Engie Confirms Talks to Sell LNG Interests to Total

French utility Engie is in talks to sell its LNG business to Total.

It has not been the first time in recent years that such a report has surfaced, but this time neither company issued a denial of what on this occasion was authoritatively published by French business magazine La Lettre de l’Expansion October 23.

Instead Engie confirmed mid-afternoon that: "Following recent media speculation, Engie confirms it has launched a strategic review of its upstream and midstream LNG activities (liquefaction, transport and international trading of LNG). Its downstream LNG activities, such as regasification and LNG ex-terminal sales, are not part of the review. At this stage, there can be no certainty as to whether the discussions with the counterparties, including Total, will lead to any agreement. Any agreement would have to be approved by the relevant governance bodies and the relevant employee representative bodies would have to be consulted."

In September 2016 Engie announced plans to divest all coal-fired generation and oil production interests but CEO Isabelle Kocher then scotched rumors it would divest its LNG trading business. She told Reuters at the time: “Gas really is part of our activities ... Shipping gas to countries which today are relying on coal and which want to switch to gas, that is at the heart of our business.”

Predecessor company Gaz de France has imported and traded LNG since 1965.

Engie said in July 2017 it was ahead of schedule on a 2016-18 restructuring plan, with €11bn ($11.9bn) of disposals, or 73% of total program, arranged to date – of which €8bn was completed at that stage. In May 2017 it entered exclusive talks for the sale of its 70% stake in Engie E&P to private equity-backed Neptune Oil & Gas, led by ex-Centrica CEO Sam Laidlaw, for $3.9 bn; completion was scheduled for Q1 2018.

On a previous occasion in March 2016 when Engie was mooted to be divesting its LNG business, Total had denied that it was in talks to acquire it.

Europe's utilities have changed their focus though in the recent past, as the growth of renewable energy plays an increasingly important role in the global attempts at decarbonising. Centrica, E.ON, RWE and others have hived off their upstream businesses.

Engie announced October 19 for example its acquisition of Fenex, an African off-grid solar home system operator, and the month before, two Brazilian hydropower schemes. Such moves do not sit easily with its 'old fashioned' gas pipelines, such as its 10% financing interest in the Gazprom-led Nord Stream 2 project, which will require Engie to fund $1bn in construction costs. It is already a 9% shareholder in the operating Nord Stream 1 pipeline.

Total, with whom Engie has enjoyed a long-term relationship, is however a major, and expanding, LNG player that could benefit from more volume as well as Engie's access to the bunkering market.

Engie's LNG and global energy management division had 2016 revenues of €9bn last year, down 21% from 2015; in 2016 it made a loss of €74mn on Ebitda of +€3mn, whereas its positive 2015 Ebitda was much greater at €196mn.

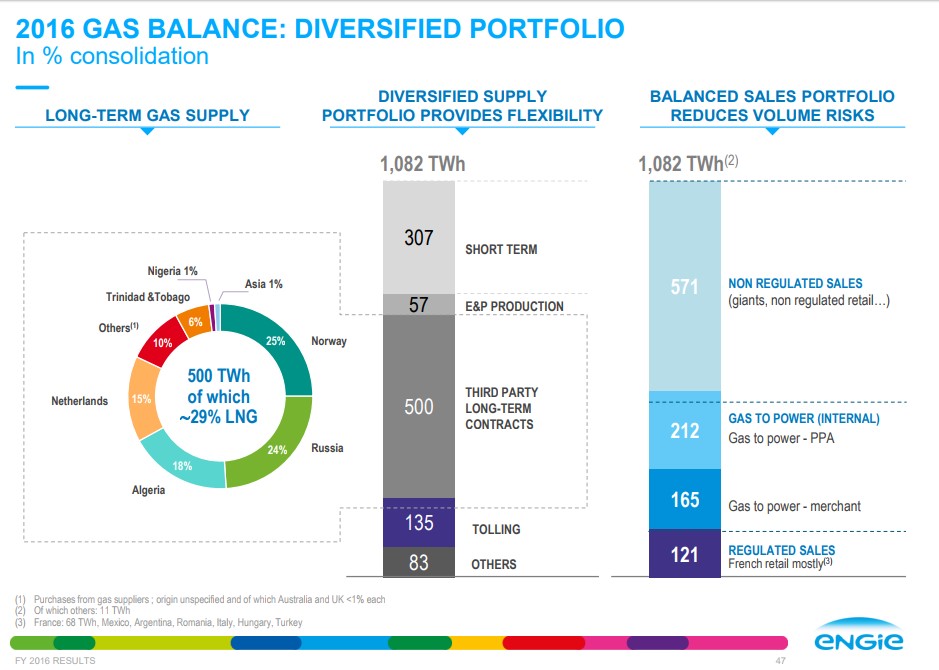

Engie's overall 2016 gas portfolio was 1,082 TWh-gas (100bn m3). Of that 500 TWh was bought on long-term contracts from third-parties, of which 29% was LNG handled by Engie's LNG unit. However an unspecified amount of Engie's 307 TWh short-term purchases were also LNG bought by the same unit. Graphic: Engie's 2016 annual results

Mark Smedley