Can Europe survive painlessly without Russian gas?

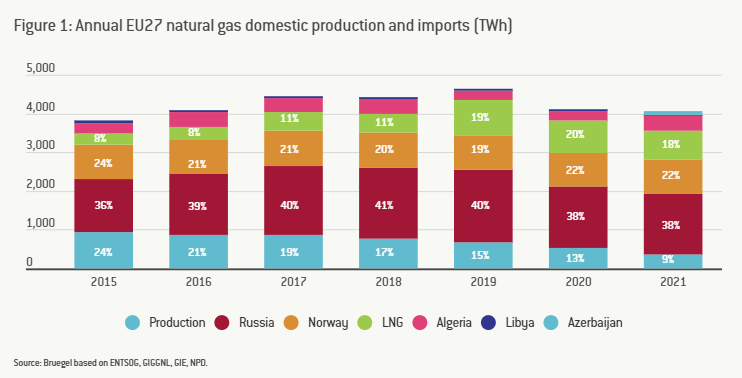

Russia has historically been the European Union’s largest supplier of natural gas. After the 2006 and 2009 Russia-Ukraine-Europe gas disputes, followed by tensions in the wake of the 2013-14 Ukrainian crisis, the EU has sought to reduce its dependency on Russian natural gas imports. However, Russia continues to supply around 40% of EU gas consumption (Figure 1).

As the threat of a Russian invasion of Ukraine intensifies, both the European Commission and the United States are looking at contingency plans in case of a further reduction or, in the worst-case scenario, a complete halt of Russian gas supplies to the EU.

|

Advertisement: The National Gas Company of Trinidad and Tobago Limited (NGC) NGC’s HSSE strategy is reflective and supportive of the organisational vision to become a leader in the global energy business. |

Should this happen, could Europe replace Russian gas imports this winter and the next two winters? Whatever happens, the most efficient solution requires demand-side adjustments to reduce dependency on gas, rather than just replacing Russian gas with imports from another country.

Below, we lay out the gas supply situation this winter, then describe the challenges of a prolonged supply disruption before focusing on possible demand-side adjustments.

What if Russian gas supplies are halted until summer?

At the end of 2021 a dramatic picture emerged, with Europe’s gas balance for the winter strongly dependent on Russian supplies and moderate weather conditions. Up to now, three main factors have prevented a worst-case scenario: i) a strong increase in imports of liquefied natural gas (LNG): 80 terawatt hours (TWh) in the first 24 days of January 2022, compared to 60 TWh in the first 24 days of December 2021; ii) the ‘winter risk’ of exceptionally cold temperatures has not materialised; since Christmas average daily temperatures at Frankfurt airport have been 4.7°C, compared to the previous 10-year average of 3.1°C; iii) a continuation of contractual supplies by Russia, amounting to 18 TWh/week. As a result, on 24 January 2022, storage levels were 42% full according to GIE – AGSI, compared to 56% at the same time of the year between 2015 and 2020.

Looking ahead, there are three scenarios:

- If Russia and all other suppliers continue to supply at current levels, implying historically high levels of LNG imports, and natural gas demand remains in line with the 2015-2020 average, then EU-wide storage would hit a low of approximately 320 TWh in April 2022.

- If Russia cuts supplies at the beginning of February, storage would reach a minimum level of 140 TWh in April 2022.

- If, in addition to Russia cutting supply, the weather is extremely cold, then EU-wide storage will be empty by the end of March 2022.

Therefore, in the short-run and taking the EU as an aggregate, the bloc will likely be able to survive a dramatic disruption to Russian gas imports. However, the picture becomes more complicated when the intricacies of individual economic, technical and political gas markets across the EU are considered.

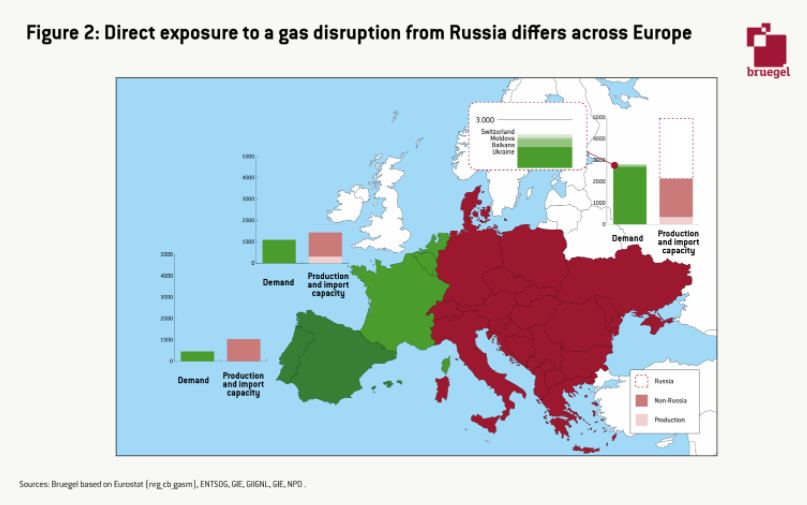

The Iberian Peninsula, for example, is a hub for LNG import terminals. As a result, the region can import 40 TWh per month, but can only consume 30 TWh. The challenge is transporting the excess gas to the rest of Europe, given that existing pipelines permit a maximum transfer of 5 TWh a month. Gas arriving in France is odorised and typically cannot be fed into neighbouring gas systems without constraints. Gas in the north-west European market has different qualities (domestically produced low-calorific L-gas in parts of Germany and the Netherlands vs. imported high-calorific H-gas in the rest of Europe) that use different infrastructures. Moreover, the central and eastern European pipeline system is designed to bring imports from the east to final consumers. Despite investment in reverse-flow capacities and new pipelines, if too much gas were to come from the west, pipeline bottlenecks could prevent sufficient deliveries to the easternmost parts of the EU or Ukraine.

Finally, and most importantly, what is technically feasible might not be feasible politically. Even if it were technically feasible to synchronise the depletion of storages across Europe to delay or prevent gas-supply disruptions anywhere in the EU, there is a risk that countries with better supply might be unwilling to share scarce gas resources with countries in worse situations. This risk is amplified by an inability to predict the length and severity of any shortage while, under worst-case scenarios, infrastructure constraints would call for anticipatory movements of volumes across borders already now.

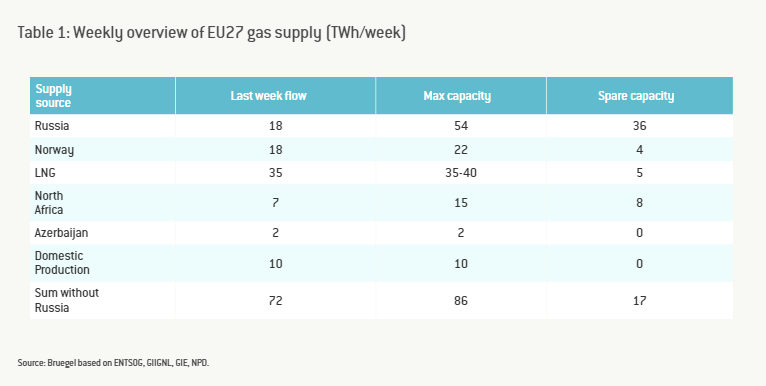

So, if the EU does not want to sit and hope for moderate weather while its storage volumes deplete, what other supply options would be available? In principle, existing infrastructure allows additional import volumes from Norway and North Africa, and additional LNG volumes, which together (17 TWh/week) could displace current (low) imports from Russia (18 TWh/week) (Table 1). But while having the infrastructure is one thing, having the gas is another. Norway’s prime minister has already announced that his country is delivering as much as it can to the EU and that global LNG markets are very tight. EU domestic gas production is limited, both in the Netherlands and elsewhere. Gas stored in pipelines, LNG-tanks and on the user-side might postpone gas shortages by a few days at most. A certain volume of gas is also held permanently in underground storage to maintain adequate pressure over the winter. The Economist cited analysts at Wood McKenzie who believe that up to 10% of this gas could be used under emergency circumstances, providing another contingency tool.

So, if the EU does not want to sit and hope for moderate weather while its storage volumes deplete, what other supply options would be available? In principle, existing infrastructure allows additional import volumes from Norway and North Africa, and additional LNG volumes, which together (17 TWh/week) could displace current (low) imports from Russia (18 TWh/week) (Table 1). But while having the infrastructure is one thing, having the gas is another. Norway’s prime minister has already announced that his country is delivering as much as it can to the EU and that global LNG markets are very tight. EU domestic gas production is limited, both in the Netherlands and elsewhere. Gas stored in pipelines, LNG-tanks and on the user-side might postpone gas shortages by a few days at most. A certain volume of gas is also held permanently in underground storage to maintain adequate pressure over the winter. The Economist cited analysts at Wood McKenzie who believe that up to 10% of this gas could be used under emergency circumstances, providing another contingency tool.

Hence, without demand-side measures a full disruption of Russian gas imports may result in some EU countries having to take emergency measures before the end of this winter.

What if Russian gas supplies are halted for years?

Getting through half a winter without Russian imports could be difficult, but running the European economy for several years without Russian gas would be hugely challenging. While there is more time to prepare, there are also much higher volumes to displace.

In 2021, Russian natural gas exports to the EU amounted to 1,550 TWh via pipeline and around 120 TWh via LNG. This implies that around 1,700 TWh would have to be replaced should Russia stop its natural gas exports to Europe completely.

Quickly increasing domestic production will only be possible at gas fields that have spare capacity. Technically, more gas can be extracted from the Groningen field – but getting a few dozen additional TWhs per year would require the Dutch government to loosen the moratorium that strongly constrains production to prevent earthquakes in the region.

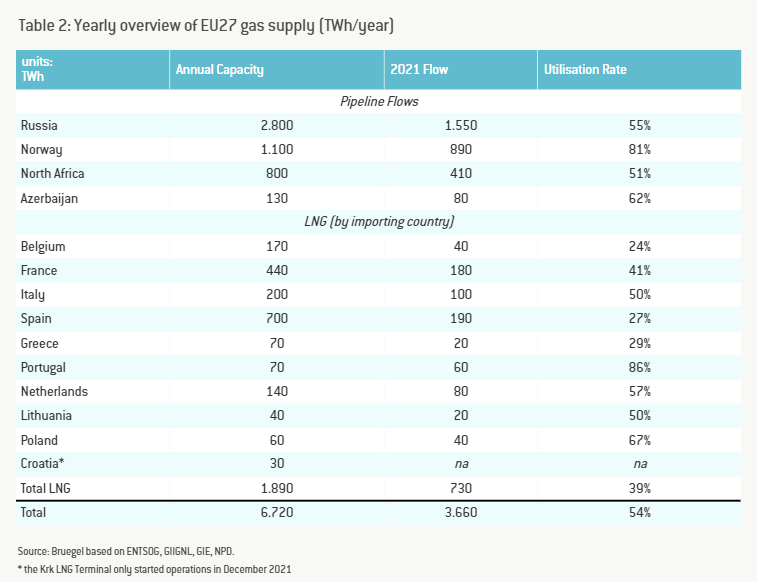

In terms of EU natural gas imports, there appears to be significant unused capacity (Table 2).

On LNG, compared to an import capacity of around 1,900 TWh, the EU only imported 730 TWh in 2021. Hence, Europe’s regasification terminals would be able to handle 1,100 TWh of additional LNG imports into the EU (in reality the number might be a little lower because of technical limitations).

On pipelines, in 2021 the EU had unused import capacities of 200 TWh from Norway, 400 TWh from North Africa and 50 TWh from Azerbaijan, a total of 650 TWh.

Based on 2021 conditions, the EU thus has spare import capacity of 1,800 TWh from alternative suppliers to Russia. This could, theoretically, allow the EU to replace Russian flows entirely (amounting to 1,700 TWh in 2021, of which some is LNG). Moreover, additional capacity is available from the United Kingdom, with two connecting pipelines offering approximately another 400 TWh per annum, but this would be dependent on the UK importing levels significantly above its domestic demand.

But using all available import capacity is unrealistic for at least five reasons:

- Upstream and liquefaction capacity is limited: the main problem here is that producers might be unable to scale up their gas production and/or LNG exports to Europe. Global liquefaction capacity is almost fully utilised and so are LNG vessels, significantly constraining the amount of additional LNG volumes that can be brought to the global market anytime soon.

- Economic and legal issues with redirecting LNG flows: a significant share of additional LNG imports into the EU would have to come from flows currently going to Asia and the Americas. But, as a significant part of global LNG is delivered via long-term contracts, European buyers are left competing for a smaller slice of global LNG. Moreover, LNG producers might prefer not to compromise their long-term relationships with their Asian buyers to provide temporary support to Europe, as their primary market is – and will be even more so in the future – Asia.

- High prices: additional demand, potentially up to 1,000 TWh, in an already tight global LNG market (of about 5,000 TWh) would place immense upside pressure on prices. This would be a major hit to the European economy, which is already suffering from high energy prices.

- Second-round effects on poorer countries: skyrocketing European natural gas prices might redirect LNG cargos away from importing countries in the developing and emerging world that could no longer afford them.

- Intra-EU issues: import infrastructure and EU gas markets were not designed for supplying all of central and eastern Europe from the west. Even if it were possible to supply the whole region, incl. Ukraine with LNG imports from the west, this would come at a very high price.

All-in-all, this illustrates that the EU cannot simply rely on increasing supply to replace Russian natural gas volumes. Demand will have to play a role as well. Only a combination of the two can deliver a workable outcome.

How can Europe realistically curb demand?

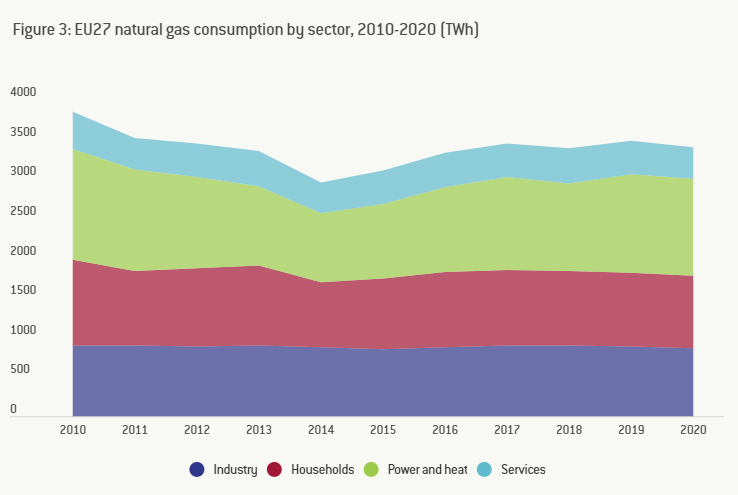

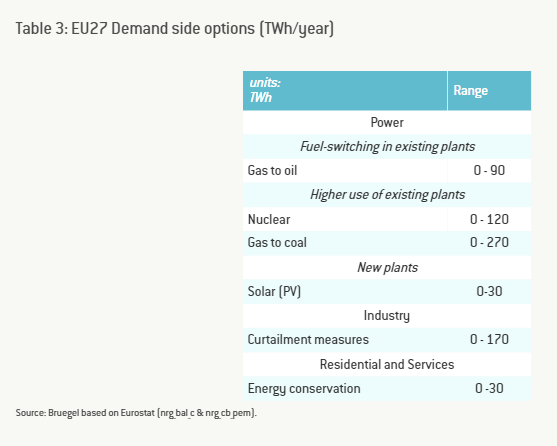

Most natural gas is used for heating, in industrial processes and for producing electricity and district heat. In all three areas there is potential to reduce demand (Figure 3).

About 900 TWh of natural gas was used in 2021 to produce electricity in the EU (Figure 3). In the short-term, some gas-fired power plants could run on oil. Assuming that 10% of EU gas-fired power plants can switch to burning oil, gas demand could be lowered by 90 TWh. Moreover, some generation from gas-fired power plants might be displaced by other power plants. One TWh of electricity not produced with gas will save more than 2 TWhs of gas burnt at below 50% efficiency in a gas-fired power plant. Hence, if the 100 TWh decline in coal-fired power generation since 2019 can be reversed (assuming the plants are still there), Europe could save more than 200 TWh of gas quickly, until more sustainable capacities are deployed (the corresponding carbon emissions allowances should be available but their price will skyrocket). Doubling the speed of annual solar PV deployment from around 15 TWh to 30 TWh per year might displace more than 30 TWh of gas. A technically and politically difficult decision to delay the closure of German nuclear power plants in operation until the end of 2021 could free up another 120 TWh of gas. But, options to reduce gas use in power production are not only constrained by economic and environmental considerations: in some regions and at certain times, gas-fired power plants remain the only option. Hence, a significant share of the 900 TWh of gas consumption we saw last year will still be necessary in 2022, unless high electricity prices drastically reduce power consumption.

In the industry sector, the only short-term option is demand curtailment. Steel and aluminium makers (top European smelter, Aluminum Dunkerque, has announced reduced production), silicon producers (Ferroglobe switched off two furnaces in Spain), chemicals (the biggest Italian manufacturer of AdBlue, an additive that reduces diesel vehicle emissions, announced a temporary closure months ago) and fertilisers have already reacted to high prices.

In the industry sector, the only short-term option is demand curtailment. Steel and aluminium makers (top European smelter, Aluminum Dunkerque, has announced reduced production), silicon producers (Ferroglobe switched off two furnaces in Spain), chemicals (the biggest Italian manufacturer of AdBlue, an additive that reduces diesel vehicle emissions, announced a temporary closure months ago) and fertilisers have already reacted to high prices.

Beyond market-based curtailments, EU countries need emergency plans (Germany’s can be found here) which could include forcing non-critical industries to shut down in an emergency scenario. Simultaneously, the reduction of heating in commercial/office buildings and homes could also be mandated.

In the residential and services sectors, energy efficiency could massively reduce the reliance on gas as almost 75% of the building stock is energy inefficient. However, the required investments and physical work are too slow to provide a significant contribution in the near future.

Another option is energy conservation. If, for example, final users turn down their thermostats slightly during the winter or make equivalent small energy efficiency improvements (isolate doors), about 2% of gas used for heating, or 30 TWh, could be saved. To encourage this, European governments might consider giving money back to households by ‘paying them for saving’. That is, households could get a payment based on their 2021 energy demand compared to their 2020 energy demand. Like all other approaches, this would not be perfect, but the essential point is that the incentives are right. Saving energy pays off. This could possibly be combined with a behavioural campaign, highlighting non-welfare-reducing methods for cutting energy consumption.

Summary

Until the summer, the EU would likely be able to survive large-scale disruption to Russian gas supplies, based on a combination of increased LNG imports (to the limited extent this is technically possible) and demand-side measures such as industrial gas curtailments. However, this would come at a cost for the EU economy and might even result in some countries (those more exposed to Russian gas and less interconnected with other EU countries) having to take emergency measures.

But, should a halt of Russian gas be prolonged into the next winters, it would be more difficult for the EU to cope. On the supply side some spare import capacity is available but reaching the scale required to entirely replace Russian volumes would be at best very expensive, and at worst physically impossible. Limiting factors include global liquefaction capacity constraints, existing obligations in the current LNG market and commercial opportunity considerations in producing countries in relation to diverting shipments away from Asia. There would also be pricing implications and second-round effects on the poorest countries. The EU would thus need to resort to demand-side measures, which would prove painful for different countries/constituencies. This will raise questions on how to fairly share the burden. Difficult and costly decisions would have to be taken to manage the situation in an orderly way.

Originally published by the Bruegel.

The statements, opinions and data contained in the content published in Global Gas Perspectives are solely those of the individual authors and contributors and not of the publisher and the editor(s) of Natural Gas World.