Australia: achieving net zero with natural gas [Global Gas Perspectives]

“Natural gas has an important role to play, and will continue to be required by hard-to-abate industries beyond 2050.” This is one of the conclusions of Australia’s recently published Future Gas Strategy (FGS), which views hydrogen, other renewable gases and electrification for industrial decarbonisation as unlikely to provide commercially viable alternatives to gas even by 2050.

Yet Canberra also wants net zero emissions economy wide by this date.

It appears natural gas will be part of the solution. Even with the accelerated deployment of renewable power, phasing coal out soon is only possible, the government argues, with flexible support from gas. Electricity demand will increase with electrification and the grid will become more dependent on variable renewable generation, requiring gas back-up.

In effect, the government is plotting a course which achieves net zero, while continuing to use natural gas for industry and in power generation. The only way this is possible is by creating a central role for carbon capture and storage (CCS) as a way of reducing the emissions footprint of natural gas both upstream and downstream.

CCS indeed plays a key role in the FGS. Of five actions recommended for immediate implementation, three concern the technology. These are: to continue to release offshore acreage for GHG storage; establish a new Transboundary CCS program to provide options for energy security and carbon management with regional partners; and clarify the consultation requirements for offshore storage activities as part of a three-year review of the offshore environmental management regime.

Note action number two. CCS is not just a domestic strategy, but one that will reduce the emissions footprint of Australia’s LNG exports and potentially provide CCS ‘as a service’ to those countries which consume the LNG abroad.

CCS projects in Australia

Chevron’s Gorgon CCS project is well known, if not infamous. It came on-stream late, has cost around $3bn and to date has been unable to meet its full capacity of storing 4mn t/yr. As a poster child for Australian CCS, it could have done better.

But this is criticism of a half empty glass rather than one half full. Big oil companies have jointly invested billions in developing what is the world’s largest CCS facility – a serious financial commitment. Gorgon CCS has successfully stored millions of tonnes of CO2. The problems it faces appear resolvable and related principally to water removal and their impact on carbon injection rates rather than the capture and storage of the CO2 itself.

The experience it provides is important, even if it never lives up to its design capacity. Moreover, the experience has not deterred other CCS projects from moving ahead.

Australian CCS projects fall into three groups, those focussed on natural gas processing related to LNG production, projects targeted at transport and storage, with the aim of providing CCS ‘as a service’, and those looking at CCS in relation to the production of hydrogen and fertilisers.

The Global CCS Institute cites one project as operational (Gorgon), one under construction, five at an advanced stage of development and a further six in the early stages of development. In total, six focus on CCS from natural gas processing, including the largest, Santos’ 10mn t/yr Bay-Undan project, which would use as a storage site East Timor’s depleted Bayu-Undan gas field. Carbon would be captured from the gas produced from the Barossa reservoir and other sources in the area. The Barossa Gas Project will provide a new source of gas for the Darwin LNG plant.

Santos is also behind the next major CCS project to go live, the Moomba CCS project in the Cooper basin. There is little doubt that after the press scrutiny of Gorgon CCS, Moomba will be closely watched. The company said in July that the project was 92% complete. Mechanical completion was achieved on July 6 and the project has entered its final commissioning phase. A second phase would capture and store carbon for third parties. Phase one aims to capture 1.7mn t/yr.

Extended domestic use of gas

Under the Australian Energy Market Operator’s (AEMO) 2024 integrated system plan (ISP), coal will now be phased out faster than before. All coal plants will cease operations by 2038, five years earlier than previously planned. 90% of the remaining 21 GW of coal-fired generation will close by 2034-35.

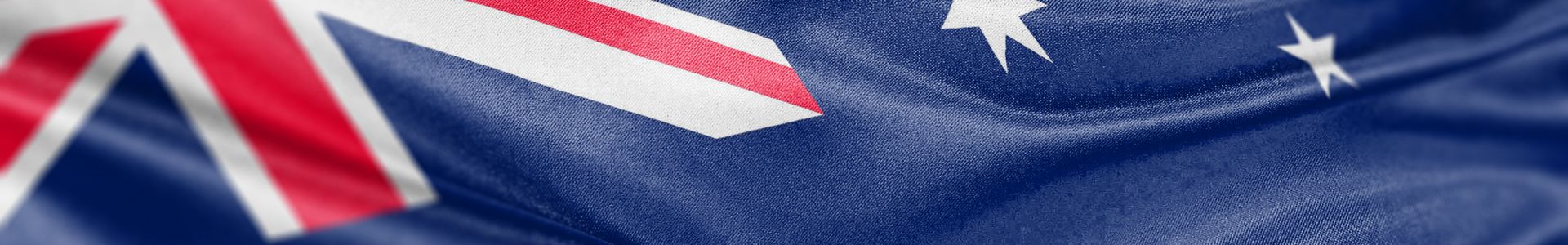

This ambition has a major impact on what other sources of power generation will be needed, including gas, as coal, in 2023, still provided 46.1% of the country’s electricity.

A key requirement is to build more renewables. Solar power capacity has expanded rapidly in Australia jumping from 11.4 GW in 2018 to 33.7 GW in 2023. The country boasts the world’s highest level of solar generation per capita at 1,774 kWh. Solar power contributes more to annual electricity generation than wind, despite the latter’s huge remaining potential both on and offshore.

The ISP says about 6 GW of utility-scale renewable energy capacity a year is required, alongside a significant jump in the already buoyant market for rooftop solar. This looks achievable.

In 2023, Australia added 772 MW of wind and 3,725 MW of solar. New connections this year for wind should total 1 GW from three projects, and there are more than 50 wind farm projects at various stages of development. In particular, the government has recently granted feasibility licences for 25 GW of offshore wind for the Gippsland Offshore Wind Zone.

Solar power is expected to continue its acceleration, becoming a 6.2 GW/yr market in the 2024-28 period, according to SolarPowerEurope.

However, the ISP says the system will require 654 GWh of storage and 16.2 GW of gas-fired generation. This latter figure is a significant jump from the 9 GW of gas-fired generation in the previous plan, and the existing level of installed gas-fired capacity of 11.2 GW, much of which will have to be retired before 2050.

In the FGS’s Step Change scenario, electricity generation triples by 2050 as more of the economy electrifies. Gas-to-power capacity grows in absolute terms, but falls as a percentage of overall power generation. From 2035-2050, annual demand for gas for power generation is expected to increase.

By retaining so much gas in the power sector, Australia is apparently ignoring one of the low hanging fruits of the energy transition. Most EU countries, for example, are targeting total power sector decarbonisation in the mid-2030s or earlier, although those that do are not so coal-dependent as Australia, some have nuclear power and many have interconnectors linking them to other electricity markets, which is not a practical option for Australia.

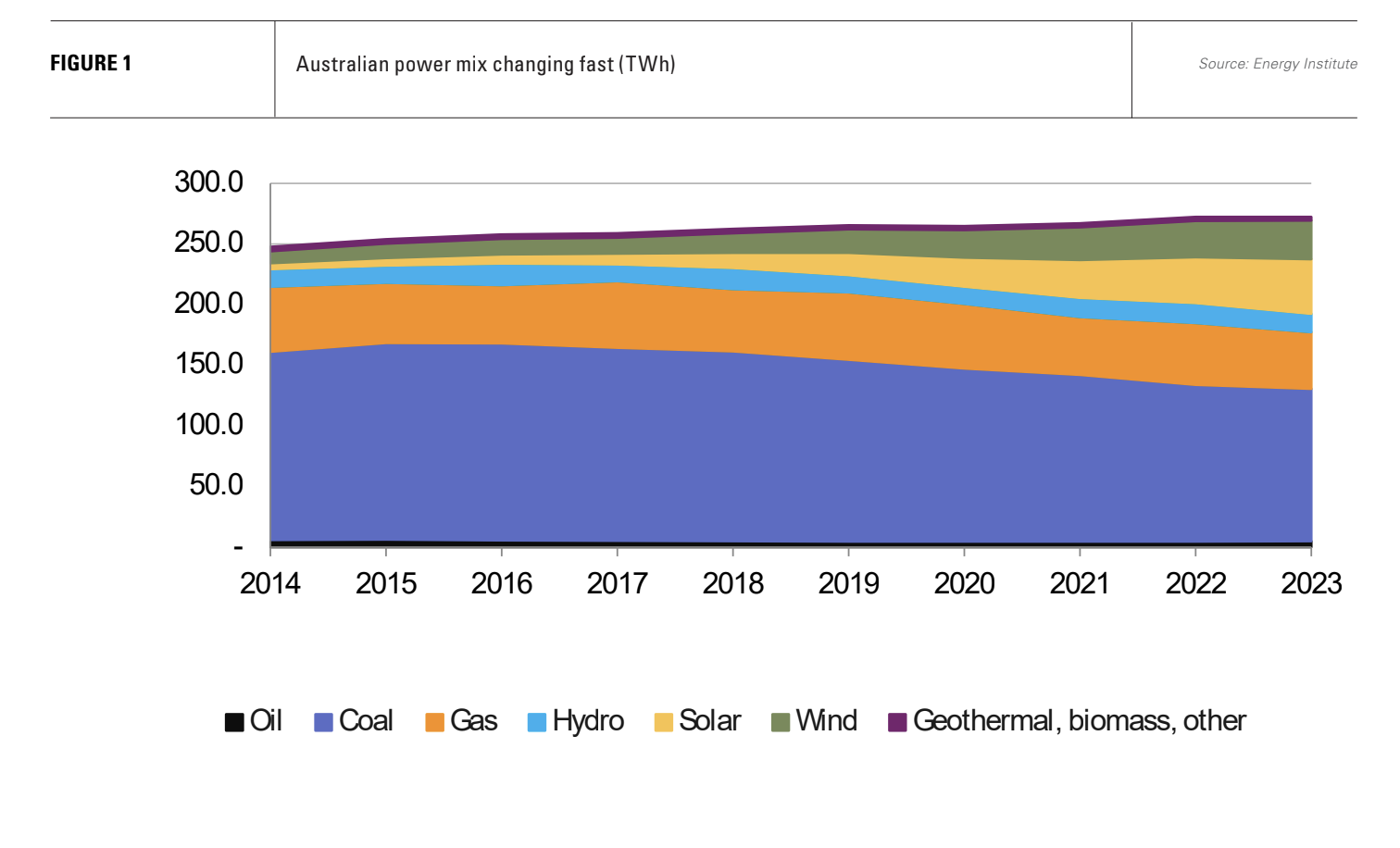

Other elements of Australia’s gas demand are harder to abate. The manufacturing sector uses about a quarter of all gas consumed, of which about three quarters is for industrial heat. About 17% of domestic gas in 2021-22 was consumed as a chemical feedstock to make other products. Overall, gas provided 27% of Australia’s energy needs and accounted for 24% of its GHG emissions.

An interesting example of the government’s thinking is provided by its approach to lithium production, a key energy transition metal. Australia has become the world leader, accounting for 47.8% of global mine production last year, according to the US Geological Survey.

Demand for lithium, a key component of electric vehicle and grid storage batteries, is expected to rise sharply as electrification broadens across economies. Hard rock mining is one three primary means of production in addition to brines and lepidolite. Australia is a hard rock miner, and the metal is extracted from mineral concentrate by roasting at temperatures of about 1,050°C.

Running high heat kilns on electricity or hydrogen is not yet technologically possible, so the expansion of lithium processing will require greater natural gas use.

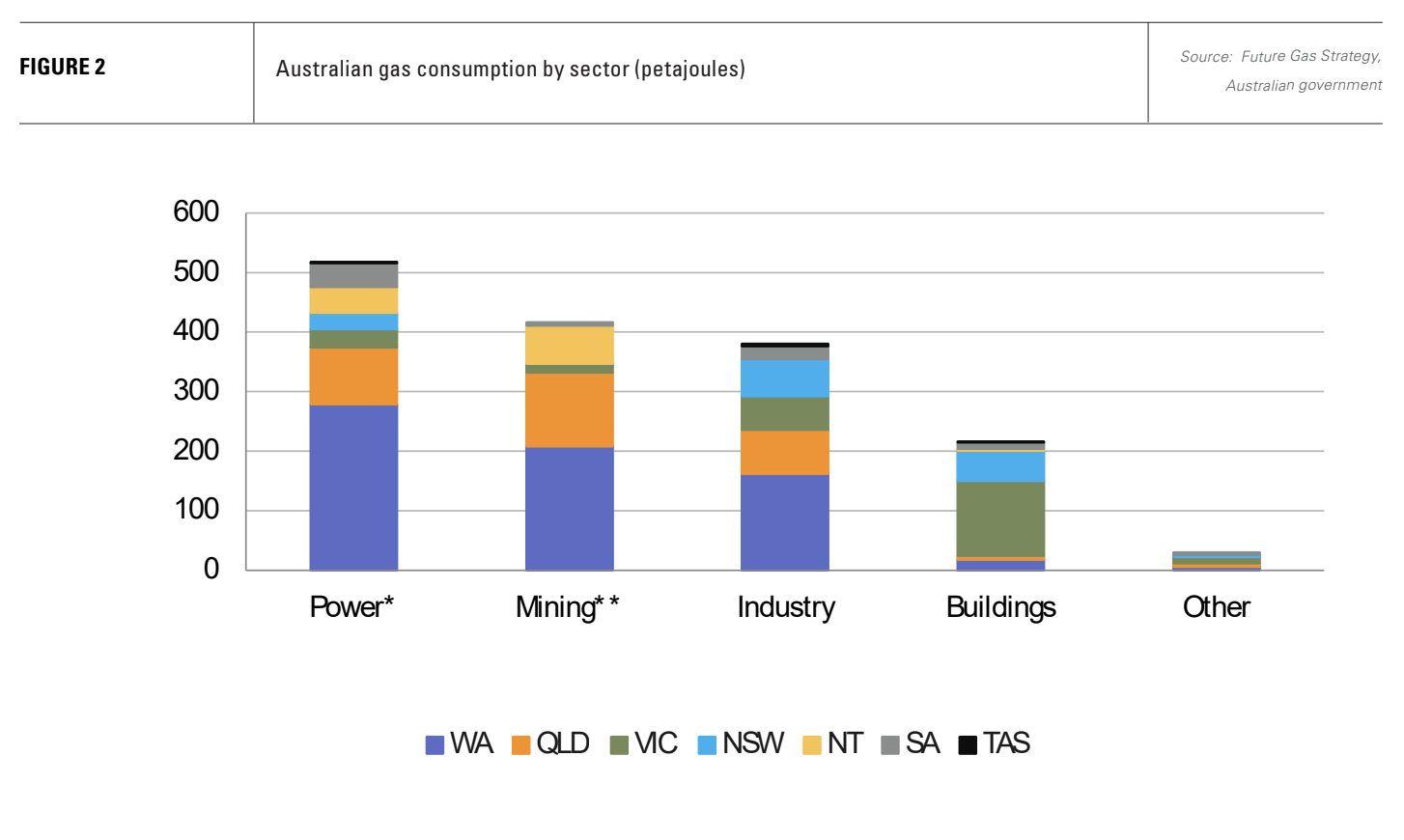

LNG exports to continue

CCS is also expected to play a key role in maintaining another of Australia’s major exports, LNG. CCS can be used to reduce emissions from natural gas processing and thus exported LNG. There is also potential for Australia to play a role similar to that envisaged for the North Sea and provide sites for the storage of carbon transported back from the Asian countries which consume Australian LNG.

Making use of its stable geology and depleted oil and gas fields, Australia could capture and store carbon from its regional neighbours, particularly those within the ‘ring of fire’, a 40,000-km horseshoe shaped area of intense seismic activity surrounding the Pacific Ocean, which hosts three-quarters of the world’s active volcanoes.

Japan, South Korea, Singapore and Taiwan are all major consumers of Australian LNG and all lack sufficient geological storage potential. All four intend to achieve net zero by 2050, and Taiwan and Singapore, in particular, suffer from a lack of land for the expansion of solar and onshore wind.

Interest is evident. Japan’s J-Power announced in August that it would partner with Australian CCS developers deepC Store and Azuli, which have assessment permits for CCS projects in the Bonaparte and Browse Basins, some 200-250 km off Australia's Northwest coast. The intention is to transport carbon captured in Japan by ship to sites offshore Australia for storage.

CCS could then become something of a revenue earner as much as a significant added cost.