Disputes intensify over Calcasieu Pass commissioning [Gas in Transition]

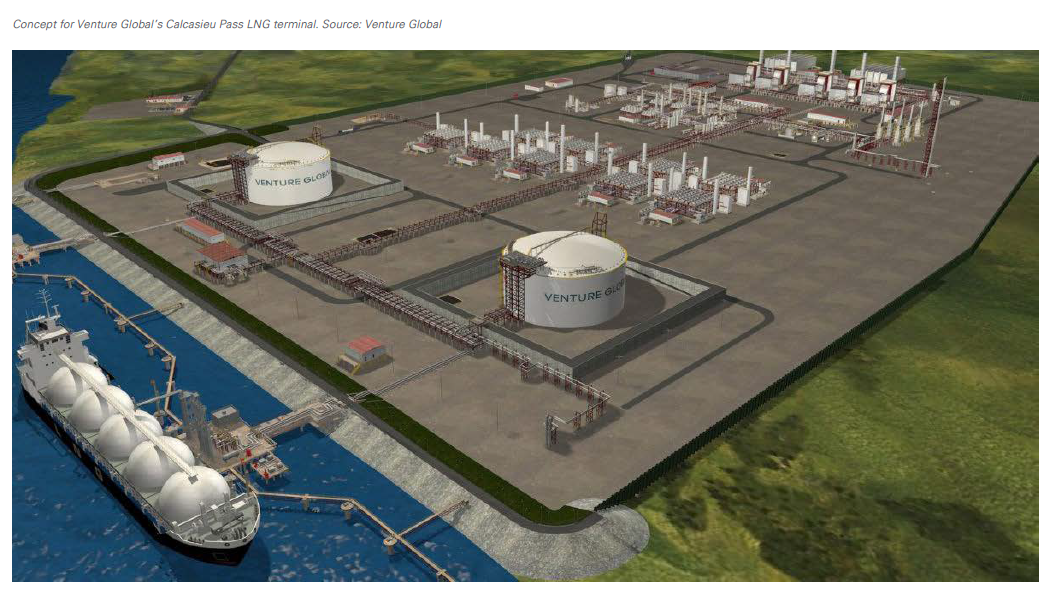

Disputes continue between US-based Venture Global LNG and its customers amid the ongoing commissioning of its Calcasieu Pass export terminal on Louisiana’s Gulf Coast. The terminal exported its first cargo in March 2022, with Venture Global touting the 29 months it took to build the plant and achieve LNG production as a record for a large-scale greenfield LNG facility. However, Calcasieu Pass has since achieved another record, for the longest ever commissioning period for a US liquefaction terminal.

As of September 2023, the facility remained in commissioning and no date has been confirmed for commercial service. However, media have reported that Calcasieu Pass’ customers have been informed that they may only begin receiving their contracted LNG cargoes from late 2024 or early 2025.

Venture Global has previously attributed the prolonged commissioning period to operational issues with power equipment at the Calcasieu Pass site. However, it has continued to export LNG cargoes throughout the commissioning period. According to data shared with NGW by analytics firm Kpler, 12.3mn tonnes of LNG have been shipped from Calcasieu Pass to date, of which almost 70% has gone to Europe. Exports continue to ramp up, with 6.2mn tonnes shipped in 2022, and 6.1mn tonnes shipped in January-August 2023, according to Kpler. Meanwhile, data shared with NGW by the London Stock Exchange Group (LSEG) showed that the volumes amounted to 203 cargoes exported from Calcasieu Pass to date.

Disputes

The start of exports from Calcasieu Pass coincided with a spike in natural gas prices, caused by the war in Ukraine, and a scramble by European buyers to find alternatives to imports of pipeline gas from Russia. Thus, selling cargoes on the spot market – especially in 2022 – is thought to have represented a more lucrative option than selling them to the plant’s long-term buyers.

The continued shipping of cargoes from Calcasieu Pass has led to disputes between Venture Global and its customers. On September 20, Reuters reported, citing people familiar with the matter, that Spain’s Repsol had launched arbitration proceedings against Venture Global.

Repsol did not respond to an NGW request for comment, but it becomes the fourth company to pursue an arbitration case against Venture Global, after Shell, BP and Edison. Shell, meanwhile, has been openly critical of what it sees as a deliberate attempt by Venture Global to prolong commissioning and capitalise on higher spot prices for natural gas.

“By all appearances, Venture Global is intentionally drawing out the commissioning process to delay making long-term contract cargoes available to the foundational buyers,” a Shell spokesperson tells NGW. “The company has already sold nearly 200 cargoes on the spot market and continues to do so, despite informing foundational partners of their extended force majeure.”

“By all appearances, Venture Global is intentionally drawing out the commissioning process to delay making long-term contract cargoes available to the foundational buyers,” a Shell spokesperson tells NGW. “The company has already sold nearly 200 cargoes on the spot market and continues to do so, despite informing foundational partners of their extended force majeure.”

At the Gastech conference in Singapore earlier in September, Shell Energy’s executive vice president, Steve Hill, went a step further, describing Venture Global’s actions as “deceitful” and “damaging and dangerous” for the LNG industry.

“This is a wake-up call for the industry. The LNG business is underpinned by trust in long-term contracts. The long-term commitment that foundation buyers make, enable the regulatory certainty, the financing, and the development of new LNG projects. If contracts are seen as options for suppliers, then buyers simply won’t sign and the industry won’t grow,” Hill told the conference. “It's simply not credible to operate for over a year, often above nameplate capacity to sell 185 so-called commissioning cargoes for what's reported to be over $15bn and claim, firstly, that you're not in commercial operation, and secondly, that you can't supply any cargoes to those foundation buyers who you've previously publicly acknowledged enabled your project. Or if you do, you can't expect anybody to believe you, especially in the current price environment.”

Hill said that the other US LNG export terminals supplied on average less than 10 commissioning cargoes each. Analytics firm RBN Energy noted in a recent blog post than a newly built LNG train typically produces 1-3 commissioning cargoes before it is placed into commercial service, which generally activates its long-term contracts. Elba Island LNG, the only other operational terminal in the US that has used midscale modular technology to date, had only six commissioning cargoes prior to commercialisation, with RBN noting that this was despite it running into operational issues.

Venture Global did not respond to NGW’s request for comment. However, the company has previously said that it remains in compliance with all of its contractual obligations, including on timing.

Implications

Many industry observers have been hesitant to comment publicly on the potential outcome of the arbitration proceedings against Venture Global. However, Reuters cited a lawyer familiar with the matter as saying the arbitration cases faced an uphill battle because Venture Global’s contracts give it sole discretion to determine the start of commercial operations. Nor does the US Federal Energy Regulatory Commission (FERC) have rules specifying the length of commissioning periods. Typically, though, commissioning takes 1-3 months.

Repsol is now reported to be asking that Venture Global either start providing contracted cargoes or pay more than $100mn for fuel not delivered, according to another of Reuters’ sources.

If the sources are correct, the arbitration cases may not have the desired outcomes for Venture Global’s buyers. In the longer term, the disputes could end up having an impact, both for Venture Global and for the LNG industry more broadly. However, this has not yet played out, with Venture Global continuing to sign new offtake agreements for its under-construction Plaquemines terminal and planned CP2 project over recent months.

“Not delivering the volumes from Calcasieu Pass to the offtakers that they signed off on, then remaining in the commissioning stage at this point in time should affect future LNG SPA offtake agreements, but it hasn't,” a Rystad Energy North America gas market analyst, Ade Allen, tells NGW. He notes that this year alone, Venture Global had signed offtake agreements for close to 6mn tonnes/year of LNG from its future projects even as commissioning at Calcasieu Pass has dragged on.

“Demand for gas is so robust and Venture Global has a tried and tested product, in the sense that they were able to go on this path with Calcasieu Pass, develop the facility and actually start to liquefy gas in a reasonable amount of time. The offtakers are looking beyond the contractual issues that they have for Calcasieu Pass,” Allen says.

However, he does expect the current disputes to result in stricter contractual terms in the future.

“Going forward, I think you're just going to have tighter contracts, where the contractual details would be much more finely ironed out so this won't occur,” Allen says.

A Solaris MCI LNG operations specialist, Mehdy Touil, takes a similar view on how the current situation could affect Venture Global’s future efforts to secure offtakers.

“Recent announcements regarding VG's Plaquemines and CP2 seem to indicate that VG has not faced significant challenges in marketing LNG volumes for these projects, so the perceived reputational hit does not look as bad as we initially thought,” Touil tells NGW. “Additionally, it appears that the terms offered by VG are attractive to potential offtakers, possibly similar to those of Calcasieu Pass. However, I am confident that going forward, any new contracts will likely include a more detailed definition of ‘commissioning’,” he says.

This could also affect other LNG developers as they seek to attract long-term buyers for their output, while would-be customers become more wary of finding themselves in a similar situation to Venture Global’s offtakers currently.

“This highlights the importance of clear contractual terms and definitions in the LNG industry, especially during the commissioning phase of projects,” says Touil. “VG will obviously take steps to avoid any ambiguities or disputes related to commissioning in future contracts. The VG saga will also put unnecessary stress on the other developers trying to take their projects off the ground.”