Europe begins the new year with 5% less gas [Global Gas Perspectives]

Russian gas transit via Ukraine stopped on January 1, as the 2019 transit contract was not renewed or extended. Just hours before, European gas prices reached a record level for 2024 of over €50/MWh ($548/’000 m3), as the market adapted to the new reality.

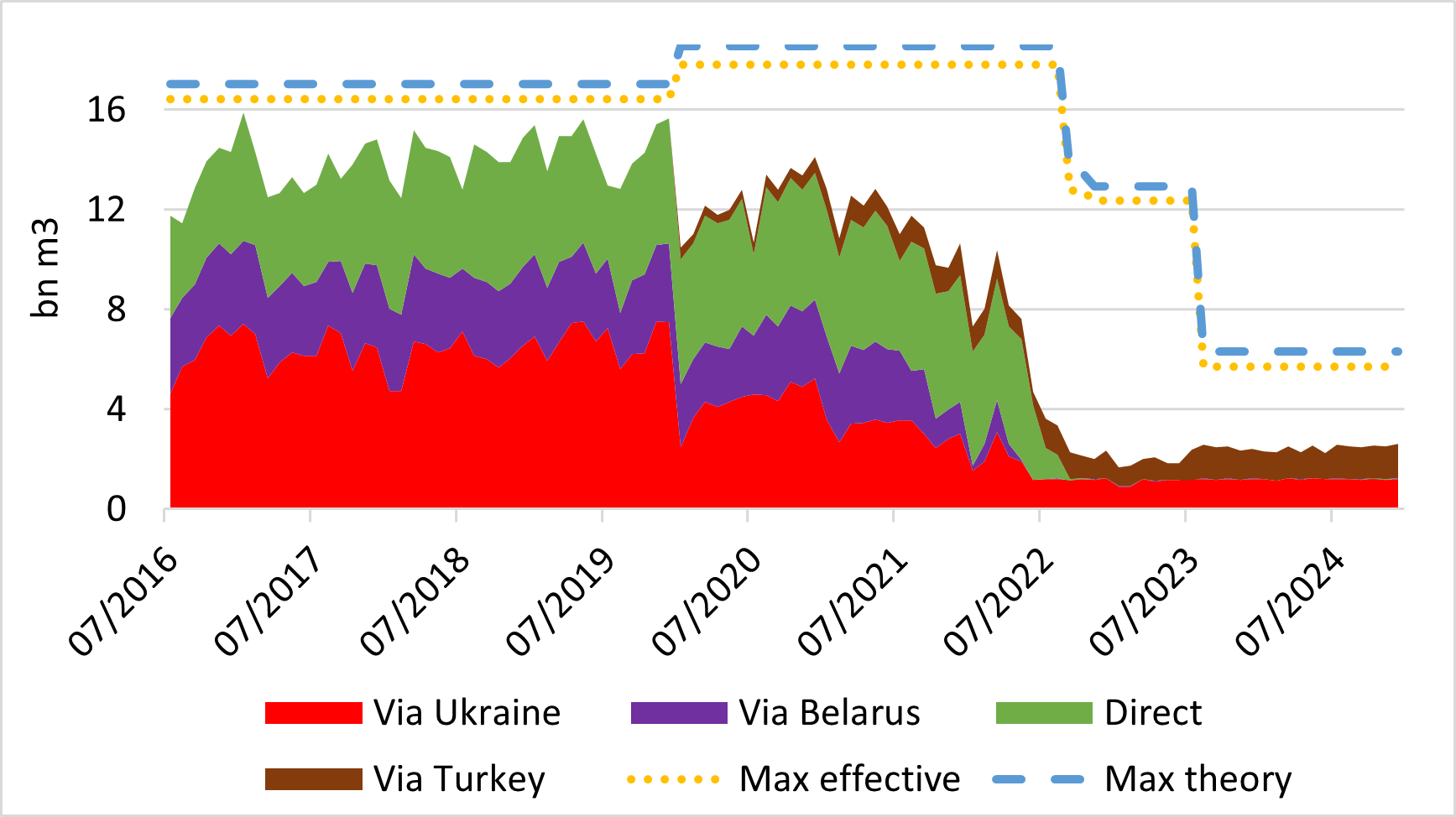

Last year, Russian pipe gas exports to Europe grew by 14%, split between the Ukrainian route (14.3bn m3, up 5% versus 2023) and the TurkStream (15bn m3, up 23%). Russian LNG delivered into the EU also reached a record in 2024 of 23.7bn m3, up 12% versus 2023.

The volumes transited via Ukraine met nearly 5% of total EU gas demand. As global supply growth has been restrained in 2024 with very little LNG supply growth (less than 2bn m3 versus 2023), Gazprom alone provided 60% of world gas growth demand (circa 100bn m3).

While everyone can agree that it is morally wrong for Europe to buy Russian gas, that is financing the war in Ukraine, business is not done on moral grounds but on what is allowed and what is not. So, with European wholesale gas prices at a record level, replacing that 14.3bn m3/year of gas is going to be a challenge. Replacing 5% of EU gas demand could be very expensive and could contravene the European Commission’s new focus on re-industrialisation.

Those 14.3bn m3 were costing European buyers around $6bn annually, with less than $1bn for the cost of transit going to Ukraine, $1.8bn going directly to the Russian state in export duty and the remaining $3.2bn to Gazprom. If by replacing those volumes, the European spot price increases by 10%, in a full year, the extra cost for the EU could be circa $16bn.

As there is no embargo or sanction on Russian pipe gas in the EU, in the next few weeks we could witness some tough negotiations between member states not willing to go through yet another deindustrialisation process while the US, that is embarking on a massive deregulation pro-business cycle, would be more than happy to see European industries relocating in the US. The new EU Energy Commissioner Dan Jørgensen, whose first mission is to “bring down energy prices for households and companies,” might start with a big failure. For his other responsibility, “developing a roadmap towards ending Russian energy imports and ensuring the full implementation of REPowerEU” he has, over New Year’s Eve, achieved 25% of the stated goals! I’m not sure Commission President Ursula von der Leyen would be pleased with this new comer.

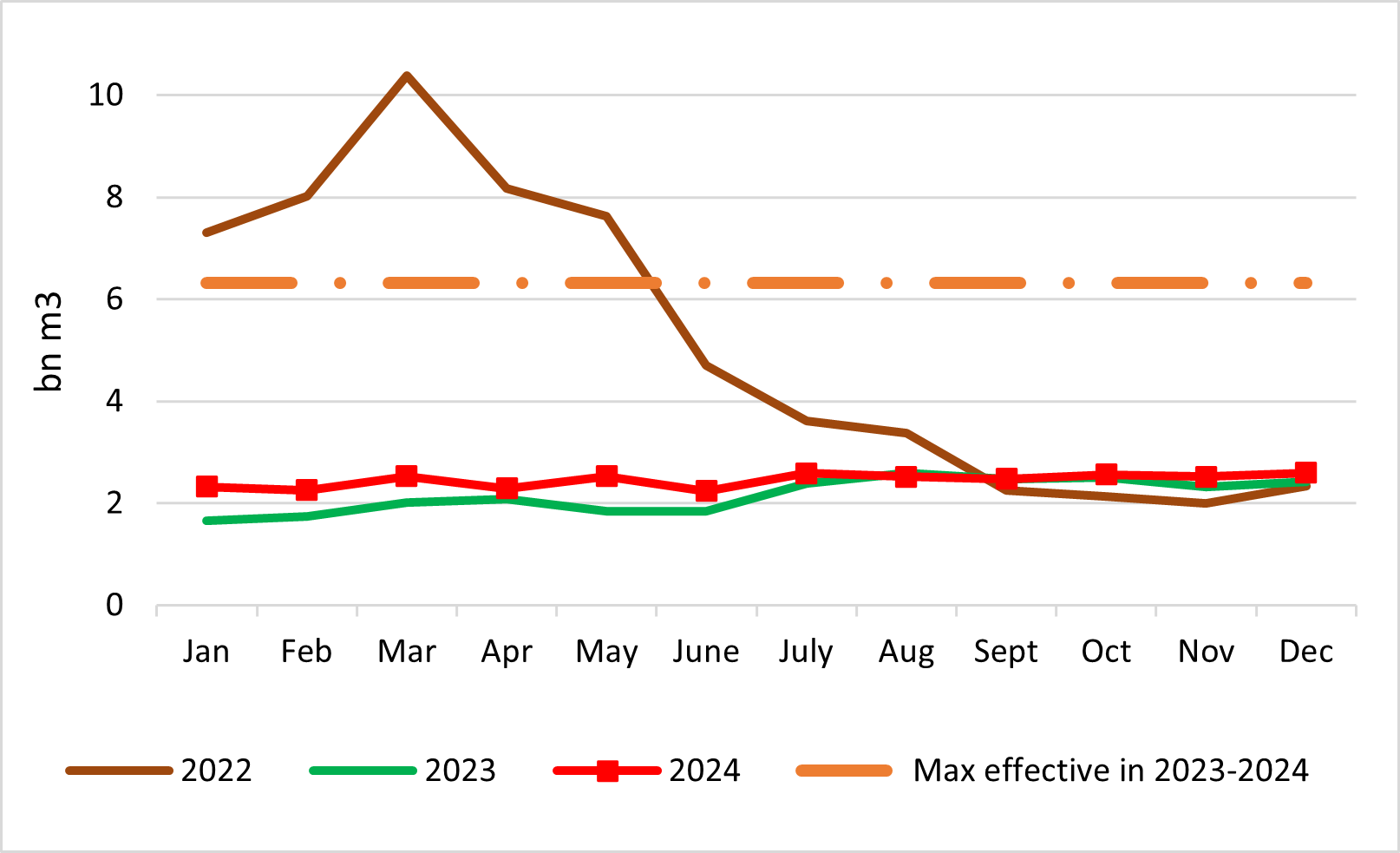

Gazprom’s monthly pipeline gas exports to Europe

Sources: Entsog, thierrybros.com

Without Ukraine, the maximum effective export capacity moves down from the prior 5.7bn m3/month to 1.4bn m3/m.

Split of Gazprom’s monthly gas exports to Europe by route

Sources: Gazprom, GTSOU, Entsog, thierrybros.com

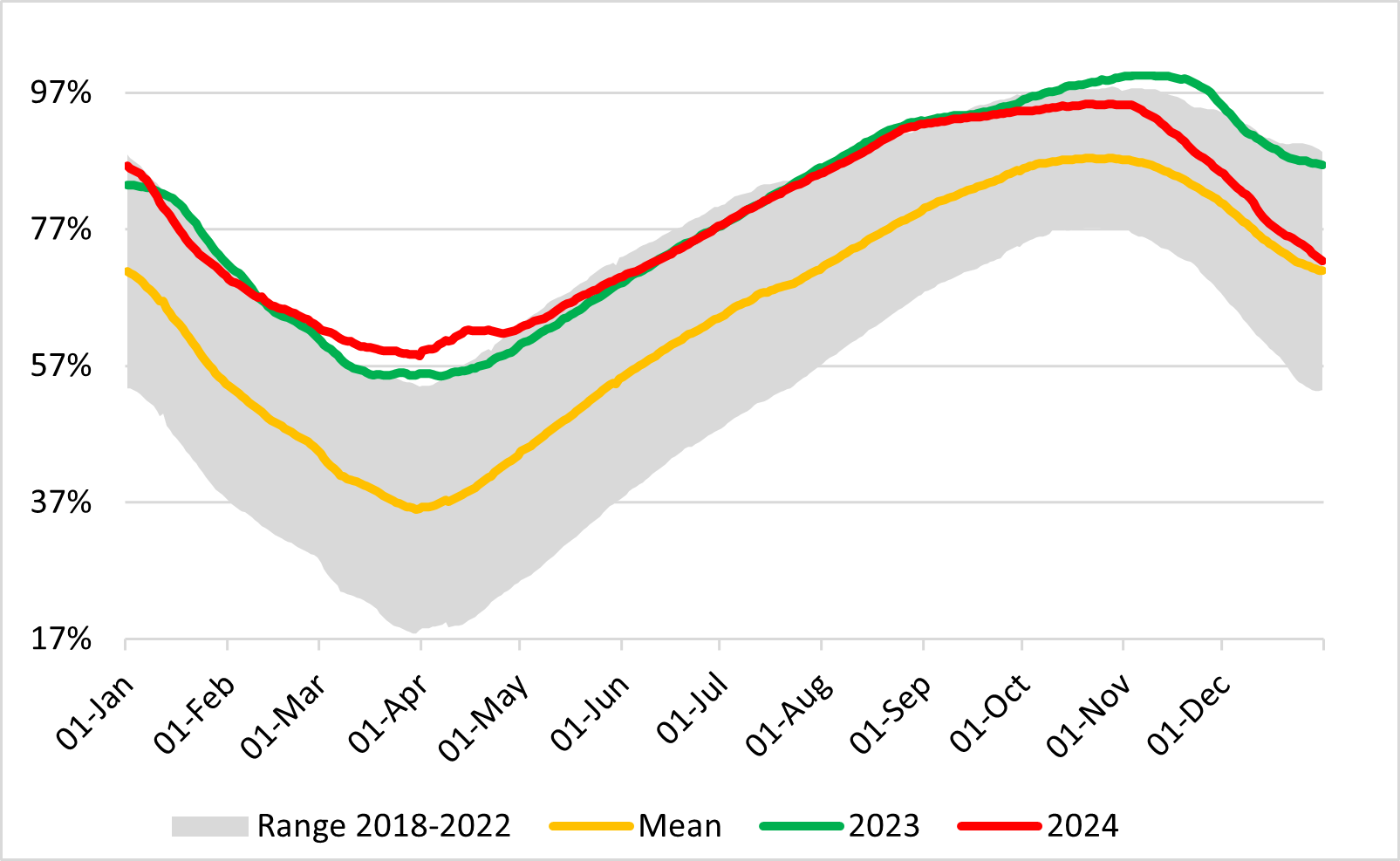

EU storage facilities ended 2024 at 72% full, just slightly above the 2018-2022 mean value of 71%.

EU gas storage utilisation

Source: GIE, thierrybros.com

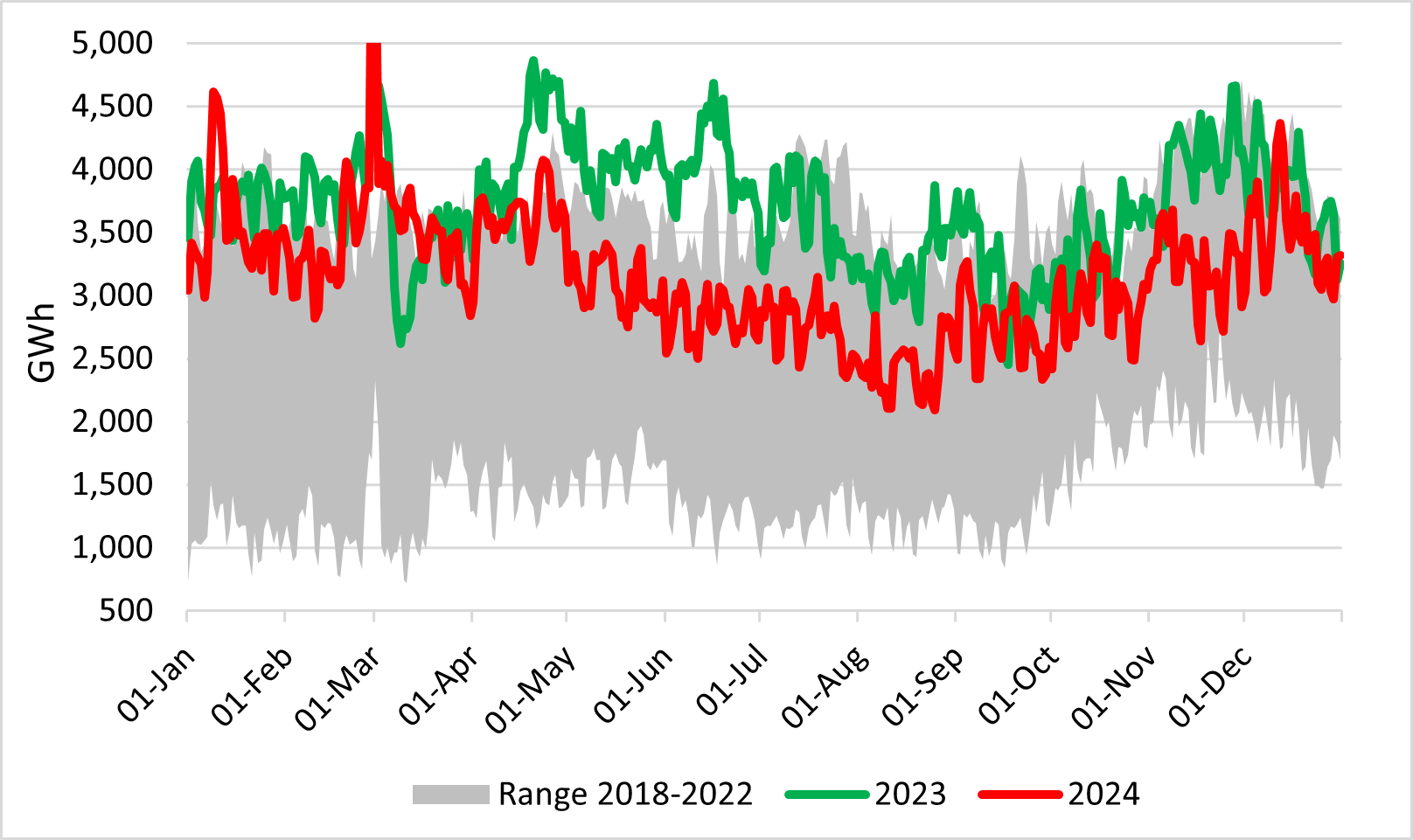

Spot LNG provides the equilibrium between Asia and Europe, with Asia more willing to attract LNG in 2024. In 2024, EU send-out was 16% lower than in 2023. Europe is paying up to $15/mn Btu for gas but got less LNG than last year as the global gas market is tighter than the consensus predicted, because of delays in LNG plants start-ups and continued world demand growth.

EU LNG send-out (excluding Malta)

Source: GIE, thierrybros.com

The halting of Russian gas flow through Ukraine is perhaps the end of an area but not the end of the story. Considering realpolitik versus political postures, 2025 is going to be a very interesting year to watch. Happy New Year!