Transport may prove Arctic LNG-2’s Achilles heel [Gas in Transition]

According to Russian Deputy Prime Minister Alexander Novak, speaking in February, Russia will expand its LNG capacity to 110mn tonnes/year by 2030, up from today’s 30mn t/yr. It looks like a tall order.

Central to this expansion will be the Arctic cluster, where capacity will treble from 17.4mn t/yr to 60mn t/yr. The first step is to complete the three trains of the sanctioned Arctic LNG-2 project, which will add a capacity of 19.8mn t/yr.

LNG capacity in the Baltic area (Portovaya 1.5mn t/yr and Vysotsk 0.66mn t/yr) will rise to 15.5mn t/yr, while capacity on Sakhalin Island will grow from 9.6mn t/yr to 15mn t/yr and from the Murmansk LNG cluster from zero to 20mn t/yr. The 20mn t/yr Murmansk LNG project, to be built by Russian gas producer Novatek, operator of both Yamal LNG and Arctic LNG-2, received priority approval from the Russian government in October and could begin construction this year.

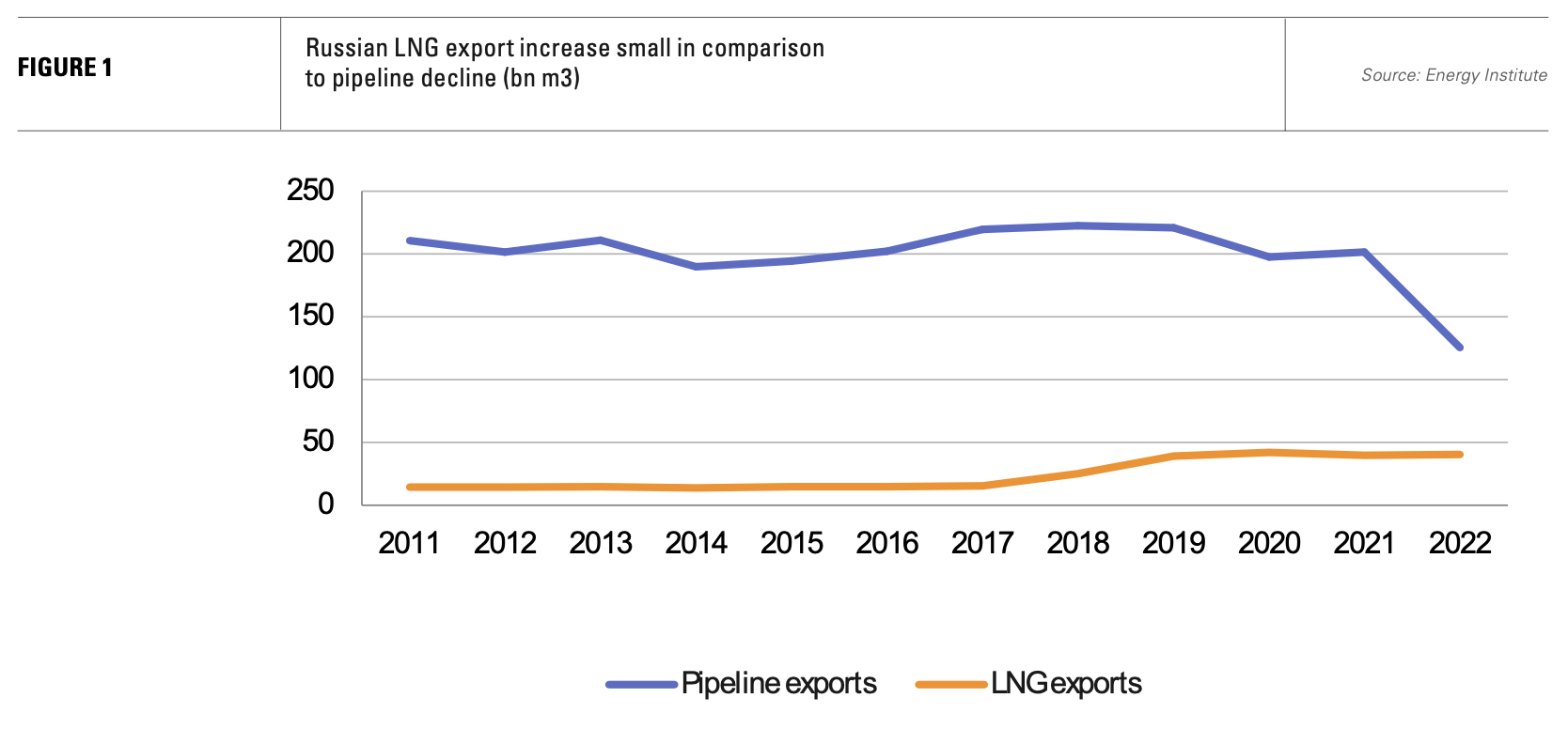

Russia’s need to expand its LNG capacity is clear. The country has lost a huge portion of its European gas market as a result of its invasion of Ukraine (see figure 1).

According to estimates, Russian gas exports by pipeline to Europe fell to just 28.3bn m3 (21mn t/yr) in 2023, down from about 85.4bn m3 in 2022 and 169bn m3 in 2021. While it is ramping up supplies to China through the Power of Siberia pipeline and plans to build a second line, they will not compensate for the loss of European markets, nor provide the end-market flexibility of LNG.

LNG exports therefore look like the best means of boosting gas exports. The big question is whether such an expansion can be achieved under sanctions. Russia is not short on gas resources; its problems are instead political, technological and logistical.

Arctic LNG-2: state of play

Sanctions and the retreat of foreign partners have slowed development of Arctic LNG-2. Novatek has been forced to reorientate its supply chain to Chinese companies and reconfigure the trains under development. Nonetheless, Train 1 started production at the end of the 2023 at 50% capacity, although no cargoes have yet been exported.

Reports, backed by satellite imagery and ship tracking, also indicate that the final modules for the completion of Train 2 have been delivered. Assembly will take place at the Belokamenka yard before being floated out to location. Observers suggest this could take place this summer, although it is not clear that all of the requisite technology is in place.

The completion of Train 3, scheduled for 2026, looks more problematic. The sanctions noose is tightening.

Foreign shareholders in the project, France’s TotalEnergies (10%), China’s CNOOC (10%) and CNPC (10%) and a Japanese consortium of Mitsui and JOGMEC (10%), suspended participation in Arctic LNG-2 in December, following two new rounds of US sanctions issued in September and November. Further sanctions came in February. US sanctions now target the purchase and transport of Russian LNG. It is the latter which might prove Arctic LNG-2’s Achilles heel.

Specialist fleet

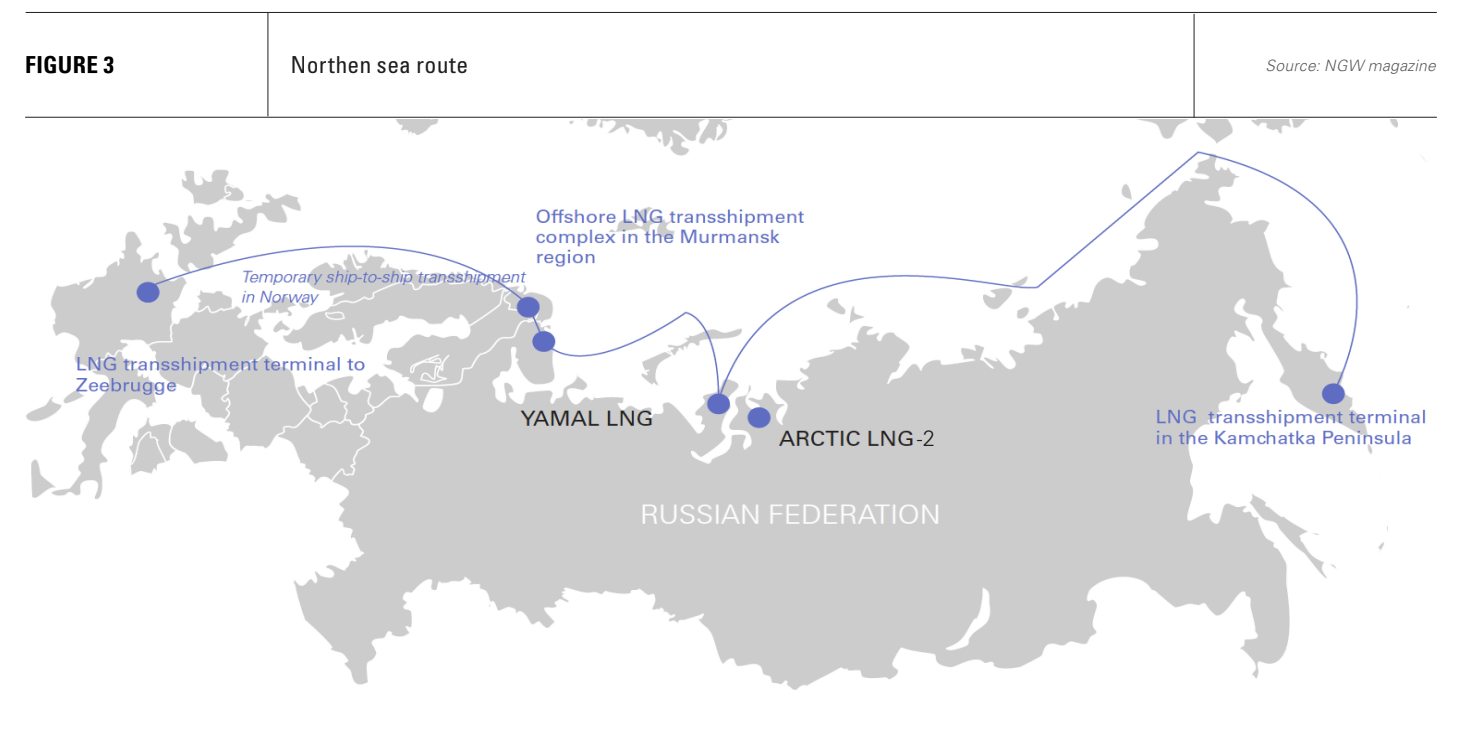

Arctic LNG-2’s northerly location in the Gulf of Ob means it depends on ice-class LNGCs to transport LNG at least to transhipment points where ship-to-ship transfers in warmer waters can be made for onward delivery.

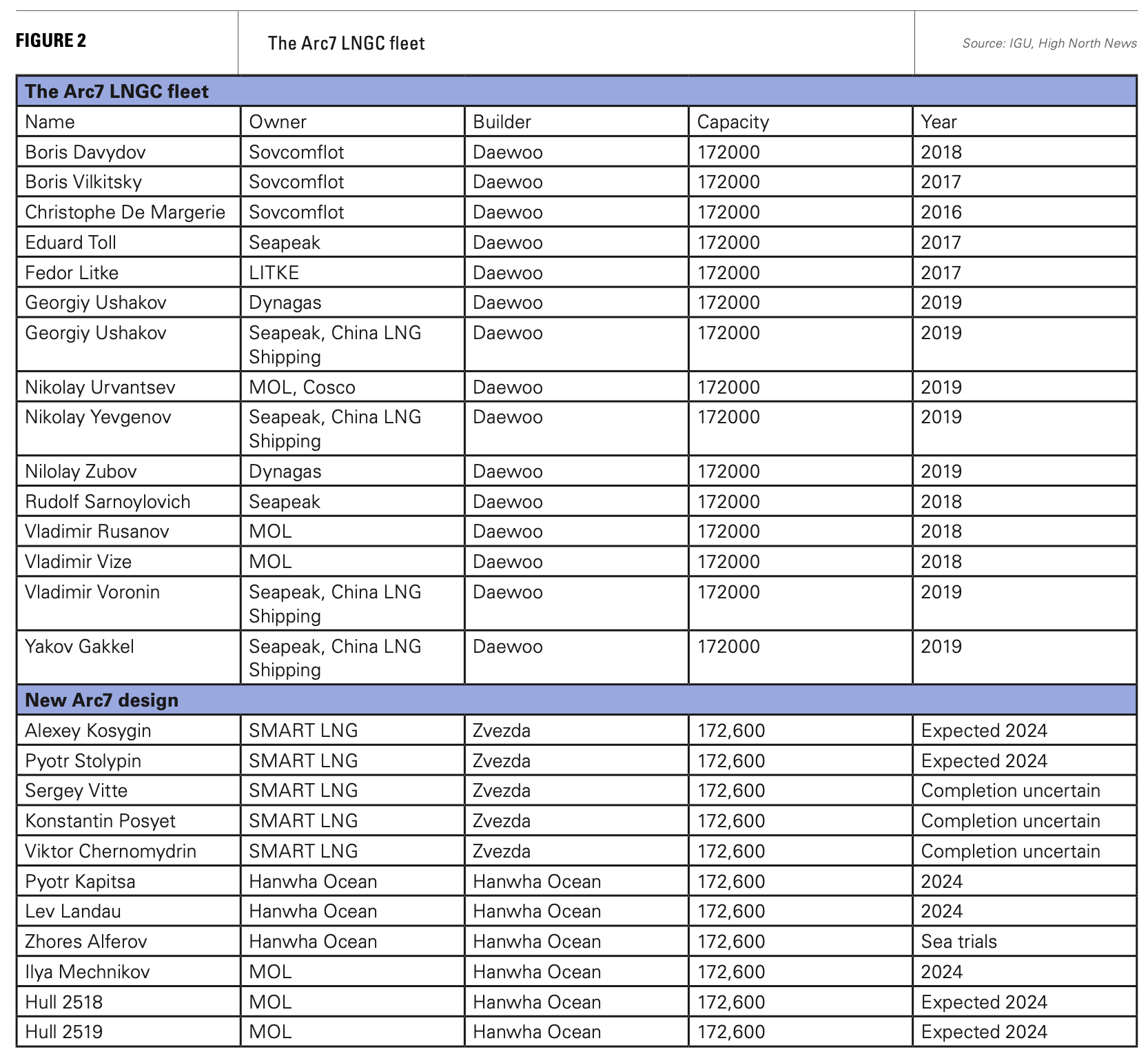

The Yamal LNG plant is also located in the Gulf of Ob. It is served by a fleet of 15 Arc7 vessels all built by South Korea’s Daewoo between 2016 and 2019, each with a capacity of 172,000 m3.

Although these vessels can break ice, they are optimised for efficiency in open water and were designed to move westward into Europe in the winter and eastward along the Northern Sea Route (NSR) only in summer to Asia. They can take LNG to a transhipment point or further.

Arctic LNG-2 will use new Arc7 vessels. These vessels with 172,600-m3 capacity, are designed to allow year-round use of the NSR and for maximum speed through ice rather than open water efficiency – i.e. to serve as the crucial link to the transhipment points in Murmansk to the west and Kamchatka in the east.

Their lack of efficient operation in open water means they are of little use to anyone except the Arctic LNG-2 partners.

Yamal’s fleet of Arc7 vessels could be used for Arctic LNG-2, but there is reportedly understandable resistance to this from the project’s non-Russian shareholders (France’s TotalEnergies and China’s CNPC and Silk Road Fund), as they fear the vessels will fall foul of sanctions on the Arctic LNG-2 project and limit transport availability from Yamal LNG.

As a result, Arctic LNG-2 needs its new Arc7 vessels to come into operation to start regular shipments (see figure 2).

Five of the new Arc7 LNG vessels are under construction at Russia’s Zvezda shipyard. Three have been launched and are being internally outfitted. At least two are expected to come into operation this year.

Although the first ice-class LNGCs to be built in Russia, Zvezda is more of an assembly operation. The yard relies on South Korea’s Samsung Heavy Industries (SHI) for the main hulls. They also depend on French company GTT’s membrane containment system and propulsion systems provided by US company General Electric. Both GTT and General Electric exited Russia last year and SHI has suspended work on the hulls, having delivered only five.

As a result, it is uncertain whether the shipyard will be able to complete all five ships, while additional hulls will likely have to be sourced from Chinese shipyards.

In total 15 Arc7 LNGCs were to be built at Zvezda. The current situation suggests that at best only two or three will be able to operate this year, an insufficient number to serve even Train 1, if it can operate at 100% capacity. As a result, even if Novatek is successful in completing the liquefaction trains, access to sufficient ice-class transport looks set to remain a problem for some years.

Other Arc7s hit by sanctions complications

There are other new design Arc7 ships available or soon to be available built for use at Arctic LNG-2. South Korean shipyard Hanwha Ocean – formerly Daewoo Shipbuilding – has completed three new Arc7 LNGCs, which are ready for service. These were originally ordered by Russia’s Sovcomflot, but payment issues resulted in Hanwha completing the ships on its own balance sheet. Ownership of one of the ships was reported by maritime media gCaptain to have passed to a Dubai-based entity in February before being passed back to Hanwha soon afterwards.

Japan’s Mitsui OSK Lines (MOL) also has three Arc7 LNGCs under construction with Hanwha, the first of which has already undergone sea trials. However, the US sanctions announced in February mean that it can no longer charter the ships to Arctic LNG-2. Mitsui OSK says it needs to sell the ships as a result, but the only real customer is Arctic LNG-2, to which sanctions prevent a sale.

Hanwha Ocean is in the same position. It can neither sell nor charter the vessels directly for use on the project without falling foul of sanctions, hence the apparent search for a third-party owner. This is becoming increasingly difficult.

The sanctions announced in February directly sanction the Zvezda shipbuilding complex, SMART LNG, a Russia-based joint venture to lease new Arc7 LNGCs, Novatek Murmansk, the civil construction company operating the Belokamenka shipyard, as well as three Cyprus-based shipping companies, Azoria, Elixon and Glorina, all of which have been incorporated to purchase Arc7 LNGCs for Arctic LNG-2 and all of which have Sovcomflot as their global ultimate parent, according to the US government.

In addition, the two 361,600-m3 floating storage units at the Murmansk and Kamchatka transhipment points were added to the US sanctions list in September.

In addition to struggling to find the ships to transport the LNG, Novatek has had to spend far more on the project than it wanted, owing to the delays and the need to build new supply chains with Chinese companies. Moreover, Novak’s intended expansion of Russia’s LNG sector relies not just on Arctic LNG-2 but on multiple new projects, such as Murmansk LNG, which will almost certainly fall foul of sanctions from the outset and benefit much less, if at all, from the delivery of western LNG technology.

This will increase Russia’s dependence on China further, but both countries still have technological gaps in terms of constructing full LNG supply chains.

The UK has banned imports of Russian LNG, and the European Commission has said it wants to end all imports of Russian gas, whether by pipeline or as LNG, by 2027. Further US sanctions are likely as Washington has made Arctic LNG-2 in particular, and the development of Russia’s energy complex in general a target. Meanwhile, even if Hanwha and MOL can resolve their issues with stranded Arc7 vessels, they are unlikely to risk a repeat of the experience when it comes to new Russian LNG projects.