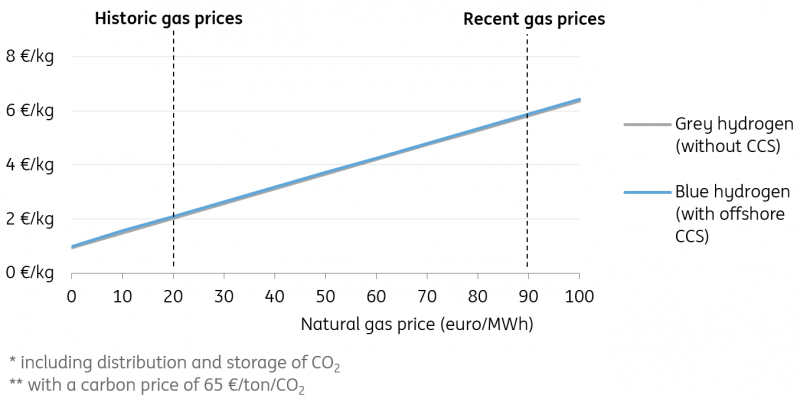

High gas prices triple the cost of hydrogen production

There are many different ways of producing hydrogen with grey, blue and green hydrogen, being the most important. Natural gas is the main input for grey and blue hydrogen. Electricity is the main input for green hydrogen. Carbon emissions vary considerably between the different forms of hydrogen, with grey being the dirtiest and green being the cleanest.

Value drives of grey, blue and green hydrogen

|

Advertisement: The National Gas Company of Trinidad and Tobago Limited (NGC) NGC’s HSSE strategy is reflective and supportive of the organisational vision to become a leader in the global energy business. |

The economics of hydrogen: gas, power and carbon prices

This article examines the economics of hydrogen, by analysing the impact of gas, electricity and carbon prices on the business case of the various production techniques. In doing so, we examine a hypothetical project at an industrial site near the North Sea coast. We assume that hydrogen can be produced 24/7, so the hydrogen plant runs at a high capacity factor. In producing blue hydrogen, we assume the carbon is captured and stored in a depleted offshore oil or gas field. The CO2 is then transported through a 50km pipeline, not by ships (which is more expensive) and not in an onshore field or salt cavern (which meets more social opposition).

These assumptions are similar to those that actually apply in real-life situations in some coastal European countries, notably the Netherlands, Germany, Belgium, the United Kingdom and countries in the Nordics like Norway and Denmark. These CCS assumptions are near-optimal. As a result, the scenario outcomes are likely to represent the lower cost range of a wide variety of hydrogen production possibilities.

In practice, many project-specific factors determine the eventual outcome of a business case. The factors that have a particularly important bearing on the profitability include whether carbon can be captured pre- or post-combustion, the availability of depleted gas fields to store carbon, sea depths, whether or not existing gas infrastructure can be used to transport carbon or if new infrastructure is required. As a result, our calculations are only illustrative and aim to show the general dynamics of gas, power and carbon prices on hydrogen production. They should not be considered as perfect benchmarks. With that disclaimer in mind, let us have a look at the economics of hydrogen production.

Read the rest of the article by ING's Think unit here.

The statements, opinions and data contained in the content published in Global Gas Perspectives are solely those of the individual authors and contributors and not of the publisher and the editor(s) of Natural Gas World.