Future EU demand does not match with future US LNG exports [Global Gas Perspectives]

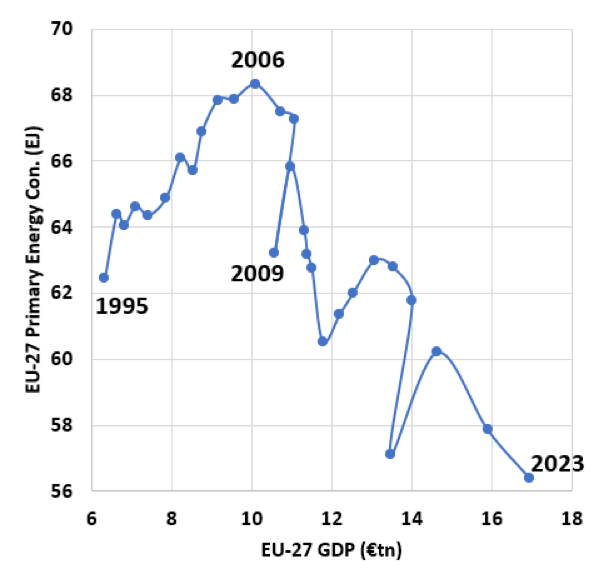

With recent 2023 publications, it is interesting to explore what could be the EU’s future energy consumption. Since 2006, the bloc has managed to decouple, for the first time in human history, its GDP from its energy consumption. It must be also noted that during this period the EU did more poorly than the US and China in terms of economic growth. So, the EU can be viewed as an example in terms of energy sobriety and efficiency but at the cost of poorer economic growth and de-industrialisation. Policymakers should ask themselves not only if the curve is steep enough to reach net zero by 2050 as they have done in Brussels under the outgoing European Commission, but how is this affecting the EU position on the global scene.

EU energy primary consumption versus GDP

Source: EI Statistical Review, RichesFlores Research, Macrobond, thierrybros.com

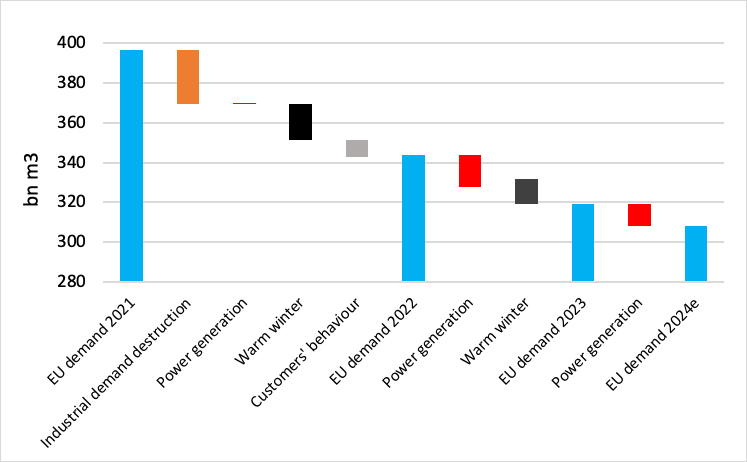

As EU gas demand continues to decline, again mostly due to power generation (-16% in H1 2024 versus H1 2023), if we assume this trend to continue in H2 2024, gas demand could be 11bn m3 lower in 2024e (-3.6%) versus 2023.

Evolution of EU gas demand in 2021-2024e

Source: EI Statistical Review for historical data, thierrybros.com

Lower expected US LNG growth

By freezing non-free trade agreement (FTA) authorisations for US LNG in January, the Biden administration delivered a domestic agenda that pleases both greens and voters that want cheap US gas. As expected, non-FTA countries that are not US allies like China and India are focusing on their domestic coal to get affordable baseload energy. Non-FTA countries and US allies like Europe, Japan and South Korea did not complain as they believe their respective gas demand should go down.

On the US side, this pause was viewed as a “freeze” by the gas industry and the Republicans started questioning publicly the IEA. For Republicans in the US Congress “to defend the indefensible, the Biden administration trots out its ostensible fear that more LNG export capacity may be built than is needed. The basis of that fear is the IEA’s unrealistic modelling. Decisions about future LNG export capacity should be left up to market participants and investors, not politicians or bureaucrats. It is highly concerning that politicians are using the IEA’s biassed modelling to make highly controversial decisions that undermine world energy security. Restrictions on US LNG exports will have a significant impact on domestic economies and fuel prices, energy security, and global emissions. Notably, US LNG exports have spurred European countries to construct LNG import facilities in order to further wean themselves off of Russian natural gas.”

On July 1, a federal judge sided with 16 Republican-led states in holding that the US Department of Energy's (DoE) pause on approvals of LNG exports was "completely without reason or logic." The federal judge, an appointee of Republican former President Trump, said the states were likely to succeed in showing the pause contravened the Natural Gas Act and was arbitrary, capricious, and unconstitutional. For him, the department's actions were "above and beyond its scope of authority" and he ordered the DoE to “act expeditiously”. But this decision is unlikely to immediately jump-start approvals as the DoE disagrees with the ruling. Biden’s pause on new non-authorised US LNG projects should hold for at least the remainder of this year.

The DoE has not published anything on its new analysis, and it must be emphasised that a public consultation is a burdensome process where mostly people/NGOs in favour of the pause will take part. In favour of lifting the ban, only the gas industry is expected to contribute. The general public rarely answer those consultations as they are not directly interested (even if indirectly economically impacted) and are not willing to lose time. The general outcome of this public inquiry should be that the “consulted parties” are, for a vast majority, in favour of the pause to be extended.

After Qatar, the world's third LNG exporter, announced in February that it was proceeding with a new LNG expansion project, to further raise its production capacity to 142mn tonnes/year, Oman announced on July 27 its plan to develop an additional 3.8mn t/yr train to raise its total LNG export capacity to 15.2mn t/.yr. US competitors are viewing this pause as an opportunity.

The final decision, like the initial one, will stay in the hands of the US president. If a Democrat president is elected, the pause could last a lot longer than the market expects. If former President Trump gets in, he would have first to deal with the IEA and then lift the US pause.

Rebound in Russian gas exports to the EU

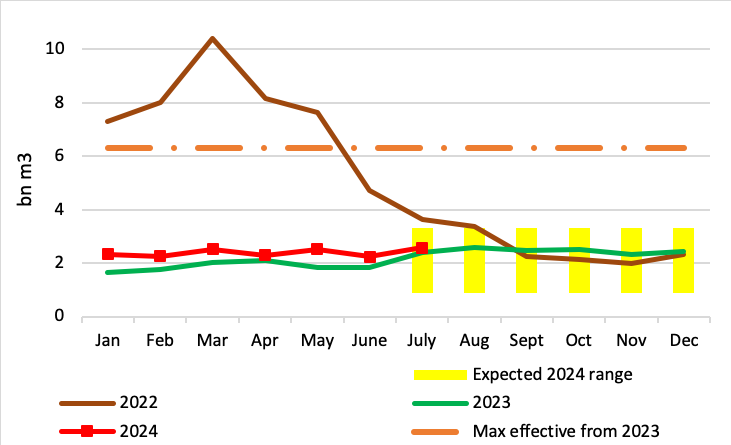

With 2.6bn m3 exported in July 2024 versus 2.4bn m3 in July 2023, for eleven months in a row Gazprom’s exports to Europe are up yr/yr. Since the beginning of the year, exports are up 23% yr/yr, even though EU policymakers want to reduce Russian supplies.

Gazprom’s monthly gas exports to Europe

Sources: Entsog, thierrybros.com

We should continue seeing Russian pipe flows in the expected narrow range between 0.9 and 3.5bn m3/month during the rest of the year.

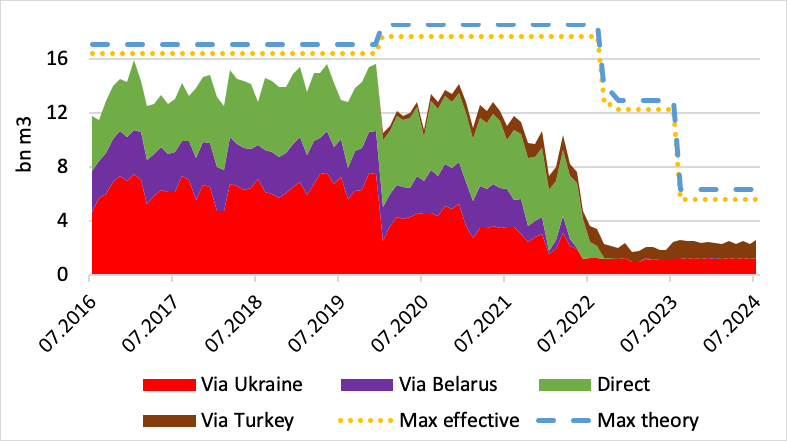

Split of Gazprom’s monthly gas exports to Europe via route

Sources: Gazprom, GTSOU, Entsog, thierrybros.com

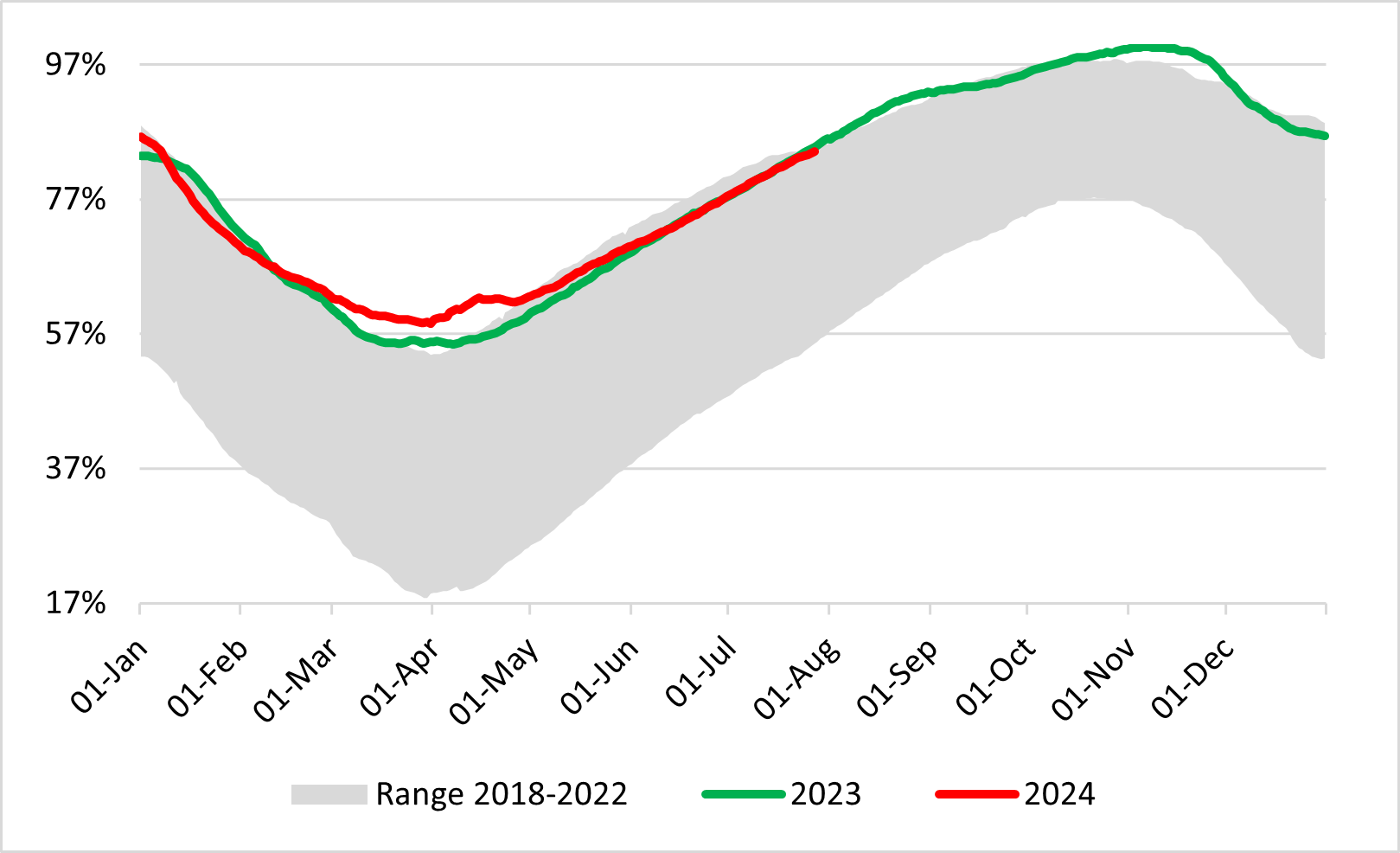

On March 31, with storage facilities filled to a record 58% of capacity, the summer injection started in Europe. The storage level at the end of July was 85%, at the high level of the historical range, just slightly lower than a year earlier.

EU gas storage utilisation

Source: GIE, thierrybros.com

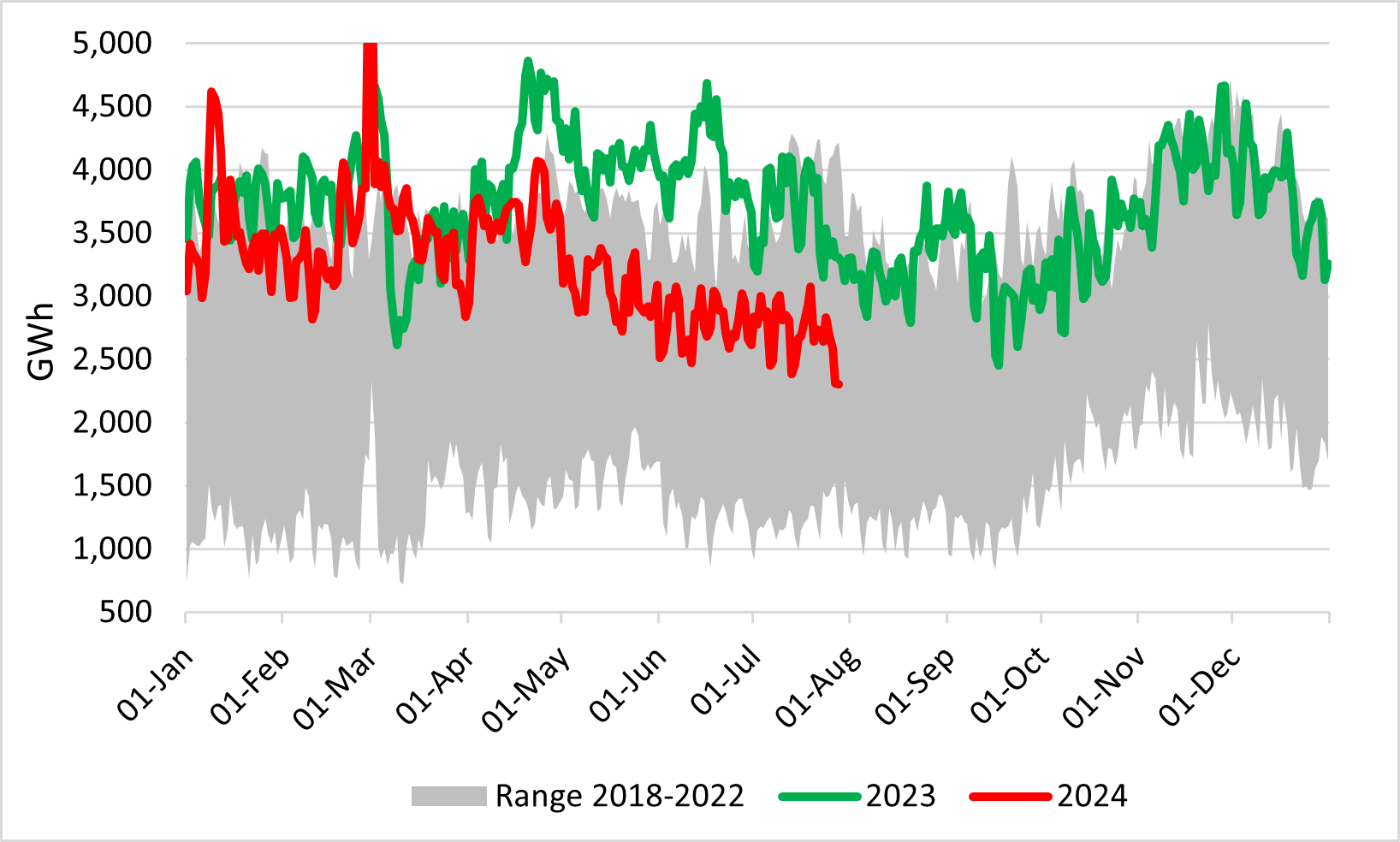

Spot LNG provides the equilibrium between Asia and Europe. EU LNG send-out data shows that Asia is more willing to attract LNG since the beginning of 2024 as the EU is in no need of extra LNG thanks to more Russian pipe gas and further demand destruction. For the first seven months of 2024, send-out was 16% lower than the same period last year. But even in the middle of summer and with its storage nearly at record high, Europe faces around $11$/mn Btu gas prices as the global market is getting tighter as US LNG supply has been disrupted after Hurricane Beryl and Egypt is boosting imports amid power shortages.

EU LNG send-out (excluding Malta)

Source: GIE, thierrybros.com

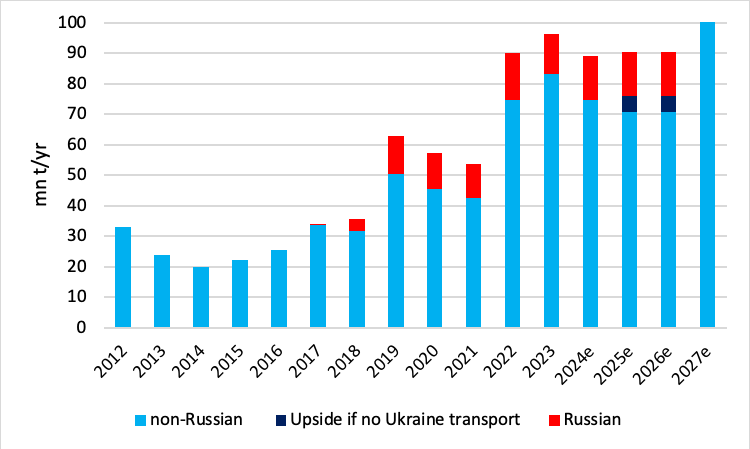

But the EU needs record volumes of non-Russian LNG post 2025e

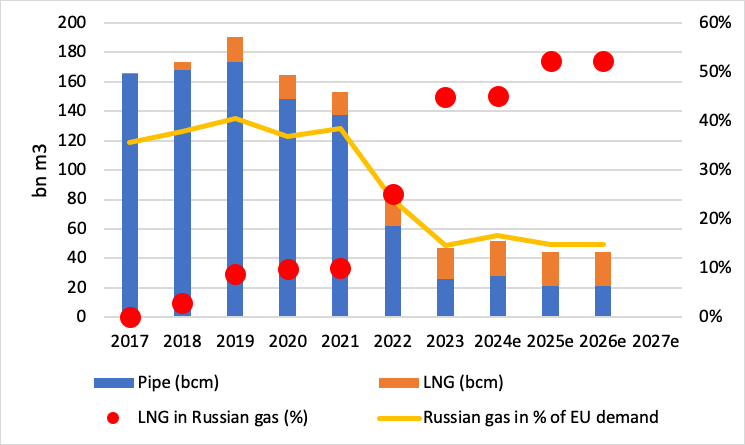

The growth in Russian LNG and pipe imports into the EU is pushing Russia’s share of the gas market up from the 15% low reached in 2023 to 17% in 2024e.

Russian gas supplies to the EU 2017-2027e

Source: GIIGNL & EI Statistical Review for historical data, thierrybros.com

As the Ukrainian transit contract is ending on December 31, 2024 and unlikely to be renewed, technically transit could stop but Slovakia and Hungary could sign amendments to their Russian contracts with delivery moved at the Russia-Ukraine border which would result in around 7bn m3 of gas still flowing through Ukraine annually, until the EU is able to implement its 2027 target of eliminating Russian gas. In July, Ukraine stopped transiting Russian oil via the Druzhba pipeline to Hungary and Slovakia, making the above scenario more challenging. This means that going forward, the EU will continue to need record volumes of non-Russian LNG in the years to come. On top of that, if a Democrat President is elected in the US, Washington’s temporary pause on LNG export facility authorisations could become a definite freeze, further tightening the gas market.

Net EU LNG imports

Source: GIIGNL for historical data, thierrybros.com

Dr. Thierry Bros

Energy Expert & Professor

August 01, 2024