Canada’s Pieridae Sets 2021 Guidance

Canada’s Pieridae Energy issued a 2021 spending guidance December 7 that includes capital expenditures in the C$305mn-C$420mn (US$238mn-US$328mn) range and net operating income (NOI) of C$100mn-C$130mn.

“We are guiding to an increase in NOI primarily due to higher anticipated gas prices in 2021, as well as continued optimisation of our assets, higher third-party processing fees, increased overall volumes and other cost saving initiatives,” CEO Alfred Sorensen said.

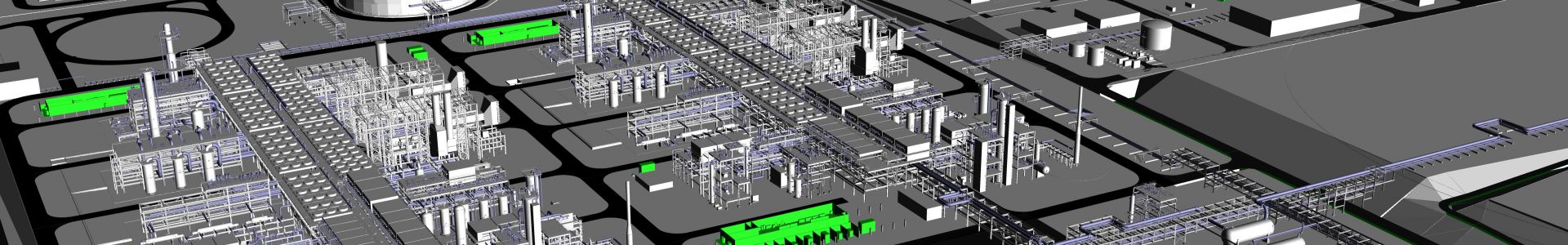

Upstream capital spending has been set in the C$45mn-C$55mn range, while the pre-development expense budget of C$10mn-C$15mn for the 10mn mt/yr Goldboro LNG project (banner image courtesy Pieridae Energy) has been set ahead of an anticipated final investment decision (FID) in June 2021.

About half of the pre-development budget will be allocated to third-party due diligence work and fees for midstream companies for the delivery of pipeline engineering analyses that are required before FID can be considered.

The rest will go to EPC contractor Bechtel for it to deliver a comprehensive engineering, procurement, construction and commissioning (EPCC) execution plan by March 31, 2021 and a final lump sum, turnkey EPCC contract price proposal by May 31, 2021.

FID will trigger 2021 capital expenditures on Goldboro of C$250mn-C$350mn for early works: highway realignment, a down payment on construction of a C$720mn workforce lodge, marine offloading facilities and site preparation for storage and large-scale facility building materials.

It would also signal the start of Pieridae’s five-year drilling plan to fill the first train at Goldboro.

“Prior to FID, the company plans to spend approximately C$12mn on development capital to further flatten our low decline production base,” the company said. “Our ultimate goal through a multi-year conventional Foothills drilling program is to fill our three Alberta sour gas plants as we prepare to send feed gas to the LNG facility.”