Gazprom-EU Flows Hit 2020 Record in October

The Nord Stream 2 saga took a new turn October 7 with the Polish office of Competition and Consumer Protection (UOKiK) imposing a penalty of over zlotys 29bn (€6.5bn) on Gazprom, and of over zlotys 234mn on the five other companies participating in the construction of the pipeline.[1] It is interesting to note in the Polish press release that:

- “The agreements concluded between the participants were concerned both with financing and with a number of other authorizations, such as, for instance, the ability to interfere with the operation of NS2. Furthermore, by establishing a pledge on the stocks of Nord Stream 2, the financing parties became “quasi” stockholders of that company - in the event of its default under the loan agreement, they would be entitled to take over the stocks of the company constructing the gas pipeline.”

- “If the project were solely of a financial nature, then Gazprom could easily obtain financing from the Government of the Russian Federation or from commercial banks. Perhaps they would be able to pull it off on their own. It needs to be stressed that operating as a financial institution is not the core activity of any of the remaining concentration participants. (…) The fact that a joint venture is financed by participants of the gas market and not by financial institution proves that all the entities involved share the same economic interests.”

The companies have 30 days to terminate their contracts. But as the decision is appealable, we can expect at least Gazprom to appeal to avoid the fine and the termination of contract. So, any partner who did not appeal would have to withdraw from the financing arrangements they had in place with Nord Stream 2. Could some partners be tempted not to appeal to get out?

In an unrelated (?) news[2], the French government stepped in to force its national company Engie to delay signing a potential $7bn deal with a US liquefied natural gas company over concerns that its US shale gas was too dirty. I believe this makes it even less likely for Engie to appeal the UOKiK 7 October decision. France would then be in a position to say no to both Russia and the US, something that de Gaulle would be very proud of! And at the end of the day, markets will solve this worldwide supply - EU demand equation.

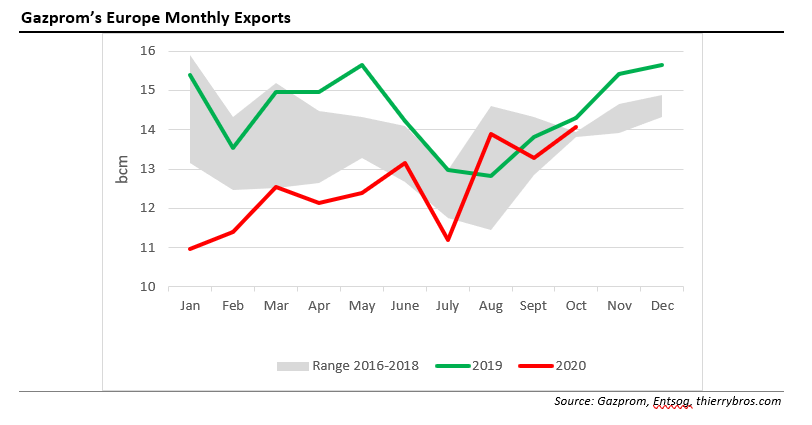

October saw the highest monthly export volume so far this year.

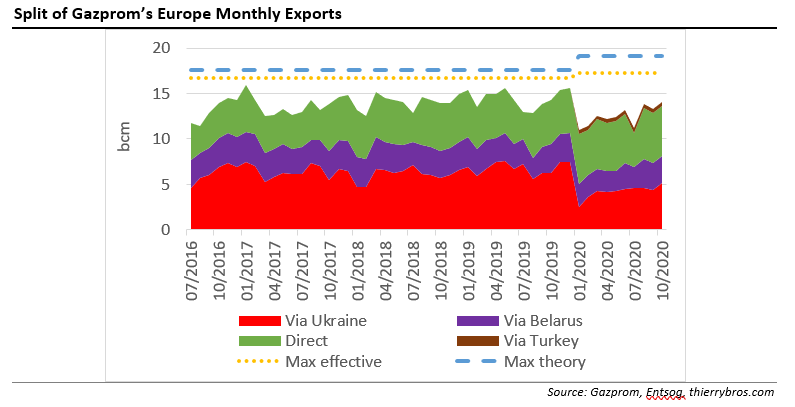

Gazprom used, in October, all routes more except via Turkey.

Belarus is in the news as democratic peaceful protests are requesting election results to be implemented (i.e. a regime change). It is also an important energy country as 20% (c. 35bn m³/yr) of the Russian pipe gas for the EU and UK needs to transit there. There are always at least 2.1bn m³ transiting each month via Gazprom Transgaz Belarus (fully owned by Gazprom since 2011). The contracts between Gazprom and Gazprom Transgaz Belarus for gas supplies to and gas transportation across Belarus are valid until the end of 2020[3]. In the coming months, Belarus could also become an energy country to watch…

The long-term transit deal signed December 29, 2019 between Gazprom and Naftogaz provides for 65bn m³ transit volumes for 2020. As the 65bn m³ should be on a uniform flow of 178mn m³/d [4] or 5.5bn m³/month, any lower historical flow cannot be offset by higher flows later: Gazprom must book additional short-term capacity. In October, Gazprom, for the first time in 2020, used all its long-term contracted transit capacity and also bought some extra earlier in the summer.

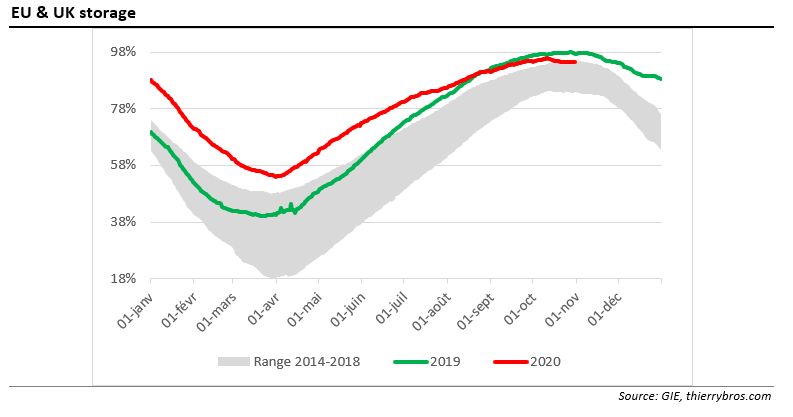

European Union + UK storage reached its peak on 12 October with 95.7% full, slightly lower than the record high reached last year (97.8% on 28 October). Ukraine was also at very high level.

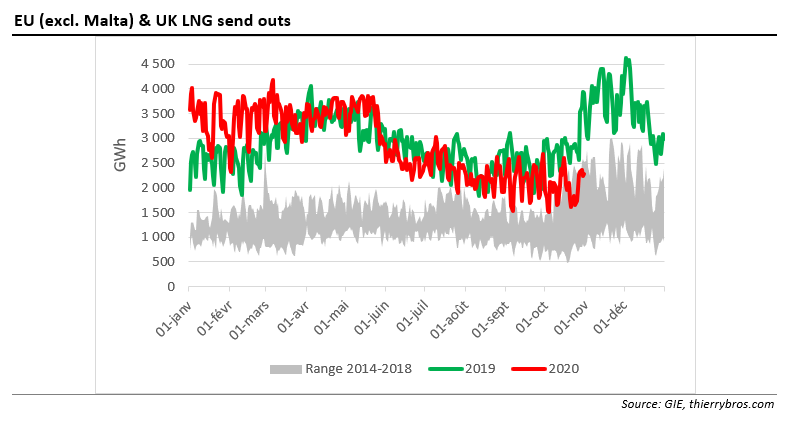

The Coronavirus will continue to limit EU demand and hence imports needs. But as we have been writing since early this year, Gazprom is not the only producer to swing supply any longer. For the first time ever, Gazprom could only hold half of the global spare capacity. All producers are sharing the burden of reducing volumes to the EU.

As we explained back in August, Gazprom’s flexible strategy, to reduce severely volumes in Jan-July 2020 (-17.9bn m³ or -17.6%) compared with last year and then to increase exports is turning out to be more profitable/ less costly than slower-moving LNG suppliers that are turning down volumes only when price start to recover. As storage withdrawals ramp up and LNG imports dip, we should expect continued high imports from Gazprom in the coming months.

Thierry Bros

2 November 2020

Advisory Board Member, Natural Gas World