Gazprom Eyes 13% of China's Market by 2035

Gazprom expects to take about 10% of China's natural gas market in 2025 and increase the share to 13% by 2035, the head of Gazprom’s directorate for long-term development programs of Gazprom Cyril Polous said at an investors day held in New York February 6, local media reported.

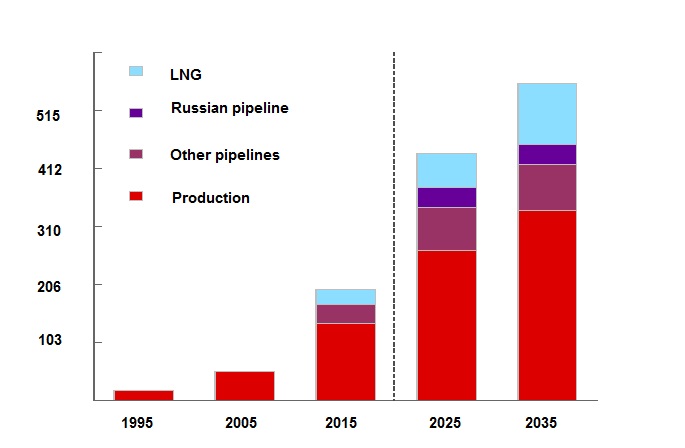

According to some forecasts, by 2035 the difference between consumption and domestic gas production, including shale gas, may reach 200-280bn m3/yr.

China imported 92bn m3 of pipeline gas and LNG in 2017, rising about 27.6% on 2016, while demand rose 15.3bn m3 to 237.3bn m3, according to China’s national development and reform commission. The country’s own production also increased 8.5% to 148.7bn m3.

Despite Gazprom’s plan, BP estimates that Russian pipe gas flow to Chinese market will stay flat 2025-2035, as LNG will take up the slack. However, Gazprom can increase LNG sales to China as well.

China’s gas import, production:

Source: BP 2017 Energy Outlook (bn m³/yr)

Gazprom has a 38bn m3/yr gas purchase contract with to China, to be supplied though Power of Siberia pipeline, 1,480 km long as of February, or two thirds the total length, from the Chayandinskoye field to the border with China. The first gas is expected to flow in December 2019.

"In 2017 alone we built more than 900 km, significantly ahead of the originally planned construction time," Polous said, noting that Gazprom is working with Chinese partners on other routes as well.

The deputy head of Gazprom Alexander Medvedev also said during the conference that China could pay in its national currency as bilateral trade is growing. "And not only trade, but also investments, including on Russian territory," he said.

Medvedev also stressed that Gazprom is not afraid of increasing supplies of American liquefied natural gas (LNG) to Europe. "We are confident that we sold both at competitive prices and we will be able to sell further, while still having sufficient profitability for our operations," Medvedev explained.

EU markets

Gazprom increased its share in the European market from 33.1% in 2016 to 34.7% last year, exporting 165bn standard m³ in 2017, or 193.9bn m³, based on Gazprom’s own smaller measure. Medvedev stressed that the contract model makes Gazprom's gas the most attractive in the market, and the existing export gas routes allow flexible response to changing demand.

The deputy head of Gazprom added that the average export price for gas this year could exceed $220/'000 m3. "We put a conservative price of $197/'000 m³ into the 2018 budget, but we are confident that the budget price will be surpassed," he said.

Gazprom’s budget and actual prices for gas export in 2017 were set at $179 and $190 respectively. He said: "US and EU sanctions do not limit Gazprom's access to global capital markets."

The possibility of imposing new US sanctions on export gas pipelines does not apply to projects announced for sale before August 2, 2017. In addition, technological sanctions limits concern less than 1% of the production of hydrocarbons of the Gazprom group, the company's presentation says. Gazprom plans to produce 476bn m3 of gas this year, about 5bn m3 more than last year.