If Europe wants to embrace natural gas as a bridge to a low-carbon future, it should draw from America’s success

Why have Europeans paid nearly $500 billion more than Americans for their gas over the past six years? Jeff D. Makholm looks at the differences in gas markets between the U.S. and Europe, writing that while America’s pipelines are run in an open and competitive way, Europe’s are secretive and monopolistic. He argues that gas suppliers in European countries operate behind the European Union’s protectionist legislation, which leads away from competition in gas supply. Only when the European Union empowers its gas consumers to act collectively and confront this regulation, will gas related energy costs – and carbon emissions – begin to fall.

America has seen a competitive and technological revolution in natural gas production in the 21st Century—dramatically lowering the price of gas and displacing high-carbon coal with low-carbon gas for power generation. But America’s success is Europe’s problem. Without a functioning competitive gas market, and facing largely oil-linked gas import prices, Europeans have paid a staggering $492 billion more for their gas than Americans have in the past six years. Such a bill for gas has hurt European industrial competitiveness and retarded European economic growth. Worse still, a sizeable portion of America’s displaced coal (no longer cost competitive at home) heads to Europe, where those high gas prices make coal the cheaper fuel. Europe’s carbon footprint for its electricity swells, while America’s shrinks. The gas boom in America is no source of joy for Europe.

A single root cause exists for the dramatically different roles played by gas in America and Europe: the treatment of each continent’s extensive pipeline systems. Gas is a wonderfully clean fossil fuel; but inconvenient to transport. Unlike oil, gas needs pipelines to connect sellers with buyers. With an open and competitive pipeline sector, like America’s, the gas flows. With a secretive and monopolistic pipeline sector, like Europe’s, competitive entry is effectively impossible (in gas or new pipelines) and the gas does not flow.

America’s pipeline sector exhibits a brilliant paradox. Each mile of every interstate pipeline is—and has been for more than 75 years—subject to the skillful regulation of the Federal Energy Regulation Commission (the FERC). The FERC licenses physical pipeline capacity and sets regulated prices based on recorded costs. The pipeline companies collect those costs from customers (mostly, America’s independent local gas utilities) who buy capacity on particular pipelines from one spot to another under long-term leases. From available capacity, to costs, to pipeline prices, it is all an open book—available for the public to see.

One particular insight turned this decades-old regulatory model into the high-tech vehicle for competitive gas transport: “sub-letting.” Capacity rights can be bought and sold in a separate, organized market. Using concepts that gave the late Ronald Coase his 1991 Nobel Prize in Economics, the FERC created such a market in highly-specific, point-to-point capacity rights on its licensed pipelines. Using that sub-let market, gas producers physically can reach any buyer on the interstate pipeline system simply by buying the rights from customers with existing contracts at the going price. If the gas market wants new capacity on existing pipelines, or a pipeline in a new location, pipeline companies (along with customers willing to pay) simply ask the FERC to license the addition—which then adds to the wider competitive pipeline capacity market. It works, with little active participation by the FERC beyond licensing and cost-based tariff setting.

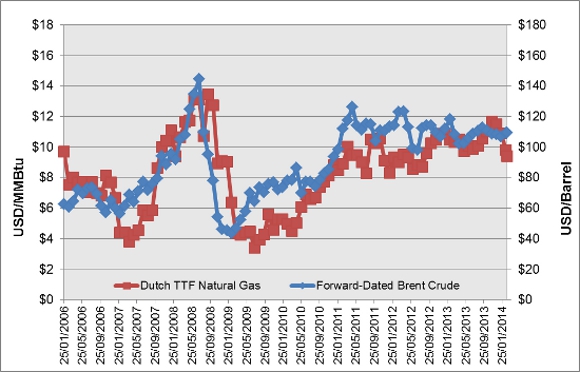

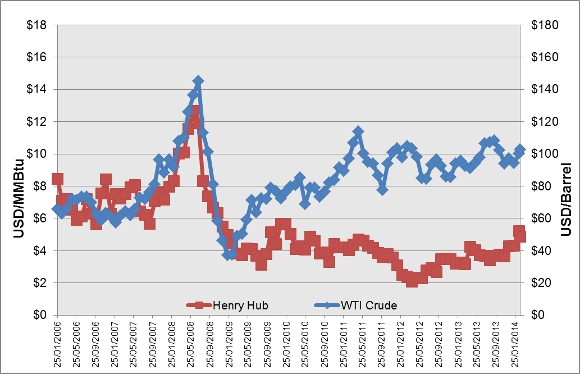

This is not to say that the “Coasian” market in pipeline capacity rights came without a fight. It took decades of collective action by those independent local gas companies—the real heroes of the new American gas markets acting in the interests of their millions of gas customers—to overcome pipeline interests in the pursuit of reasonable access to competitive gas supplies. The pipelines’ resistance was understandable: no toll-gate operator wants to give up power over who gets in. The irony is that by losing the regulatory fights over access and the sub-let capacity market, America’s pipelines are more profitable than ever. They now serve a booming competitive gas market, building new lines at six times the rate of their European counterparts. American gas prices show what such competition can do, allowing the gas market to seek its own equilibrium price independent from the oil-linked prices that still dominate Europe, as Figures 1 and 2 illustrate.

Figure 1 – Dutch TTF Natural Gas and Forward-Dated Brent Crude 2006- February 2014

Figure 2 - Henry Hub Natural Gas and WTI Crude 2006 – February 2014

For a number of reasons—structural, political and cultural—Europe pushed its pipeline sector in the other direction. In 1998, 2003 and 2009, while ostensibly wishing to foster a Europe-wide gas market, EU legislation put a competitive gas market further out of reach. It solidified an effective blockade against the type of competitive entry evident in America. Without independent local gas utilities (or any other collective body) to represent them, the EU’s 115 million gas consumers are no match for the interests of the member state pipeline monopolies, those firms’ local ministerial allies, and their suppliers. Gas does trade at various “hubs” in the EU, but the financial industry, which manages risk in commodities futures markets generally (and is an integral part of America’s gas market), has shown no interest in what are essentially trades for convenience with and between member state gas suppliers that operate behind the EU’s protectionist legislation. Indeed, what has appeared lately as EU gas regulatory policy, borrowed from regulatory methods for electricity markets, deals not with addressing entry barriers but with modeling and managing “cross-border” relations between those existing member state gas suppliers combined with public funding of new pipelines. Such a path creates much bureaucratic work to the benefit of EU and member state regulators. But it leads inexorably away from competition in the supply of this low-carbon fuel.

America enjoys political and institutional endowments supportive of its gas market success that the EU does not: a bankable continent-wide regulator, federal sovereignty over interstate commerce, independent local gas distributors—supported by a century of legal, accounting and administrative refinements in regulation. History matters a lot in how America got its competitive gas industry—in fits and starts over decades of effort. Unless the EU empowers its hard-pressed gas consumers to act collectively and confronts those institutions that defeat gas markets, gas will continue to play a smaller role in lowering energy costs and decreasing carbon emissions in Europe.

This article by Jeff D. Makholm originally appeared at USAPP – American Politics and Policy

Jeff D. Makholm is an economist with National Economic Research Associates (NERA) in Boston Massachusetts. He has long researched the role of pipelines in energy markets. His latest book, The Political Economy of Pipelines, was published by the University of Chicago Press in 2012.