will empower more businesses to sell and distribute power, so as to bridge the gap of electricity supply in the country.

Liberalising the power sector involves structural re-organisation and introducing competition into the supply chain. If Nigeria adopts this, consumers will be able to vary demand in response to the price.

Nigeria’s current generating capacity stands at about 4 GW, for a population of over 160mn, and so power cuts are a regular occurrence, particularly in rural areas. To combat this, in May 2019 the Rural Electrification Agency (REA) launched the mini-grid and solar home components of the Nigeria Electrification Project.

The mini grid component is aimed at extending electricity services to 300,000 households and 30,000 enterprises in rural areas by 2023.

As a way of improving Nigeria’s power deficit, in the last quarter of 2019 the World Bank approved Nigeria’s request for a $3bn loan to expand the transmission and distribution networks.

According to Nigeria’s finance minister, Zainab Ahmed, the loan will come in four tranches of $750mn each and approval of the first tranche will be this April.

In its 2019 report, the Nigeria Economic Update, the World Bank said that for Nigeria to increase its economic capacity, the government must focus on reducing regulatory discretion, as this approach will attract foreign and domestic investment to the nonoil sector, encourage competition. The report also suggests that Nigeria must reduce investment risks and ensure policy transparency and predictability to promote economic growth.

|

Gas to Power is happening UK-listed Savannah Petroleum is at the opposite end of the supply side from Italian Eni – the co-owner of Nigeria LNG and also a major gas supplier to the power market. Savannah’s acquisition of indebted Seven Energy took two years to secure government approval but now growth seems assured. Despite its size, Savannah’s gas output accounts for a tenth of Nigeria's power; and the population and the economy are both growing. Its Nigerian subsidiary Accugas had four customers until this year: Calabar Nigerian National Integrated Power Plant; the Mfamosing Cement Plant (in Cross River State) and Ibom Power (a power station owned by Akwa Ibom State). They have contracted to buy this year a minimum take-or-pay volume of 141.4mn ft³/d. At full rates it sells the gas at a volume-weighted average price of $3.41/mn Btu, or about a third of the price of diesel locally. In January, Accugas signed an interruptible gas sales agreement (IGSA) with First Independent Power (FPI) for its 180-MW Afam plant in late January. As before, its 80%-owned upstream subsidiary Uquo will produce the gas, this time at a maximum rate of 35mn ft³/day for one year but renewable thereafter. “The commercial terms of the FIPL IGSA are expected to augment the weighted average profitability of the Accugas portfolio while Accugas' sales volumes, revenues and cash flows are expected to increase,” Savannah said, adding it was “confident that this will be the first of several new gas sales agreements signed over the course of 2020 and, through Accugas, we aim to be seen as the gas supplier of choice to the power sector in Nigeria." -- William Powell |