EU 2020 Gas Supply, Demand Collapse

Statistics from the Joint Organisations' Data Initiative (Jodi) have just been released. As Bulgaria, Croatia, Malta and Romania have not yet provided all data for 2020 they are absent. We are therefore looking only at EU-22 before extrapolating to EU-27. Post Brexit, we are excluding the UK from past EU data to make the analysis more relevant.

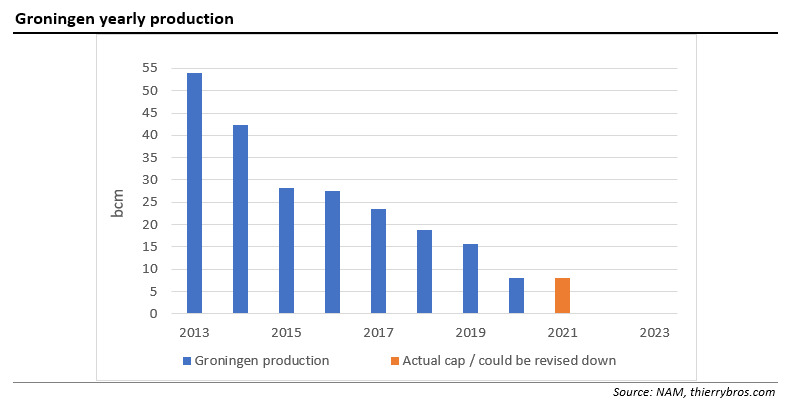

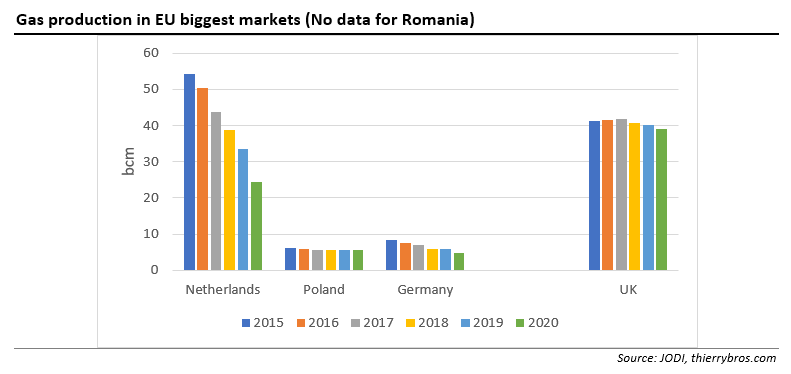

EU-22 gas production was down by a massive 23% last year, owing to a 27% drop in the Netherlands. With a massive 49% cut, Groningen production was, in 2020, even below the target set for 2021. It won’t be long before this field is shut down.

In percentage terms however the worst decline was witnessed in Denmark with -54%, with the Tyra field being rehabilitated. Germany production is declining (-15%) and has been overtaken by Poland (-1%). If we take into account a Romanian production of around 10 bcm (between the Netherlands and Poland), we can estimate EU-27 production to be down by 20% in 2020.

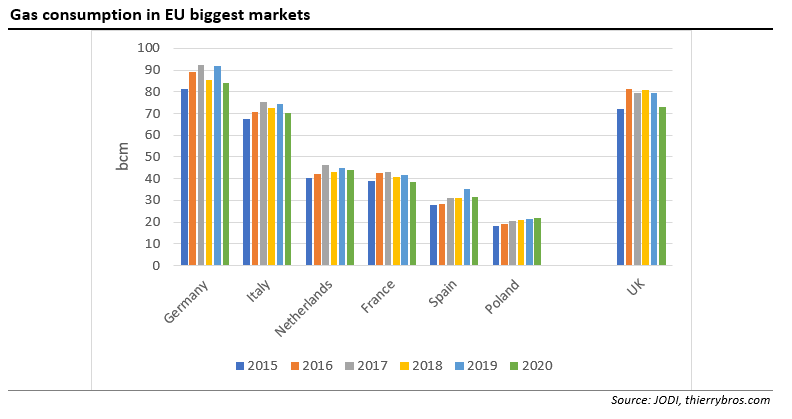

Overall EU-22 demand was down by 5% due to Coronavirus with contrasting evolution between Poland (+ 3%) and Spain (- 10%). This -5% is a good proxy for EU-27 demand evolution.

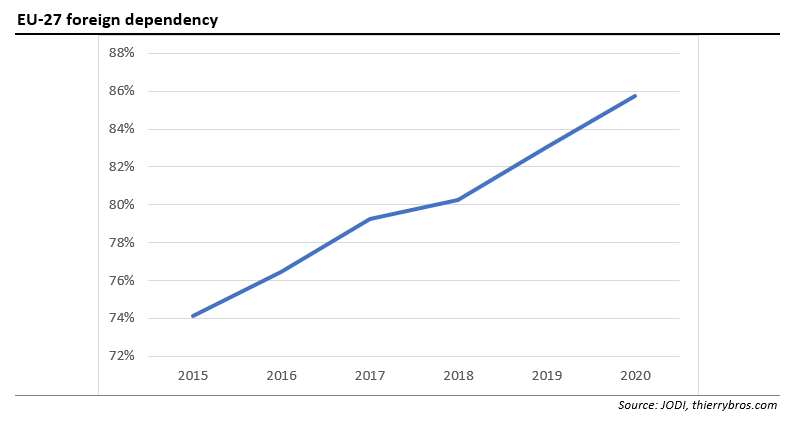

EU-27 foreign dependency factor set, in 2020, a record at 86%. We should expect this percentage to continue to grow in the coming years (at least due to the decline of domestic production), but thanks to supply diversification and low prices, this is not an issue any longer in Brussels… Until prices move back up and policymakers start to worry!

Thierry Bros

19 February 2021

Advisory Board Member, Natural Gas World