Draghi’s report: a wakeup call after five years of EU green dogma? [Global Gas Perspectives]

Former Italian Prime Minister Mario Draghi’s report, The future of European competitiveness, paints a stark picture of how high natural gas prices have killed the EU’s competitiveness. Draghi clearly states “to reduce the EU’s exposure to the volatile spot market and leverage potential downward pressures on prices, it would be beneficial to promote the signing of long-term contracts by European companies which incorporate pricing formulas reflecting less spot indexation,” adding that “the indexation of contracts should move to formulas closer to a fixed predetermined cost, rather than betting on spot market stability during the next two decades.”

He calls for the European Commission to propose a coordinated approach of “production cost plus mark-up” for EU industrial gas users when negotiating supply contracts with third countries. Brussels could also provide clarity to industries on how to secure long-term contracts directly with exporters to avoid as much as possible the need for intermediaries and spot market purchases.

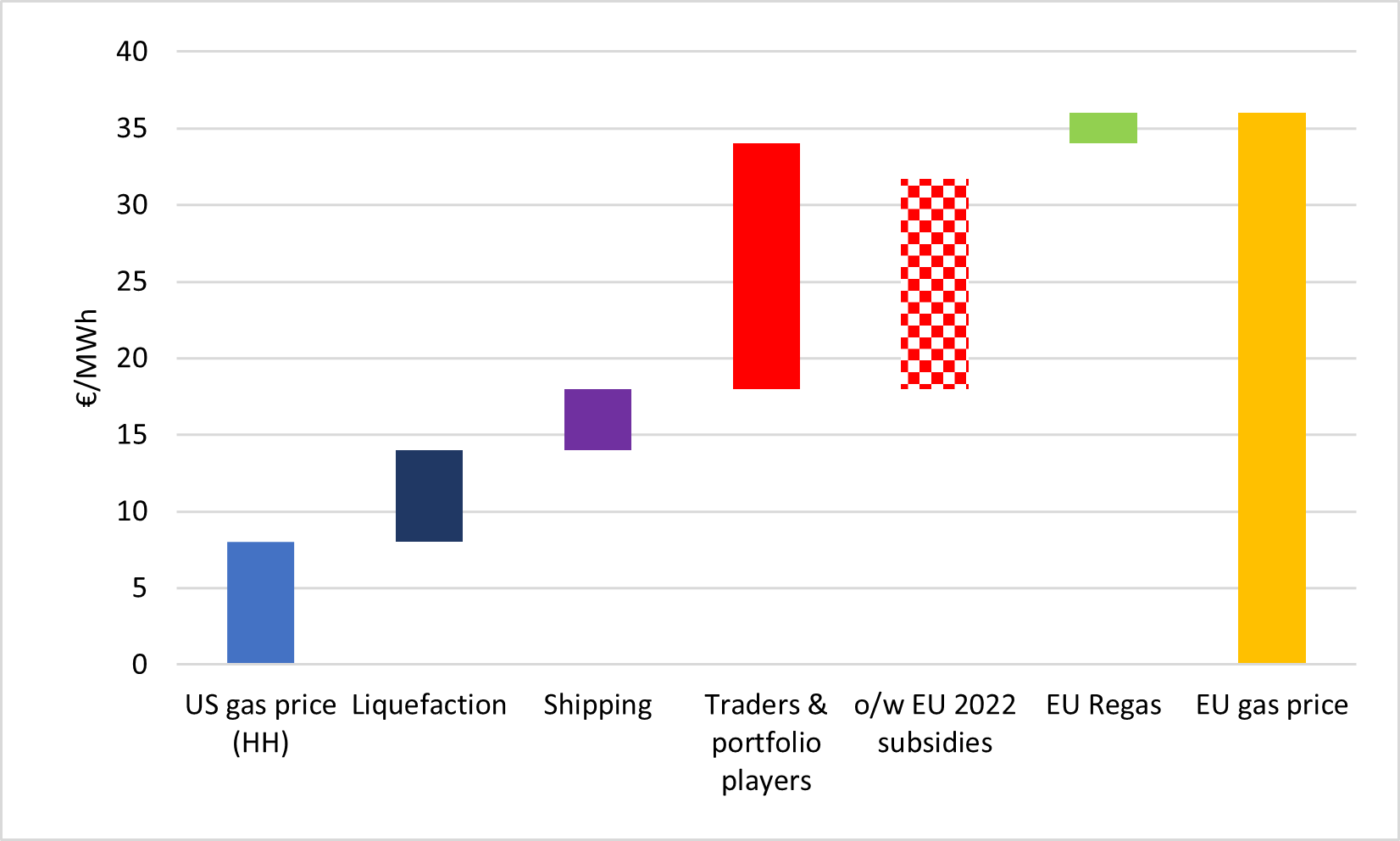

Value chain of US LNG sold to Europe, December 2023, versus EU subsidies in 2022

Sources: The future of European competitiveness 2024, 2023 Report on Energy Subsidies in the EU, thierrybros.com

The report also states clearly that the ones benefitting from the EU’s energy supply crunch are traders and oil and gas operators. This is only partially true, as the ones maximising profit at the EU customers are mainly traders and portfolio players. Security of supply has a cost and when European utilities do not want to engage in long-term contracts to please political masters driven by green dogma, the final cost is unbearable both for customers and taxpayers. In 2022, EU member states provided €46bn (or €13.7/MWh) in subsidies for gas that went directly in the pocket of the traders and LNG portfolio aggregators. In short, 85% of the traders’ profits were provided by EU subsidies.

Draghi also clearly states that “domestic production could also play a key role in ensuring security of supply and to avoid being affected by geopolitical developments, supplying the last molecules of gas in the 2040s and 2050s.”

The former president of the European Central Bank, Draghi was tasked by the European Commission to prepare a report on his vision for the future of European competitiveness. Yet the report’s recommendations contrast greatly with the commission’s policies over the last five years. But the question remains whether Europe, which has been sleepwalking into this crisis, is going to wake up and act. Draghi’s recommendations are unfortunately highly unlikely to be implemented as the new commissioners-designate for Transition, Spain’s Teresa Ribera Rodriguez, and Energy, Denmark’s Dan Jørgensen, are both dogmatic.

One of the birthplaces of coal power, and having relied on the fuel for 142 years, the UK turned off its last coal-fired power plant on September 30. The country’s successful phase-out of coal is thanks to the government’s introduction back in 2013 of a carbon price support mechanism, on top of the EU Emissions Trading System (ETS). This increased the price of CO2 in the UK and kickstarted the coal-to-gas-to-renewable switch. From today, the UK is the first major economy that is not using coal any longer. This is in stark contrast with the EU that failed until 2020 to have a meaningful CO2 price of above €30/t, and introduced a dogmatic Green Deal, but still relied on coal for 10% of its energy mix in 2023.

The share of coal in European G7 countries varies greatly. In 2023, France, thanks to its nuclear fleet, performed best with only 2%, followed by the UK with 3%, though as noted that has now fallen to zero. Then there was Italy with 4% and Germany with 16%. The UK’s success is another good example of well-designed energy policy where polluters are made to pay, instead of spending billions of euros in public money on impossible to achieve green targets. And as any new energy policy takes a decade to be fully implemented, we can easily guess that Germany will still be coal reliant in the middle of next decade, unless it is fully de-industrialised.

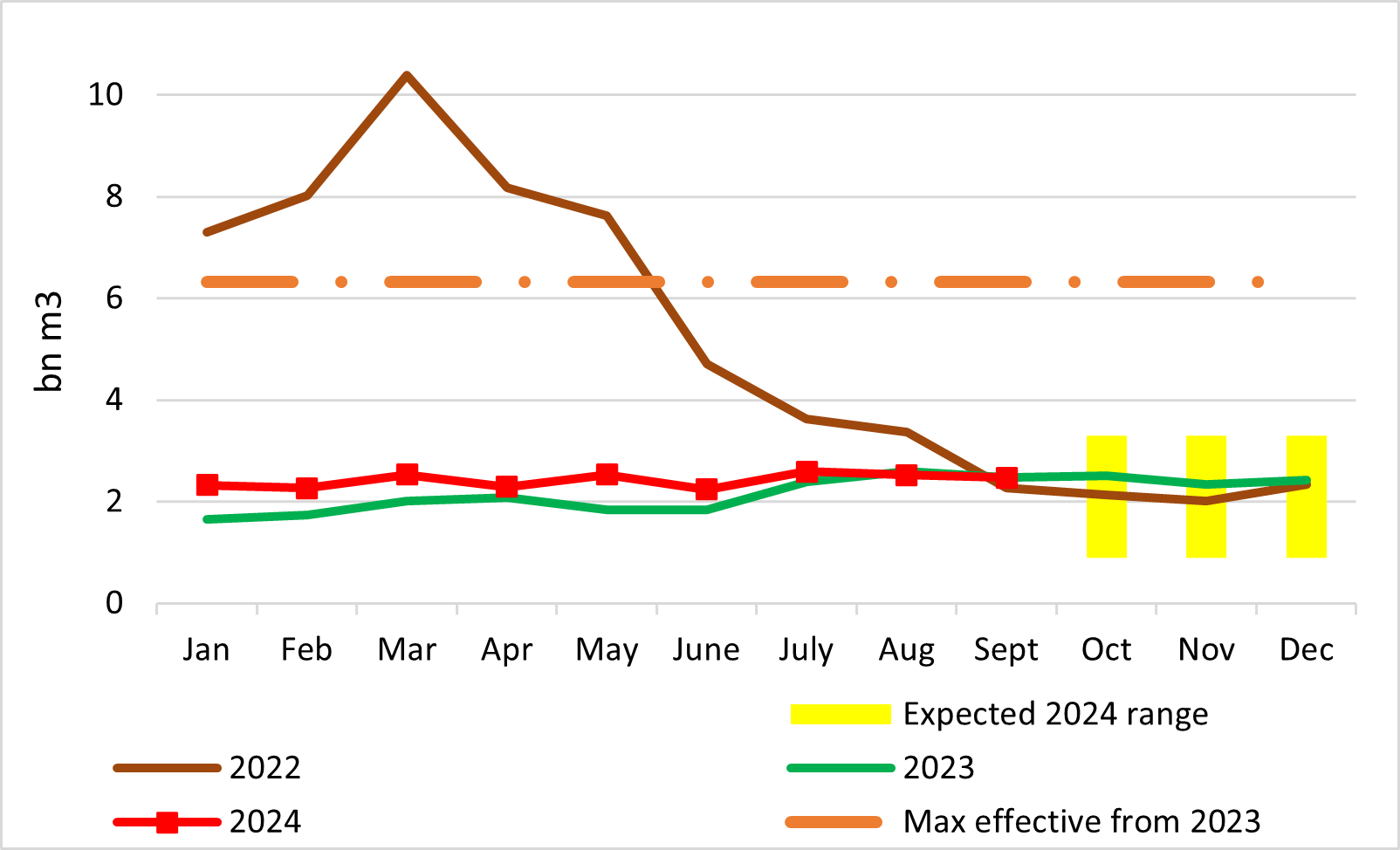

Gazprom flow remains stable

Gazprom piped 2.5bn m3 of gas to Europe last month, close (-0.4%) to what it delivered in September 2023. Nevertheless, year-to-date are still 17% higher than for the same period last year. This is in defiance of the ambition of EU policymakers to eliminate Russian gas imports entirely within a few years.

Gazprom’s monthly gas exports to Europe

Sources: Entsog, thierrybros.com

With the Ukrainian war still raging, and ahead of the final winter where gas supply-demand is expected to remain tight, we should not expect Gazprom to expand its flow further year/year. This is the last winter where the Russian gas exporter has the ability to drive up prices by withholding supply, in an attempt to make the EU less united and less resilient. Nevertheless, the company’s pipeline flow should remain within the expected narrow range of between 0.9-3.5bn m3/month.

Split of Gazprom’s monthly gas exports to Europe by route

.png)

Sources: Gazprom, GTSOU, Entsog, thierrybros.com

The EU reached its target of filling gas storage facilities to 90% of capacity on August 19, more than two months ahead of schedule. By the end of September storage had increased to 94% of capacity, towards the higher end of the historical range but slightly less than at the same point last year.

EU gas storage utilisation

.png)

Source: GIE, thierrybros.com

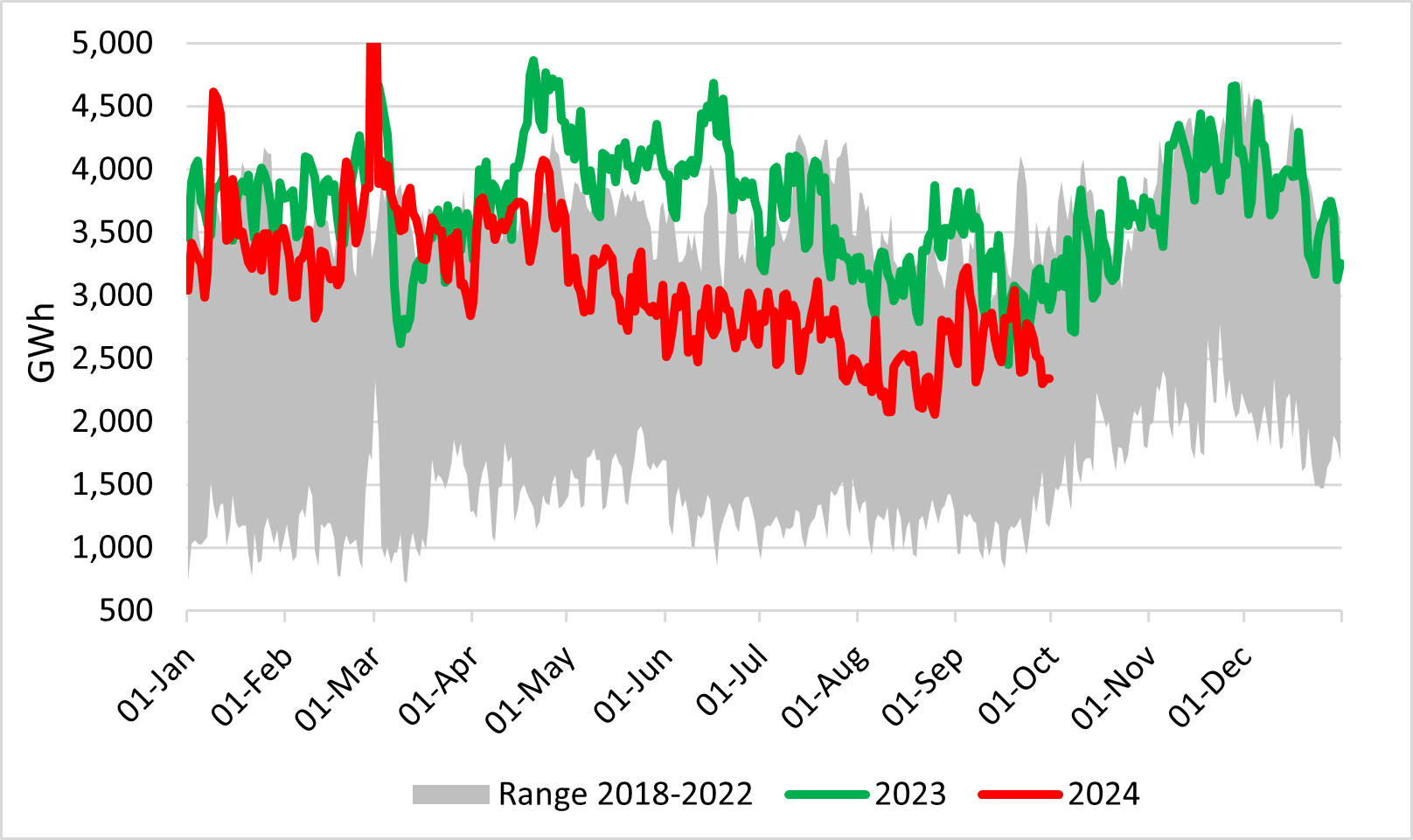

Spot LNG provides the equilibrium between Asian and European markets. EU LNG sent-out data shows that Asia is more willing to attract LNG since the start of this year as the bloc is in no need of extra LNG thanks to Russian supply and further demand destruction. Year-to-date send-out is 17% lower than for the same period last year. But even with European storage levels at a near record high, Europe is paying over $12/mn Btu for gas, as the global gas market is tighter than the consensus predicted.

EU LNG sent-out (excluding Malta)

Source: GIE, thierrybros.com

Looming three months from now is the expected end of Russian gas transit via Ukraine. Moscow and Kyiv’s long–term transit contract expires at the end of December and is unlikely to be renewed. But with European wholesale gas prices at above $12/mn Btu, replacing the 14bn m3/yr of gas that is delivered through Ukraine’s pipelines is going to be a challenge. Replacing a further 5% of EU gas demand could be very expensive and could contravene the next European Commission’s focus on re-industrialisation. We might see a double standard emerge, with sanctions on Russia increasing on the one hand and some manoeuvres to find a solution for gas to keep flowing through Ukraine, until the EU is able to implement its 2027 target of no Russian gas, thanks to the arrival of more LNG.

Dr. Thierry Bros

Energy Expert & Professor

October 1, 2024