IEA net-zero roadmap “a fairy tale” [Gas in Transition]

The IEA stunned markets in May with the publication of its Net Zero by 2050 roadmap, which calls for an immediate end to new investments in oil and gas projects as part of a “total transformation of the energy systems that underpin our economies.” According to Cyril Widdershoven, an energy analyst at Dutch consultancy VEROCY, the IEA’s recommendation is “irresponsible” and “incomprehensible.” “If we do this, there will be shortages in five or six years that will severely impact the world economy,” he tells NGW in an interview.

Cyril Widdershoven, who also holds several advisory positions with international think tanks around the world and is global head of strategy and risk at Berry Commodities Fund, frankly admits that he finds it difficult to understand what made the IEA propose such a policy measure. “In the IEA’s World Energy Outlook, even in the Sustainable Development Scenario, gas demand was set to grow in the period till 2050. Indeed, not so long ago the IEA proclaimed that we were on the eve of a golden age for gas. I fail to see why they have suddenly changed their stance so radically,” he says.

|

Advertisement: The National Gas Company of Trinidad and Tobago Limited (NGC) NGC’s HSSE strategy is reflective and supportive of the organisational vision to become a leader in the global energy business. |

Widdershoven notes that “there are thousands of reports, even from opponents of natural gas, that show we need natural gas in the energy transition. There is no energy system anywhere in the world that can deliver reliable energy supplies in the quantities needed without natural gas – unless perhaps they rely on nuclear power. To proclaim that the world should stop all investment in gas is simply irresponsible.”

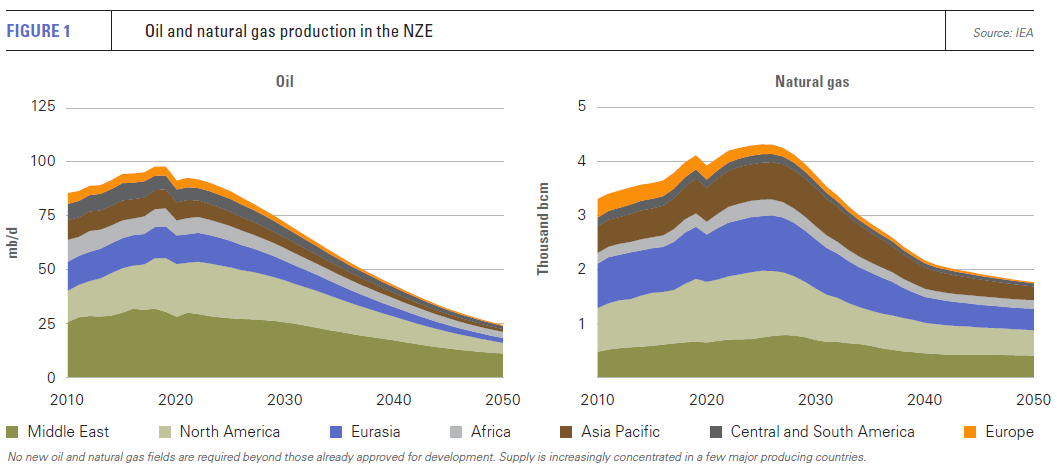

Widdershoven points out that if the world were to stop upstream investment overnight, there would be shortages of oil and gas within five or six years. “Oil and gas production decline naturally by 8% to 12% per year. The IEA knows this. What would the consequences be? It would be a disaster.”

People seem to have forgotten that oil and gas are not just needed to provide energy, but are inextricably linked to almost all of our economic activities, notes Widdershoven, including the production of medicines, food, clothes and fertilisers. “In a very short time there would be 2bn people in the world without adequate food supplies. By viewing oil and gas simply as energy products, the IEA appears to overlook the many other functions they perform,” he says.

Shell court case

Widdershoven does not for a moment believe that the world will heed the IEA’s recommendations. Indeed, many countries have already said as much. But, he notes, “the danger is that politicians and investors in OECD countries do take the IEA seriously. They regard whatever the IEA says as gospel truth. What is likely to happen is that financing for international oil companies (IOCs) will be cut, which will do nothing for the climate, but will undermine security of supply in the OECD.”

The IEA admits that in its net-zero scenario the share of OPEC in oil supplies will grow from 37% now to 52% in 2050, but says this is not a problem, since oil will not serve such an important role in the energy mix. By the same token, says Widdershoven, OECD countries will become even more dependent on external gas suppliers than they are now. “Take Norway. They are still giving out licences for gas exploration. These will be bought by the Russians, Qataris and others if we restrict our own companies,” he says.

The decision by a Dutch court in May to require Shell to reduce its CO2 emissions by 45% by 2030 is a case in point, says Widdershoven. “There will be other court cases. People will say: if the IEA says we should stop investing in oil and gas, then it must be right.”

Already, the IOCs are endangered by dwindling reserves, Widdershoven observes. In an article he wrote for Oilprice.com in April, he noted that “the dwindling of investments, caused by a very tough economic environment and the growth of activist investing, has resulted in a major decline in new projects and the underdevelopment of existing or prospective opportunities. Citibank warned in a recent research note that IOCs, such as Shell, Exxon, and Chevron, are looking at a major decline of reserve/production life spans.”

Toyotas not Teslas

Widdershoven has other criticisms of the report. It comes at a time, he notes, when people are increasingly becoming aware of the limitations of solar and wind power. “Prices of renewable energy have been declining for many years, but they may well start to rise now, as there likely will be shortages of critical materials, and demand will exceed supply. Space limitations are also becoming more keenly felt. People love renewable energy but they don’t want to have a wind turbine in their own backyards.”

The IEA’s assumption that the world will use 7% less energy by 2030, even though the economy will be 40% larger than today, as the roadmap notes, strikes Widdershoven as quite unrealistic. “People are buying EVs, yes, but they are buying even more SUVs. In developing countries people are buying Toyotas, not Teslas.” In addition, the COVID-19 pandemic is likely to boost private car ownership at the expense of public transport and car sharing schemes, Widdershoven believes.

“I am not against energy transition,” Widdershoven stresses. “We have to reduce the use of oil and gas. It’s wasteful to use these commodities only once. We burn them and they are gone.” But the IEA’s roadmap, he adds, “reads like a fairy tale of the Brothers Grimm. And not every fairy tale ends well.”