Green gas means go [NGW Magazine]

Renewable gas can not only reduce emissions, but it can also help integrate the energy and agricultural sectors, create rural jobs, develop a circular economy, diversify future energy supply and avoid stranded natural gas assets. And it can be used in sectors difficult to electrify such as heat and heavy transport.

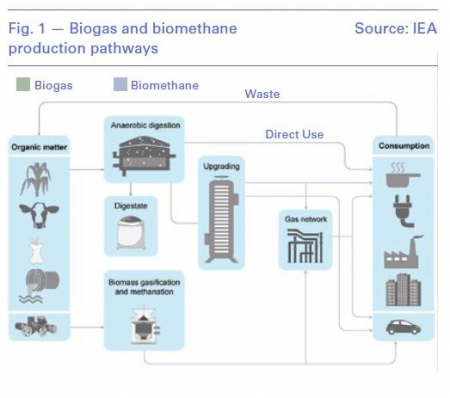

‘Green’ gas depends heavily on government subsidies or carbon pricing, and feedstocks. Unlike biofuels, which can encourage the destruction of forests and agricultural land to grow the feedstock, biogas is produced mainly from agricultural and food waste, crops and landfill gas sites which would otherwise vent methane. It is about 65% methane so it needs refining into biomethane before being liquefied or injected into the grid. The allowable limits for impurities in renewable natural gas (RNG) vary by pipeline and are a point of contention within the industry.

What is biogas and biomethane?

In Europe, 72% of the feedstocks used for biogas production comes from agriculture, while in the US it mostly comes from landfill gas. Biogas can be used as a generation fuel, although it is not cost-competitive with natural gas, particularly after the downward price pressure caused by lower demand during the Covid-19 pandemic and growing supply from other renewables.

The growth prospects are better for biomethane. Biogas upgrading facilities and biomass gasification plants have increased around five-fold over the last decade and are likely to exceed 1,000 worldwide this year, according to the International Energy Agency. Around three fifths of plants inject biomethane into the gas distribution network, the other two-fifths being split equally between vehicle fuel and other end uses.

Britain's National Grid connected biomethane to the transmission system for the first time in August, the gas coming from an anaerobic digestion plant in Cambridgeshire running on cattle manure and straw. Another pilot project in Cornwall will also use farm manure to produce biomethane to fuel trucks. Based on existing technological efficiency and at full potential, the UK could generate as much as 5.7bn m³/year of biomethane by 2030, according to a report by the Anaerobic Digestion and Biogas Association. "Alongside hydrogen, biomethane will play a critical role in the journey to Britain achieving net zero," said Ian Radley, head of gas systems operation at National Grid.

Across the Channel, France is connecting biomethane plants at a rate of about one a week and already has 155 sites injecting into the gas grid with a capacity of 2.7 TWh/yr. The country could be using purely renewable gas by 2050, according to official estimates.

Untapped potential

The full potential of biogas is “far from being exploited” according to the latest statistical report from trade association Bioenergy Europe.

Most of the 40.7 TWh of global biomethane production is in Europe and North America, but Brazil, China and India are on the way up. Resource potential is sufficient for biomethane alone to supply around a fifth of gas demand, up from current levels of around 0.1%. Global biomethane demand in 2040 could exceed 2,326 TWh, the International Energy Agency (IEA) estimates.

The US could produce almost enough renewable natural gas to supply the entire residential gas demand by 2040, according to consulting firm ICF. Residues from the ethanol industry, animal manure and municipal solid waste (MSW) will contribute roughly equal amounts of the feedstock. In the EU the potential contribution of MSW to biogas production is much lower owing to regulations limiting what flows into landfills.

Co-benefits

As climate targets are raised, green gas may be the only alternative to cut emissions in hard-to-abate sectors which defy affordable electrification. But the benefits of renewable gas go far beyond avoided greenhouse gas emissions: they include better waste management, cleaner air and water, agricultural employment opportunities, energy independence and resource diversity.

It is one of the very few technologies able to reduce emissions in agriculture and will play a key role in gas and power integration. While biogas and biomethane typically cost more than wind or solar PV for power production, the existing natural gas infrastructure can be used, which will shorten deployment time, mitigate expense and also avoid stranded assets.

“If you only look at cost per energy unit you are not capturing the full value,” said Pharoah Le Feuvre, renewable energy analyst at the IEA in a recent European Biogas Association (EBA) webinar.

And yet, in some developed countries deployment will slow without renewed support as subsidies are removed and feed-in tariff schemes are winding down. Germany’s 20-year price guarantees for renewables end next year, and in the UK the feed-in tariff for electricity generated from biogas combustion is less than a third of what it was in 2011. Further, the upfront cost of the biodigester can be a barrier to development, despite just a two-year payback time.

Frenetic policy debate

The EC’s renewable energy policy officer Pierre Loaec told the webinar that while hydrogen shows great promise, it is the ‘new kid on the block’, while renewable gas is mature and can be deployed quickly and creates a big opportunity in the short term.

All gas supplied in Europe must be renewable or decarbonised by 2050, in line with Europe’s climate commitment made at the COP 21 climate meeting in Paris. A stream of work is underway to upgrade the regulatory framework for gas to ensure cross-border interoperability.

The EU will step up its climate ambition later this month, and a raft of new legislation will be introduced including overall gas market reform by June 2021. As yet there is no overall target for renewable gas in the EU energy package, but the Renewable Energy Directive (‘RED II’) sets a binding target of 32% of all energy to be renewable 2030, including 14% renewables in the transport sector with a sub-target of 3.5% coming from advanced biofuels and biogas.

But the new policy may also hold back production of biogas and biomethane, by introducing sustainability thresholds that require 65-80% greenhouse gas savings relative to the fossil fuel alternatives.

Nonetheless, biogas will have an increasing role to play, with demand projected to double by 2030 and quadruple by 2050. A dedicated green gas target of 10% of the overall gas supply should be set by 2030, proposes the Guidehouse Gas for Climate consortium in its report Gas decarbonisation pathways 2020-2050.

The EC issued a strategy on energy sector integration in July, with a methane strategy to be published soon. Both could have implications for biogas. The EC will also present a proposal later this year to align the Trans-European Energy (TEN-E) regulation with the new strategies. TEN-E identifies energy projects for funding and natural gas projects have been unpopular with members of the bloc’s parliament.

US voluntary market uncertainty

The use of renewable gas in the US is most advanced in the transport sector. A voluntary market for RNG is emerging as forward-thinking utilities set their own targets or programmes, such as Oregon’s Senate Bill 98 which sets non-binding targets of up to 30% for renewable gas by 2045-50 and allows utilities to recover investments in renewable natural gas projects. Some utilities such as CenterPoint, SoCal Gas and Northwest Natural are offering RNG tariffs or buying larger volumes of RNG as large corporate buyers displace natural gas.

“In the last twelve months our industry has brought more RNG production facilities online than it did during its first thirty years of existence between 1982 and 2011,” said the US RNG Coalition. Voluntary green gas or renewable thermal certificates are being issued, providing an additional revenue stream. The Midwest Renewable Tracking System launched a platform in January that tracks thermal certificates.

Various standardisation initiatives are underway in the US, grappling with similar issues to early renewable energy certificate markets: for example, whether the certificates include greenhouse gas attributes or whether they should be tracked separately in a carbon offset.

The World Resources Institute’s (WRI) Greenhouse Gas Protocol, a stakeholder group, is developing guidance on how bioenergy and other land use activities are reported in company’s emissions inventories, and the Center for Resource Solutions (CRS) is expecting to publish a new Green-e® standard and certification programme for biomethane products and associated environmental attributes by the end of this year.

One of the issues under discussion is whether to use a volume-based structure for an incentive programme, used in the federal renewable fuel standard, or a carbon intensity calculation as used in California’s low carbon fuel standard. The decision will affect how many certificates are issued to each type of project depending on whether they are currently required to capture their fugitive methane emissions.

Amendments to the WRI guidance on how to use green gas certificates for GHG reporting have caused some uncertainty. If WRI treats natural gas offset with carbon credits as equivalent for reporting direct emissions, then the RNG voluntary market could be at a big disadvantage. But downward pressure on prices has been mitigated by strong demand and a general shortage of supply, says the UK’s Green Gas Certification Scheme.

In the UK, Guarantees of Origin used by companies to disclose their use of biomethane were trading at around £7-£8/MWh at the beginning of 2020, significantly up from the £1-£2/MWh range in 2017.

The Guarantee of Origin system is being rolled out for renewable gas for more countries in the EU to meet the requirements of RED II.

Biomethane can also be used in the EU Emissions Trading Scheme (ETS), but it requires individual member states to go though a process of recognising how the gas should be tracked via the grid and very few have put in place the necessary processes and guidelines.

Green tailpipes

The quest for zero emission tailpipes will predominantly be pursued with electric battery and fuel cell vehicles, but there is a role for biomethane in certain applications such as heavy industrial use.

Several European member states have already introduced support for biomethane in transport, and the EC has an open consultation on its Strategy for a Sustainable and Smart Mobility, part of the Green Deal, which will close September 23. The strategy, which should be published by the end of 2020, could include a new CO2 standard for cars and trucks. The different responsibilities of the car makers and the fuel suppliers need to be clarified though.

In the US, the federal renewable fuel standard programme and California’s Low Carbon Fuel Standard (LCFS) have set targets to reduce the carbon intensity of the transportation sector which use certificates called Renewable Identification Numbers (RINs) and LCFS credits. Other countries including China and Brazil have also introduced support schemes for biomethane in transport.

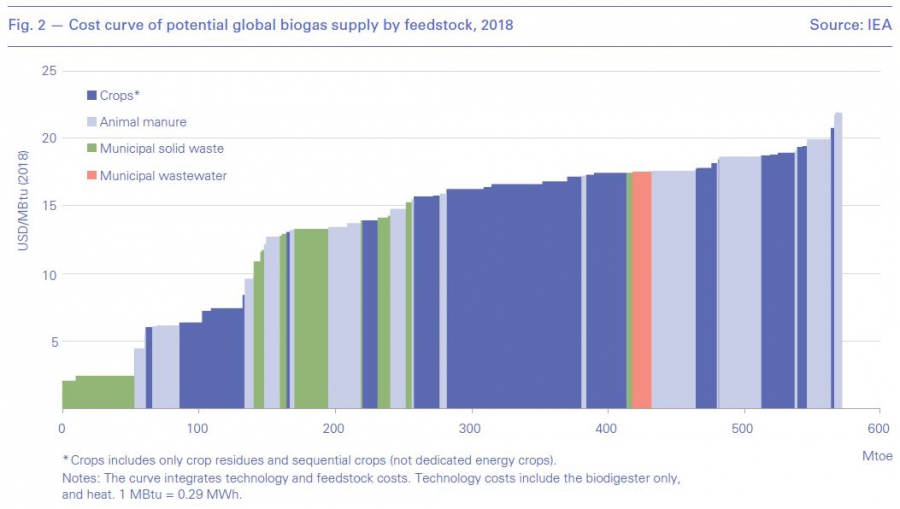

Biogas production costs vary widely from between $2/mn Btu to more than $20/mn Btu depending on the region and the type of feedstock. Landfill gas systems can provide biogas for less than $3/mn Btu (about $10/MWh).

ICF estimates that most of the RNG produced in its high resource potential scenario is available in the range of $7-$20/mn Btu, which results in a cost of GHG emission reductions between $55-$300/metric ton in 2040.