The peril of underestimating energy demand [Global Gas Perspectives]

The International Gas Union (IGU) has warned of energy shortages arising by the end of the decade, while also cautioning against too much reliance on “target-orientated scenarios” published by the International Energy Agency (IEA) and other institutions to determine future energy demand.

Energy demand has surged, as developing regions need more of it for urbanisation and industrialisation, and growth in demand in developed nations continues in spite of efficiency gains and structural declines in certain sectors, the IGU, which represents more than 150 members in over 80 countries covering more than 90% of the global gas market, said in its Global Gas Report 2024 on August 27. Other factors driving growth include the expansion of power-intensive technologies and rising temperatures that increase cooling demand, along with the ongoing electrification of transport and buildings.

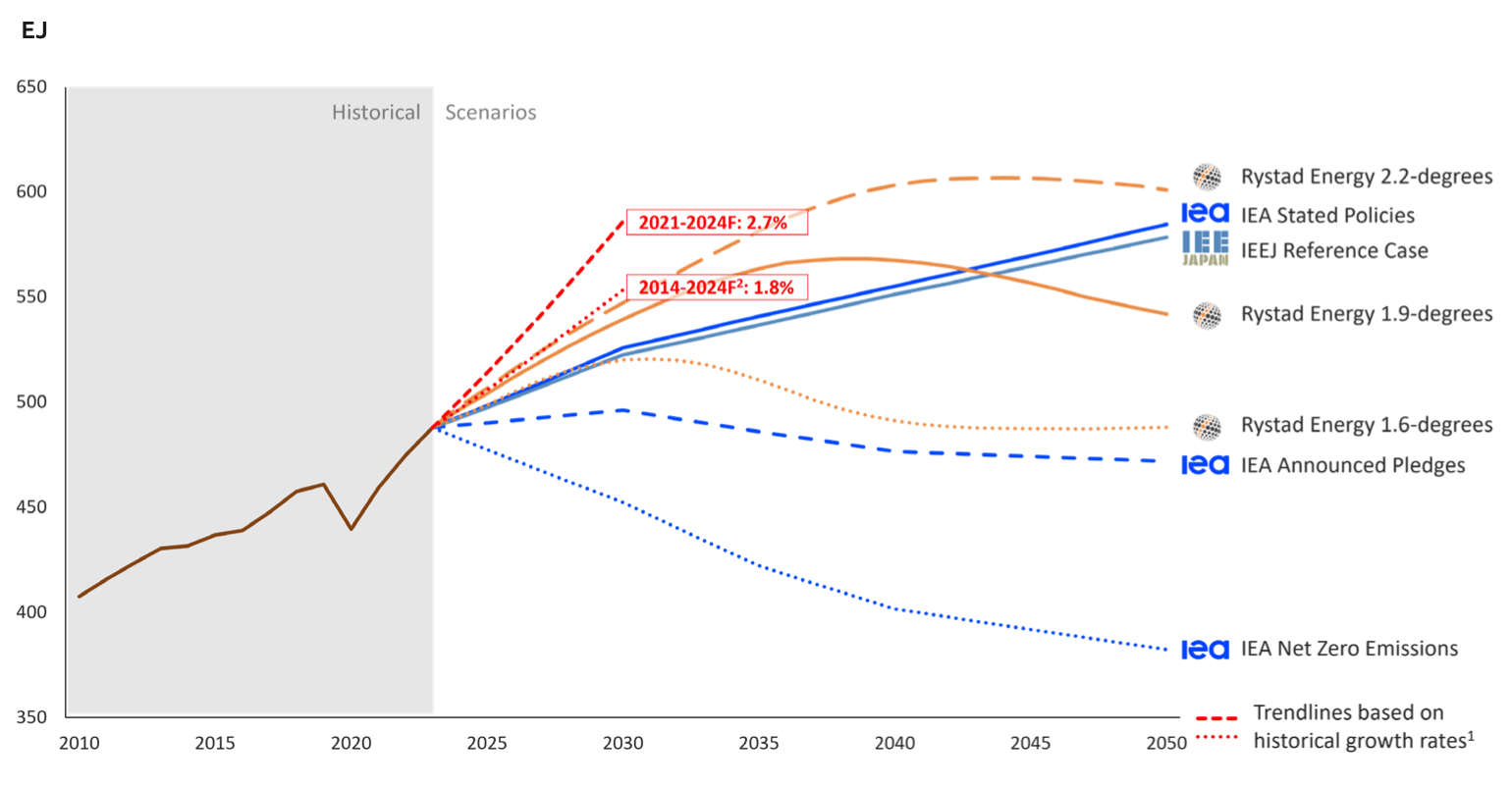

The rise in demand challenges assumptions underpinning “target-orientated scenarios,” as mapped by institutions like the IEA, the IEEJ and Rystad Energy, the IGU said.

“If energy use continues to evolve as it has in recent years, actual demand will significantly diverge from scenario pathways, potentially leading to a significant gap between demand and planned supply of gas and low-CO2 demand,” the IGU said.

Between 2021 and 2024, global energy demand has risen by 2.7% annually, and if that growth rate continues, the world will be consuming 586 EJ by the end of the decade, it said.

However, “all the diverse energy demand scenarios examined … assume that the growth rate of global energy demand will significantly decelerate towards 2050,” the report said. These scenarios assume “a flattening and eventual decline in demand,” but this has not been seen except in periods of severe disruption such as during the COVID-19 pandemic, which triggered a slump in economic activity and energy demand.

Notably even in Europe, where developed countries have experienced weak economic growth and industrial decline in recent years, in part because of the high cost of energy, demand for energy continues to grow, the IGU said. In North America, demand is now higher than it was in 2019 and continues climbing, driven by increased use in the transport sector and the rise of AI data centres. In Asia, demand is also surging, particularly as a result of industry growth in India and China. Africa’s energy demand is growing at a faster rate than most other regions, supported by urban development. But there is still not enough energy access, and this is also a significant challenge in parts of South America.

Global final energy demand scenarios from various institutions

Source: Global Gas Report 2024

Great uncertainty

The IEA’s scenario, which aims to plot a course towards net zero emissions from the energy sector by 2050, puts global energy demand at 452 EJ by 2030. This is 134 EJ higher than the IEA’s forecast based on the trend seen in the last few years, and this difference is twice the annual consumption of Europe. Even according to the IEA’s state policy scenario, described as “a more conservative benchmark for the future,” the gap is 60 EJ, so roughly the same as Europe’s demand.

The IGU also noted that even in the Japan-based IEEF’s “reference scenario” and Rystad’s outlook that factored in previous trends in energy consumption, the difference in projections reaches 64 EJ. Rystad’s scenario that limited global warming to 2.2 C had the smallest gap, of 39 EJ.

The high level of uncertainty about energy demand “has profound implications for investment decisions, energy infrastructure development and technology planning, and reconciling scenarios with forecasts is necessary to inform prudent policy.”

Ultimately, scenarios are not forecasts and rely on assumptions about the ability of policy to impact energy consumption patterns, behavioural changes and technology adoption rates, the IGU said.

“Scenarios are analytically informed proposals of a possible future. Forecasts, on the other hand, project energy demand based on research into trends observed in actual historical demand to determine the most likely outcome for the future,” it said. “Neither of those instruments are a perfect predictor of the future, but when planning investment, it is critical to consider both.”

Fragile equilibrium

Following great upheaval, the global gas market is now in a “fragile equilibrium,” the IGU said. Demand is rising steadily – by 1.5% in 2023 and predicted to climb by a further 2.1% this year – but supply growth is limited. Asia remains the key driver of demand growth, while North America and the Middle East are leading the increase in exports. Since the energy crisis began in late 2021, the overwhelming majority of newly-sanctioned LNG export capacity has been in the US and Qatar.

If gas demand continues growing at the same pace as in the last four years and there is no additional production, there will be a 22% shortfall in supply by 2030, the IGU said. If demand rises faster, the shortfall will be even greater, it warned, stressing the need for investments to be scaled up.

The amount of coal that is burned globally increased more than ever last year, with the fuel remaining the biggest source of energy emissions.

“Natural gas today provides an immediate opportunity to cut emissions from coal by 50% and from oil by 30% through cost-effective switching,” the IGU said.

Biomethane, a direct substitution for natural gas, is also being developed at significantly below its potential, it added. Biomethane currently accounts for around 1% of the gas market, and it is mainly produced in North America and Europe, although new production hubs are emerging in China and India. Likewise CO2 capture capacity is still far below the level needed, even though it will be critical for a successful energy transition, the IGU said, and the same is true for low-carbon hydrogen.

“These technologies will play a critical role in decarbonising energy supply (especially in hard-to-abate sectors) and ensuring its resilience. Scaling them is essential, calling for urgent investment and enabling policies to start building the growing volumes of project proposals.”

Natural gas plays a pivotal role in balancing the energy trilemma of sustainability, security and affordability, the IGU said in its conclusion. “As we look ahead, the potential supply and investment gap in gas and other low-CO2 energies calls for immediate attention. It is essential to cross-check scenario pathways with actual forecasts to avoid misalignment and ensure that the energy supply keeps pace with evolving demand.”