Brazil is emerging as South America’s most dynamic LNG market [Gas in Transition]

Brazil’s role as an increasingly important LNG market has gained impetus this year, owing to regulatory changes in the gas sector and continued problems in the hydro industry, which currently accounts for about 65% of the country’s electricity generation.

Ongoing drought has seen water levels at the nation’s hydro plants fall, forcing power companies to maximise thermal power production, in what is becoming an all-too-common occurrence as rainfall patterns become increasingly erratic.

Brasilia has been forced to accept that in the short term it will have to rely on power imports from neighbouring Argentina and Uruguay, with which it has 2.25-GW and 570-MW capacity respectively in cross-border connections. However, Argentina, too, is facing low hydro generation, increasing its need for gas and LNG imports.

LNG backstop

Rainfall in Brazil between September 2020 and April 2021 was the lowest on record, while reservoir levels in the regions with most hydro capacity, the Southeast and Central-West, were 29% below capacity in July. Lower hydropower production boosted LNG demand, with 17mn m3/day regasified in January-April this year, double last year’s 8.4mn m3/d.

An average 11,613 MW thermal generating capacity was used in April, up 37% on the same month last year, including 5,837 MW of gas-fired capacity, more than double the April 2020 figure. To address the high level of demand, sector regulator ANP in June approved an application by state oil and gas company Petrobras to double its LNG imports to 30mn m3/d this year.

Longer term, the government expects thermal power generation to at least double between 2020 and 2030, as demand for electricity rises and hydro generation becomes more unreliable.

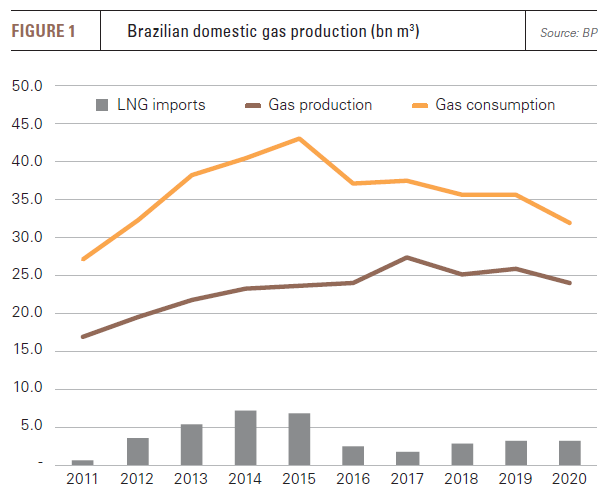

LNG accounted for 23% of the gas market in Brazil in first-quarter 2021. This proportion is expected to grow, owing to a lack of growth in domestic gas production. In 2020, Brazil’s gas output totalled 23.9bn m3, 7.3% lower than in 2019 (Figure 1).

Import capacity

Gas sector liberalisation is encouraging private sector investment in LNG import projects, but a big problem is that only 5% of municipal areas are currently supplied by natural gas, making delivery of the fuel to new customers a significant challenge.

Brazil has less than 10,000 km of gas pipelines, a very low figure for such a huge country. As a result, many planned import projects will either require truck distribution or the construction of new dedicated pipelines. LNG-to-power projects are dominating at present. Gas Natural Acu completed its 1.33-GW LNG-fed power plants in Rio de Janeiro in May, while the 1.5-GW Porto de Sergipe LNG-to-power project came online one month later.

Brazil currently has five LNG import terminals, including one in Rio de Janeiro that is operated by Gas Natural Acu, and New Fortress Energy’s (NFE) Sergipe terminal in Celse.

The three remaining facilities at Guanabara Bay in Rio de Janeiro state, Baía de Todos os Santos in Bahia and at the port of Pecem in Ceara state are operated by Petrobras, although the Pecem terminal is not currently in use. Petrobras is in the process of increasing the capacity of its Guanabara Bay terminal from 20mn m3/d to 30mn m3/d.

In July, the government asked ANP to find a way to ensure that the Pecem terminal reopens by the end of September.

In a statement, the Ministry of Mines and Energy said: “The lack of a regasification vessel in Ceara state is preventing additional dispatch from important plants in the northeast region, which would help substantially and strategically in supplying energy to the national grid.”

A new regasification vessel needs to be secured, but reports in Brazil suggest that any new vessel could be deployed at the Bahia terminal, with Petrobras’ floating storage and regasification unit (FSRU) relocated from Bahia to Pecém.

New projects underway

About ten other import projects are at an advanced stage of planning; seven have reached the licensing stage. Some of these are designed to supply single customers. Of the seven projects at the licensing stage, two separate facilities are planned for Maranhao state in the northeast, which would supply the Geramar III power plant and the Sao Marcos I and II plants respectively.

NFE and Aruanã Energia, which is an offshoot of OnCorp Group, expect to bring a new import terminal at the port of Suape in the northeast online early next year. Aruana aims to use an FSRU with processing capacity of 14mn m3/d to supply the Transportadora Associada de Gas grid via a 7.6-km pipeline for local distribution. For its part, NFE plans to reach areas beyond pipeline networks by distributing LNG via trucks carrying ISO containers.

NFE and Aruanã Energia, which is an offshoot of OnCorp Group, expect to bring a new import terminal at the port of Suape in the northeast online early next year. Aruana aims to use an FSRU with processing capacity of 14mn m3/d to supply the Transportadora Associada de Gas grid via a 7.6-km pipeline for local distribution. For its part, NFE plans to reach areas beyond pipeline networks by distributing LNG via trucks carrying ISO containers.

NFE has also taken final investment decisions on another two projects, both with regasification capacity of 15mn m3/d: Terminal Gas Sul in Santa Catarina, which is due for completion in 2023, and the Barcarena terminal in Para, which is scheduled to come into use in 2022.

In April, NFE completed the purchase of Hygo Energy Transition from Golar LNG Partners and Stonepeak Infrastructure Fund, as it banks on rising LNG demand in Brazil, in return for $580mn and 31mn NFE shares, giving it a total value of $2.43bn.

Wes Edens, Chairman and CEO of NFE said: “With this acquisition, we are now a leading gas and power provider in a large and fast growing market.” The deal gives it a 50% stake in the Porto de Sergipe LNG-to-power project and interests in three other FSRU terminals, plus seven FSRUs themselves and six LNG carriers.

Sector liberalisation

The gas market, previously dominated by Petrobras, was liberalised in March to allow much greater competition at all stages of the supply chain. The Ministry of Mines and Energy issued 30 natural gas import permits last year, by far the highest annual figure on record, while Brazilian mining giant Vale secured its first LNG import permit in July, for 1.66mn m3/d to be used for industrial heating.

In addition, no new taxes have been introduced on LNG and federal taxes on FSRUs have been suspended, but new taxes have been introduced this year on domestic gas production, processing and storage. This will increase the cost of Brazilian production in comparison with LNG, favouring imports.

In addition, rather than allowing ad hoc development for specific customers or distribution over a fairly confined area, the government has begun to take a more strategic approach to LNG development.

In mid-July, Brasilia’s Energy Research Office (EPE), published a report which concluded that four new LNG import terminals were needed in Brazil, each with import capacity of 14mn m3/d: on the Amazon River near Manaus; at Sao Luis in Maranhao; in the town of Presidente Kennedy in Espirito Santo state; and at Pontal do Parana in Parana state.

The 20mn m3/d FSRU Presidente Kennedy project is particularly interesting, as, in addition to LNG imports, it may also be supplied with offshore gas via the planned Route 6 gas pipeline from Brazil’s giant pre-salt oil fields in the Espirito Santo basin. The terminal would supply existing and proposed local gas-fired power plant. A 20-km gas spur connection to the existing 1,387-km Gasene pipeline has also been proposed.

Suppliers

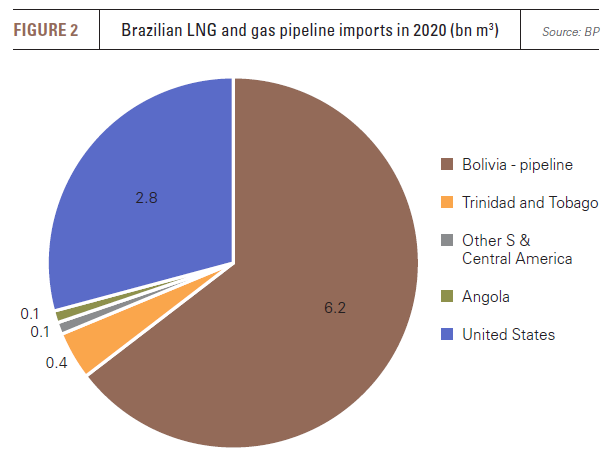

Long-term contracts for LNG supply may emerge as the domestic market for the fuel matures. Petrobras buys most of its LNG on the spot market, but higher prices this year have increased its costs. The average price of LNG imported in June was $12.30/mn Btu, 81% higher than in March. Rising US LNG production is providing a relatively convenient source of supply, with the US providing 92% of Brazilian imports in the first half of this year, up from 82% for the whole of 2020 (Figure 2).

Competition for available spot cargoes comes from Argentina, which is importing similar volumes to Brazil because of its own shortage of hydro production. However, the role of Argentina in the Brazilian gas market is more complicated than that because Buenos Aires’ policy of promoting domestic gas production to reduce its own LNG imports could help producers resume gas exports to both Chile and Brazil. Argentine producers that increase domestic supplies have been given permission to secure export contracts up to specified levels.

|

Golar Power looks to road network for LNG distribution Golar Power has signed contracts to develop micro liquefaction and regasification facilities in Brazil, using gas from small domestic fields, as well as biogas, to supply a new network of LNG filling stations for heavy vehicles. The first two projects will have production capacity of 15 and 30 metric tons/day in Sao Paolo and Bahia respectively, and will use biomethane from landfill sites. However, these two trial projects can be expanded thanks to the modular design of the liquefaction technology and many more projects are planned once the model has been tested. In 2020, the company teamed up with Argentina’s Galileo. The deal is for Galileo to provide gas conditioning, distributed LNG production, LNG filling stations and regasification plants for the Brazilian market. Golar Power said then that by distributing LNG via Brazil’s road network it would overcome the limitations posed by the country’s local gas distribution network. |