France: Europe’s largest LNG importer [Global Gas Perspectives]

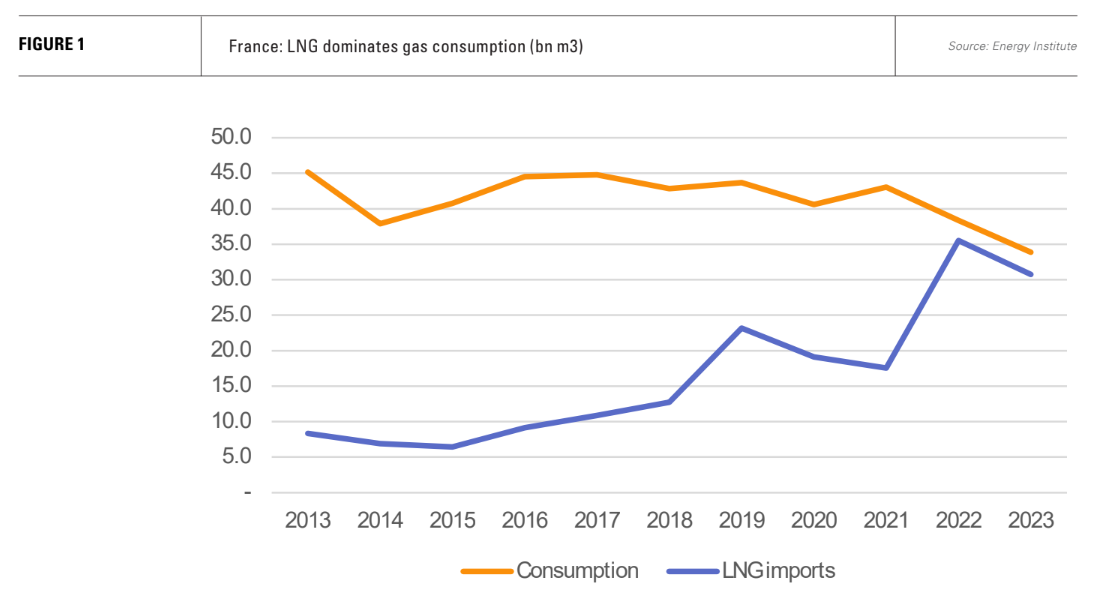

In the last few years, France has emerged not only as Europe’s largest importer of LNG, but the fifth largest single country market in the world. Energy Institute data shows France importing 30.7bn m3 of LNG in 2023, making up 90% of its total gas consumption, compared with less than half in 2020.

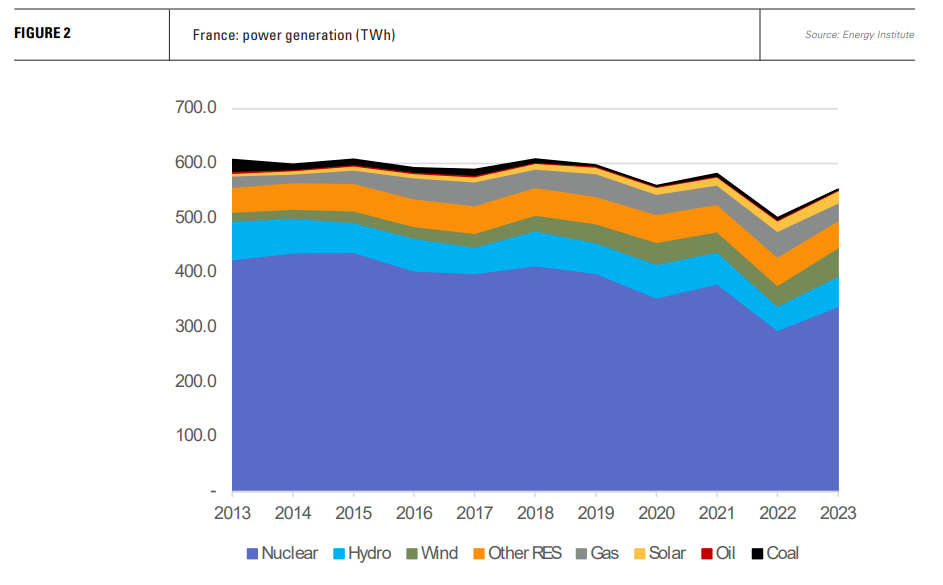

However, France has never been a gas consumer on the scale of Europe’s other large economies. Its extensive fleet of nuclear power plants has kept gas demand low as a proportion of overall energy consumption. The primary destinations for gas in France are residential and commercial buildings and industry rather than power plants. Public gas distribution accounted for 53.6% of demand in the period August 1 to November 10 this year, industry 41.6% and gas-fired generation just 4.9%.

As elsewhere in Europe, France’s overall gas consumption has been heavily dented by high prices in the wake of Russia’s invasion of Ukraine. Gas demand peaked in 2010 at 49.6bn m3 and remained fairly stable between 2012 and 2021, varying between 40-45bn m3, but dropped to 38.4bn m3 in 2022 and 33.9bn m3 in 2023 even as LNG imports surged.

Energy security concerns notwithstanding, LNG’s honeymoon in France appears likely to be short-lived. Demand for gas is expected to continue downward and, as almost all gas consumed is now LNG, it is LNG imports which will feel the impact.

Green gas to accentuate fall in fossil gas demand

According to the Gaz Perspectives report published by Transmission System Operators (TSO) GRTGaz and Teréga and gas distributor GRDF, French gas demand will fall from 381 TWh (34.3bn m3) last year to 320 TWh (28.8 bn m3) in 2030.

LNG imports will be hit even harder than this implies because of an expected increase in the production of renewable and low carbon gases (excluding hydrogen). The report estimates these will provide 60 TWh by 2030, rising to 120 TWh in 2035.

This implies a reduction in natural gas use of 4.6bn m3, reducing total natural gas demand – the majority supplied by LNG - to 23.4bn m3 in 2030 and to about 18.0bn m3 in 2035.

Biomethane production in France is growing fast, reaching 9.1 TWh in 2023. The number of installations injecting gas into the grid increased by 140% between 2020 and 2023. According to GRTGaz, by 2024, France had 652 renewable gas production sites, of which 80 were connected to the gas grid. “The connected fleet as a whole has a generating capacity of 11 TWh/yr ... representing 2.5% of France’s natural gas consumption,” the report says.

However, the forecast highlights a number of sensitivities which could result in higher than forecast gas consumption. Demand will depend on the availability of nuclear generation, the speed of deployment of renewable energy capacity, both in France and in neighbouring countries, and other factors such as the adoption of more proactive reindustrialisation policies.

Nuclear gloom

Although it plays a minor part in France’s overall gas consumption, gas-fired generation plays a key role in providing flexibility to a power system dominated by nuclear power and with a growing proportion of variable renewables. Gas demand for power generation fills the gap created when nuclear generation and/or hydro are low. Despite the high-priced environment, gas-fired generation jumped to 47.1 TWh in 2022, a record, owing to a slump in both nuclear generation and hydro.

Nuclear generation, the largest component of France’s power system, was particularly low in 2022 and 2023, and appears likely to stabilise at levels below the preceding decade. This year, nuclear generation was up 12.2% in the first half, suggesting an annual result at the higher end of EDF’s forecast of 314-345 TWh. Next year should be boosted by generation from the long-awaited Flamanville-3 reactor, which began start-up operations in September.

EDF has a large modernisation program for its mostly ageing reactors, which will continue to keep nuclear generation below nameplate capacity. About 400 TWh generation is expected in 2035, with 360 TWh/yr forecast as realistic for the period 2030-35, according to the utility.

Renewables growing but still off-target

Wind and solar capacity will continue their upward trajectory, but they are not yet expanding at rates which will deliver on France’s renewable energy targets.

Wind capacity in France has more than doubled since 2015, reaching just over 22 GW at the end of 2023, almost all onshore. The target is 33-35 GW by 2030. France’s tardy offshore wind sector is beginning to show signs of real life. The country’s second offshore wind farm, Fecamp, was commissioned in May. The Saint Brieuc wind farm is partly commissioned, and three further offshore wind farms are under construction. There are 15 projects in the pipeline for 2035, for which time France has set an interim target of 18 GW, on the road to 45 GW by 2050.

Deployment of solar capacity is accelerating. Annual installations totalled 3.2 GW in 2023, the fastest rate to date, following 2.7 GW in 2022, 2.6 GW in 2021 and 1.2 GW in 2020. In its updated National Energy and Climate Plan submitted last year, France set a target of 60 GW solar by 2030, rising to 75-100 GW by 2035. As current capacity is just over 20 GW, like wind, this also implies an acceleration in annual deployment rates.

What role for gas?

As such, it appears that gas-fired generation will be squeezed by higher renewables output. However, grid-scale battery storage is lagging, with forecasts suggesting an increase from 500 MW in 2023 to 1.5 GW by 2030. Plans for the ‘degasification’ of buildings hinge on electrification, which increases peak demand for power, thereby increasing the need for flexibility.

However, most significantly, forecasters expect the falling trend in French electricity demand to reverse.

Electricity consumption fell from a peak of 472 TWh in 2010 to 411 TWh in 2023, but electricity TSO RTE last year forecast that power demand would rise to between 580-640 TWh/yr by 2035, an increase of 25-29%. The forecast was made on the assumption that both accelerated decarbonisation and reindustrialisation targets were met, but also included 75-100 TWh of energy efficiency improvements, which would depend largely on hard-to-achieve thermal renovation of buildings.

In all of RTE’s scenarios, renewable energy needs to expand rapidly, rising to a minimum of 270 TWh, up from 112.6 TWh in 2022, including hydropower.

The big bet is on wind and solar, but France will need to increase deployment rates significantly. More variable generation will increase the importance of technologies, like gas-fired generation, which provide flexibility. Any shortfall in nuclear generation, owing to possible complications with EdF’s reactor modernisation programme, or bad years for hydro, will likely mean falling back on gas.

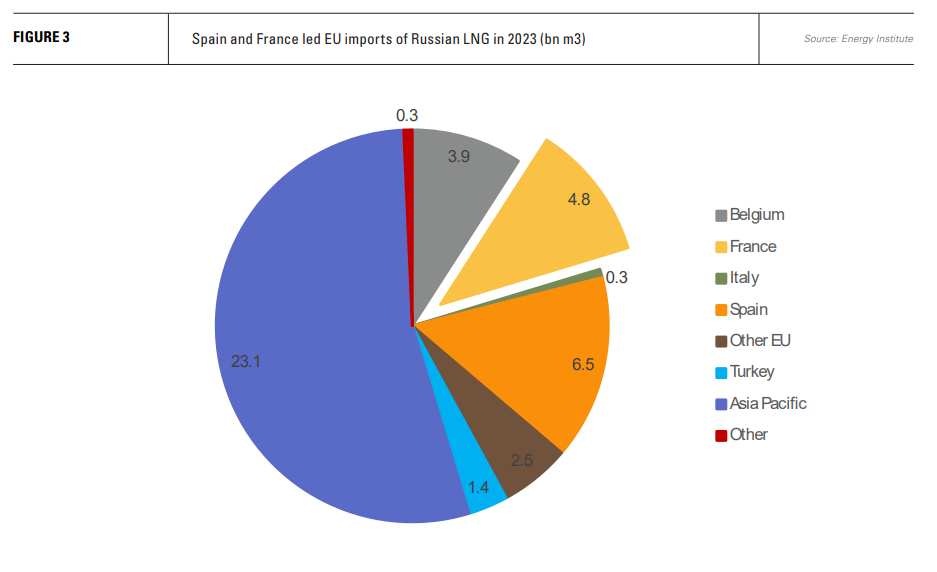

Wider European energy security

While France’s demand for natural gas and the process of replacing pipeline gas imports with LNG both appear to have peaked, the importance of France’s LNG infrastructure is likely to endure. France has been able to export regasified LNG to its neighbours, although flows have typically been small and seasonal. France has exported to Spain, Switzerland, Italy, Belgium, the Netherlands, Luxembourg and Germany, more latterly increasing exports to Italy and Switzerland. It has also imported more gas from Spain, although pipeline connectivity with the Iberian Peninsula remains modest.

The news on November 18 that Russia’s Gazprom is cutting off gas supplies to Austria is a timely reminder of the value of France’s LNG terminals and pipeline connectivity with the rest of Europe. LNG cargoes destined for Asia are already re-routing to Europe, some will likely unload in France. The cessation of remaining Russian pipeline gas transits across Ukraine at the end of the year will further reduce Europe’s pipeline gas supplies.

As forecasters will attest, there are always major uncertainties when looking into the future, but it is often flexibility which proves the name of the game, and for European energy security that still means LNG, providing a key role for France’s LNG import terminals.