Gazprom's Exports Dip in September

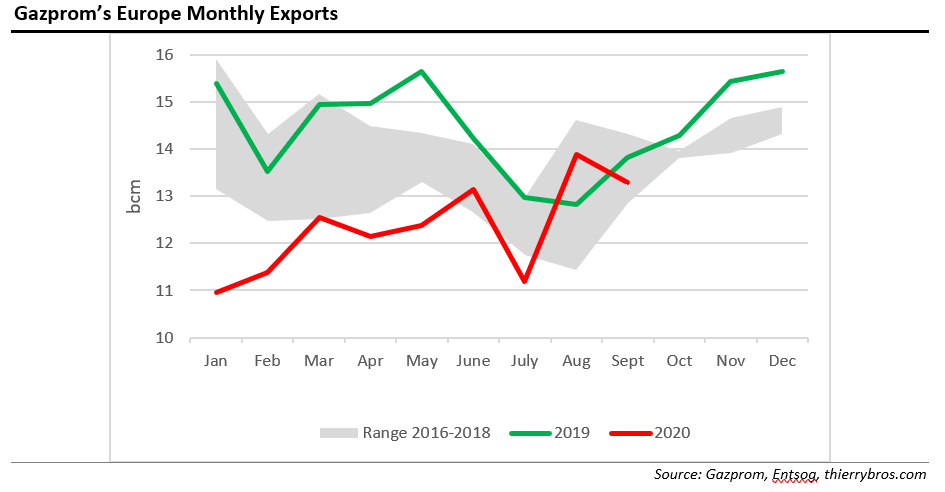

After peaking in August, Gazprom’s flows were down 4,2% in September and down 3.8% on September 2019.

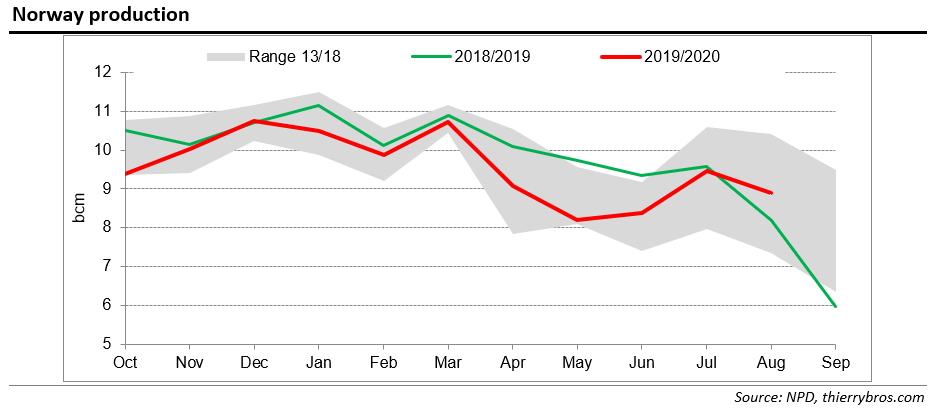

It is interesting to note that Norway has followed the same pattern as Gazprom so far this year[1]. In Jan-July 2020 vs Jan-July 2019 Norway exported 5.8bn m³ (5.8%) less, compared with Gazprom's 17.9bn m³ less (-17.6%). And then, in August 2020, Norway exported more than last year (+8.7%, compared with 8.3% more for Gazprom).

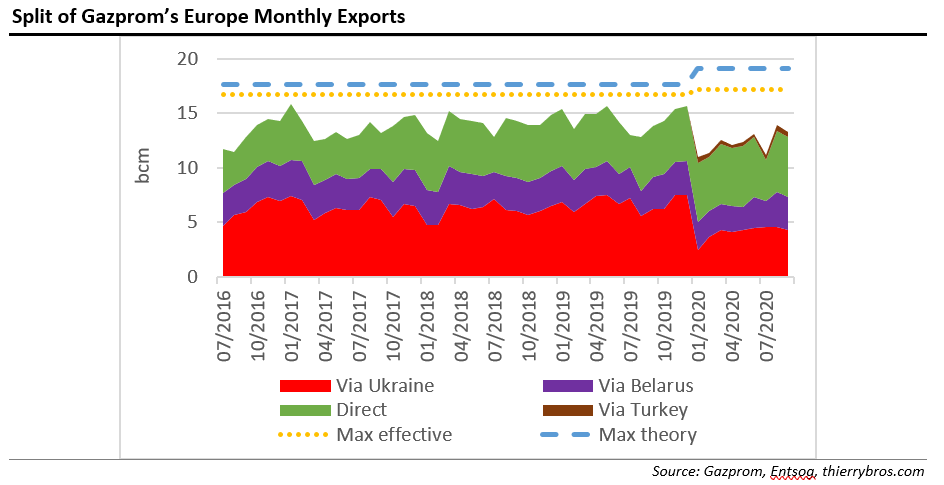

Gazprom used, in September, all routes less – except TurkStream which was stable.

Belarus is in the news as democratic peaceful protests are requesting election results to be implemented (i.e. a regime change). It is also an important energy country as a fifth(about 35bn m³/yr) of the Russian pipe gas for the EU & UK transits it. There will always be at least 2.1bn m³/month via Gazprom Transgaz Belarus, which has been fully owned by Gazprom since 2011.

The contracts between Gazprom and Gazprom Transgaz Belarus for gas supplies to and gas transportation across Belarus are valid until the end of 2020[2]. In the coming months, Belarus could also become an energy country to watch…

The transit deal signed December 29 last year by Gazprom and Naftogaz provides for 65bn m³ for 2020. As that quantity is divided evenly (178mn m³/d[3] or 5.5bn m³/month, there is no carry-over of under deliveries in any given month to the next. So Gazprom must book additional capacity as it just did for the first time in September for October[4]. This will provide extra flexibility to Gazprom in case of unforeseen events.

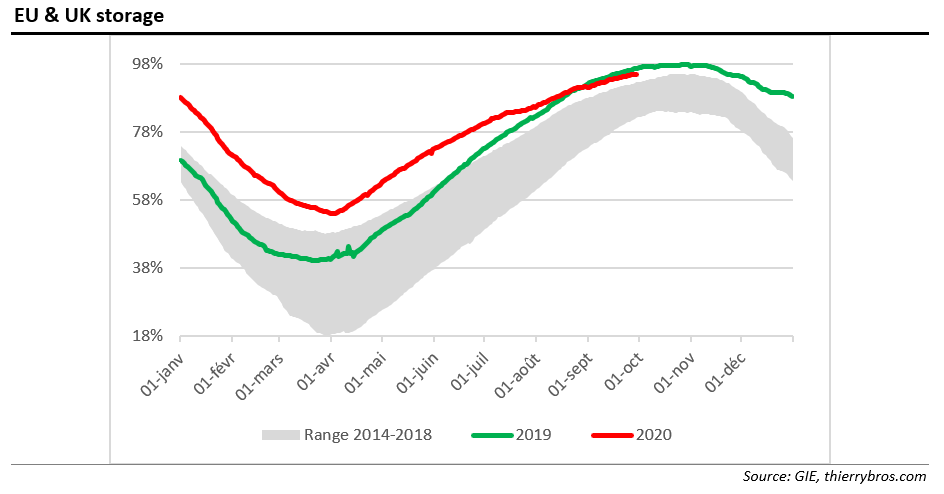

The storage withdrawal season is round the corner with storage at 95% full, close to 2019 record (98%).

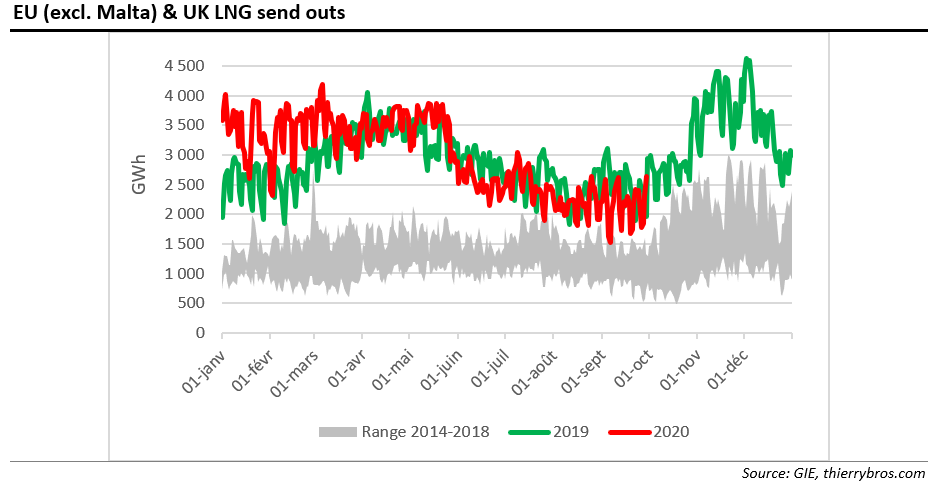

As we have been writing since early this year, Gazprom is not the only producer to swing supply any longer. For the first time ever, Gazprom could only hold half of the global spare capacity. All producers are sharing the burden of reducing volumes to the EU and this translates into less pipe gas and, since June, lower LNG imports.

The coronavirus-impacted-demand will continue to restrain EU imports needs even if low prices should continue to boost gas competitiveness. The LNG time-delay adaptation should now be over and with fewer US LNG cargo cancellations, we should expect a slight rebound in regasification volumes in the winter months.

Thierry Bros

1 October 2020

Advisory Board Member of Natural Gas World

[1] Production data in Norway for September available from NDP only in a week time

[2] https://www.gazprom.com/press/news/2020/september/article512781/

[3] https://interfax.com.ua/news/interview/635485.html

[4] https://www.naturalgasworld.com/gazprom-books-extra-ukrainian-transit-capacity-in-oct-82056