German Gas Use Continues to Rise

Germany used 9% more gas year on year in the first nine months of 2017, according to authoritative preliminary data released November 10 by industry-academic think-tank AG Energiebilanzen (AGEB).

The increase was mainly in power generation, but industry and home heating also contributed, it said. The 9% gas increase in the first nine months of 2017 is significantly higher than the 3% increase recorded year on year in 1H 2017.

Coal demand fell by 7.6% year on year, said AGEB. Coal burned by power plants fell sharply by 12.5% – as more gas-fired and renewable electricity was fed into the grid – but the iron and steel industry upped its coal/coke use by 2.3%.

Brown coal (lignite) use rose 2%, thanks to better power plant availability. That availability however will decline by 15% over the coming years, added AGEB.

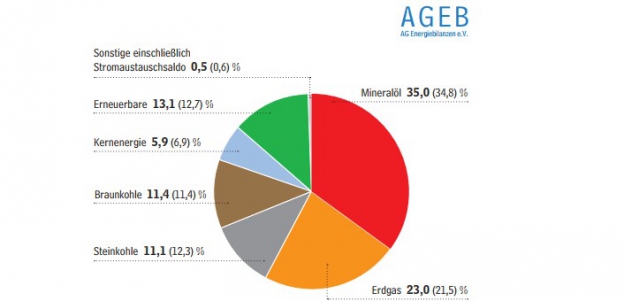

Germany’s overall energy demand over the period was 1.9% higher than in 2016: 9,971 petajoule (PJ), with cold weather at the start boosting gas use and windy conditions boosting renewable generation generally. Oil remained the most used fuel in Germany, up 2.6% year on year, with gas second, renewable energy third, ahead of lignite and coal in roughly equal fourth position – albeit with lignite creeping ahead of coal.

Nuclear came a distant sixth, with its production down 13% year on year. The US Energy Information Administration said earlier this week that total nuclear capacity in Europe/Eurasia is expected to decline, as policy decisions to phase out or reduce the nuclear generation share in countries such as Germany (since the 2011 Fukushima disaster in Japan) and France offset new capacity in non-OECD countries such as Russia, Ukraine, Belarus, and Romania. EIA says since 2011, Germany will have shut down ten reactors by the end of 2017 and is expected to retire its last reactor in 2022.

Renewable energy production was 5.3% higher, said AGEB. That split out into gains for wind and solar generation into the grid of 21% and 5% respectively, with biomass up 3%. That contrast with German hydro-generation which declined by 18% as this year has proved drier than last – just as it has in the Iberian peninsula.

Gas and renewables increased their shares year on year of the 9,971 petajoule German energy market in 9M2017 (Graphic credit: AGEB)

From top right clockwise, oil is in red, natural gas (gold), coal (grey), lignite (brown), nuclear (light blue), renewables (green), and net power imports (0.5% of total market)

Prognosis for full year 2017

AGEB said its forecast for full year 2017 was an increase in Germany’s overall energy consumption of slightly over 1%, to about 13,600 PJ.

On the basis of its estimates so far this year, it expects full year carbon dioxide (CO2) emissions to rise slightly.

Utility industry association backs NS2 against EC initiative

Separately, German energy and water utilities association BDEW has come out firmly against the European Commission's proposal to extend the 2009 EU Gas Directive to import pipelines.

"The EC's initiative is incomprehensible to us: Nord Stream 2 is a private-sector project, and every new pipeline that transports natural gas to Europe is good for secure supply," said Stefan Kapferer, BDEW's CEO in Berlin November 8. He said the proposal would "significantly curtail" Germany's sovereignty over deep-sea pipelines. Moreover he argued that the "increasing integration of the European natural gas supply network considerably simplifies intra-European gas transport and thus cross-border natural gas trading. This increases the security of supply in Europe."

Mark Smedley