French Gas Grid to Take over Elengy

French utility Engie said late January 16 that it reached a preliminary agreement on selling its wholly-owned Elengy business to the owners of France's major gas grid GRTgaz.

Elengy is Europe’s second largest LNG terminal operator with three terminals, a regasification capacity of 21.25bn m³/yr. GRTgaz is Europe’s second largest natural gas transmission network operator with over 32,000 km of pipelines.

Engie said that the agreement was in the form of a preliminary memorandum of understanding signed by itself, Societe d’Infrastructures Gazieres (a joint venture of French state-owned CNP Assurances and Caisse des Depots) and GRTgaz to "pursue negotiations for the acquisition of Elengy by GRTgaz"; the latter is 75%-owned by Engie and 25% by SIG.

Such a planned acquisition responds to both European gas infrastructure challenges and market player needs, said Engie, adding it would have no impact on the legal status of the two companies, GRTgaz and Elengy, nor any consequences for their employees. Nor would it modify GRTgaz's current shareholdings -- following a capital increase reserved to SIG and a contribution of shares owned by Engie – but it would cut Engie net debt by €200mn. Such a deal would require approval from both French energy regulator CRE and the governing bodies of the companies involved.

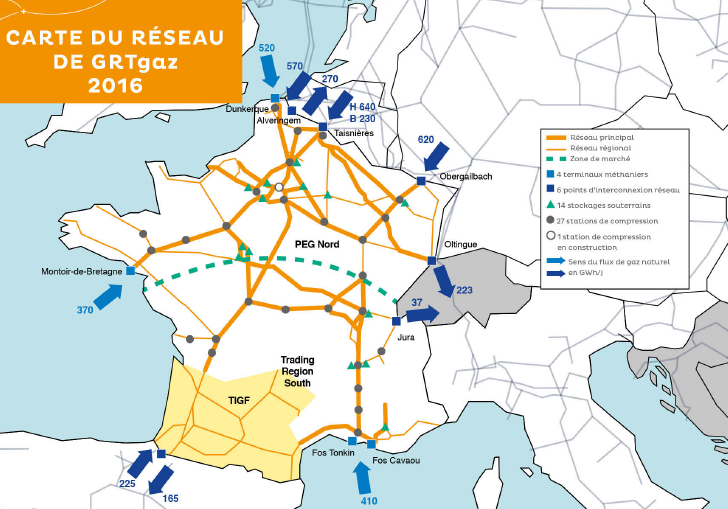

GRTgaz's gas transmission area in northern and southeast France - with separate TIGF's shown in yellow (Map credit: GRTgaz)

Elengy operates three LNG terminals in France: Montoir-de-Bretagne on the Atlantic coast, and Fos Tonkin and Fos Cavaou on the Mediterranean coast. Montoir and Fos Tonkin are wholly-owned by Elengy. Fos Cavaou belongs to Fosmax LNG, itself 70%-owned by Elengy and 30% by Total.

A takeover of Elengy by GRTgaz would make French gas infrastructure ownership much more like that of integrated operator Fluxys in Belgium, and closer to the model in Britain and Spain where the main gas grid operator also owns some, though not all, LNG infrastructure.

France's smaller gas grid TIGF, whose shareholders includes Snam, EDF and Singapore state-owned GIC, is not involved in the transaction.

Mark Smedley