Building LNG’s resilience through turbulent times [GGP]

The global LNG industry is thriving. A record 200 mmtpa of new supply is under construction as players bet big on Asia’s push to reduce its dependence on coal and Europe’s need to replace Russian gas.

Given the urgency of the energy transition, an increasingly fractious geopolitical system and concerns over global economic growth, could the LNG industry have bitten off more than it can chew?

|

Advertisement: The National Gas Company of Trinidad and Tobago Limited (NGC) NGC’s HSSE strategy is reflective and supportive of the organisational vision to become a leader in the global energy business. |

Gavin Thompson, Vice Chair EMEA, and Massimo Di Odoardo, Vice President, Gas & LNG Research, consider how players can prosper through turbulent times.

Is there too much LNG under construction?

In short, no. Increased supply availability will bring prices down and boost demand growth. In our latest investment horizon outlook, we anticipate the market will need another 60 mmtpa of new LNG by 2033. Much will hinge on sustained economic growth driving increased demand across emerging markets in Asia. China’s LNG demand will increase by 12% in 2023, and with 50 mmtpa of LNG contracted over the past two years, imports will double by 2030. LNG demand in South and Southeast Asia will also grow two-fold by this time.

But economic growth won’t be enough. Domestic policies across Asia must increase their focus on decarbonisation and ensure appropriate pricing and infrastructure developments. LNG developers must also play their part, ensuring affordable LNG supply if Asia’s full potential is to be unlocked.

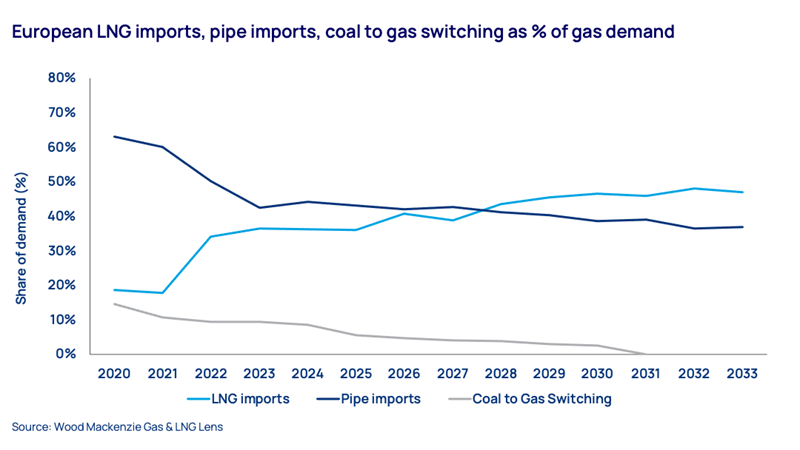

Europe will also need more LNG. While overall gas demand continues to fall, pipeline imports from Norway and Algeria will decline beyond 2025, meaning LNG imports will not peak till around 2030. They will remain relatively resilient thereafter as decarbonisation of the residential and industrial sectors slowly gathers pace. The recent signing of 8 mmtpa of LNG contracts from Qatar and its partners Shell, TotalEnergies and Eni to Europe through 2053 underpins supplier confidence in the longevity of European demand.

How long will price volatility persist?

There is no immediate cure as most supply under construction will not be available until at least 2026. As a result, buyers face several years of high – and volatile – prices before the next wave of LNG supply rebalances the market and improves affordability.

But the arrival of more LNG isn’t the end of the story. Investment in new LNG supply will slow beyond 2025, setting the scene for potential renewed market tightness around 2030.

Ultimately, the market has structurally changed. In the past, Europe provided flexibility for the global LNG market. At times of excess supply, Europe could reduce discretionary pipeline imports to use more LNG, limiting the downside on prices. And when less LNG was available, Europe leveraged more pipeline imports and coal, preventing price spikes.

Those days are over. With Europe increasingly dependent on LNG, and with limited flexibility from pipeline imports and coal, Europe and Asia will both rely on global LNG availability.

At times of excess LNG supply, prices could be extremely low as the market tries to absorb more LNG than required, possibly testing the economics of US LNG. But as markets tighten, prices could be extremely high as both Europe and Asia scramble to secure marginal cargoes. Volatility is now a constant.

Could external shocks upend the outlook for LNG?

Recent dynamics are a stark reminder of how susceptible energy markets are to external shocks, including conflict, geopolitical tensions and supply disruption. The global gas market has staged a remarkable recovery since Russia’s invasion of Ukraine in early 2022 but remains easily spooked: the conflict in Israel/Gaza, possible pipeline sabotage in the Baltics and the threat of fresh strike action at Australian LNG facilities all pushed spot prices up 35% through October.

The risk of further external shocks to the LNG market looks almost inevitable. Accurately forecasting these is an impossible task. But in an already tight market, their impact will only amplify volatility.

How are companies positioning for market turbulence?

The risks highlighted underline the importance of building low-cost, low-carbon portfolios supported through deeper trading and optimisation capabilities. Several IOCs and traders are doubling down on LNG, leveraging their role as aggregators to develop ever larger and diversified portfolios. This will best position them to capture market opportunities and secure buyers through suitable pricing and volume optionality.

Key buyers are also embracing this approach. PetroChina is building a global portfolio way beyond its legacy footprint. Some European (RWE, SEFE) and Japanese (Tokyo Gas, Jera) companies are positioning to become bigger local players and expand trading into other regions. Joint ventures may come back in vogue. Smaller players that lack optionality will inevitably be exposed to market volatility. Securing some long-term supply remains their best bet to navigate through turbulent times.

This insight piece was originally published by Wood Mackenzie here.

The statements, opinions and data contained in the content published in Global Gas Perspectives are solely those of the individual authors and contributors and not of the publisher and the editor(s) of Natural Gas World.