Gazprom persists in flat transit through Ukraine

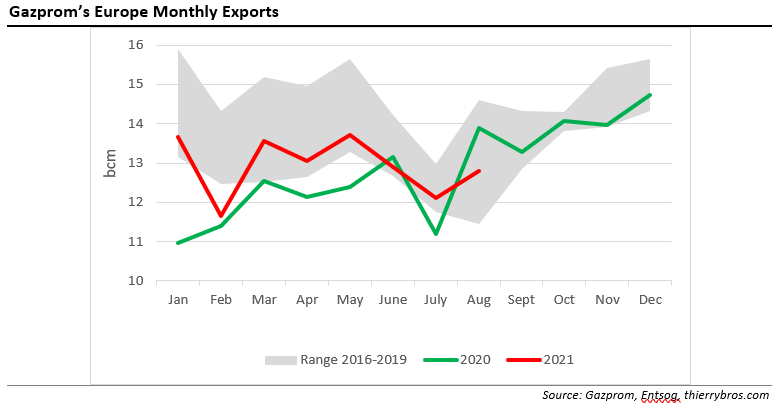

Gazprom’s overall flows westwards were down in August compared with last year (-7.8%) but up compared with July (+5.7%). After the end of the Nord Stream annual scheduled maintenance (July 13-23), the Russian pipeline gas exporter sent 32.5% more gas to Germany than in July, while flows through Belarus were down 28.6% on the month.

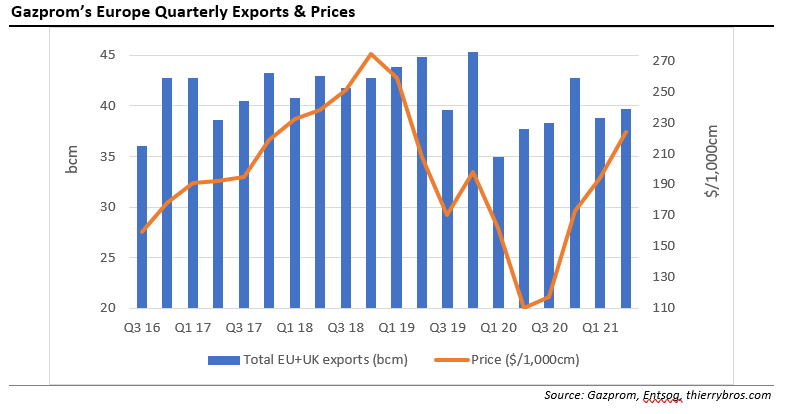

Year-to-date, Gazprom has exported 5.8bn m³ more than it did last year (+5.9%) but 11.1bn m³ less (-9.7%) than in 2019. But as we are now used to living with the virus, we should compare 2021 with 2019 and not with 2020 when the economy was severely affected by the pandemic.

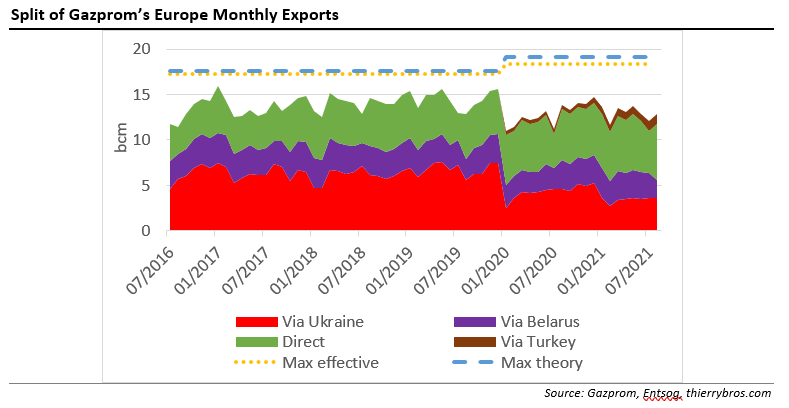

The transit deal signed in December 2019 between Gazprom and Naftogaz provides for 40bn m³ transit for 2021. Spread evenly over the year at 110mn m³/d, any lower historical flow cannot be mitigated by higher contracted flows. For higher flows, Gazprom needs to book additional capacity to the operator Gas Transmission System Operator of Ukraine (GTSOU), as it did last year. But Gazprom seems, so far, unwilling to do so, with transit volumes via Ukraine capped at the maximum contracted allowances.

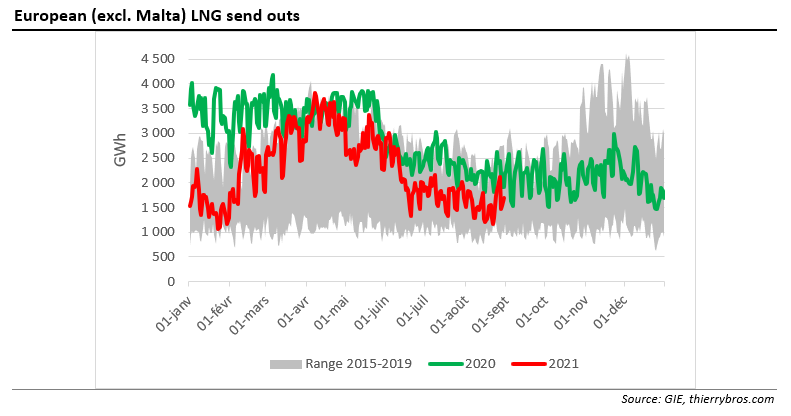

LNG send outs were again down on last year as high prices in Asia are still making Europe slightly less attractive. Year-to-date, Europe LNG regas is down by 19bn m³ compared with last year, but fortunately up 8bn m³ compared with the historical average.

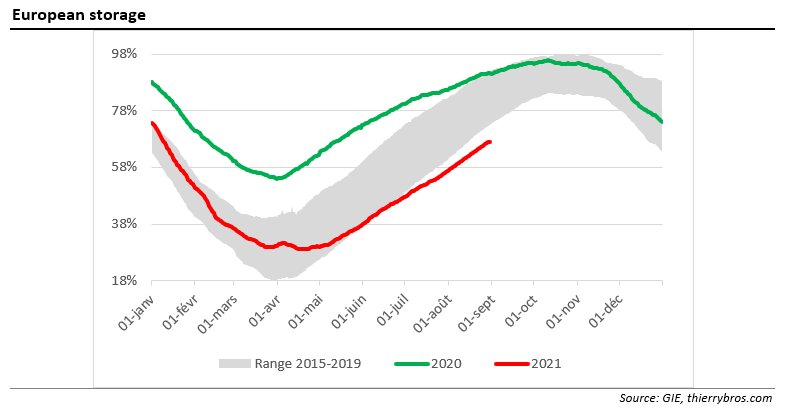

On April 19, Europe’s gas storage was at its lowest (29.1% full) before a delayed and feeble injection period. Persistent limited Russian and LNG flows are pushing storage lower than its 2015-2019 historical range, leading to record high TTF prices… Storage was, as of end-August, 7bn m³ lower than the past record low (2018) and 17bn m³ lower than the historical average.

Gazprom is now benefiting from record prices[1] but seems reluctant to pay for additional capacity in Ukraine to benefit also from increased volumes. It could be viewed as a way for Gazprom to make the case to Europeans that gas is absolutely needed in an energy transition world. But unfortunately for final customers that are going to face sky-rocketing energy bills, policy-makers in Brussels do not seem to notice/care as they are focused on their net zero 2050 hydrogen scenarios.

In its Q2 21 conferemce call Gazprom confirmed that it will produce a record (for the last 10 years) 510bn m³ in 2021 compared with 453bn m³ last year. It confirmed its target of exporting 183bn m³ to Europe[2] for 2021 irrelevant of Nord Stream 2 being or not operation…

The Nord Stream saga continues. On 25 August, a German court ruled that Nord Stream 2 will have to comply with EU competition law on unbundling and third-party access. This ruling is a setback for Nord Stream 2, making it unlikely to be able to flow the expected 5.6bn m³ of gas by the end of the year.

Dr. Thierry Bros

1 September 2021