EU Antitrust Probe Could Weaken Russian Energy Dominance

Summary

The European Commission on Sept. 5 announced the launch of a formal antitrust investigation into Russian state-owned energy firm Gazprom, which has allegedly engaged in monopolistic practices in natural gas markets in Central and Eastern Europe. Under EU rules, Gazprom could face steep fines if found guilty. The investigation is a continuation of the European Union's ongoing efforts to liberalize its natural gas markets and reduce European dependency on Russian energy.

The probe has been characterized in the media as a major escalation in the multi-year conflict between the European Union and Russia over Gazprom's business practices. In reality, the Kremlin has become more flexible about pricing and bundling issues in recent years to retain its market share in Western Europe, and the European Commission cannot antagonize Moscow to the point of threatening EU access to Russian natural gas. Thus, rather than punishing Gazprom, Brussels is trying to encourage Russia to become more accommodating in natural gas negotiations with EU countries in Central and Eastern Europe. And while Russia's public response to the antitrust probe might be combative, the Commission and the Kremlin likely will reach a deal behind the scenes.

Analysis

Natural gas sales to Western Europe are one of the two main pillars of Russia's economy. But Moscow recognizes that the dynamics of Western European energy markets have changed since the mid-2000s, when Gazprom benefitted from what was essentially a regional monopoly. Since then, Western Europe has been successfully liberalizing its natural gas markets by leveraging its international political weight, its status as a major source of revenue for Russia (Germany is Russia's largest customer) and the cultivation of alternative natural gas supplies.

Market-driven pressures have forced Russia to revise its tactics in trying to maintain a significant energy presence in Europe. In the past year, the firm offered substantial discounted natural gas prices that were de-indexed from oil to large customers in Western Europe, particularly Germany and Italy, in exchange for the renewal of long-term delivery contracts. While reluctantly making such concessions to strategic European partners, Russia has been compensating for this flexibility in negotiation by becoming more involved in other regional energy sectors -- particularly nuclear energy and gas-fired electricity generation.

Russian Dominance in Central and Eastern Europe

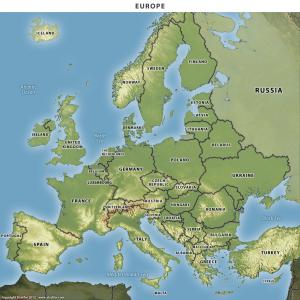

Central and Eastern Europe are in a more delicate position than Western Europe when it comes to dealing with Russia. Moscow maintains significant influence in several regional sectors, most notably energy. Some Central and Eastern European countries, including Hungary, Slovakia, the Czech Republic, Bulgaria and Romania, rely almost solely on Russia for energy, without consuming enough to gain leverage over Moscow. Gazprom charges such countries as much as 50 percent more for natural gas than Western European clients, and Russian interests dominate energy sectors in many Central and Eastern European countries. In response, regional EU member states have been turning to EU legislation to get control over their energy markets.

In September 2011, Brussels began a series of inspections of Gazprom subsidiaries in Central and Eastern Europe. The new antitrust investigation will focus on accusations that the firm restricted competition and charged unfair prices in certain regional markets by indexing long-term contracts to oil prices and hindering natural gas transportation between EU members. Such practices would violate the European Union's Third Energy Package, which was designed to liberalize European natural gas markets. The legislation provides EU members with legal tools to combat energy supply chain monopolies, thereby ensuring competitive energy prices and secure energy supplies. Under the legislation, Gazprom could be fined as much as 10 percent of its annual revenues in any markets where it is found guilty, or more than $12 billion -- a sum that would be difficult to absorb for the increasingly cash-strapped firm.

Russia and Europe's Mutual Interests

Despite the investigation, Gazprom is unlikely to receive any significant fines or other punishments. The Commission has limited options for enforcing potential fines short of reducing access to European markets. Such a punishment would be financially devastating to Gazprom, but it could also cause supply shortages in Europe during the height of winter. Russia currently provides roughly 25 percent of Europe's natural gas, so the Commission cannot afford to punish Gazprom too harshly. Moreover, the Western European countries that already benefit from Gazprom discounts likely would pressure Brussels into easing punitive action.

The antitrust investigation is meant to encourage Gazprom to extend the cooperation and goodwill it recently has shown Western European customers to EU members in Central and Eastern Europe as well. Though Moscow's public response might be negative, the Kremlin likely will reach a discreet compromise with the Commission outside the courts. The compromise would probably entail Gazprom avoiding a significant fine if it agrees to soften its future policies regarding Central and Eastern Europe energy liberalization in the interest of ensuring continued market share across the Continent.

Marc Lanthemann

Europe Analyst

STRATFOR

www.stratfor.com

Natural Gas Europe is pleased to provide this article in cooperation with Stratfor. For more visit http://www.stratfor.com/