Hoegh Sees Soaring LNG Carrier Rates

The LNG market is continuing to develop favourably, backed by robust demand growth in Asia, and an ongoing increase in volumes, said Hoegh LNG which owns LNG carriers as well as floating import terminals (FSRUs). In its 3Q results presentation November 29, it cited how recent spot rates for LNG carriers had soared to record levels of $180,000-200,000 per day

The Bermuda-registered, Norway based and listed company made a $6mn profit in 3Q 2018 (up from $1.1mn in 3Q 2017) while pre-tax earnings (Ebitda) were $47.9mn (year ago $31.6mn). Latest 3Q figures were net of an $9mn impairment on jetty equipment previously installed in Ain Sokhna, Egypt, that was part of its Hoegh Gallant charter – the ship ended its deployment there 18 months earlier than scheduled. The vessel is now on charter to Gunvor, with Egyptian state Egas picking up any shortfall in income – perhaps an unlikely scenario given the sky-high rates.

Voracious China

The global LNG market is robust, noted Hoegh, with 9M 2018 trade at 236mn metric tons (mt), up by 7.1% year-on-year, buoyed by robust Asian demand and new supplies of LNG from Australia and the US.

China’s 20 land-based LNG import terminals have monthly regas capacity of 5.6mn mt (equivalent to 67.2mn mt or 93bn m3 annually) which Hoegh said nonetheless is "expected to be insufficient for meeting seasonal demand swings and for supporting the current rate of growth in demand" – citing that as one factor why state CNOOC chartered Hoegh’s FSRU Hoegh Esperanza to operate this winter at Tianjin, starting up earlier this month (see banner photo above) even though an existing onshore terminal run by state rival Sinopec has been operating near the city since February.

Use of FSRUs down globally year-on-year

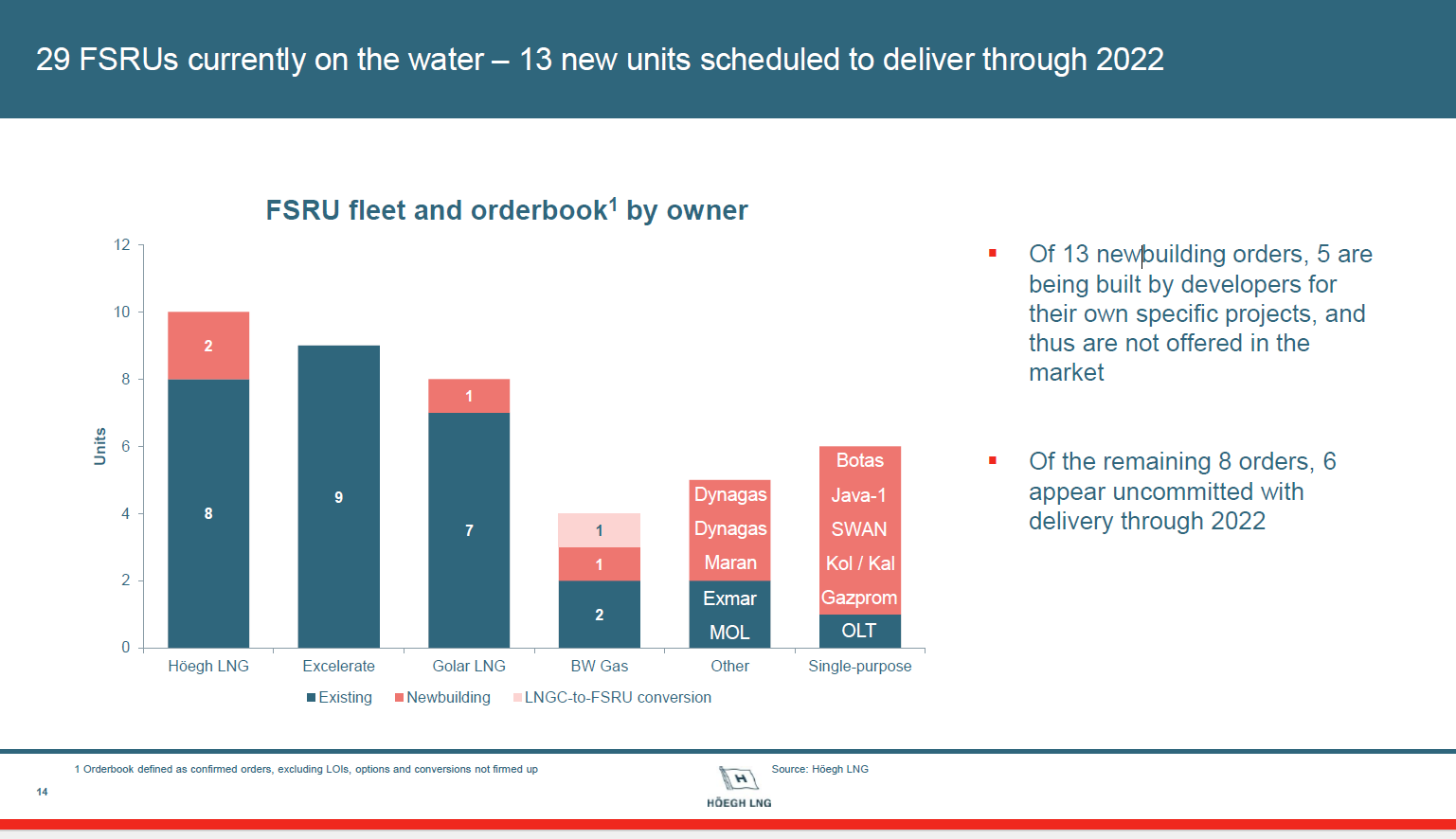

LNG imports through FSRUs increased by 26% from 2Q to 3Q 2018. At 10.1 million mt, however, FSRU imports were 6% lower than in 3Q 2017, as increased imports to Bangladesh, Pakistan, Turkey and Brazil were offset by a halt in imports to newly self-sufficient Argentina and Egypt. However, the growth trend is expected to resume, said Hoegh, as FSRUs currently serve 22 import projects worldwide with a further 10-12 projects having signed up FSRU capacity that will start LNG imports by late 2020. It noted that 29 FSRUs are currently afloat (see graphic far below for details).

Hoegh itself has eight FSRUs in service – although not all are currently employed as terminals. It expects to take delivery of a ninth FSRU next month (initially on charter to Spain’s Naturgy) following a naming ceremony in South Korea earlier this week at which it was christened Hoegh Gannet. It expects a tenth to be delivered in 2Q 2019. Both new ships will likely operate initially as LNG carriers but Hoegh LNG stressed that its "main commercial objective is to have all its FSRUs placed on long-term contracts".

Small-scale LNG venture

Hoegh reminded investors of its new stake in Avenir LNG, acquired October 1, a small-scale LNG supplier that has an interest in a small LNG import terminal in Sardinia (Italy) under development. Avenir is investing in six new small LNG carriers, the first two of which (both 7,500 m3 capacity) are due for delivery in November 2019.

Floating storage and regasification units (FSRUs) currently on the water and on order worldwide (Graphic credit: Hoegh LNG)