Gazprom keeps Europe in suspense

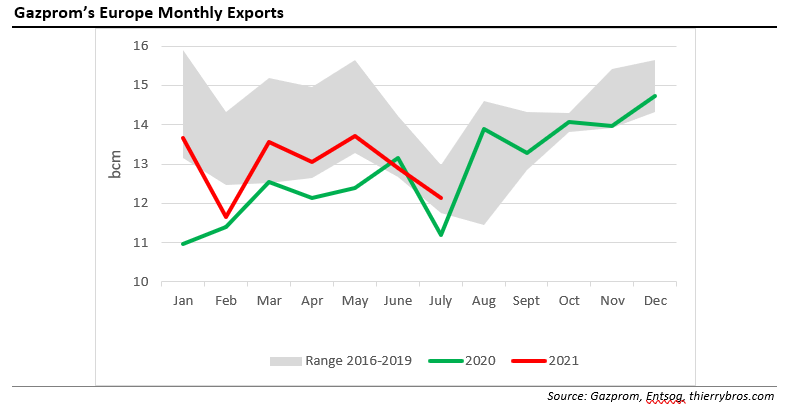

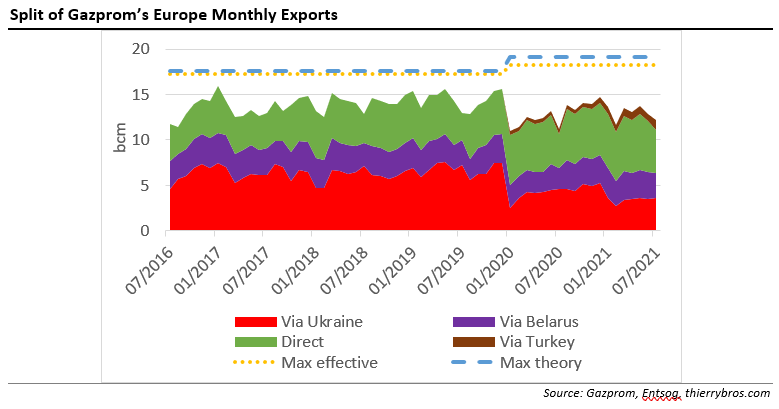

Russian pipeline export monopoly Gazprom’s flows were in July up compared with last year (+8.3%) but down on June (-6.2%). Nord Stream's annual scheduled maintenance was completed on time between July 13 and 23, reducing de facto the direct flows to Europe (-18% vs June 2021). In July, Gazprom managed to transit a record high 1.1bn m³ through Turkey for Europe to mitigate the maintenance.

The transit deal signed in December 2019 between Gazprom and Naftogaz provides for 40bn m³ this year. As the volume has to be spread evenly each month, that means 110mn m³/d with any lower flow in one month not contractually balanced by a larger flow later on in the year. Gazprom has to book additional capacity with Gas Transmission System Operator of Ukraine (GTSOU) – as it did last year – to increase flows. But Gazprom seems, so far, unwilling to do so, with transit volumes via Ukraine running at maximum contracted allowances.

Gazprom is now benefiting from record European gas prices but is still reluctant to pay for additional transit capacity in Ukraine to benefit also from increased volumes.

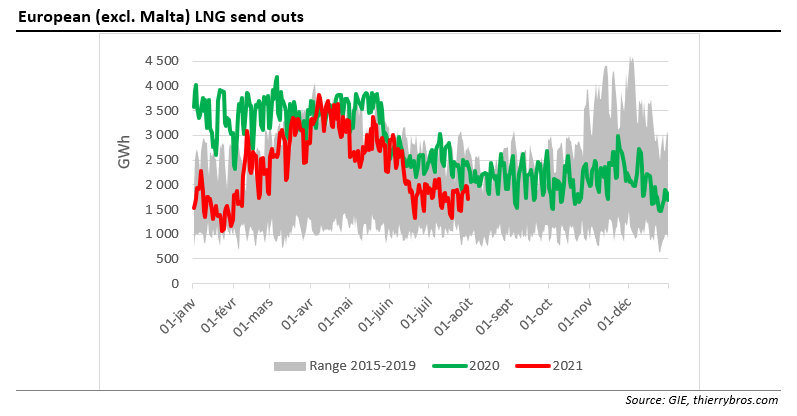

In July, LNG send outs to Europe were also down respectively by 14% and 29% compared with last month and last year as high prices in Asia are still making Europe slightly less attractive.

On April 19, Europe’s gas storage was at its lowest (29.1% full) before a delayed and so far feeble injection period. The late cold spell and persistent limited Russian and LNG flows push storage lower than its 2015-2019 historical range, leading to record high Dutch Title Transfer Facility prices…

With so much more storage to fill, will Gazprom continue to limit its flows via Ukraine to avoid booking extra capacity or will it react to the market signals? The economic rational answer should be to supply more gas but the uncertainty strategy[1] is providing added benefits. It could also be viewed as a way for Gazprom to show the necessity for Nord Stream 2. But even if Gazprom were to book more capacity in Ukraine, the company has even bigger market power by deciding when to do so. Gazprom, as the ultimate judge, will alone decide when to take traders by surprise…

The Nord Stream saga continues. On July 15, the Court of Justice of the European Union ruled that the European Commission (EC) violated the principle of energy solidarity by issuing a decision on the OPAL gas pipeline. The court agreed with Poland that the EC should not have exempted OPAL gas pipeline from EU regulations. According to the ruling, the EC's action was contrary to the principle of energy solidarity and did not take into account the interests of all member states concerned[2].

This is in line with my 2019 article where I wrote: “With Germany being so reliant on Russia, should other member states, in the event of a gas supply disruption, reduce their industrial gas demand in order to keep German households warm? Is it acceptable that Germany, the wealthiest state in the EU, should rely on others to bear the cost of supply diversification to provide its security of supply?”

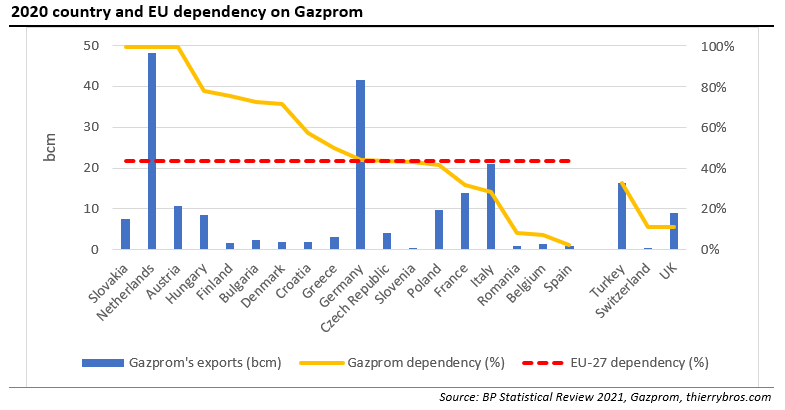

This gives a good opportunity to update the 2020 EU dependency on Gazprom. As EU consumption was negatively affected by the pandemic and as Gazprom’s exports volumes[3] were up in 2020 vs 2019, EU-27 dependency on Gazprom reached a record high of 44%... As consumption is increasing while Gazprom is not willing to provide additional gas, we can expect this dependency figure to move back down, in 2021, to the usual 40% level.

But if Nord Stream 2 becomes operational, Germany dependency will then move from its actual 45% to 100%, regardless of the EU overall dependency…

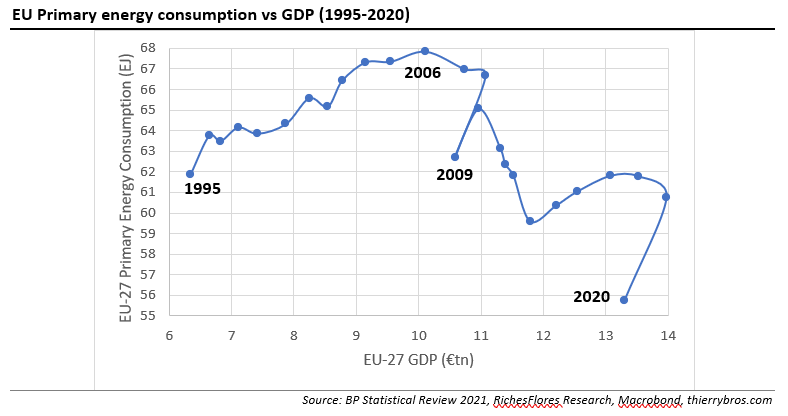

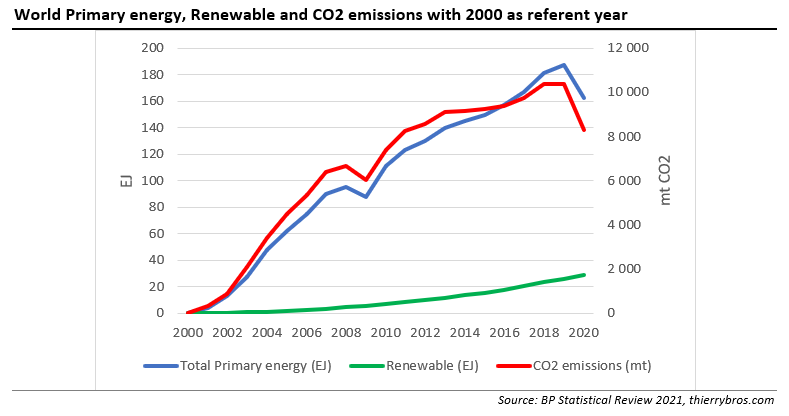

With the (delayed) latest edition of the BP Statistical Review, we can grasp the impact of the Coronavirus crisis in 2020. After the 2020 crisis, we should expect primary energy consumption to move inside the 60-62 exajoule range. Even if science and innovation managed, in 2006-2014, to break the link between economic growth and energy consumption, it is highly unlikely that we could, in the 2020s, grow our GDP while reducing further our primary energy consumption.

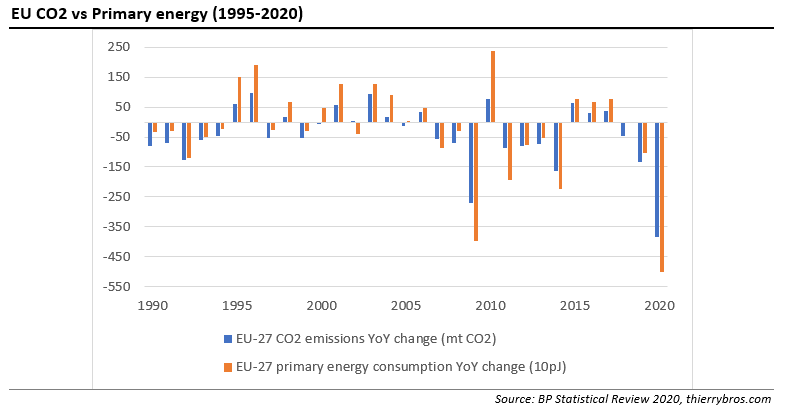

But as energy consumption and CO2 emissions are highly correlated, this means that the 2020 reversal is already being erased…

On July 14, the EC unveiled its Green Deal Package. But as executive vice-president Frans Timmermans stated during the press conference it is going to be “bloody hard” to achieve the new “fit for 55” 2030 targets, with 2021 on track to see a record annual growth in CO2 emissions!

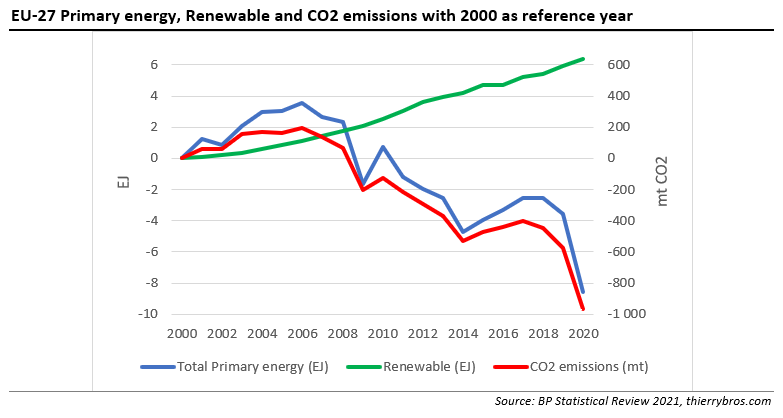

We must also always remember that the EU is not the world. If, since the millennium, the EU managed to decrease its primary energy consumption while increasing renewables and hence cut its CO2 emissions, at the worldwide level the renewable growth only accounted for less than 14% of the total growth of primary energy consumption.

This analysis should lead to caution any magical solution where the EU could further reduce its CO2 emissions thanks to imported renewable energy The track record of the last 20 years shows this is highly unlikely to work soon as renewable growth is still not enough to meet world energy primary consumption…

Thierry Bros

August 2, 2021

Advisory Board Member, Natural Gas World

[1] As defined by Sadek Boussena and Catherine Locatelli in 2017 in “Gazprom and the Uncertainty of the European Gas Market: Towards a Market Share Strategy?” available in French at https://journals.openedition.org/rei/6513

.PNG)