Gazprom Cuts Flows on NS Pipe Maintenance

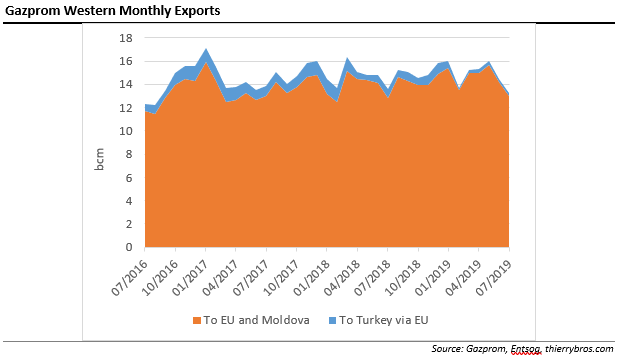

With annual Nord Stream 1 maintenance under way, Gazprom’s flows were down in July compared with June (-8.8%) but slightly up compared with July 2018 (1.4%).

The low transit to Turkey via EU is still on-going and, since 12 February, this line has seen very little gas flowing. This can be explained by a severe drop in gas demand in Turkey since last year. According to the latest BP Statistical Review of World Energy, 2018 has been a year of very high gas demand (+5.3%) with Turkey experiencing a major drop in consumption (-8.3%).

The price competition between LNG and Russian pipeline gas has been in progress since 2015 when Gazprom responded to the opening of the Lithuania regasification terminal by discounting its gas price by 23%. Gazprom Export is now using its Electronic Sales Platform (ESP) as an added flexibility tool. Buyers can select either to call more contracted gas (above the 70% take-or-pay) or bid on the ESP while Gazprom provides the volumes required to balance the market.

This mechanism allows Gazprom to continue to push for long-term contracts (to finance the upstream capex and transport capacity bookings) without losing market share. With spot prices very low in Europe, a lot more gas has been sold on the ESP than before. Following the commissioning of TurkStream in 2020, we could see this same mechanism being developed for the Turkish market for Gazprom to increase its market share.

The Turkish long-term contracts would stay as they are in commercial terms with Turkish importers allowed to bid on a Turkish ESP for spot gas for additional volumes. Here as in Europe, the transportation cost would be covered by the long-term contract as the ESP additional volumes would be shipped via the new TukStream.

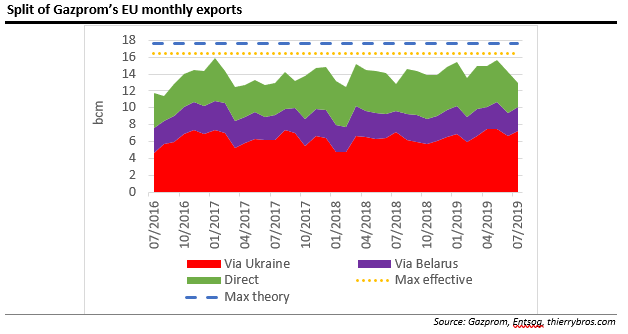

The annual Nord Stream 1 maintenance finished three days early , with flows resuming July 27. With Nord Stream 1 maintenance starting July 16, the direct volumes to Europe went down 38.8% vs June 2019 and Ukraine and Belarus transit were up respectively 8.2% and 1.9%. We should expect the reverse in August: more direct flows and less through Ukraine.

On April 12, Nord Stream 2 AG triggered the three-month consultation period during which parties must seek an amicable settlement before a notice of arbitration can be served. As no amicable settlement has been reached, Nord Stream 2, as a Swiss investor, can now defend its rights under international law by proceeding with arbitration against the EU pursuant to the investment protection guarantees of the Energy Charter Treaty.

On July 25, Nord Stream 2 brought an action for annulment before the EU General Court. Nord Stream 2 requests that EU Directive 2019/692 amending the EU Gas Directive be annulled because of an infringement of the EU law principles of equal treatment and proportionality. This and the Ukrainian transit would be the first issues that the new EU energy and climate change commissioner will have to deal with when appointed in November 2019. Let’s hope (s)he will be competent from Day 1 and won’t need, as too often, months to be up-to-speed with the domains (s)he is supposed to supervise!

Thierry Bros

August 2, 2019

Advisory Board Member, NGW

[1] https://www.nord-stream.com/press-info/press-releases/nord-stream-pipeline-resumes-transmission-after-2019-maintenance-works-are-fully-completed-506/

[2] https://www.nord-stream2.com/media-info/news-events/nord-stream-2-calls-on-court-of-justice-of-the-european-union-to-annul-discriminatory-measures-133/