How to make oil and gas cleaner – and fast [Gas in Transition]

The International Energy Agency (IEA) expects global energy demand to increase by 4.6% in 2021, led by growth in emerging markets and developing economies as they come out of COVID-19. As a result, the IEA’s Global Energy Review 2021 estimates that global energy-related CO2 emissions are on course to surge by 1.5bn metric tons in 2021, or 1.5%, to 33bn mt. This marks the second-largest annual increase in history.

The COP26 Glasgow Climate Pact expressed “alarm and utmost concern that human activities have caused around 1.1°C of warming to date, that impacts are already being felt in every region, and that carbon budgets consistent with achieving the Paris Agreement temperature goal are now small and being rapidly depleted.” The Pact called for “rapid, deep and sustained reductions in global greenhouse gas emissions (GHG),” including methane emissions.

The agreement at COP26 made an unprecedented reference to the direct role that fossil fuels have played in causing climate change. And this could mean the oil and gas industry is entering a phase of even greater scrutiny of their operations. There was recognition that keeping the 1.5°C Paris Agreement goal alive required a shift away from fossil fuels, but coming up with a plan of action for achieving this was postponed to COP27. Pressure will only increase from now onwards, climaxing in Egypt next year, where that next summit will take place.

Some of the criticism that followed COP26 was that, while most parties stepped up their long-term emission reduction goals, there was insufficient emphasis on near-term actions. Pressure, including public mistrust, is increasing, with demands for the oil and gas industry to show how it will achieve real reductions in emissions now. Further investments in the oil and gas sector without visible and effective plans to reduce emissions are bound to be subject to strong criticism. The industry must develop a convincing narrative around its value in a decarbonising energy system, ahead of added scrutiny at COP27.

The question, then, is quite simple: what can be done to achieve GHG emission reductions in the oil and gas sector by as early as 2030?

Pivoting away from oil

The quickest way to reduce emissions, at least in the short-term, is to downsize oil assets. BP has a target to phase out 40% of its oil and gas production by 2030 and increase spending on low-carbon energy to $5bn annually. Shell has said that its oil production peaked in 2019 and is now expected to recede by 1% to 2% annually. ExxonMobil expects its oil and natural gas production to stay in line with 2020 levels of 3.7mn barrels of oil equivalent/day up to 2025, having abandoned a previous plan to reach 5mn boe/d. Eni has a plan to plateau oil and gas production by 2025 and subsequently reduce oil production to ensure that natural gas makes up to 85% of its overall output by 2050.

None of the other majors or NOCs have any plans to pivot away from oil, however, and this oil will still be needed unless there are dramatic reductions in demand. But those companies that do shift away from oil could benefit from improved ESG ratings and less scrutiny of their investments.

Shell has also said that it will reduce its refinery footprint from 13 locations to six chemicals and energy parks, reducing traditional fuel production by 55% by 2030. It has also pledged to halve emissions by 2030.

Chevron outlined plans to reduce its carbon emissions intensity from production by 35% by 2028 and, more importantly, to halt routine flaring of natural gas by 2030.

Another way for majors to reduce their emissions footprint is to shift future production to oil and gas fields with the highest returns and the smallest carbon footprint – the highest-emitting reservoirs produce about three-times more emissions than the lowest.

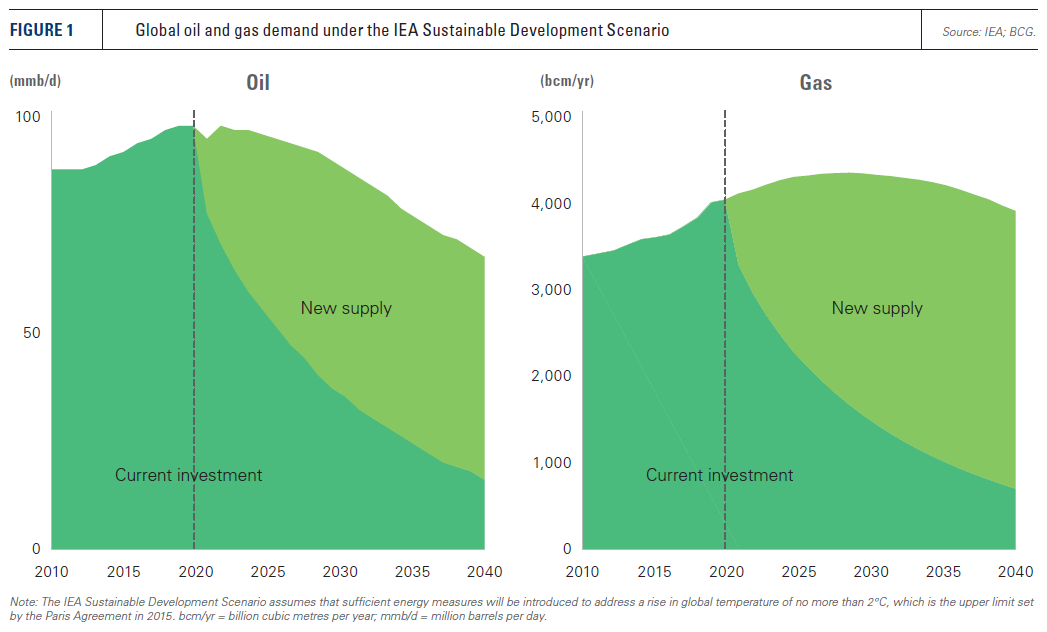

But experience so far is that where majors have pursued divestment of oil and gas assets, it has not led to any global reductions in production. The disposed assets have been bought by other companies that fully intend to exploit them, albeit often with less stringent commitments to control emissions. Most reputable forecasts show oil peaking between 2025 and 2035 and natural gas not until after the mid-2030s (Figure 1). As Rosneft has said, many national producers see this as an opportunity to grow their own market share.

Evidently, forcing majors to pivot away from oil will not necessarily have the desired effect. This was part of Shell’s defence against a Dutch court action in May that called for the major to reduce its Scope 1, 2 and 3 emissions by 2030 compared with 2019 levels. This was not accepted by the court, which found Shell’s sustainability policy to be insufficiently “concrete”. The company was told it had a duty of care and that its level of emission reductions and those of its suppliers and buyers should be brought into line with the Paris Agreement. Shell is appealing this decision, but if upheld it will have wide implications for the oil and gas industry.

Clearly the court decided that Shell should be taking responsibility for cutting its emissions much faster. This is a warning to majors that their drive against climate change must be accelerated.

But as BP CEO Bernard Looney said: “if the supply side moves too early and society doesn’t move, we’ll have a mismatch," and high prices. The IEA agrees. It warned that the world will need oil and gas for decades to come as renewable producers try to catch up.

Tackling methane emissions

Another first at COP26 – promoted jointly by the US and Europe – that will massively impact the oil and gas sector was the agreement by more than 100 countries to cut methane emissions by 30% by 2030, and eventually eliminate them altogether. Methane has a much more potent effect on global warming than CO2 – more than 80 times.

This can be achieved through leak detection and repair efforts to reduce fugitive emissions, and operational improvements at both upstream and downstream facilities and operations.

Methane emissions are the second biggest contributor to global warming after CO2. But despite methane's potency as a GHG, its time in the atmosphere is also short-lived, meaning reductions achieved today can have quicker results.

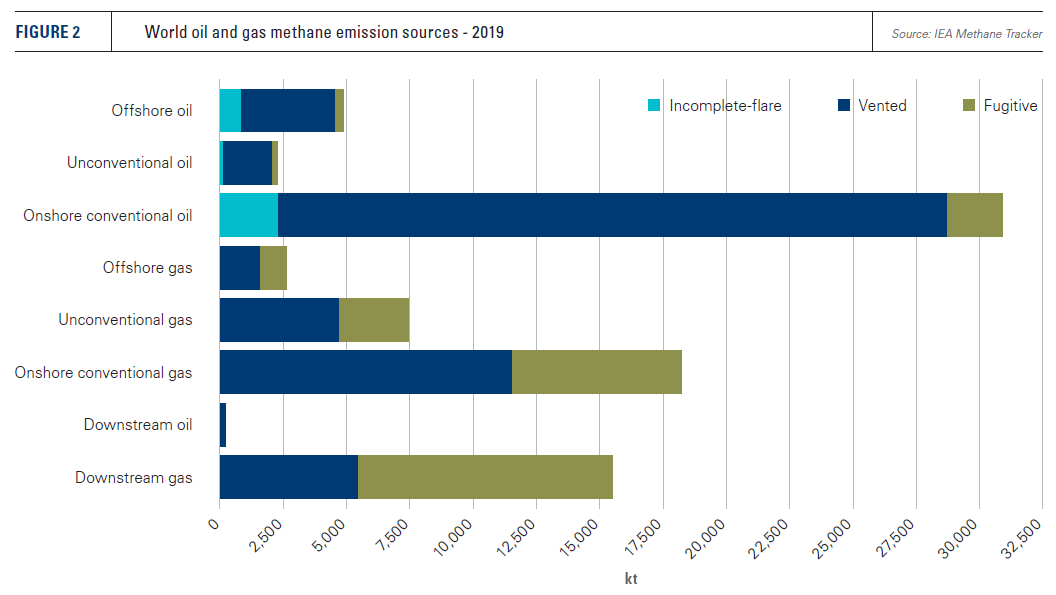

Global methane emission sources from the oil and gas sector are summarised in Figure 2, based on IEA data. The IEA states that the oil and gas industry can deliver a 75% reduction in methane emissions with technology available today. Moreover, more than half of this is achievable at net-zero cost.

The process must start with the development of a baseline that uses accurate, high quality and credible quantification of current emissions. There is a range of advanced satellite technologies available to detect and quantify methane leaks. The baseline can then be used to help optimise emission reduction and quantify the effectiveness of abatement methods.

Identification, minimisation and elimination of methane emissions along the gas production and supply-chain – including fugitive emissions and venting – is needed to ensure that natural gas, as the cleanest of fossil fuels, can play a significant role in the global energy system well into the future.

One suggestion to force change is to set a threshold for methane emissions intensity – defined as the ratio of methane emissions to the volume of natural gas produced – that gas supply must meet in order to enter the market. The price of gas could also be linked to its methane intensity.

Elimination of flaring

This is low-hanging fruit. Elimination of flaring does not require the development of new technologies. Often this process happens because the required infrastructure to process the gas does not exist, or it is cheaper to burn it than to build the infrastructure to sell it. Incomplete burning also results in the release of methane. Making commitments and putting plans in place to eliminate flaring by 2030 should be a priority. Joining the World Bank's Zero Routine Flaring by 2030 Initiative, or other credible initiatives, would be a good start.

Renewable generation at oil and gas facilities

Electrification of oil, gas and downstream facilities, including offshore platforms, by replacing hydrocarbon-fired turbines with renewable energy, can lead to significant reductions in emissions. Switching fossil fuel power generation to renewable power is an obvious choice that can achieve immediate results.

Switching to cogeneration can also help reduce carbon emissions by utilising heat that would otherwise be a waste by-product of burning fossil fuels. Cogeneration systems that combine power and heat generation processes can almost double efficiency, up to 80%.

AI

Artificial technology and advanced analytics have the ability to handle and analyse large volumes of data from many different sources, to help come up with the fastest and most effective solutions to problems. This is something that has the potential to reduce energy consumption, optimise energy efficiency and lower carbon and methane emissions.

AI can be particularly effective in reducing emissions from existing, legacy assets that will probably continue to play a significant role in the global energy mix in the short- to medium-term future.

A recent report published by Microsoft claims that AI can help reduce global emissions by 1.5% to 4% by 2030 through simulations, visualisations, predictive forecasting, better monitoring and distribution of energy resources and operation and management of physical assets, among other ways. Data can then be used to optimise energy usage and resulting emissions.

The report states that exploration and production companies can “use AI in multiple ways to lower their carbon footprint: from predictive maintenance, to performing predictive monitoring of carbon emissions from a particular oil – or gas – field.”

Energy efficiency

The most cost-effective method of reducing emissions is to save energy. Persistent application of operational efficiencies, and the development and deployment of lower-emission technologies, both upstream and downstream, can help reduce Scope 1 and Scope 2 emissions.

Companies should set clear targets for improving energy efficiency across all their operations. Reducing energy use has a direct effect in reducing the emissions of a facility. Replacing or upgrading lower-efficiency equipment and switching to lower-carbon power and heat equipment are other ways of reducing energy consumption and improving efficiency at oil, gas and downstream facilities.

Proper training of employees on how to reduce emissions can also help reduce carbon footprint. In addition, digitalisation and making knowledge-sharing more effective, can reduce human error and improve operational efficiency.

The IEA states that “an annual rate of energy intensity improvements averaging 4% to 2030 – about three‐times the average rate achieved over the last two decades” is needed if net-zero is to be achieved by 2050.

Accounting for environmental performance as part of executive compensation

Linking the achievement of sustainability targets on reducing emissions to oil and gas company executives’ compensation is considered to be a critical driver in promoting change. This is a trend that appears to be growing.

Shell was the first energy company to link executive pay and carbon emissions. It is doing that by setting short-term carbon emission reduction goals that cover periods of three to five years. The targets are being set on an annual basis, and run to 2050. More companies have since joined, linking ESG to executive pay. There is evidence to show that adopting ESG creates value.

Carbon pricing

Wider application of carbon pricing, both globally and to all energy sectors, could contribute to the reduction of emissions, as clearly demonstrated by the success of Europe’s Emissions Trading System.

The new Article 6 agreement at COP26 includes, for the first time, guidelines for a global carbon market that will allow countries to trade carbon offset credits. This could unlock billions of dollars of finance to fund the transition and protect vulnerable countries. Ultimately, carbon pricing encourages emissions abatement.

Other technologies, such as CCUS and green hydrogen, may take longer before they can be used at scale to have any significant impact in cutting emissions in the near term.

Other factors

In addition to ESG, the formation of a new Sustainability Standards Board at COP26 will drive climate-aligned investing, putting even more pressure on businesses to reduce their carbon footprint. These will be used by investors that expect oil companies to demonstrate how they are abating emissions not just in the longer term, but also in the short to medium-term – especially as cost-effective, market-based, solutions are readily available.

Oil and gas companies should commit to major reductions in emissions and announce such plans before COP27 – where oil and gas is expected to be the focus of attention – with clearly set, quantified and verifiable targets for 2030 and interim targets for 2025.

In any case, the global finance world and investors are increasingly driving change, pushing oil and gas companies to decarbonise.

Clearly there is massive room for improvements. But governments can also contribute by addressing the challenging problem of reducing demand for fossil fuels – not just concentrating on supply. They should persuade consumers to cut energy consumption to help achieve climate targets. The IEA’s executive director, Fatih Birol, said as much when he warned that achieving net-zero targets would be difficult without global consumption patterns changing. But relying on consumers to do that may not work, because the majority are not ready to pay to cut emissions or significantly change their lifestyles. This may take time, but it is a campaign that governments must lead.

On a more positive note, the IEA says that “all the technologies needed to achieve the necessary deep cuts in global emissions by 2030 already exist, and the policies that can drive their deployment are already proven.”