A Golden Age of Natural Gas in Europe?

In 2011 after the accident at the Fukushima Nuclear Power Plant, the International Energy Agency (IEA) in its annual edition of the World Energy Outlook proclaimed an emerging ‘golden age' of natural gas to 2035. The IEA’s prediction is driven by the following expectations:

1. Enormous economic growth in China coupled with significant natural gas consumption,

2. A low share of nuclear energy in electric power generation,

3. An increase in the use of natural gas in the transportation sector,

4. A boom in unconventional gas and its low prices.

This forecast has begun to meet its expectations on a global scale as total natural gas consumption in 2011 increased by 2.2% over the previous year (consumption in China grew by 21.5%, with consumption also increasing in Japan by 11.6% and by 10.3% in Canada). Nearly every continent, except for Europe, recorded increases in this indicator. Given the seeming disconnect between Europe and the rest of the world therefore begs the question: what is the reality of the European natural gas market and in particular in terms of the European Union? What are current conditions for natural gas demand in this region and what factors have the greatest potential to influence the use of this commodity in Europe?

The current situation and resulting consequences

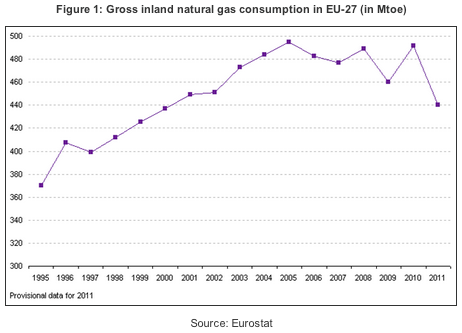

The year 2011 saw an even more dramatic decrease in demand for natural gas in Europe than was observed in 2009 when the full effects of the global economic crisis were fully felt. Consumption of natural gas in the EU in 2011 dropped by around 10% compared to 2010 (Fig. 1). The same trend appears to be continuing going forward as natural gas consumption in the EU declined by 7% in the first half of 2012 compared to the same period during a miserable 2011 whichrepresented the worst 6 month decline in the last 10 years .

The only European demand-fall exception was Turkey, where gas consumption increased by 17% year-on compared to 2010. The reasons for this bleak situation in the EU are manifold:

1. The lingering economic crisis has limited the performance of European economies and dampened demand for electricity (generated, among others, by combined cycle gas power plants);

2. An increase in electricity production using renewable resources (primarily solar and wind) driven by generous subsidy policies and ongoing re-evaluation of the use of nuclear power (paradoxically moving away from nuclear energy should have contributed toward increasing the percentage of electricity generated using natural gas);

3. Milder winters and an overall increase in the average ambient temperature have lowered electricity demand for heating which in turn has contributed to a decline in natural gas demand.

4. Coal supplanting natural gas in electricity production, due primarily to two factors:

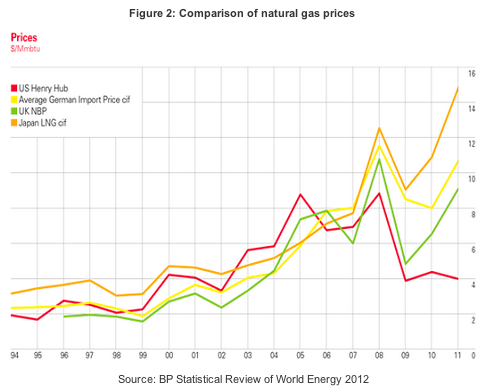

(a) An increase in European prices for natural gas driven up by global demand for this commodity. As opposed to oil, the gas market is characterized by significant fragmentation and European prices fluctuate between less expensive American shale gas and more expensive Asian liquefied gas (Fig. 2). The year 2012 has turned out to be a turning point as the American Henry Hub price has dropped down to a level of US $2/Mbtu, its lowest level for the past decade while the European average spot price and oil-indexed price have fluctuated in a range of between US $8-10/Mbtu.

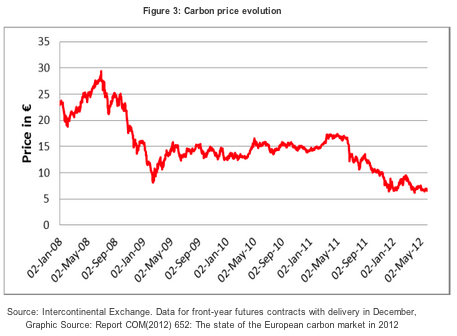

(b) A decline in European coal prices induced by imports of excess supplies from the USA and Canada, where the trend is just the opposite. The North American power industry has shown a clear preference for cheaper shale gas. Another unexpected consequence of the economic crisis has been a significant surplus of emission allowances (955 million units) in the EU emission trading system (EU ETS) and a corresponding low price for such allowances of around €7/tCO2 in 2012 (Fig. 3). This has made coal as a fuel, despite twice the amount of CO2 emissions per unit of energy produced when compared to natural gas, a much better financial proposition for electricity producers to burn.

This grim situation in terms of demand for natural gas in the EU has, of course, generated negative price signals. At risk are required investments into EU gas infrastructure, which have been estimated (in the period to 2020) by the European Commission to total €70 billion on up to €90 billion according to the European Network for Transmission System Operators, which if implemented could easily end up being transformed into stranded costs. Investments into high-efficiency cogeneration units (energy efficient combination of electric power/heat generation and reduced carbon emissions) with relatively low levels of capital expenditure may also be lacking for the same reason.

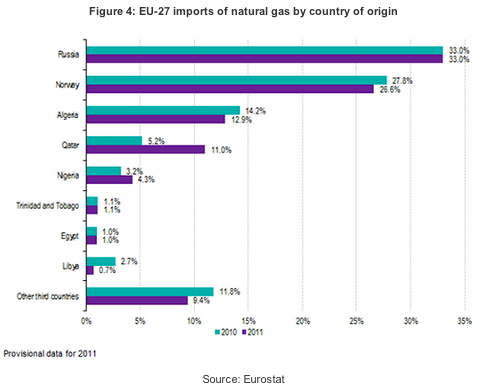

In addition to other factors, low gas consumption on the European market has likely had a negative impact on critical improvements to ensure the security of supplies. Currently the EU is primarily supplied with pipeline gas from Russia and Norway and to a lesser extent from Algeria and LNG from Qatar as well as from Nigeria (Fig. 4). The mutual dependency with respect to existing gas pipelines is clear but it is more worrisome with respect to liquefied gas imported by tankers as the destination LNG terminal is largely determined by current pricing. In this spirit, source diversification, and specifically an extension of the Caspian pipeline through Turkey, would help to ensure the security of supplies to Europe; however the drop in demand in the EU has not helped this effort. On the other hand, an exceptional increase in consumption in Turkey and potential increases in demand for this commodity in the countries of the western Balkans could provide suitable investment stimulus for the construction one of the less expensive pipeline variants within the Southern Gas Corridor bypassing the Russian Federation. The EU may just yet thank Turkey for increasing the security of its energy supplies.

Outlook for future developments

Despite the International Energy Agency's optimistic predictions that natural gas would become the fastest growing fossil fuel with accompanying constant global demand, the EU shows a significant deviation from this expected global trend with the 2010 demand expected only to be surpassed in 2020. While this forecast is relevant, its accuracy will only be proven over time. Among the factors with major or minor potential to impact this forecast of natural gas consumption in the EU in the coming years/decade, save for any geopolitical events, include the following:

1. Economic growth, stimulating industrial production and the related generation of electricity, driving an increase in consumption;

2. A European boom in shale gas extraction, which would certainly bolster natural gas prices in the EU remains highly unlikely in the near future due to low levels of support among politicians and the public. Bulgaria and France have banned exploratory drilling that employ controversial hydraulic fracturing technology. Similarly perplexing information is also coming from Poland, an advocate of shale gas in Europe, where energy giant ExxonMobil recently declared an end of exploratory work due to insufficient commercial quantities of this commodity. If the fantastic reserves of shale gas in Europe were ever confirmed and could be extracted under financially and ecologically acceptable conditions, this would surely drive changes in other EU countries. The UK may soon become an apt example;

3. Globalization of natural gas prices, i.e. the creation of a global natural gas market similar to that for oil, would certainly be supported by the planned construction of LNG export terminals in Australia and the USA in 2015. This should lead to an increase in the security of supplies to Europe but the overall positive effect on European prices is questionable as liquefied gas is more expensive than pipeline gas;

4. Development of renewable energy sources in particular for the needs of the electric power industry where natural gas has the potential to become the backbone of the entire system. Apparently the intermittent wind and solar energy sources require extra system balancing reserves, i.e. non-RES generating capacity needed to meet shortfalls with the purpose of ensuring reliable and safe operation of the electrical transmission grid. In such cases, natural gas seems an ideal back-up fuel, at least until technology enabling highly efficient storage of electricity is discovered and commercialized. Likewise decentralised power generation and heat production enable a common utilization of photovoltaics and natural gas;

5. The proposed modifications to the EU emissions trading system as well as potential structural measures which, however, require the approval of the European Parliament and, above all, the consent of all Member States represented in the Council of the EU. One consequence could be preference given to CCGT plants over thermal power stations;

6. The transition to a low carbon energy system in the EU around 2050 (e.g. through electromobility), when greenhouse gas emissions should be reduced by 80 to 95% of their 1990 levels. If such an ambitious objective was achieved, natural gas would have a difficult time maintaining its place without the development of Carbon Capture and Storage (CCS) technology. On the other hand, such technical advances would naturally be of great assistance to all fossil fuels;

7. Increased energy efficiency would probably negatively impact demand for natural gas (a) in the heating industry where proposed efficiency measures in the construction sector seek to achieve nearly zero energy consumption as well as (b) in the electric power generation industry due to the anticipated introduction of smart electric meters and technologies as well as the production of more efficient appliances.

Conclusion

The current level of natural gas consumption in the EU is not flattering and has even been recognized by the International Energy Agency, which has already forecast a "lost" decade in Europe. The reasons for the flat-lining of European natural gas demand are many and varied. These range from the economic crisis Europe has experienced since 2007 to a surprising increase in the demand for coal at a time when the EU has declared open season on carbon emissions as part of its war on climate change. Of course it is nearly impossible to precisely define the future development of the gas industry in Europe. Perhaps the best we can say is that natural gas, just as the sun will rise tomorrow, will also retain its standing in the European energy sector.

Contributor Jozef Badida is a Regulatory Specialist at Eustream (Slovak gas TSO) and is involved in the implementation of the ITO Project as a member of its Coordination Team. This article is not an official statement from eustream, a.s. or from any other company and is exclusively the personal opinion of the author. For further information Jozef can be contacted at j.badida@yahoo.com.