China re-embraces LNG as southern power demand surges [Gas in Transition]

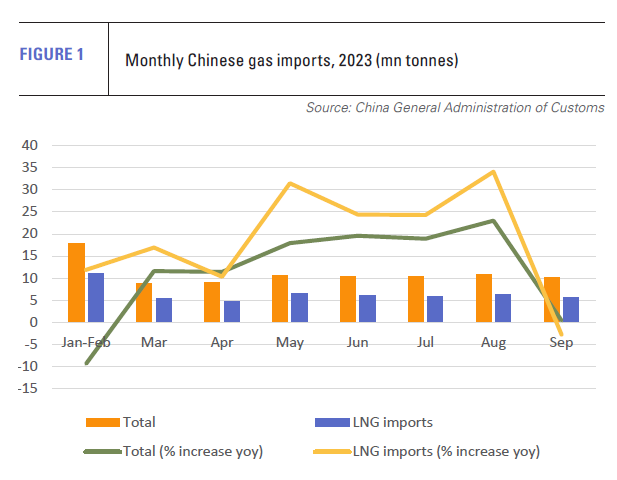

Chinese LNG imports have grown rapidly in 2023 after their unprecedented fall in 2022 (see figure 1). The drop in import volumes last year reflected the country’s economic travails, which resulted in large part from zero-COVID policies, the war in Ukraine and a depressed domestic property market.

The Chinese economy grew by only 3% in 2022, well below both the 8.4% posted in 2021 and the official target for last year of at least 5.5%. As a result, total primary energy consumption grew by less than 1%.

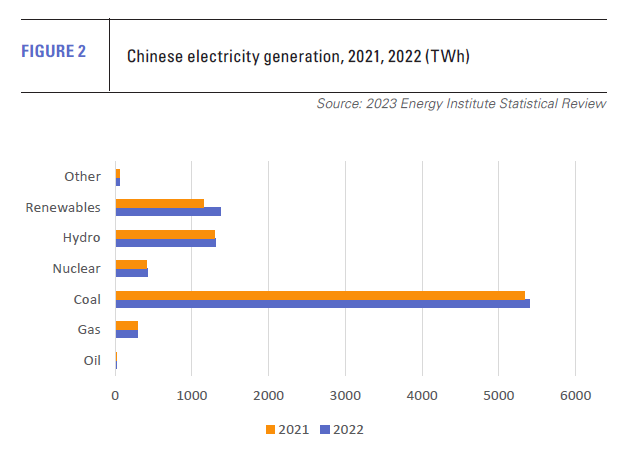

Growth was also well below trend in the electricity generation sector (see figure 2). According to data from the National Bureau of Statistics (NBS), Chinese power production grew by only 2.2% last year. Double-digit growth in solar and wind generation, a 2.5% jump in nuclear output and a 1% increase in hydropower meant that thermal power generation grew by only 0.9%.

Within the thermal power sector a combination of buoyant growth in Chinese coal production – up 9% in 2022 – and high international gas prices resulted in extremely low growth in gas-fired generation. According to the Energy Institute Strategic Review (EISR), Chinese gas-fired generation of 290.6 TWh in 2022 was little different from the 287.1 TWh recorded in 2021.

With demand from the industrial sector faring no better, overall Chinese gas consumption of 375.7bn m3 in 2022 was 1.2% lower than in 2021. At the same time, there was an uptick in domestic gas production, which increased by 6% to 221.8bn m3 (see figure 3).

With demand from the industrial sector faring no better, overall Chinese gas consumption of 375.7bn m3 in 2022 was 1.2% lower than in 2021. At the same time, there was an uptick in domestic gas production, which increased by 6% to 221.8bn m3 (see figure 3).

This left the requirement for gas imports at just over 150 bn m3, down 7.1% versus 2021.

Piped gas imports rose 9.7% year-on-year to 58.4bn m3, driven mainly by an increase to about 15bn m3 in the gas supplied through the Power of Siberia-1 line from Russia. The increase in piped supplies further squeezed the requirement for LNG imports, which fell by more than 15% year on year to 93.2bn m3. As a result, China lost its status as the world’s largest single LNG importer, which it had gained from Japan only a year before.

2023 recovery

As 2022 gave way to 2023 the prognosis initially appeared to be one of continued gloom. GDP growth in fourth-quarter 2022 came in at only 2.9%, with the apparent economic malaise being paralleled in the energy sector. Total gas imports in January and February 2023 fell by 9.4% yr/yr to 17.93mn t (24.7bn m3), according to the NBS.

However, since then, the country’s economic performance and energy requirements have shown a marked resurgence. GDP grew by 5.2% in the first three quarters of 2023. Meanwhile, gas imports increased year on year in every month from March to September..png)

For the first nine months of the year they were over 8% higher than in 2022 at about 88mn t (121.4bn m3). Domestic gas production grew by 6.4% to 170.4bn m3 during the first nine months of the year, but still lagged growth in demand.

In July, the National Energy Administration’s (NEA) Natural Gas Development Report projected that gas demand would grow by between 5.5%-7.0% in 2023. In September, a subsidiary of the state-run energy company CNOOC estimated it would be even stronger, rising by 8%.

Gas demand has been increasing across the industrial, city gas and especially power sectors. Surging demand for electricity led to a 4.2% increase in power generation in the first nine months of the year.

Solar and wind generation both registered double-digit increases in output (see figure 4). However, generation from hydroelectric plants, which produce more power than wind and solar facilities combined, fell by more than 10%. This meant thermal generation had to increase by 5.8% year/year.

Southern Chinese power demand key for LNG imports

With coal production having grown by only 3% in the first three quarters of 2023, much of the onus fell on gas-fired output. This was particularly true in southern provinces, such as Guangdong, where increased gas-fired generation was needed to combat hotter-than-usual weather and to replace the much-reduced electricity supplies from drought-hit hydropower plants in Yunnan province.

The location of the demand for higher gas-fired generation in part explains the fact that increased gas imports in 2023 have to date mainly comprised LNG, supported by lower spot prices for the fuel. LNG imports totalled about 51.5mn t (71bn m3) during the nine months to September, while pipeline imports delivered to northern China from Russia and Central Asia totalled about 50bn m3 during the same period..png)

As a result, Chinese LNG demand in 2023 seems certain to exceed that of Japan and could establish a new record within China itself. Based on the EISR consumption figure for 2022 of 375.7bn m3, and demand growth of 5.5-8.0%, Chinese gas demand this year should be around 396-406bn m3. Assuming domestic production of 225-230bn m3 and piped imports of about 60-65bn m3, this suggests somewhere in the region of 101-121bn m3 of LNG imports in 2023.

Buying more LNG for storage than in 2022 could also push up import levels. Increased storage is a priority for the government. The Gas Development Report called for 55-60bn m3 of storage capacity by 2025. In addition, LNG demand could be boosted by an unusually cold winter, although conversely a mild winter could constrain demand closer to the bottom of the range.

Large-scale and co-ordinated LNG spot purchases have begun, including Sinopec’s tender for up to 25 cargoes for delivery by the end of 2024. Long-term purchases are also being actively pursued. Recent deals include China National Petroleum Corporation (CNPC)’s 27-year contract with QatarEnergy for 4mn t/yr, and ENN Energy’s contract with Cheniere Energy in the US for 1.8mn t/yr for more than 20 years.

Long-term prospects are positive

Chinese gas and LNG demand are likely to continue growing. Gas demand is set to continue rising in tandem with economic activity, which has registered significant growth in 2023 without much help from the ailing property market or increased global demand for Chinese exports. As activity in these sectors improves, substantial additional growth in Chinese GDP might be expected.

Increased economic growth does not automatically translate into increased LNG demand. Beijing’s emphasis on increased security of energy supply means that renewables and domestic coal will continue to be favoured, especially if global LNG prices move too far out of kilter with those of local coal production.

At the same time, there are factors that favour gas use and, within that, LNG. Coal has environmental and some locational disadvantages relative to gas, the latter especially so in the south and southeast of the country. Untapped and economic hydroelectric potential is now low, while output from much of the existing capacity is hamstrung by low water levels or competing claims for water.

Wind and solar can have locational disadvantages, but despite the amount of installed and under construction capacity, renewables remain a relatively minor contributor to Chinese electricity supply. Substantial gas use will thus continue to be needed, not least for bridging purposes.

Wind and solar can have locational disadvantages, but despite the amount of installed and under construction capacity, renewables remain a relatively minor contributor to Chinese electricity supply. Substantial gas use will thus continue to be needed, not least for bridging purposes.

As with gas, so too with LNG. Domestic gas production will always be favoured for security of supply and foreign exchange reasons, but both the growth rate and peak production are likely to be modest compared to gas demand.

Piped gas imports can have cost advantages once operational, but are capital intensive and their entry points are concentrated in the north and west of the country, much of which is well served by coal or renewables. It is very likely that more import pipelines will be agreed, but Beijing does not appear to be in a hurry to commit to more projects in the near term.

Expectations that the 50bn-m3/yr Power of Siberia 2 project would be formally agreed at a meeting held in October between Presidents Xi Jinping and Vladimir Putin proved to be unfounded. A key stumbling block is the additional domestic transmission infrastructure, and its cost, which would need to be built to bring the gas from the Russian/Chinese border to consumers.

LNG demand thus appears likely to experience significant further growth, especially in the south and southeast of the country, with much of the fuel being used for power generation or supplied to the country’s burgeoning city gas networks. That means that more regasification capacity is likely to be built on top of the 26 existing terminals.

As a result, China’s role in the global LNG market will continue to grow and deepen as it re-establishes and then consolidates its position as the world’s largest LNG market.