[GGP] Transformed Gas Markets Fuel US-Russian Rivalry, But Europe Plays Key Role Too

This month, the Wall Street Journal reported that U.S. President Donald Trump has been pressuring Germany to drop its support for a major new Russian gas pipeline if Europe wants to avoid a trade war with Washington, while a senior U.S. diplomat warned that the project could be hit with U.S. sanctions; Russian President Vladimir Putin responded defiantly. This development, sadly, fuels the further politicization of the European gas market—a space that, in many ways, has reflected the triumphs of a depoliticized, pro-market technocracy, which has managed to stimulate competition and lower prices irrespective of changing political trends. Just last year, Trump called on European countries to buy American liquefied natural gas, or LNG, which, for now, remains more expensive than Russia’s pipeline gas. Certainly, the U.S. has much to gain on the global gas market, which has changed drastically over the past decade, as America rapidly transformed from an importer to an exporter. Europe’s gas market, meanwhile, has much to gain from additional supply. But Trump’s approach, especially if the latest reports are true, both alienates Western European partners and feeds into a sensationalist, simplistic portrayal of the new U.S. role’s effect on Russia—as a zero-sum game, in which these new, plentiful U.S. gas supplies serve as an antidote to Russia's “gas dominance” in Europe and hence to Moscow's political leverage.

In fact, even if Russia remains Europe’s dominant gas supplier in the coming years—as is likely—it now has to play by EU rules and vie hard for market share, ultimately benefiting European consumers. America's gas boom has catalyzed this thriving competition, but an equally important factor has been a massive, long-term investment in infrastructure and regulation by Brussels. These EU efforts have done a great deal to weaken Moscow’s geopolitical “gas power,” which has never been uniform across the continent. Today, gas is a prized commodity but not a major weapon in East-West relations: Russia’s gas leverage cannot harm the West, and neither does competition with U.S. gas pose a major threat to Russia as a state or, for now, to its gas behemoth, Gazprom. Moreover, in the near to medium term, Russian and U.S. gas companies may face many challenges in common: Both will be competing against new, price-lowering producers and grappling with ever “greener” regulations on the European market, while also trying to profit from Asia’s thirst for energy.

Major Changes to Gas Market

To better understand the power dynamic among gas suppliers, it’s important to get a sense of how Europe’s gas market works and how drastically it has been reshaped over the past decade—not only by American exports but also by expanded infrastructure, technological advances and Brussels' decades-long effort to create a well-regulated, competitive and flexible market. In the broadest sense, the main change has been a shift from rigidity to flexibility—in price, destinations and timing of shipments—and from domination by a handful of strong players to greater competition.

As recently as the 2000s, gas markets were dominated by pipelines, which were rigid both physically and contractually. Because pipelines travel from Point A to Point B and—until recent technological developments—could offer few diversions of supply, they led to discrete, geographically isolated markets. This gave Russia, via Gazprom, geopolitical leverage—particularly over countries in Eastern and Central Europe where it held a near monopoly: If Russian supplies were interrupted there was simply no way that EU countries getting gas from other importers or enjoying domestic production (for example, the Netherlands) could share their supplies with those experiencing a shortfall. Gazprom, like other exporters, also maintained the market’s rigidity through long-term contracts that were difficult to renegotiate. The early trade in LNG wasn’t fundamentally different because it too was constrained by restrictions on any supply diversion in such contracts and was dominated by a few established producers and buyers. Moreover, gas prices were indexed to oil prices, making them unresponsive to fluctuations of supply and demand.

Naturally, buyers of gas had long sought greater competitiveness and the European Union had tried to promote it, but heightened competition has genuinely, gradually emerged only in the past 10 years or so and was greatly accelerated by the spike in U.S. gas production. In 2009-2011 the U.S., previously a major importer of gas, mastered the extraction of previously hard-to-reach “shale gas” to such an extent that it came much closer to self-sufficiency. This created a glut on world gas markets. Some of the excess supply got dumped onto nascent gas exchanges in Europe—so-called hubs, where buyers were trying to purchase gas with more flexibility in pricing, speed and destination than the existing system had allowed. This sudden, significant increase in supply rapidly improved the quality and power of the hubs themselves: The abundance of gas meant that prices on the exchanges got pushed down and, with this new option available, buyers were no longer willing to lock themselves into long-term contracts linked to the price of crude oil.

This development affected gas exporters across the board, including Gazprom, whose rigidly priced pipeline gas had become uncompetitive compared to gas sold via the hubs. Sellers were forced to renegotiate contracts and move away from long-term agreements indexed to oil in favor of spot pricing or “hybrid pricing” (which combines spot prices and oil indexation). Meanwhile, technological innovations and infrastructure improvements, like pipeline interconnectors and reverse-flow capability, as well as rapid improvements to gasification plants in Australia and Qatar, were linking up regional markets that had previously been separate, allowing more gas to flow where it was most needed, fueling yet more competition. In 2016, the U.S. brought online its first LNG export facility in the so-called lower 48 states and U.S. LNG exports shot up more than six-fold from the previous year. Today, thanks to all these changes, LNG prices in Europe are increasingly competitive and able to challenge pipeline gas from Russia. As a result, Gazprom is lowering prices for pipeline gas, changing sales methods and developing new gas infrastructure, including its own LNG facilities.

One episode that vividly illustrates the new flexibility on global gas markets occurred early this year: During a particularly frigid winter, a tanker of Siberian LNG initially destined for Asia did a U-turn and went to Boston. Just a few years ago, such a rapid-response change in course would have been unthinkable: The Russian tanker could not have simply turned around and gone where gas was most needed.

Today’s Playing Field: More Free Market Than Zero-Sum Game

The upheaval in international gas markets has certainly been disruptive for Russia, but rather than erode Moscow’s energy dominance in Europe the new U.S. supplies of gas, coupled with the EU’s efforts, have affected it in more variegated and subtle ways—decreasing Russian market share in some places but boosting it overall, for now at least, in a new and intensely competitive environment. Again, this competition has stemmed not just from increased supply but from new infrastructure and regulations, as well as Europe’s steadily declining demand for gas. The greater liquidity on the gas market meant that Gazprom could now pick, as one energy analyst put it, between “competing on price and [thereby] defending market share” and “cutting back on supply to keep prices high.” While initially Gazprom seemed keen on the latter approach (so-called value maximization), the company was eventually, and reluctantly, forced to ramp up production and cut prices: Its average selling price fell from about 300 euros per thousand cubic meters of gas in 2012 to about 160 euros in 2016—a drop of nearly 50 percent in just four years. This has kept Russian gas attractive to most European buyers: As recently as 2015 Gazprom supplied about 30 percent of natural gas to Europe as a whole; today it delivers close to 40 percent, with exports rising to record levels two years in a row.1

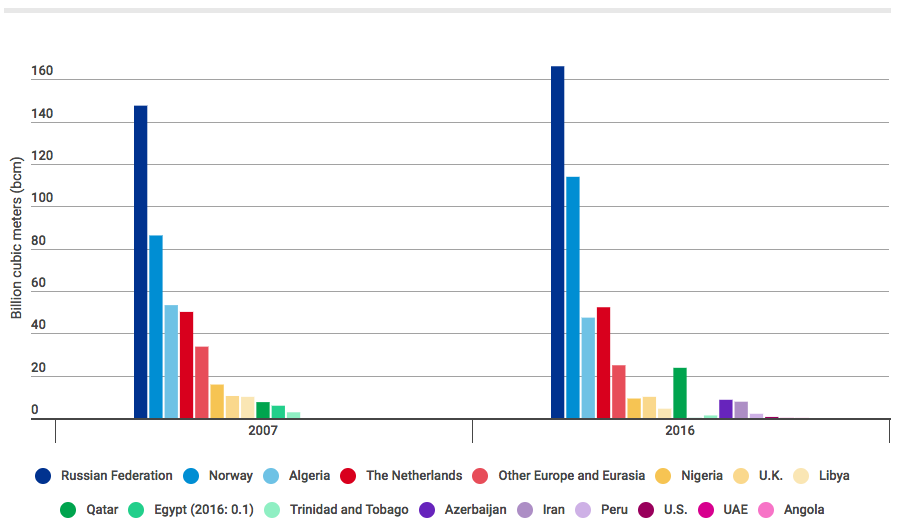

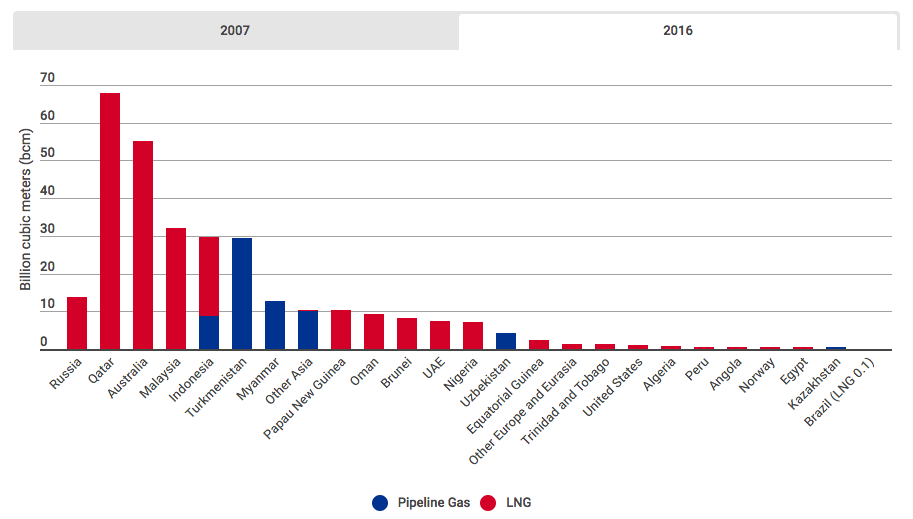

Who supplies Europe's gas?

According to BP, the following countries did not supply gas to Europe and Turkey in 2007: Azerbaijan, Iran, Peru, the U.S., the UAE and Angola.

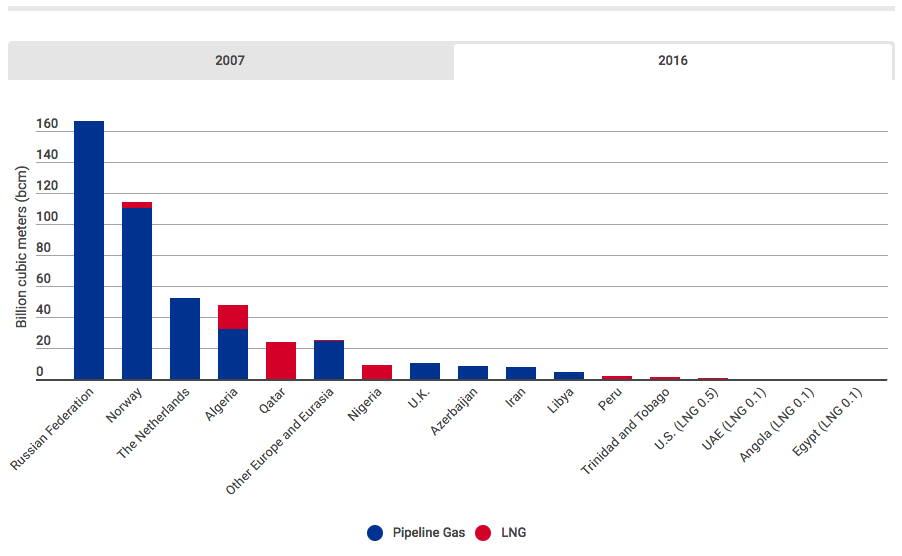

Gas exports to Europe and Turkey, pipeline gas vs. liquified natural gas (LNG) 2016

Source: BP Statistical Review of World Energy, June 2008 and BP Statistical Review of World Energy, June 2017. BP includes data for Turkey in its numbers for Europe.

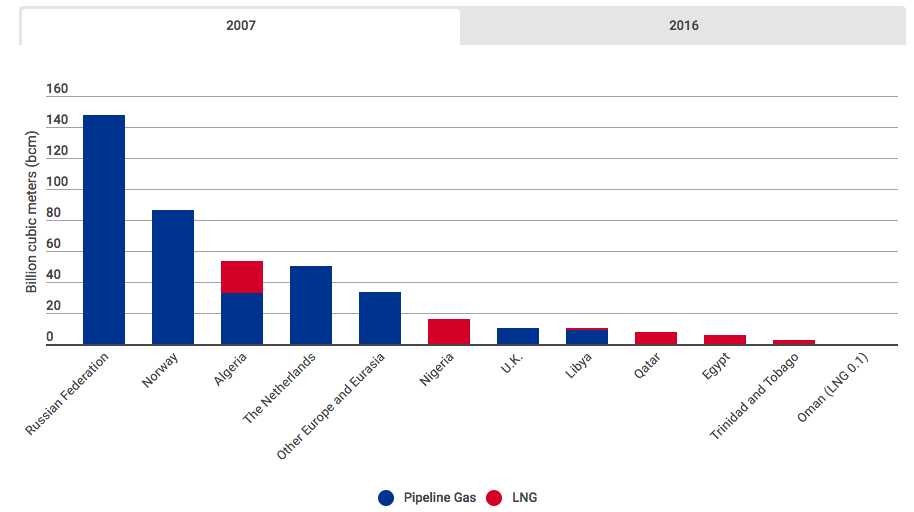

Gas exports to Europe and Turkey, pipeline gas vs. liquified natural gas (LNG) 2017

Source: BP Statistical Review of World Energy, June 2008 and BP Statistical Review of World Energy, June 2017. BP includes data for Turkey in its numbers for Europe.

A textbook example of market pressure on Gazprom has been the growing liquidity of the European gas hubs. First of all, these hubs have forced Russia, like other producers (including Algeria, Norway and Qatar), to compete hard for the slice of market not covered by long-term gas contracts, or LTCs. Second, even the remaining LTCs—Gazprom’s included—are becoming increasingly hybrid in price, reflecting the daily intersection of supply and demand at the gas hubs.

The most obvious example of regulatory pressure on Russia, meanwhile, has been Europe’s six-and-a-half-year anti-trust battle with Gazprom, in which the European Commission has alleged that the company was “breaking EU antitrust rules by pursuing an overall strategy to partition Central and Eastern European gas markets, for example by reducing its customers’ ability to resell the gas cross-border,” and was possibly charging “unfair prices.” Gazprom has been largely cooperative with the investigation—otherwise it could have been fined up to 10 percent of its total annual revenues, which in 2016 amounted to $91.1 billion—and finally settled the dispute last week by agreeing to price reforms and to giving rivals greater access to Eastern European customers.

While Gazprom was slow to transform its practices and had long hoped to avoid price wars in Europe altogether, it will continue to dominate Europe’s gas market for at least the next 10-15 years if it keeps up the free-market response to new pressures that it grudgingly adopted several years ago. Russia’s main advantage in this area is significantly lower production costs than elsewhere, as well as its focus on pipeline gas—still a cheaper option than LNG, which requires liquefying gas, shipping it on tankers and then re-gasifying. In 2016, on average, U.S. LNG shipped to Europe cost $6.29 per million British thermal units, based on cargo data analyzed by S&P Global Platts and reported by the Wall Street Journal, while Russian gas delivered to Germany cost an average of $4.86 per MMBtu. According to Jonathan Stern, an analyst from the Oxford Institute of Energy Studies, U.S. LNG supplies to Europe “will be negligible until the big volumes come on-stream in 2018-2019” given that “cargoes will probably go to higher-value markets in Latin America and elsewhere.” That said, America is forecast to become the world’s largest LNG exporter by the mid-2020s, according to a July 2017 report by the International Energy Agency. In the future, declining gas production in Europe itself may make room for both increased LNG imports and Russian pipeline gas. But for at least the next 10 years pipeline gas will continue to win against LNG and this favors Russia.

Politicizing the EU’s Gas Supplies (Once Again)

Russia’s energy influence has always been split unevenly across Europe and these disparities reverberated, as noted above, in Gazprom’s anti-trust conflict with the EU. When it was supplying about a third of Europe’s gas overall, Russia was responsible for 85 percent or more of the gas in some former Socialist-bloc countries of Eastern and Central Europe, where Gazprom enjoyed a monopoly or near monopoly. In that part of Europe the gas market remains relatively fragmented, so the recently intensified competition has certainly helped countries wary of overreliance on Russia to diversify supplies or get more leverage in price negotiations. For instance, the mere existence of a new LNG terminal in Lithuania won it a better gas price from Russia even before any LNG from the United States had touched European soil; and last summer both Lithuania and Poland opted to import U.S. LNG, though it was more expensive than Russian gas, largely in order to depend less on Moscow.

With the arrival of U.S. gas in Europe, Washington seems intent on pushing countries on the other side of the pond to wean themselves off Russian gas and, sometimes at least, to buy American instead. While additional supply on Europe’s gas market can only be welcomed, the emerging U.S. policy is at loggerheads with Europe’s regulatory approach, which has been striving for technocratic and technological stimuli for competition, like new pipelines and interconnectors that ensure they work in both directions. Indeed, Washington’s conflation of geopolitical and economic interests has caused some frictions, boosting U.S. soft power in Eastern Europe but irritating the European West. Most notable among these irritants is Nord Stream 2, Gazprom’s planned expansion of an existing pipeline running from Russia to Germany via the Baltic Sea. Well before Trump’s latest reported talks with German Chancellor Angela Merkel about the project, U.S. sanctions that risk undercutting Nord Stream 22 had been rattling German and Austrian politicians who see the measure as an unacceptable intervention in Europe’s energy sector—using political sanctions as instruments of economic interests.

The perception of a zero-sum rivalry between Russia and the U.S. surfaces occasionally in public discourse, which is not surprising considering the dismal state of bilateral relations. In July 2017, for example, Trump suggested to representatives of a dozen European nations that the U.S. is eager to export natural gas to Central Europe, thus weakening Russia’s alleged choke hold. (Four months later Poland, where Trump delivered his speech, signed a five-year contract for American LNG.) Moreover, when the Russian tanker came to Boston this year, media quickly reported that some of its gas had likely been produced at Yamal LNG, a facility controlled by the company Novatek, which is under U.S. sanctions; after its arrival, an editorial in the Boston Globe screamed, “When it comes to Russian gas, just say nyet,” complaining that American “customers will now … burn gas extracted from the delicate Arctic ecosystem by a firm linked to one of Vladimir Putin’s cronies” and that the tanker’s voyage “represents a PR coup for Putin, at a time he’s on the defensive for sowing instability in Ukraine and meddling in U.S. elections.”

While both Cold War-era superpowers have politicized Europe’s gas market in their own ways, there is a major difference worth noting between the two: Because American big business is less beholden to the state than its Russian counterparts, it’s almost impossible to imagine U.S. LNG companies selling gas at a loss in exchange for geopolitical influence (whereas Gazprom has). So the U.S. will necessarily use a different playbook than Russia, which sees energy as a pillar of state security and gives the state a very strong role in this sphere.

Europe’s Long Game

In this evolving “gas war,” both Russia and the U.S. often see the EU as having limited agency and existing merely as a battleground where American and Russian gas suppliers square off. In fact, though Europe may not have teeth as a geostrategic actor, its bite as a competition enforcer is strong. This goes unnoticed because regulations are arcane and boring. But the EU Commission, the bloc’s competition authority, has been undeterred in its pursuit of a single, competitive, flexible European gas market and the recent changes we have seen in that direction are vindicating Brussels.

The commission’s objective has always been to reshape the market rather than win short-term tussles and the EU has implemented new rules without specific actors in mind—whether Russia, Nigeria or Qatar. Each incremental piece of competition legislation has been a facet of the EU’s transformative power. For the past 20 years it has sought to limit incumbent suppliers’ influence by imposing numerous regulations on the operation and ownership of gas infrastructure, and by investing heavily in this infrastructure, including across borders.

Without a doubt, U.S. LNG has acted as a catalyst and a “force multiplier” for the EU Commission’s changes. Despite three packages of legislation passed since the 1990s, there was little competition on European gas markets until, at the earliest, 2009, when America’s heightened self-sufficiency increased global supplies. Before that two powerful adversaries had been acting against competition: One was Russia, which tried to keep a tight hold on gas supplies to Eastern Europe; the other was EU national governments and their state-owned companies, which historically enjoyed monopoly power over national energy markets and resented the way cross-border trade in gas and electricity had started eroding it. The EU’s 2009 gas directive, the so-called “third energy package,” made progress against Russia’s South Stream project by barring suppliers from owning both pipelines and the gas that passes through them, while the cross-border energy interconnectors funded by the EU have helped get additional gas to isolated “energy islands” like Iberia, the Balkans and the Baltics. But it was the American gas boom that highlighted the effectiveness of the EU’s many measures by driving greater competition and flexibility in the market. Today Europe plays a much bigger role even in setting global gas prices given that it has so many LNG terminals (i.e., excess re-gasification capacity) and given that extra volumes from a saturated Asian market are being re-directed to European markets. As a result, Europe can take advantage of the price difference between the gas “spot” market and the market for piped gas by striking “hybrid” deals that capitalize on the imbalance.

Looking Forward

Global competition among LNG gas suppliers is likely to get more intense. And LNG is the only way the U.S. can compete with Russia in the world’s two main export markets, Europe and Asia.

On the European market, both Russian and American companies will have to face increasingly competitive producers like Qatar, which, by some estimates, may beat out both countries in sales to Europe in five to 10 years. Both Russian and U.S. companies will likewise have to contend with Europe’s push for more renewable energy: According to Stern of the Oxford Institute for Energy Studies, if energy companies want to hold on to their gas market shares in Europe post-2030, they will have to develop a “decarbonization strategy,” since Europe’s coordinated energy policy is moving primarily in that direction. For a gas giant like Gazprom this challenge may well outpace any U.S. LNG threat.

Both Russian and American gas firms will also keep vying for the lucrative Asian LNG market, where the U.S. has made inroads in a very short period of time, exporting some 1.15 million metric tons in 2016 (about 30 percent of its total export volumes of 3.8 million metric tons) versus Russia’s estimated 10.8 million metric tons3 for the same year. However, U.S. LNG exports quadrupled in 2017, with over 40 percent of those volumes directed to Asia. The Russian response appears to have been Yamal LNG, which came online in 2017 and is the first Russian gas export project to have “escaped” Gazprom’s control.4 Putin personally sent off the facility’s first tanker to China in December 2017. Though the company has been hit by Western sanctions, recent evidence suggests that Russia’s growing access to Asian capital and energy markets may offset their negative effects. Given Russia’s legacy of an extensive pipeline-gas system, it is not surprising that Russia until recently accounted for only about 4-5 percent of the world LNG market share, according to the country’s energy minister. This is changing quickly, however, and the launch of Yamal LNG (with a full capacity of 16.5 million metric tons per year) signaled a new era in the development of Russian LNG.

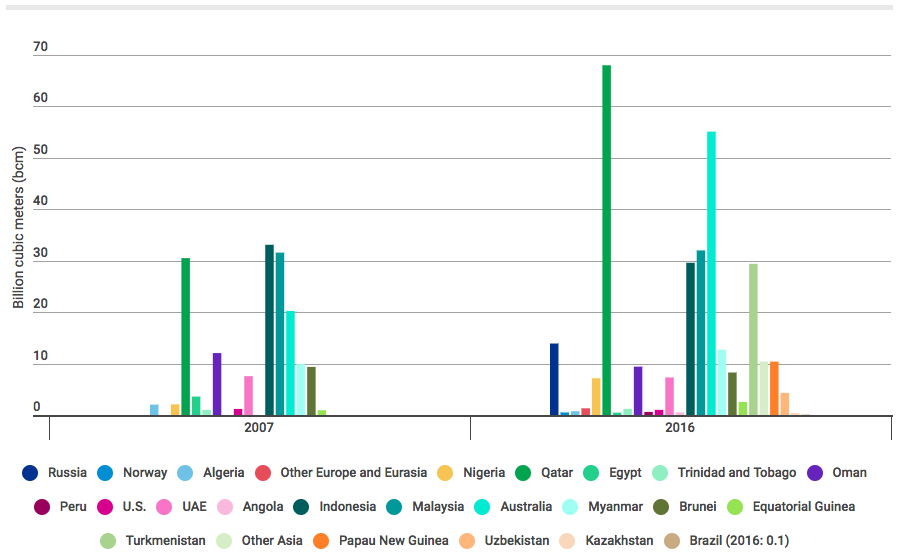

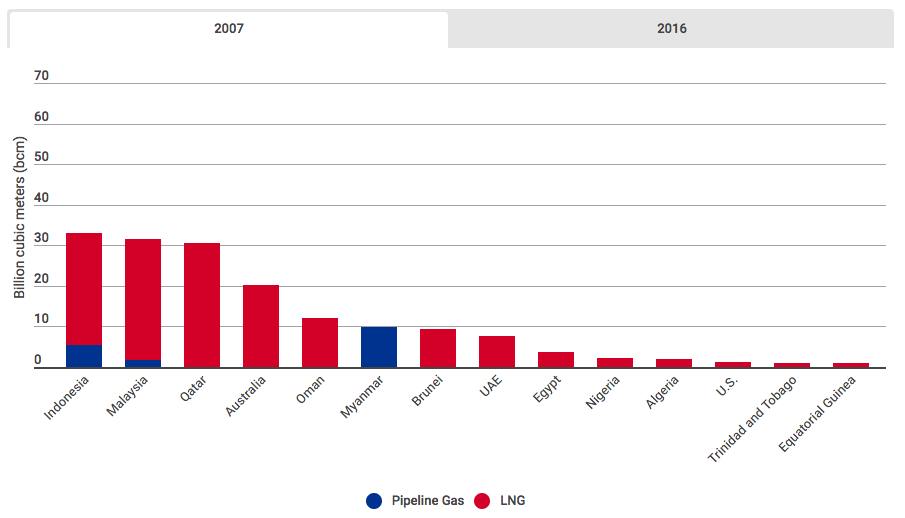

Who supplies Asia's gas?

According to BP, the following countries and regions did not supply gas to Asia in 2007: Russia, Norway, Other Europe and Asia, Peru, Angola, Turkmenistan, Other Asia, Papau New Guinea, Uzbekistan, Kazakhstan and Brazil.

Gas exports to Asia, pipeline gas vs. liquified natural gas (LNG) 2016

Source: BP Statistical Review of World Energy, June 2008 and BP Statistical Review of World Energy, June 2017.

Gas exports to Asia, pipeline gas vs. liquified natural gas (LNG) 2016

Source: BP Statistical Review of World Energy, June 2008 and BP Statistical Review of World Energy, June 2017.

While U.S. liquefaction capacity is predicted to outpace Russia’s in the coming four years,5 there has been a lot of talk recently about Russia’s securing of a much-heralded alternative to Europe in the East via Gazprom’s mammoth Power of Siberia, a 3,000-kilometer pipeline running from eastern Siberia to the Chinese southeast. This $55 billion project is now being constructed and thus is years away from bearing the desired fruit. (Gazprom announced this month that the pipeline is “83 percent complete.”) So, despite the shift to China, in the next 10 years Europe will remain Russia’s most lucrative, geopolitically critical and painfully essential gas market by far.

As agonizing as recent challenges in Europe may be for Gazprom, none of them poses any existential threat either to the company itself or to the Russian economy as a whole. Even though over the past five years the energy sector has accounted for about 40-50 percent of Russia’s budget revenue, the bulk of this comes from oil, with natural gas typically making up only 10-15 percent of these “energy revenues.”

What remains an open question is whether the growing politicization of Europe’s gas market will have long-term reverberations and, if so, what those might be.

Author Morena Skalamera is an associate with the Geopolitics of Energy Project at Harvard Kennedy School's Belfer Center for Science and International Affairs. She is also a visiting fellow at the Higher School of Economics in Moscow and the visiting director of the Institute of Applied Research at Narxoz University in Almaty, Kazakhstan.

Originally published by Russia Matters, a project launched by Harvard Kennedy School’s Belfer Center for Science and International Affairs

The statements, opinions and data contained in the content published in Global Gas Perspectives are solely those of the individual authors and contributors and not of the publisher and the editor(s) of Natural Gas World.

Footnotes

1. In 2017 Gazprom’s exports to Europe went up by approximately 8 percent year on year to 192.2 billion cubic meters (bcm); in 2016, Gazprom sold 178.3 bcm of gas to Europe, helped by cold weather on the continent and a collapse in oil prices, which (through the practice of oil indexation) still affects gas prices in Gazprom’s “hybrid” contracts.

2. According to an article in the Russian-language Vedomosti newspaper, financing obligations of the Nord Stream consortium group will have to be reviewed. Sanctions put commercial lenders at risk if they provide loans for Nord Stream 2.

3. In the hyperlinked report, the figure of 10.8 million metric tons is given in the pie chart on p. 9. According to Russia’s Energy Ministry, all of Russia’s 2016 LNG exports went to Asia.

4. Yamal LNG is co-owned by Russia’s Novatek, France’s Total, the China National Petroleum Corporation and China’s Silk Road Fund.

5. See Figure 4.4 on p. 21 of the hyperlinked report.