EC Looks at Engie's Lux Tax Deals

The European Commission has opened an in-depth investigation into Luxembourg's tax treatment of the GDF Suez group (now Engie), it said September 19. The competition directorate is concerned that several tax rulings issued by Luxembourg may have given GDF Suez an unfair advantage over other companies, in breach of EU state aid rules.

Some of the rulings are as much as a decade old but only in the last few years have all member states agreed to open up these confidential agreements for review by the EC. These are bearing fruit, such as the discovery of the generous tax treatment that US Apple received at the hands of Ireland, worth some €13bn ($14.5bn).

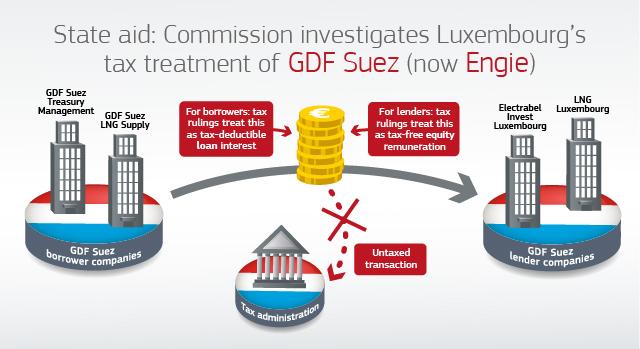

The rulings concern loans that can be converted into equity and bear zero interest for the lender. One convertible loan was granted in 2009 by LNG Luxembourg (lender) to GDF Suez LNG Supply (borrower); the other in 2011 by Electrabel Invest Luxembourg (lender) to GDF Suez Treasury Management (borrower).

How the EC sees it (Source: EC)

The EC will assess in particular whether Luxembourg tax authorities selectively derogated from provisions of national tax law in tax rulings issued to GDF Suez but not other companies. "They appear to treat the same financial transaction between companies of GDF Suez in an inconsistent way, both as debt and as equity. The Commission considers at this stage that the treatment endorsed in the tax rulings resulted in tax benefits in favour of GDF Suez, which are not available to other companies subject to the same national taxation rules in Luxembourg," it said.

"A single company cannot have the best of two worlds for one and the same transaction. Therefore, we will look carefully at tax rulings issued by Luxembourg to GDF Suez. They seem to contradict national taxation rules and allow GDF Suez to pay less tax than other companies."

A spokeswoman told NGW that it could not say how much money was involved in this case. Engie did not comment at time of press.

William Powell