Global energy investment in free-fall: IEA [NGW Magazine]

The International Energy Agency (IEA) warned that the Covid-19 pandemic is causing the biggest ever drop in global energy investment.

This is the key message in IEA’s World Energy Investment (WEI) report released May 27.

Using data available as of mid-May, the report provides “a unique and comprehensive perspective on how energy capital flows are being reshaped by the crisis, including full-year estimates for global energy investment in 2020.”

Earlier in May, the IEA also released a related report, Renewable Energy Market Update (REMU), providing an outlook for 2020 and 2021. This concludes that while Covid-19 looks set to hurt renewable growth in the short term, it will not halt it.

The key findings from WEI are:

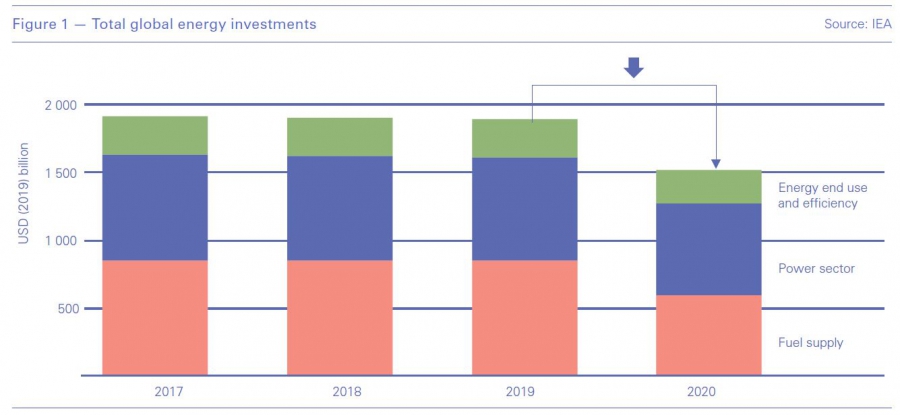

Energy investment is set to fall by 20%, or $400bn, in 2020 due to the Covid-19 pandemic (Figure 1).

- Investment activity has been disrupted by lockdowns but also by a sharp fall in demand and hence revenues.

- Pre-crisis expectations of modest growth, about 2% up in 2020 in comparison to 2019, have turned into the largest fall in global energy investment on record.

- Over the last ten years, power sector spending has been relatively stable, down by just over 10% or $79bn, compared with the rollercoaster ride for oil and gas.

- Fuel supply investments have been hit hardest in 2020 while utility-scale renewable power has been more resilient, but this crisis has touched every part of the energy sector.

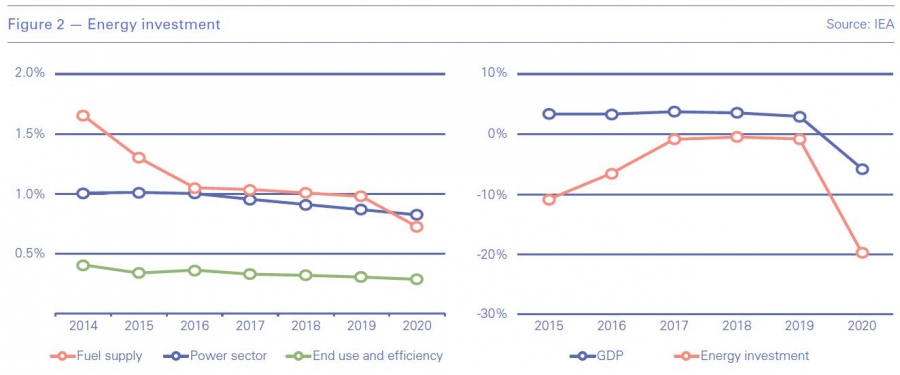

- Energy should be in the front line of the world’s push for sustainable development, but the energy investment data reveal a harsher reality, plummeting over three times as fast as global GDP (Figure 2).

- The crisis has underscored existing vulnerabilities and created new uncertainties, with US shale outlook looking bleak and LNG facing a major overhang of capacity

- Even before 2020, investment trends were poorly aligned with the world’s projected needs, especially when compared to IEA’s Sustainable Development Scenario (SDS).

- Clean energy investment has been relatively resilient in the downturn, but a flat trend of spending since 2015, with a 10% drop in 2020, is nowhere near enough to bring a lasting reduction in emissions.

- The implications of the current investment slump, and recovery in 2021, depend on the speed and sustainability of the world’s economic recovery.

- Those economies most in need of investment have a narrower range of financing options owing to disproportionate debt burdens.

- The crisis is hastening the retirement of some older plants and facilities, especially in the oil and gas sector, but also dampening consumer spending on new and more efficient technologies.

Covid-19 is a huge shock to the energy system, but also

The IEA states: “The energy industry that emerges from this crisis will be significantly different from the one that came before.” It says that its WEI analysis “provides crucial insights for governments, investors and other stakeholders on new risks to energy security and sustainability, and what can be done to mitigate them.”

Even though renewable energy markets fare better, the REMU report states that “renewables are not immune to the Covid-19 crisis but are more resilient than other fuels.” Its key findings are:

- The number of new renewable power installations worldwide is set to fall this year as a result of the crisis, marking the first annual decline in 20 years. But, given supportive government policies, growth is expected to resume next year as most of the delayed projects come online.

- In 2020 net additions of renewable electricity capacity are forecast to decline by 13% compared with 2019, but even then global installed renewable power capacity is still forecast to increase by 6%.

- In 2021 renewable electricity capacity additions are forecast to be at the same level as in 2019.

- But despite the rebound, combined growth in 2020 and 2021 is almost 10% lower compared to the previous IEA forecast published in October 2019.

- Annual expansion of solar PV and wind is forecast to decline by 18% and 12% respectively in 2020 compared with 2019.

- Transport biofuel production is anticipated to contract by 13% in 2020, the first decrease in output in two decades.

- At the start of 2020, renewables in several markets were already facing challenges regarding financing, policy uncertainty and grid integration. Covid-19 is now intensifying these concerns.

The IEA states that “governments have the opportunity to reverse these trends by making investment in renewables a key part of stimulus packages designed to reinvigorate their economies. This offers the prospect of harnessing the structural benefits that increasingly affordable renewables can bring, including opportunities for creating jobs and economic development, while reducing emissions and fostering innovation.” However, given increased debt burdens as a result of the pandemic, it remains to be seen how countries respond. The IEA warns that in the longer-term, “a post-crisis legacy of higher debt will present lasting risks to investment.”

Another concern, that might affect future investments, is IEA’s estimate that a combination of falling demand, lower prices and a rise in non-payment of bills means that energy revenues to governments and industry are forecast to fall by well over $1 trillion in 2020 – potentially challenging debt repayment and future energy investments.

Fuel Supply

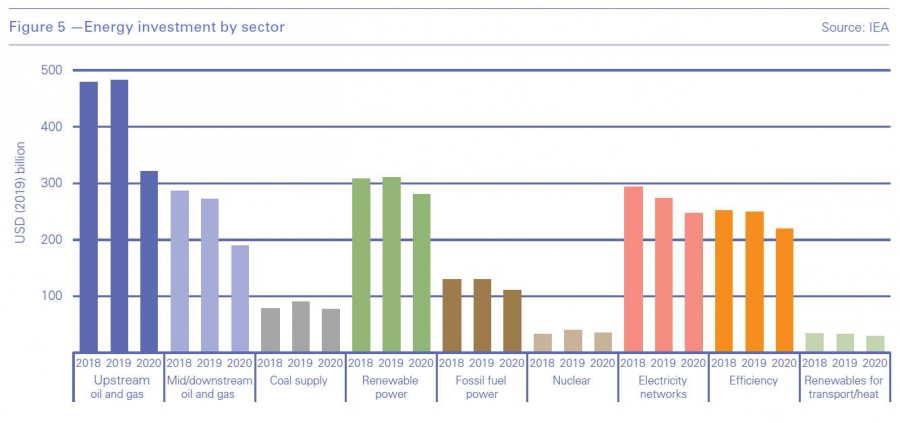

Upstream oil and gas spending in 2020 is set to be down almost one-third from 2019 (Figure 3) as the industry tries to adjust to the unprecedented shock of oversupply and reduced demand caused by the pandemic. Markets, companies and entire economies have all been affected. The oil and gas sector is in crisis worldwide.

Oil markets suffered the most. The pandemic, combined with the removal of restraints on supply from the Opec+ group, led to a free-fall in oil demand and prices. Spending in the oil and gas sector is expected to drop 32% year-on-year.

Natural gas prices were already low before the crisis due to increasing oversupply combined with a mild winter. With gas demand affected by lockdowns and gas storage almost full, oversupply was exacerbated and gas prices collapsed to levels not seen ever before. Prices in Europe and Asia have converged close to the Henry Hub price, below $2/mn Btu.

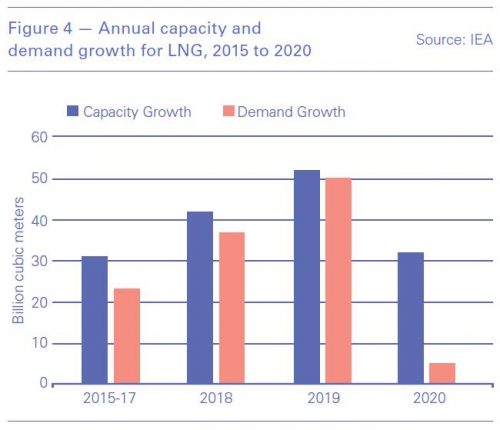

This is particularly acute for LNG (Figure 4). While supply carries on growing – with record projects announcing FID in 2019 – demand growth is forecast to be feeble in 2020, at best. The problem of longer-term overcapacity and oversupply now looms very large.

First quarter 2020 oil and gas company results show massive reductions in profits and in some cases losses, following impairments and write-downs. Anglo-Dutch major Shell, for example, reduced its dividend by a third: this was the first time since the Second World War. Eni’s profits were slashed 94%. ExxonMobil recorded a $610mn loss for the first time in 30 years.

As the IEA indicates, “the shock has been most severe for some smaller and medium-sized North American operators, although it is too soon to write the obituary for shale.” Shale gas is expected to take the biggest hit overall – among fuels – with investment halving.

As a result of these developments, the majors are showing preference for “projects that combine cost advantages with easily realisable commercial prospects – including short lead times and proximity to existing infrastructure.” But even though “natural gas features prominently in the majors’ priorities, there are few signs in the combined data of a shift towards upstream gas investments.”

The IEA also points out that there have been fewer formal announcements made by national oil companies (NOCs), but the precipitous declines in hydrocarbon revenue to the companies and their host governments are working their way through into investment plans.

Reductions in upstream activity have also meant renewed strain on the companies that provide services and supplies to the oil and gas industry.

Alongside planned reductions in capital expenditure, many projects are also being delayed, representing a further downside risk to spending in 2020 as activity is pushed back into 2021 and often beyond.

Another setback resulting from this crisis is damage to investor confidence that may take time to repair.

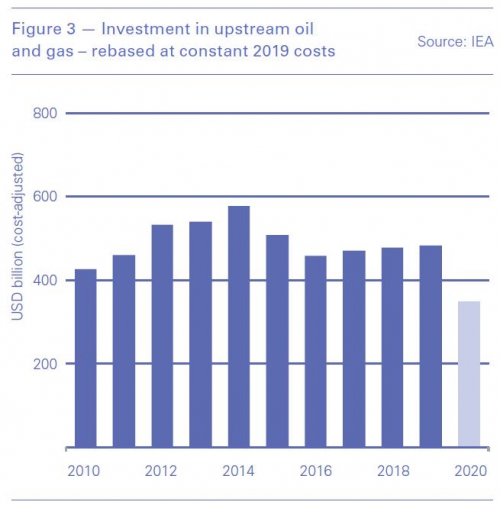

It is not just oil and gas investment that has been hit badly. All fuel supply investments have been hit hardest in 2020. Even though utility-scale renewable power has been more resilient, this crisis has touched every part of the energy sector (Figure 5), including energy efficiency where spending is forecast to decline by 12%. The IEA warns that this slowdown in energy spending risks undermining transition to more sustainable energy systems.

The IEA states that there are worrying signs in the data for the energy sector as a whole. In recent years the share of energy investment in GDP has declined and is set to fall to under 2% in 2020 – down from around 3% in 2014 (Figure 2). The IEA adds that “the trend is visible in the power sector and elsewhere, reflecting the lack of progress in boosting key clean energy technologies at the pace required by rising global needs and the imperative to address climate change.”

Power sector

Following a small decrease in 2019, global power investment is set to fall to its lowest level in over a decade in 2020 (Figure 6), forecast to decline by 10%.

Reversing expectations of an increase in spending in 2020, by about 2%, all parts of the power sector are set to be affected by restrictions on travel, delays in project development and lower demand. But the drop in investment across different parts of the power sector varies by technology.

Investment in new renewables capacity is affected as lockdowns and travel restrictions affect production, shipping and construction schedules. The IEA estimates renewable power spending will be a tenth lower than last year.

Investment in grids, which has been declining in a number of countries, is forecast to fall again, by around 9% in 2020, despite its regulated nature. IEA executive director Fatih Birol said: "These networks have to be resilient and smart to ward against future shocks but also to accommodate rising shares of wind and solar power. Today's investment trends are clear warning signs for future electricity security."

The IEA estimates a year on year reduction in total fossil-based power investment of 15%. The reduction in gas-fired generation investment arises mainly from delays in gas-rich emerging economies, like the Middle East and North Africa, regions where spending drops by about one-third.

Investment in coal supply is forecast to fall by about 15% this year, but the IEA says that it does not pose an existential threat. Although decisions to go ahead with new coal-fired plants have come down by more than 80% since 2015, the global coal fleet continues to grow. Coal prices remain a key driver of investment.

The IEA expects government policies to play a critical role in smoothing the impact on power investment, as over 95% of power investments are incentivised by regulations and contracts.

Implications

The worldwide shock caused by the Covid-19 pandemic has drastically altered the course of the global economy and energy markets. IEA’s baseline scenario assumes a gradual opening up of economies currently under lockdown, a U-shaped recovery - accompanied by a substantial permanent loss of economic activity – and a 6% decline in global GDP in 2020. There can be upside, but also downside, if actual outcomes differ from these assumptions.

The impacts of the pandemic on global energy and emissions are described in detail in IEA’s Global Energy Review 2020, with global CO2 emissions expected to decline by 8%. But the IEA warns that after previous crises, the rebound in emissions has been larger than the initial decline. Whether this will also be the case on this occasion is largely contingent on what happens to energy investment. The fact that already China and other Asian countries are putting in orders now for a new generation of coal-fired power plants to supply energy in the future does not bode well.

Birol said: “We see a historical decline in emissions, but unless we have the right economic recovery packages, we might see emissions again skyrocket and the decline of this year would be completely wasted."

Oil is bearing the brunt because of transport, which in a normal year accounts for nearly 60% of global oil demand. At the height of the lockdowns in April, demand for oil was down by around 25mn barrels/day last year, but for the year as a whole, oil demand could drop by 9mn b/d on average.

The impact of the pandemic on gas demand in the first quarter of the year was more moderate, at around 2% year-on-year, as gas-based economies were not strongly affected. But gas demand could fall much further across the full year than in the first quarter, likely by 5%, with reduced demand in power and industry applications.

The IEA points out that the overall share of global energy spending that goes to clean energy technologies has remained flat for the last 10 years – at about one-third of global energy spending – and still remains far below the levels that would be required to accelerate energy transition in line with the Paris climate goals. It needs to more than double in the next 10 years to achieve this.

With energy demand increasing, especially in Asia, to meet the energy needs of increasing populations and improved standard of living aspirations, it is clear that all energy sources are necessary – renewables alone will not achieve this but the massive reduction in energy investments increases the challenge.

With an unparalleled $400bn forecast drop in energy investments in 2020, the IEA also warns that of ever graver doubts about the availability of secure energy supplies when the global economy picks up, because energy projects take so long to deliver.