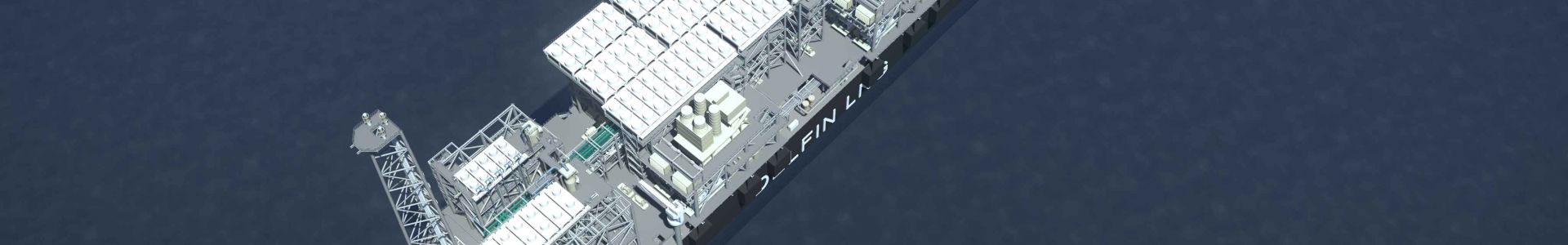

Delfin Midstream, Devon in LNG partnership

Delfin Midstream and Devon Energy said September 5 they have entered into a liquefied natural gas export partnership that includes a heads-of-agreement (HoA) for liquefaction capacity and an equity investment by Devon in Delfin.

The HoA provides the framework for finalising a detailed long-term tolling agreement covering 1mn mt/yr of capacity in Delfin’s first floating LNG vessel, with the ability to add another 1mn mt/yr in the first or future vessels. In addition to access to future liquefaction capacity, the HoA also provides for future equity investments by Devon.

|

Advertisement: The National Gas Company of Trinidad and Tobago Limited (NGC) NGC’s HSSE strategy is reflective and supportive of the organisational vision to become a leader in the global energy business. |

“We are delighted to execute this agreement with Devon, representing a truly strategic partnership between a US producer and a liquefaction provider,” Delfin CEO Dudley Poston said. “We believe our unique liquefaction solution provides significant structural flexibility that allows producers to maximise the value of their natural gas, while providing a much-needed source of additional supply to the world LNG marketplace.”

The decision to invest in Delfin, Devon CEO Rick Muncrief said, is intended to create additional pricing diversification for its natural gas portfolio, which is largely concentrated in the Delaware basin in Texas and New Mexico.

Earlier this summer, Delfin announced a binding sale and purchase agreement (SPA) with LNG trader Vitol and an HoA with UK’s Centrica covering a total of 1.5mn mt/yr from Delfin’s initial vessel, which would have the capacity to produce 2-2.5mn mt/yr of LNG. It is also in advanced discussions for additional HoAs, SPAs and tolling arrangements.

Delfin is on track to make a final investment decision on its first vessel by the end of this year. Its long-term plans call for the development of Delfin LNG, a deep-water port in the Gulf of Mexico comprised of four floating liquefaction vessels, with a combined capacity of 13mn mt/yr, connected to the UTOS pipeline, which Delfin acquired in 2014 from Enbridge.