Bangladesh's First LNG Import 'Just the Start': WoodMac

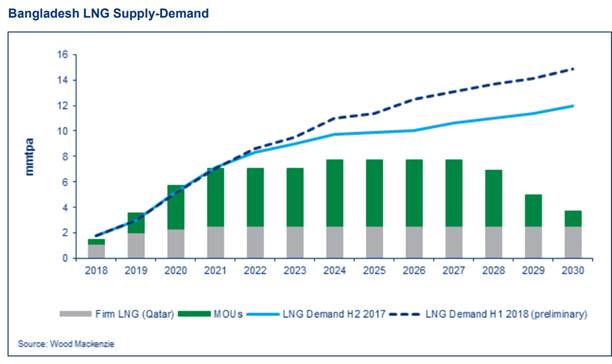

The arrival of Bangladesh’s first cargo is just the first step of a significant ramp up of the country's LNG import demand expected to reach 11mn mt/yr by 2025, according to consultancy Wood Mackenzie.

Bangladesh received its first LNG cargo April 24/25 from Qatar aboard the Excellence floating, storage and regasification unit (or FSRU) at the port of Moheshkhali. The project was co-developed by Petrobangla, US specialist shipowner Excelerate Energy and IFC, a member of the World Bank group, with a project cost of $180mn. Officials said last week that the cargo was due on April 23.

Excelerate has told NGW that the vessel arrived late April 24 but that the custody transfer occurred April 25, so thus technically the delivery was completed April 25.

Qatar Petroleum CEO Saad Sherida Al-Kaabi, who also chairs Qatargas, said: “The first LNG delivery to Petrobangla reinforces Qatargas’ continued commitment to ensuring energy security to its customers in Asia, as well as its position as a reliable supplier of LNG, a cleaner, more efficient source of energy." It too said the cargo was delivered April 25. (The banner photo of FSRU Excellence is courtesy of Qatargas)

WoodMac said in a note April 25: “This is just the first step of a significant ramp up of LNG in Bangladesh. The country's second terminal is expected to start up in 2019: it is also a 3.8mn mt/yr Excelerate FSRU which will be located at Moheshkhali." The second terminal will supply a newbuild 2.4 GW combined cycle (CCGT) power plant, named Summit Power.

Sound LNG fundamentals

According to the WoodMac report, the longer-term fundamentals for LNG in Bangladesh look sound, and other projects there are gaining momentum. “Efficient CCGT capacity is set to grow significantly and we are increasing our forecast of LNG demand to reflect this. Meanwhile, domestic gas production is expected to decline by over 25% by 2025. As such we expect LNG demand to rise to 11mn mt by 2025 and there is still market available to suppliers. Key risks to LNG demand will come from concerns around the affordability of an increasingly LNG-based power sector. This may lead the government to renew its push to build more coal capacity,” WoodMac said.

Bangladesh has already initialed deals with two global LNG suppliers and signed a letter of intent with another firm over recent months to buy 3.25mn metric tons/yr of lean LNG. The deals are Swiss-based AOT Energy, for 1.25mn mt/year of lean LNG for 15 years, signed January 30; and with state-owned Oman Trading International to import 1mn mt/year for 10 years, signed January 31. And Petrobangla inked a letter of intent with Indonesia’s Pertamina for 1mn mt/year for 10 years January 28, after a meeting between Bangladesh’s prime minister Sheikh Hasina and Indonesia’s president, Joko Widodo.

Bangladesh suffers from shortage of electricity and gas which is a major challenge for not only industries but also for residential power users. According to WoodMac introduction of LNG into the fuel mix is a critical step in tackling this challenge.

Graphic credit: Wood Mackenzie