Canada – the sleeping giant [LNG Condensed]

US shale cannot expand forever. At some point, the decline of earlier wells will start to limit its ability to grow and new sweet spots will become harder to find. The International Energy Agency puts this point around the mid-2020s. Others, such as consultants Wood Mackenzie, estimate closer to 2035.

The disparity in views highlights the uncertain depth and longevity of the US shale resource, a situation that applies just as much to Canada’s less developed unconventional gas plays.

|

Advertisement: The National Gas Company of Trinidad and Tobago Limited (NGC) NGC’s HSSE strategy is reflective and supportive of the organisational vision to become a leader in the global energy business. |

A plateau in US shale oil recovery implies a plateau in associated gas at a time when the US’s own appetite for gas is expected to have risen sharply. Firstly, on the domestic front, as the country transitions from coal to gas in power generation and builds multiple new petrochemicals plants; and secondly for export internationally as LNG and pipeline gas sent across the Mexican border.

It is at this point – somewhere between 2025-2035 -- that the only two other seriously developing shale prospects outside of the US should be getting into their stride – Argentina’s Vaca Muerta and Canada’s Montney and Duvernay formations, both of which will need LNG to reach their full potential.

Canada’s two largest shale plays are estimated to hold some 500 trillion ft3 (14.2 trillion m3) of gas in addition to 20 billion barrels of natural gas liquids and 4.5 billion barrels of oil, according to the country’s National Energy Board. Canada is also stable, both politically and economically -- unlike its Argentinean competitor.

Canada’s gas resources arguably represent the great opportunity of the next decade to meet the demand created by a global shift away from coal – one that is complimentary to the desire to mitigate climate change, unlike its carbon heavy and energy-intensive oil sands.

On the brink

After years of delay and uncertainty – a period in which Canada’s ability to deliver large new energy projects has come under serious scrutiny -- the LNG Canada project should finally give the country its first LNG export capacity.

It is both the culmination of an extended saga, but also a major point of departure. Other projects are in the pipeline, but opposition to fossil fuel development in some areas remains strong and global competition stronger still, suggesting that the country could still miss out on the full potential of its unconventional gas resources.

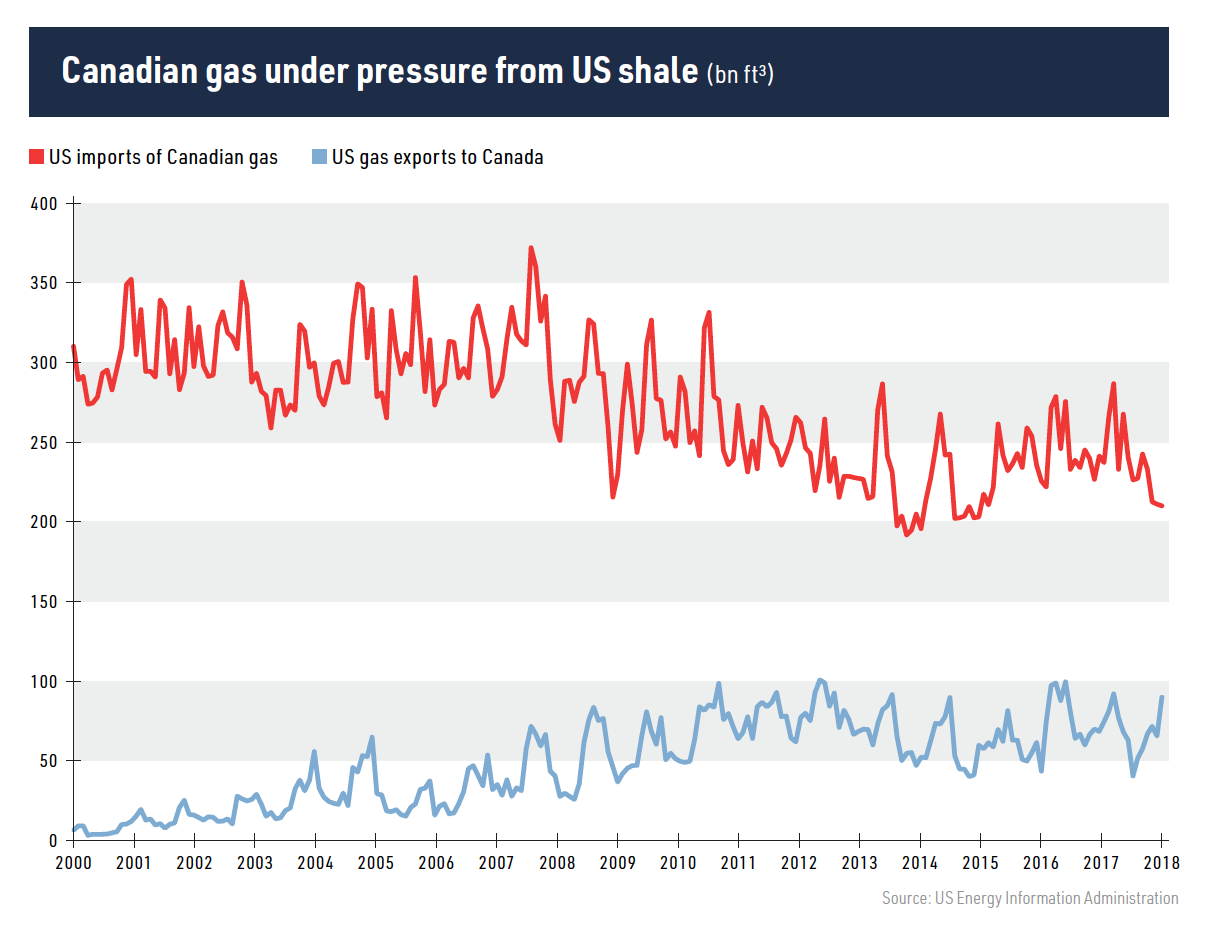

The country has historically relied on exporting gas to the world’s biggest energy market, the US, to the south. Even a dozen years ago, it was widely expected that US and Canadian production would be unable to satisfy US demand and that LNG import terminals would have to be built.

However, the US shale boom turned the market on its head. Planned import projects were cancelled or mothballed and unconventional gas priced some Canadian suppliers out of the US market.

A string of LNG projects were proposed in the US, but also in Canada to take advantage of the glut. The Canadian government has now issued licences for 24 LNG export schemes and about two-thirds of all proposed new LNG production capacity in the world is located in Canada and the US.

However, the expansion of US gas supply, the existence of brownfield sites housing redundant US LNG import terminals, and the sheer length of new pipeline required to connect reserves with proposed projects in Canada favoured US LNG development. Several Canadian ventures were cancelled and others postponed, particularly in British Columbia.

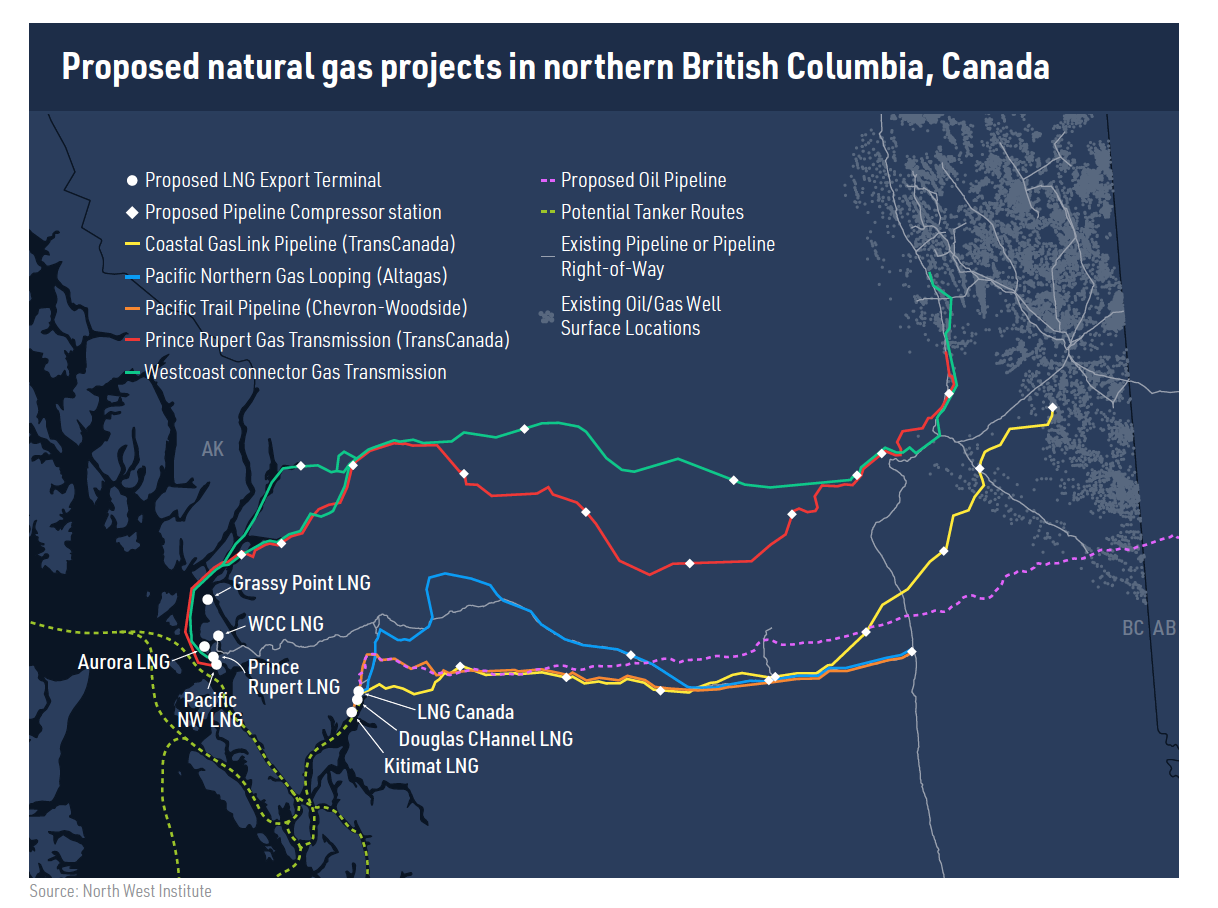

Pacific Northwest LNG, Aurora LNG, Douglas Channel FLNG, Grassy Point LNG, Malahat FLNG, Prince Rupert LNG, Tilbury LNG and Triton FLNG were all cancelled or delayed in 2016 and 2017.

A consortium of Canadian gas producers has become so frustrated with delays that they hope to develop their own project. Advantage Oil & Gas Ltd, Seven Generations Energy Ltd, Peyto Exploration and Development Corporation and another seven firms have banded together to try to take over one of the mothballed projects.

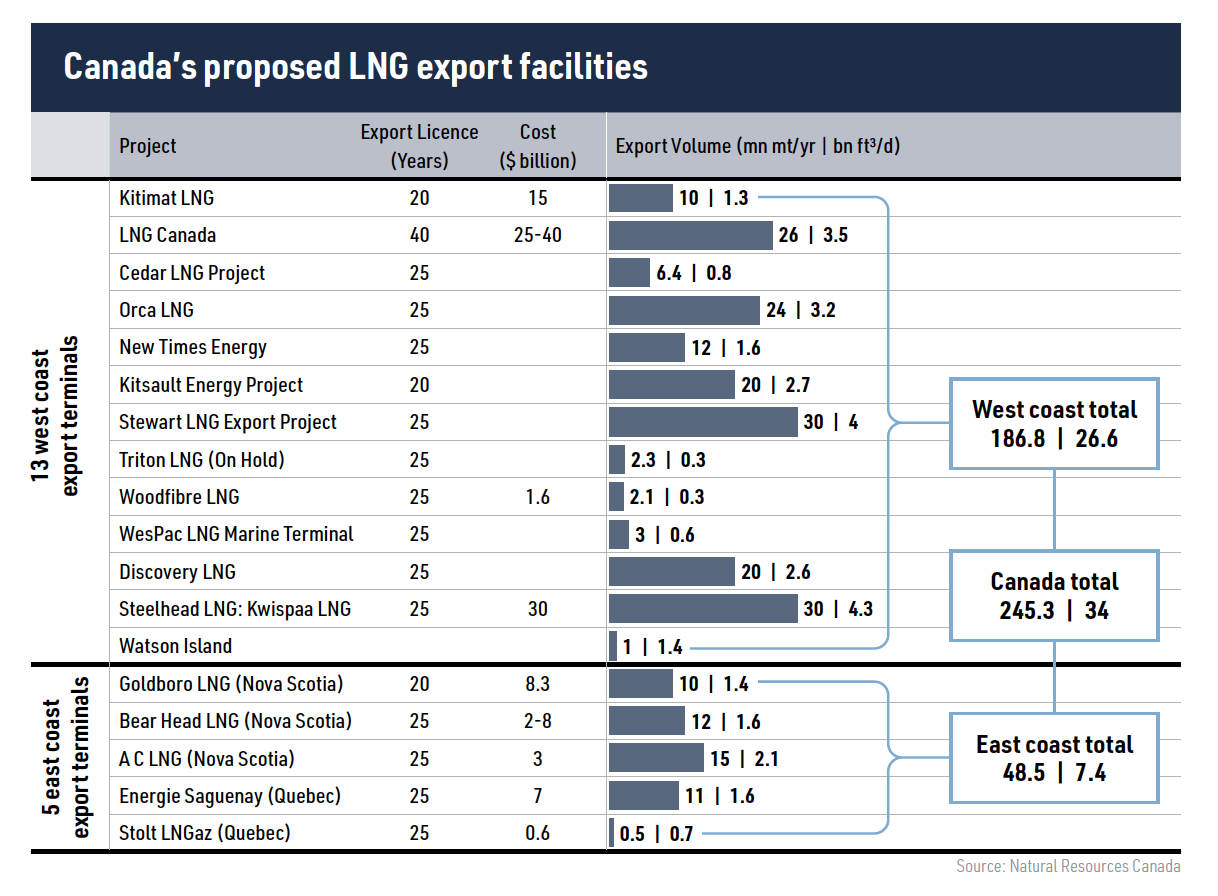

However, the Canadian government still regards 18 LNG schemes as being live, including 13 in British Columbia, three in Nova Scotia and two in Quebec, with combined production capacity of 216mn mt/year, equivalent to 28.4bn ft³/day. Not all will be built, but Canada clearly has the potential to become an LNG exporter on a par with Australia or Qatar.

LNG Canada

The final investment decision (FID) on the first phase of the LNG Canada project, which will have two trains each with capacity of at least 6.5mn mt/year, was approved in October, while the second phase would double production capacity to at least 26mn mt/year.

The consortium developing the project comprises the local subsidiaries of Shell (40%), Malaysia’s Petronas (25%), PetroChina (15%), Japan’s Mitsubishi Corporation (15%) and South Korea’s Kogas (5%). Baker Hughes will supply four of its LMS100-PB gas turbines and eight centrifugal compressors to the plant.

In March, LNG Canada CEO Andy Calitz said that the FID on Phase 2 will be taken before first production from Phase 1 in 2025. He said that members of the consortium want “some insight overall” on the project before sanctioning Phase 2.

With a price tag of $40 billion, the entire scheme would be the biggest infrastructure project by value in Canadian history. The Conference Board of Canada estimates that the creation of a 30mn mt/year LNG industry in British Columbia would add $7.4bn a year to GDP, while providing an average of 65,000 jobs a year. However, that goal remains at least a decade away.

Calitz said that the FID for LNG Canada was the result of “years of work with First Nations, including elected and hereditary chiefs, municipal, provincial and federal governments, northern communities, and thousands of people working in industry in BC [British Columbia].”

Opposition from First Nations was one of the main obstacles to the development of the Pacific Northwest LNG project.

LNG Canada considered more than 500 locations for the project, but cited British Columbia’s large gas reserves and its location on the Pacific Ocean as key reasons to build its plant at Kitimat in northern British Columbia.

Kitimat’s location at the head of the Douglas Channel allows the plant to be built as far inland as possible to shorten the length of pipeline needed to connect it to the reserves. The project will have a year-round ice-free port and can make use of existing infrastructure such as roads, power lines and the airport in Terrace.

Ongoing opposition

There have been protests against the development of LNG Canada by environmental groups and also by some First Nations’ representatives who oppose the construction of pipelines across their territory, although 25 First Nations’ groups have already sanctioned development.

The federal regulator is also currently considering a jurisdictional challenge from a private citizen who argues that the NEB needs to approve the construction of the supply pipeline. According to the federal government, federal approval is only required for projects that cross provincial boundaries and the Coastal GasLink line will lie entirely on British Columbian territory.

Ottawa is keen to support the development of an LNG industry, but emphasizes that all projects must have the support of the provinces, territories and First Nations concerned. Most of the responsibility for sanctioning and monitoring LNG terminals falls under provincial regulations, but permits for LNG export are provided by the NEB, while both federal and provincial environmental assessments and permits are required.

The pipeline, which will carry gas from the Montney shale formation, will be built by TransCanada Corporation, which hopes to sell a stake in the project.Calitz has said that he does not see “a single scenario” that would cause pipeline construction to be halted.

He commented in January: “We recognize it may not be possible to get unanimous support for a major infrastructure project in BC, but we believe Canada’s economy cannot prosper without a growing and healthy resource sector. Projects like our own provide an opportunity that many First Nations and northern communities have not had before and may not see again.”

Asian access

Any plants developed in British Columbia will enjoy significantly shorter sailing times to Asian customers than the lion’s share of planned new US capacity that will be built on the Gulf coast and will have to traverse the Panama Canal. Japan, China and South Korea are the world’s three largest LNG markets, with China the fastest growing.

However, the length of the pipelines required in British Columbia means that such projects are generally expected to have higher capital costs than US projects.

The government of British Columbia introduced an LNG-specific investment regime in 2015 and new terms of investment for gas projects in 2018, both of which are designed to make LNG projects more financially attractive. The latter may have made a difference, as LNG Canada postponed an earlier FID in 2016.

However, changes to the investment regime have not all been positive. The Canada Border Services Agency imposed import duties on some fabricated industrial steel components to deter dumping, which could push up construction costs.

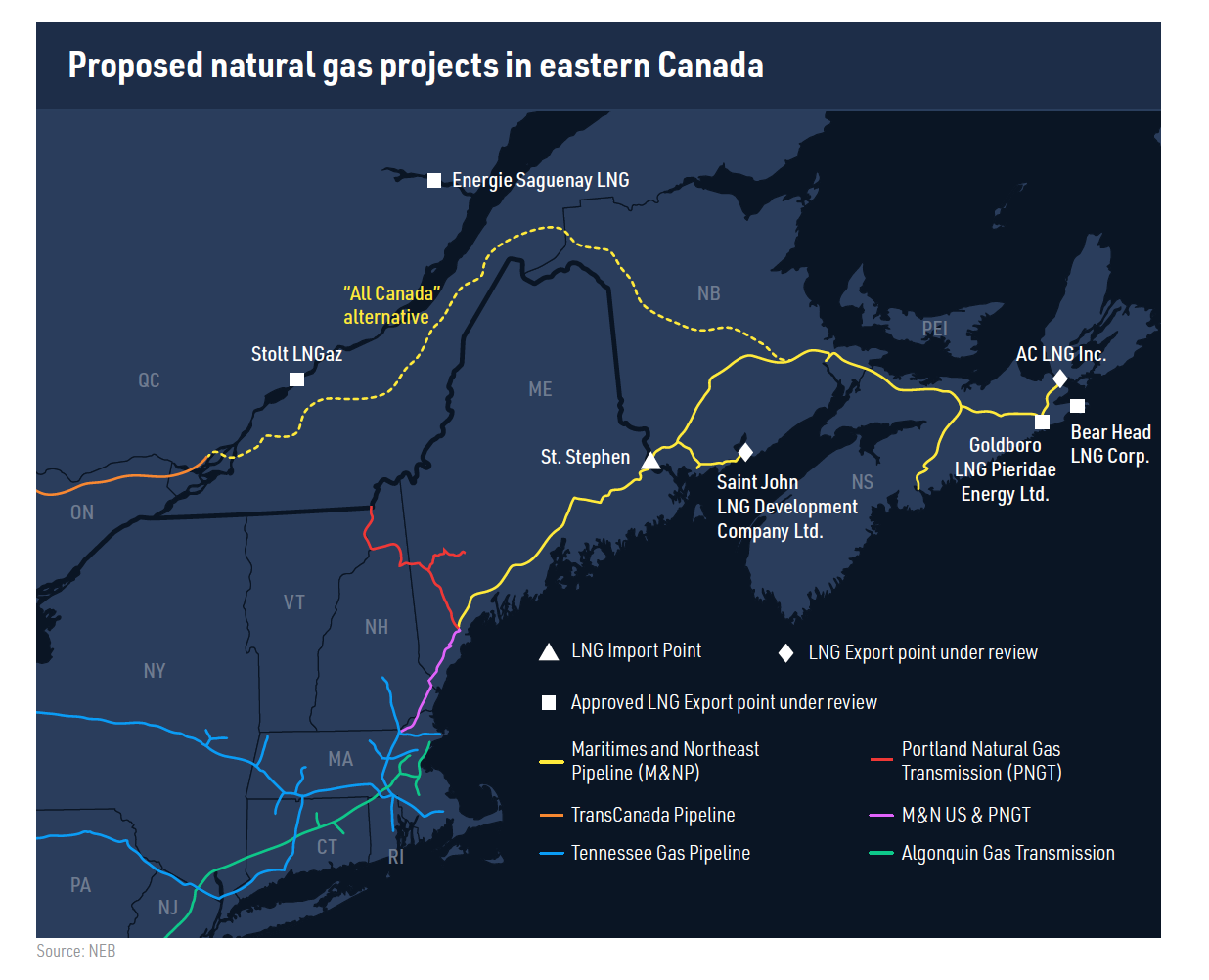

Eastern Canada

Some projects in Eastern Canada will be able to make use of existing pipeline infrastructure, although the direction of flow will have to be reversed. The east coast projects could source gas from the US and even the Western Canada Sedimentary Basin, which is estimated to hold more than 1,000 trillion ft³ of gas, but this will mean long pipelines, higher costs and more extensive permitting. East coast plants will target Atlantic basin customers, particularly in Europe.

Pieridae Energy Ltd hopes to take the FID on its $7.5bn project by the middle of this year, once it has concluded debt and equity financing, plus agreed an engineering, procurement and construction contract. Goldboro LNG would have production capacity of 10mn mt/year and its location in Nova Scotia gives it shorter transport times to northwest Europe than any US producer.

Thomas Dawson, senior vice president for business development at Pieridae, told Bloomberg: “Having the shortest distance to our primary market is extremely valuable. After last winter the system got very stressed and we now see a lot of interest from different utilities and companies looking for their slice of LNG to manage their supply portfolio.”

German utility Uniper has signed a sale and purchase agreement to take half of the project’s capacity for 20 years, while the German government last year increased its loan guarantee to the project from $3bn to $4.5bn. Switzerland’s Axpo Holding is currently negotiating an LNG sale and purchase agreement for another 1mn mt/year, while Pieridae says that it is in talks over long-term deals for another 2mn mt/year.

Long-term potential

It appears after years of delay, Canada will get its first LNG plants on both the Pacific and Atlantic coasts. From there, the world is its oyster. The first plants may prove a vanguard in the future monetisation of Canada’s vast gas resources, circumventing the current constraints of the domestic US market and entering into competition with US LNG producers.

Alternatively, the difficulties in getting these greenfield projects off the ground may still prove too much for many investors. At the same time, it is not impossible that the prospects for gas exports across Canada’s southern border once again revive post-2030 as the US shale resource hits its point of maximum expansion. At least by then, with some LNG capacity, Canada would have the choice of markets it so clearly lacks today.

For the full Magazine sign up FREE below and download the March 2019 edition of LNG Condensed.

NOW AVAILABLE: Volume 1, Issue 3 - March 2019

LNG Condensed brings you independent analysis of the LNG world's rapidly evolving markets.

LNG Condensed brings you independent analysis of the LNG world's rapidly evolving markets.

Covering the length of the LNG value chain and the breadth of this global industry, it will inform, provoke and enrich your decision making. Published monthly, LNG Condensed provides original content on industry developments by the leading editorial team from Natural Gas World.

LNG Condensed is your magazine for the fuel of the future.

Volume 1, Issue 3 - March 2019

Canada - The Sleeping Giant

> Editorial: Pressure Testing the European gas Market

> Feature: South Asia’s Shifting NGV Opportunities

> Feature: Small-Scale LNG Opens Up Markets

> Country focus: Philippines: Major Potential for Small-Scale LNG

> Project spotlight: Arctic LNG 2

and more!

Sign up now to receive LNG Condensed monthly FREE (after filling out the form you will be redirected to LNG Condensed's archive where you can find every issue already published available for download):