Azerbaijan energy export potential [Gas in Transition]

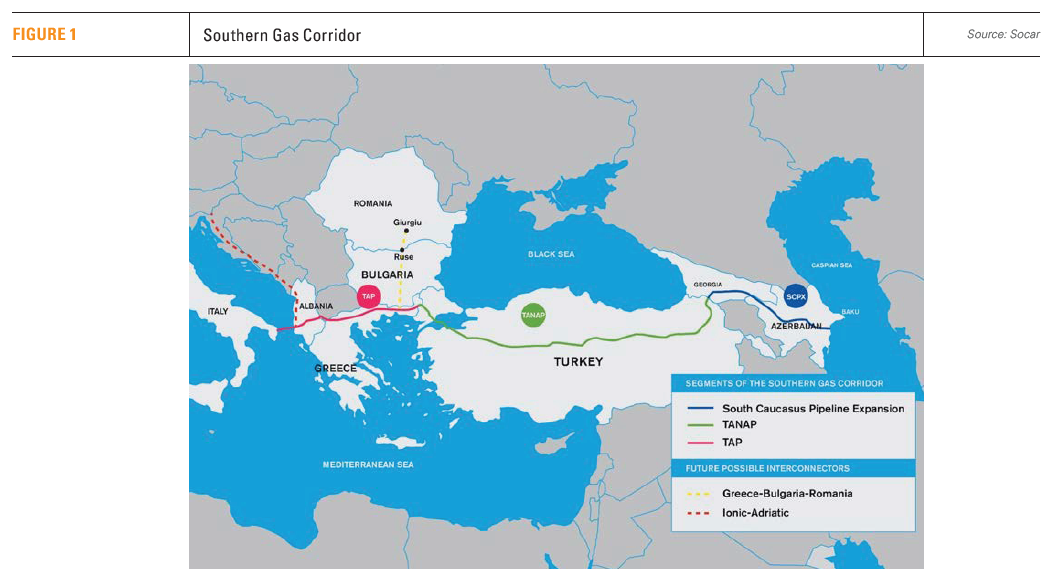

Azerbaijan has proved itself a reliable gas supplier to Europe through the 3,200km Southern Gas Corridor (SGC) (see figure 1), but has the potential to also become an important supplier of clean energy.

In July last year, European Commission (EC) president Ursula von der Leyen and Commissioner for Energy Kadri Simson met with Azeri president Ilham Aliyev and Azeri energy minister Parviz Shahbazov and agreed to strengthen the existing cooperation between the EU and Azerbaijan. The two presidents signed a new memorandum of understanding (MoU) on a strategic partnership in energy.

The MoU includes a commitment to double the capacity of SGC to deliver at least 20bn m3 gas to the EU annually by 2027. This will contribute to the diversification objectives in the REPowerEU Plan and help Europe in its drive to end dependency on Russian gas by 2030. Based on this strengthened energy cooperation, Azerbaijan increased its gas supply to the EU to 11.4bn m3 in 2022, from 8.1mn m3 in 2021. This is expected to rise to 11.6bn m3 in 2023, the maximum capacity of SGC. Boosting exports further will require considerable investment to install new compressors.

The MoU also recognises the synergies between the EU's clean energy transition and Azerbaijan's strong untapped renewable energy potential. Europe is committed to achieve very ambitious climate targets by 2030, including net zero by 2050. This requires increasing supplies of clean energy to replace fossil fuel consumption.

The International Energy Agency (IEA) identified Azerbaijan as one of the countries with significant renewable energy potential, both for domestic use but also for export. The country has the resources and the required infrastructure base to develop a green hydrogen industry for export to Europe. Given Europe's limited domestic potential to meet its targets for green hydrogen, it will require imports, offering Azerbaijan an excellent opportunity to take advantage.

The International Energy Agency (IEA) identified Azerbaijan as one of the countries with significant renewable energy potential, both for domestic use but also for export. The country has the resources and the required infrastructure base to develop a green hydrogen industry for export to Europe. Given Europe's limited domestic potential to meet its targets for green hydrogen, it will require imports, offering Azerbaijan an excellent opportunity to take advantage.

Renewable energy development will also contribute to cementing Azerbaijan’s role as a gas supplier, by replacing gas in domestic energy consumption, thus freeing more gas for export to Europe. By doing that, Azerbaijan could free enough gas to contribute to meeting the 20bm m3/yr target by 2027.

But expanding SGC capacity will require European gas importers to enter into long-term gas supply contracts. Until recently that appeared to be a challenge because of EU policies, such as REPowerEU, casting doubts about the longer-term gas demand in Europe. However, there is now a growing realisation that Europe will need gas for longer, with some European companies starting to enter into long-term LNG supply contracts, for example with Qatar and US suppliers.

Azerbaijan should take advantage of this, and implement measures to increase the uptake of renewables, that could help guarantee increased and secure gas supplies becoming available for export to Europe. Given that most of the required infrastructure is in place, an expansion project is easier and speedier to implement, provided of course long-term gas supply contracts can be secured to underpin such expansion.

Azeri gas production

Azerbaijan is one of the oldest oil and gas producers in the world, having started commercial production in the 19th century. Its gas production increased to 46.7bn m3 in 2022, in comparison to 43.8bn m3 in 2021. The government forecasts that this will increase further, by 3bn m3, to about 50bn m3 by 2026..png)

According to BP’s Statistical Review of World Energy, Azerbaijan has around 2.5tn m3 of proven natural gas reserves. This could sustain increased production for over 40 years.

Operated by BP, the Shah Deniz gas field (see figure 2) is one of the world’s largest with around 1.2tn m3 in reserves. It is expected to achieve plateau production of 26bn m3/yr this year. A third phase, Shah Deniz 3, is scheduled to begin within four years.

In addition, gas production started in July at the Absheron gas field operated jointly by TotalEnergies and Socar. First stage production is expected to be 1.5bn m3/yr – destined for the domestic market – but once fully developed, it could reach 5bn m3/yr, and could contribute to exports. A decision on this further expansion must be made in 2023, if it is to contribute to meeting the 2027 target for gas exports to the EU.

But the news in June that BP has found new gas reservoirs beneath its existing Azeri–Chirag–Gunashli oilfield (ACG) in the Caspian Sea, gives hope that the promise to double Azerbaijan’s annual gas exports to Europe by 2027 may now be a step closer to realisation. BP has confirmed that the appraisal well it drilled to a depth of 4,500 m below the ACG field has identified "deep-lying gas reservoirs." President Aliyev went as far as to say that production could start next year. However, BP has called for patience until it studies the results and identifies how much gas it can produce from this discovery, later this year.

BP is also drilling a deep well below the Shah Deniz gas field, targeting a deep gas reservoir that may lie at a depth of more than 7,000 m. This is expected to be completed by the end of the year.

However, realising all these projects in the timeframe required by the EU MoU, 2027, may prove to be too challenging. That is why Azerbaijan is turning to Turkmenistan, Iran and even Russia to secure additional gas volumes.

Renewable energy potential

One of Azerbaijan’s greatest risks to gas exports is the rising consumption of natural gas domestically, expected to reach 15bn m3 by 2026 – in the period 2017 to 2021 it grew at an average annual rate of about 3.5%. That could limit spare capacity to increase exports.

Natural gas dominates Azerbaijan’s electricity generation – close to 90%. Clearly, there is great potential to free a substantial amount of this gas for export, by increasing the uptake of renewables. Something that could also help reduce emissions and help achieve the country’s 2030 climate targets.

Natural gas dominates Azerbaijan’s electricity generation – close to 90%. Clearly, there is great potential to free a substantial amount of this gas for export, by increasing the uptake of renewables. Something that could also help reduce emissions and help achieve the country’s 2030 climate targets.

As part of its planned energy market reforms, the government is aiming for renewable energy to provide 30% of electricity generating capacity by 2030, almost doubling the 2018 share of 16%. Expanding green electricity was made a top priority in Azerbaijan 2030: National Priorities for Socio-Economic Development.

While increasing its efforts to transition to green energy, Azerbaijan is also trying to attract European investment in its renewable energy sector. The EU-Azeri MoU opened the way for Azerbaijan “to become a very reliable and prominent renewable energy partner to the EU,” specifically referring to the country’s “potential in renewable energy and in particular in offshore wind, solar energy and green hydrogen.”

SGC has already initiated engineering studies to examine the feasibility of transporting hydrogen mixed with natural gas through the pipeline to Europe. These will be completed by mid-2024.

In December, the leaders of Azerbaijan, Georgia, Hungary, and Romania signed an agreement in Bucharest to build a 1,100-km underwater electric cable under the Black Sea to provide Azeri energy to Europe. This will be promoted by a joint venture between their national electricity grid operators who will coordinate activities to progress the project. President Aliyev said "It is a step towards creating a corridor for green energy." The EU and Bulgaria attended the meeting and supported the project.

The idea behind this is that power generated in Azerbaijan will be transmitted across the Black Sea to countries in eastern and central Europe, which now have low renewable power potential and are heavily dependent on natural gas and coal. A study by the World Bank in 2020 concluded that “a 1,000 MW subsea cable across the Black Sea would generate sufficient economic benefit to warrant further consideration.” However, funding guarantees by the EU or any other international funding agencies would be essential to realise such a project.

Challenges

Azerbaijan’s commitment to increase gas flows to the EU to 20bn m3/yr by 2027 risks remaining constrained by infrastructure capacity limitations and rising domestic consumption.

There are also questions over whether enough gas will be available to support the expansion. However, BP's newly announced discovery at ACG could help remedy this.

As long as the reluctance of EU gas buyers to enter into long-term purchase contracts continues, due to EC’s short-term and clean energy policies, it makes the commitment to invest and upgrade Azerbaijan’s gas infrastructure to increase production and exports difficult. In order to meet the EU-Azerbaijan MoU 2027 deadline, EU gas buyers must make decisions this year. It will take at least four years to complete the required SGC expansion.

Another challenge, raised by MEPs, is that in November last year Gazprom announced it entered into a contract to supply 1bn m3 gas to Azerbaijan’s Socar by March 2023. This could help Azerbaijan meet domestic market demand, freeing up gas to meet export commitments, including to the EU. But this is seen as potentially undermining the goal of the EU’s MoU and the bloc’s drive to diversify away from Russian gas.

However, the biggest challenge is the lack of commitment by the EU to long-term gas deals. EU gas consumption is forecast to decline in the longer term. In addition to the 2030 and 2050 decarbonisation targets and a long-term strategy to move away from fossil fuels, REPowerEU is targeting a 30% reduction in gas consumption by 2030. Already by March 2023, gas consumption in the EU was over 17% lower than the average achieved between 2017 and 2022.

The EU is also in the process of constructing a large number of new LNG import and regasification terminals. Once completed, the EU's ability to import higher volumes of LNG will increase substantially, strengthening energy supply security and reducing the pressure to secure more gas.

However, increasingly, EC’s efforts to push climate laws are meeting resistance, due to concerns about security of energy supplies and realisation that natural gas will be needed for a long time to come. This may yet provide opportunities for Azerbaijan to increase its energy exports to the EU, provided of course it can overcome the challenges of increasing its gas production.