How can we solve gas flaring and accelerate the energy transition?

Flaring in context

Natural gas is viewed by many as a bridging fuel to a low-carbon society. But in the last 2-3 years, scrutiny over the oil and gas supply chain emissions has heightened. Of these emissions, three potentially avoidable sources stand out: "flaring" (the deliberate combustion of natural gas), "venting" (the deliberate release of methane at vents and tanks) and "leaking" (the accidental release of methane in pipelines and wells).

|

Advertisement: The National Gas Company of Trinidad and Tobago Limited (NGC) NGC’s HSSE strategy is reflective and supportive of the organisational vision to become a leader in the global energy business. |

This paper, by Capterio, looks into the most easily solved source: flaring. Whilst flaring is mostly a by-product of the oil (not gas) supply chain, we believe this distinction is somewhat irrelevant, and we must consider sources of emissions in the round. After all, wouldn't it be perverse for a country to claim it had high-quality gas if its supplies from a gas field with a low carbon intensity were next to a neighbouring oil field that was abundantly flaring gas?

In 2020, around 142 billion cubic metres (BCM) of gas was burned through gas flaring (according to data published by the World Bank's Global Gas Flaring Reduction programme, in collaboration with the Colorado School of Mines), amounting to 3.7% of all gas consumption. If it were a country, "flaring" would be the 5th largest gas-consuming country globally (after the US, Russia, China and Iran). It's also 96 GW of continuous power (3.1% of all power generated in 2020) and could displace up to 9% of all coal-fired power. Figure 1 illustrates some typical large flares from multiple continents.

Overview of flaring today

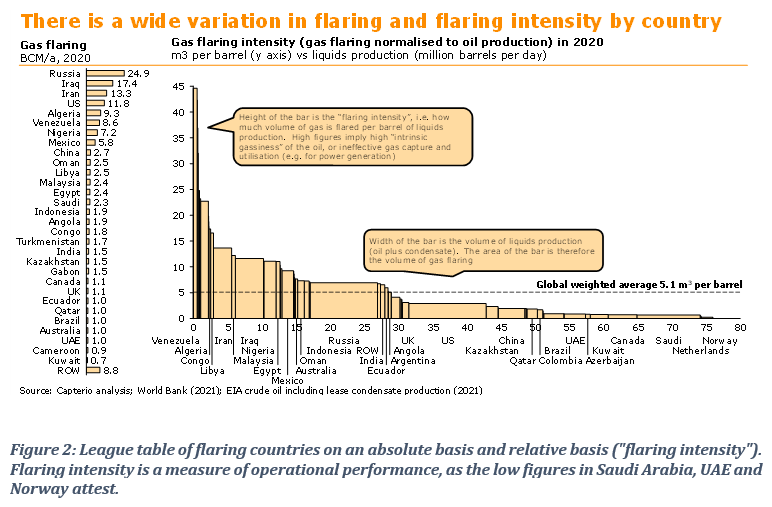

Figure 2 highlights the largest gas flaring countries on both an absolute (BCM) and relative basis (i.e. flaring per barrel of liquids production). The large variation between countries talks not only to abundant capture opportunities but also to what is possible. Norway, Saudi Arabia and UAE have had clear anti-flaring policies for decades – and the result is low flaring intensity. In contrast, Venezuela, Algeria and Libya have very high rates of gas flaring, which is mostly due to sustained underinvestment in the area, coupled with maintenance-related challenges in keeping critical kit, such as gas compression, equipment operational.

Flaring and its link with methane emissions

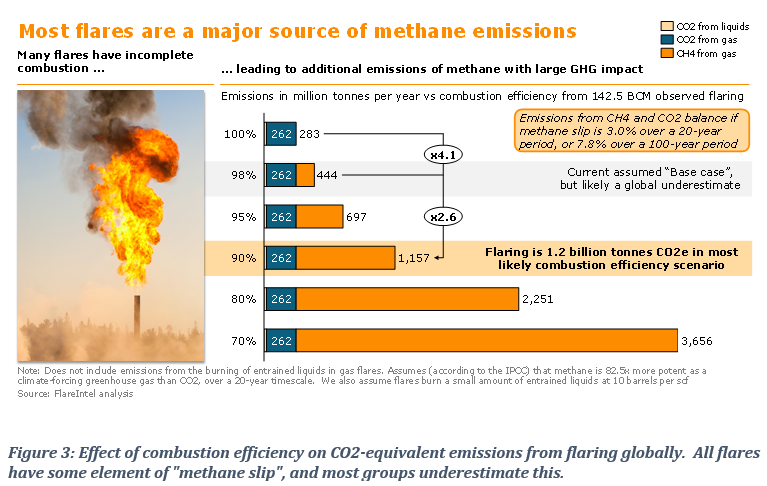

The combustion of gas at flares generates 262 million tonnes of CO2 per year (Figure 3). But CO2 is not the only greenhouse gas arising from flaring. Methane (CH4) is a major source that results from the incomplete combustion of gas at flares. Methane, as the latest IPCC report highlights, is a highly-potent greenhouse gas, some 82.5 times the Global Warming Potential of CO2, over a 20-year timescale[1]. Additionally, many flares have considerable C2+ components and burn liquids, leading to particulates.

Interestingly, most groups (e.g. the World Bank, the bp Statistical Review of World Energy, the IEA) currently assume that all flares operate at world-class combustion efficiencies (some 98% combustion efficiency, or with 2% "methane slip"). Under this scenario, the total CO2-equivalent (CO2-e) impact of flaring rises (also when liquids burn is included) to 444 million tonnes per year.

However, we can be sure that average combustion efficiencies are much lower than 98%, which is also why the EU's methane strategy focusses on this topic. Figure 3 shows how the CO2-e emissions vary as a function of combustion efficiency. Our conversations with operators and regulators suggest that a weighted-average global average combustion efficiency of 90% is plausible – and when liquids and methane are included under this scenario, the total CO2-equivalent emissions are 1.2 billion tonnes per year. That's material, and it is 1.5x that of the aviation industry.

However, we can be sure that average combustion efficiencies are much lower than 98%, which is also why the EU's methane strategy focusses on this topic. Figure 3 shows how the CO2-e emissions vary as a function of combustion efficiency. Our conversations with operators and regulators suggest that a weighted-average global average combustion efficiency of 90% is plausible – and when liquids and methane are included under this scenario, the total CO2-equivalent emissions are 1.2 billion tonnes per year. That's material, and it is 1.5x that of the aviation industry.

Beyond simply emissions, tackling flaring is also a significant revenue opportunity, especially with today's record natural gas prices in Asia (of $33 per mmbtu) and in Europe (at $17 per mmbtu), coupled with record carbon prices in Europe (of €60 per tonne). Adding in the methane slip and likely liquids burn, even at more conservative prices ($5 per mmbtu and $75 per barrel), gas flaring is an additional annual sales potential of up to $30 billion. That's a big opportunity for our industry.

Despite the opportunities, not enough is being done on flaring and methane

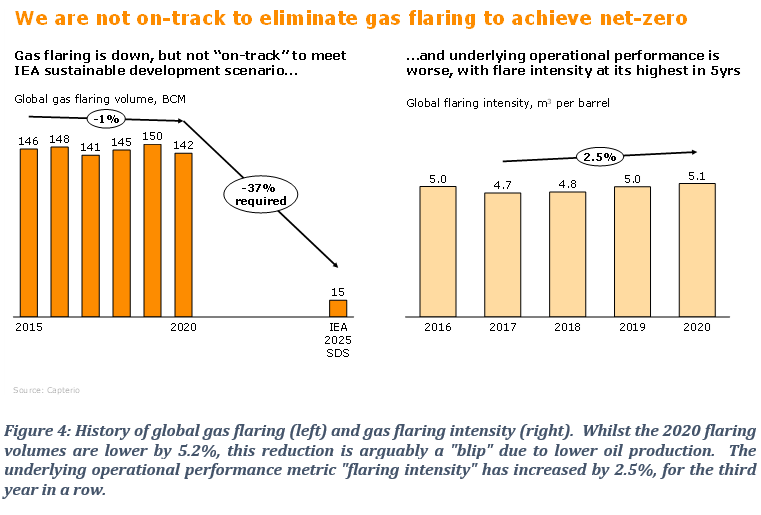

The sharp focus from scores of companies and countries on improving their "ESG" credentials and delivering on their net-zero commitments by 2050 is promising. However, there is little evidence that the oil and gas industry is on track either to materially reduce gas flaring or to eliminate routine gas flaring by 2030. Indeed, the world's "gas flaring intensity", which has now risen for three years in a row (Figure 4), demonstrates that the promised operational improvements are not happening fast enough.

Progress on gas flaring reduction is, therefore is materially off-track. To deliver the IEA's sustainable development scenario, we need to be seeing a 37% reduction per year. But the consistently rising flare intensity, coupled with a rebound in oil production, suggests that 2021 might even be a record year for flaring.

What's blocking our industry to reduce gas flaring today?

Before focussing on the solution, we need to better understand the problem. According to our extensive research and engagement with IOC and NOC operators, four major barriers currently stand in the way of flare reduction efforts:

Firstly, flaring is not always "on the radar" of operators or regulators (it is often not measured, not reported, ignored or sometimes denied). Secondly, there is often a perception that fixing flaring does not make economic sense (but creative application of technology, with the right cost and commercial structures can often unlock this), as we demonstrate in our paper "why flare capture projects make sound ESG investments". Thirdly, the industry currently lacks resources: partly this is a capability issue (dealing with "small capital projects" with low-pressure gas is often "non-core" for companies that prioritise mega capital projects), and partly this is an issue of capital allocation – especially in today's highly constrained world. Finally, regulators often do not have the mechanism or data to monitor and enforce reduction efforts (even though, in many cases, there are clear "anti-flaring" penalties).

The good news is that our work on this topic has highlighted how each of these barriers can be overcome – through use of data, agile technical and commercial solutions, deployment of new operating and business models (that bring financing) and empowered regulators.

Where there is a will, there is a way for operators

Our analysis highlights that many gas flares can be reduced with technically-proven solutions whilst also creating commercial value. Supporting this, we note, firstly, that many gas flares (especially outside the US and Canada) are material in size and continuous in nature. Secondly, we've analysed the proximity of every flare to every gas demand sink (pipeline, power station LNG terminal), and perhaps surprisingly, some 54% of all flared volumes are within 20 km of existing gas pipelines (see article).

Specifically, there are seven key things operators can do to reduce gas flaring:

- Improve operational practices (especially around equipment maintenance, to reduce equipment failures and "upset" flaring);

- Use the gas for operations (e.g. process heat, enhanced oil recovery (EOR), or for delivery to a local gas gathering system);

- Generate electricity (e.g. for local and regional consumption), especially when this displace diesel used to power oil and gas field operations;

- Extract associated liquids (e.g. LPG, condensate);

- Convert the gas to liquids (e.g. CNG, LNG or GTL) for sale via a "virtual pipeline";

- Deploy "exotic" solutions, such as cryptocurrency mining;

- Or, if all else fails, improve the flare's combustion efficiency and reduce methane emissions.

Our industry has demonstrated what is possible through recent flare capture projects delivered in, e.g. Kurdistan, Egypt, the US and Saudi Arabia (see our article "celebrating successful flare capture projects"). These examples (and there are many more) also demonstrate that solutions can be found for legacy oil fields. Based on our extensive evaluation of scores of other opportunities, we believe that much more can be done.

COP26 sharpens the focus on action

As we prepare for COP26, we need not only to put flaring firmly on the map, but also to ensure that we deliver tangible action, and to do this, we should consider to:

- Use data to recognise the true scale of gas flaring. Flaring continues to be "out of sight and out of mind" for many countries and governments. Increasing transparency through tools such as FlareIntel (see below) puts flaring firmly on the map;

- Set ambitious commitments, policies and incentives. Set ambitious NDCs, create reduction roadmaps, define and enforce flaring penalties, supported (eventually) by carbon border pricing;

- Mobilise capital to ensure on-the-ground impact happens by opening markets to third parties, deepening methane-related carbon markets, partnering to provide investment support (through concessionary capital, or grants), and certifying hydrocarbons differentiated by their supply chain emissions.

Driving renewed accountability and transparency on flaring

Delving further into the data angle, operators, regulators and the public need to know who is flaring what and where to ensure there is sufficient focus on the delivery of the flare capture projects.

To support this work, Capterio has developed "FlareIntel" for the public good, which enables, for free, any user to explore each of the 10,000+ flares globally (Figure 5). The tool (available at www.flareintel.com, see also Figure 5) integrates the last nine years of flaring data with recent satellite imagery and metadata (such as the field name, operator) and infrastructure data (such as pipelines). By bringing this data truly into the public domain, we can improve awareness, accountability and assist in identifying and delivering real on-the-ground flare capture solutions.

There's all to play for here. By working together, we can reduce flaring, create value and play a critical role in accelerating the energy transition. Our industry has always risen to challenges in the past. Now it's time to do it again.

[1] According to the August 2021 IPCC report. Whilst there is no “right answer”, we evaluate the potency of methane vs CO2 over a 20-year period (with an 82.5x multiplier) as opposed to over a 20-year period (with a 29.8x multiplier) since we believe the shorter time period is more relevant to the urgency of our climate crisis. The longer time period arguably underestimates the urgency of solving the methane challenge.

The statements, opinions and data contained in the content published in Global Gas Perspectives are solely those of the individual authors and contributors and not of the publisher and the editor(s) of Natural Gas World.