FAR Says Guinea-Bissau Changes Approved

Australian independent FAR said August 25 it has received official confirmation that the increase in equity and amendments to the Guinea-Bissau licences, announced in April 2017, have been approved by government decree. It said those licences display a similar geological setting to offshore Senegal and FAR’s interest in the large SNE oil and gas discovery there.

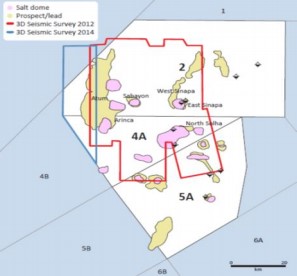

In early April, negotiations concluded with Guinea-Bissau's state Petroguin to revise the terms of Blocks 2, 4A and 5A (known as the Sinapa and Esperanca licences) offshore Guinea-Bissau.

Under the revised licence terms negotiated by FAR and its joint venture partner Svenska Petroleum Exploration, FAR now have a 21.42% participating and paying interest in the permits, an increase from the 15% participating and 21.42% paying interests as previously reported. These changes reflect the fact that Petroguin will no longer have a participating interest in the joint venture prior to a commercial discovery.

FAR explained that, upon making a commercial discovery, Petroguin will have a reduced participating and paying interest of 10% while FAR and Svenska will respectively have interests of 19.28% and 70.71%. More favourable arrangements added for deep water investment include a reduction to production royalty rates payable to government. Also a three-year extension has been agreed to November 25, 2020, in return for which the joint venture will drill one exploration well on each licence with a minimum expenditure commitment for each of $3mn (gross).

FAR managing director Cath Norman said: “FAR has previously mapped a 470mn bbls prospect [gross, unrisked, recoverable, oil-only] called Atum on the Guinea-Bissau shelf edge in a play similar to the large SNE discovery made by FAR and its Senegal partners in 2014."

Besides its interest in Guinea-Bissau, Svenska has a 27.39% interest in Cote d'Ivoire licence CI-40, 21.05% stake in Nigeria licence OML-145, and 90% interest in Latvian licence E-24 (Dalders). It divested its Norwegian assets to Det Norske (now Aker BP) in 2015.

Besides its interest in Guinea-Bissau, Svenska has a 27.39% interest in Cote d'Ivoire licence CI-40, 21.05% stake in Nigeria licence OML-145, and 90% interest in Latvian licence E-24 (Dalders). It divested its Norwegian assets to Det Norske (now Aker BP) in 2015.

Mark Smedley