India’s gas infrastructure challenge [LNG Condensed]

India is steadily becoming more important in determining the future shape of the global energy market. Oil major BP forecasts that Indian primary energy demand will balloon more than two and a half times, compared with 2017, to 1,928 million tonnes of oil equivalent in 2040, at which point India will account for 11% of global energy demand up from 6% now.

The BP Energy Outlook 2019 provides a succinct assessment of Indian energy and gas prospects. “India accounts for more than a quarter of net global primary energy demand growth between 2017-2040” it projects, adding that “gas production grows, but fails to keep pace with demand, implying significant growth in gas imports.”

|

Advertisement: The National Gas Company of Trinidad and Tobago Limited (NGC) NGC’s HSSE strategy is reflective and supportive of the organisational vision to become a leader in the global energy business. |

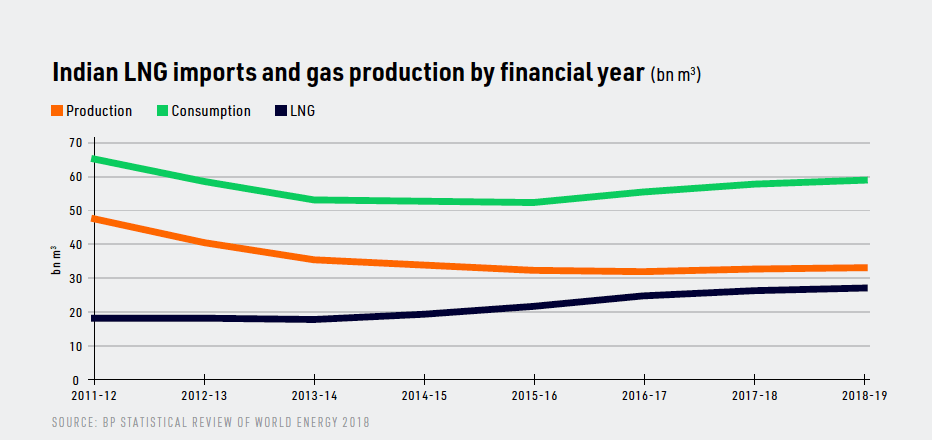

BP forecasts that Indian gas production will rise from 29bn m3 in 2017 to 74bn m3 in 2040. Gas use is projected to increase from 54bn m3 to 185bn m3 over the same period, implying that imports will rise four-fold from 25bn m3 to 111bn m3.

Few analysts would regard BP’s forecast of Indian gas production as unduly pessimistic, given the travails of KG D6 and other fields. Gas production fell sharply in the first half of the 2010s and has been treading water since. Output in the financial year ending March 2019 was a third down on FY2011-12.

On the import front, India plans to bring in substantial amounts of piped gas from Turkmenistan, Iran and elsewhere. However, all the projects involve significant delivery and other risks, not least seemingly-intractable geopolitical problems. They are proceeding extremely slowly.

LNG on the front foot

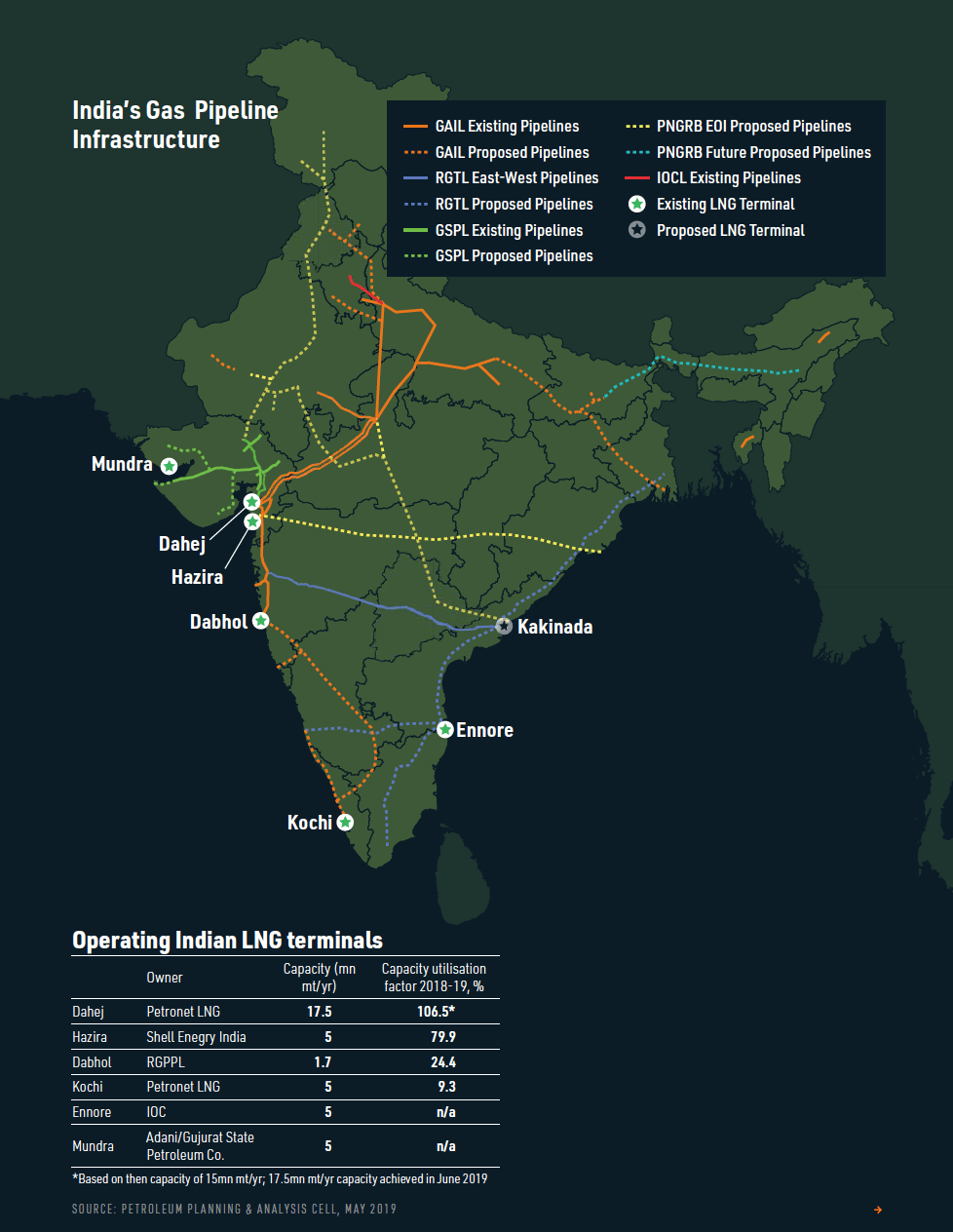

In contrast, LNG imports have been actively pursued. Six regasification terminals with nearly 40mn mt/yr of capacity in total are operational, two under construction and several others approved. It is planned that, by 2025, 11 terminals with 56.5mn mt/yr of capacity will be in use.

LNG imports could continue growing at a substantial rate thereafter, given the constraints facing domestic gas production and piped imports, and given India’s projected growth in energy demand.

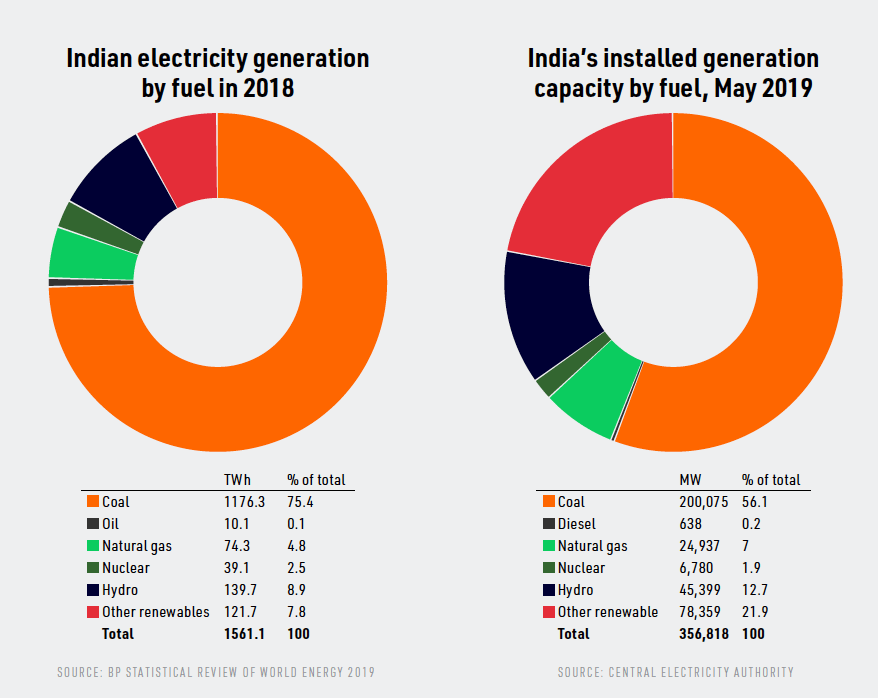

LNG seems an obvious choice to meet much of the country’s additional energy demand. Output from renewables is forecast to surge, but from a low base, while questions hang over expectations that coal use will at least double, owing both to local and global environmental concerns, as well as technical and other constraints, such as land permitting.

Given these factors, it is perhaps surprising that future LNG imports are not forecast to be higher. The muted projections mean gas’ share of Indian primary energy rises relatively modestly, in the case of BP from 6% in 2017 to 8% in 2040, while the International Energy Agency sees gas’ share below 10% in 2040.

Government projections have been much higher. In 2013, India’s Petroleum and Natural Gas Regulatory Board (PNGRB) issued Vision 2030, which forecast LNG import capacity of 83mn mt/yr in 2029-30. At 113bn m3, this was already more than the import level projected for 2040 by BP.

Missed targets

But therein lies the rub. While India has prioritised gas use for years and mandated a growing market share for the fuel, successive government targets have been revised downwards.

In 2000, the India Hydrocarbon Vision-2025 projected that gas would account for 20% of total energy supply by 2025. The target for 2025 was subsequently pared to 15%. Then the date for achieving that reduced share was pushed back to 2030 – a target reiterated by Prime Minister Narendra Modi in December 2018.

There are several reasons for the scaling back of targets. India’s legal, regulatory and pricing framework remains unfavourable to gas developments. In particular, the mandated sale of much gas to generators and fertiliser plants at low prices -- in some cases below cost -- has deterred investment in supply, both domestic and imported.

Inadequate transmission infrastructure has also played a major role in stymieing the targets. In 2013, PNGRB saw the stock of operational gas pipelines rising from 13,000 km to 28,000 km over the following “5-6 years, putting in place most of the National Gas Grid that would connect all major demand and supply centre(s) in India.”

But, by May 2019, only 16,226 km of pipelines were operational, according to the government’s Petroleum Planning and Analysis Cell (PPAC). A further 11,216 km was approved or under construction. Operational lines are concentrated in the west, north and southeast of India.

Lack of finance has delayed many gas infrastructure projects, often reflecting regulatory and pricing issues. Access to land and political or social opposition are also vexed problems. Projects can be delayed for years as cases grind through the courts, while intervening political changes can be equally problematic.

Delays the norm

Protracted delays are thus the norm rather than the exception. Petronet LNG’s 5mn mt/yr terminal at Kochi was commissioned in 2013, but a 400-km pipeline from the facility remains to be completed. The terminal’s capacity utilisation factor was thus only 9.3% in FY2018-19, according to PPAC.

Ratnagiri Gas and Power Private Ltd’s 1.7mn mt/yr Dabhol terminal, also built in 2013, is equally hamstrung by infrastructure constraints. It operated at under a third of nameplate capacity in 2018-19 as it awaits construction of a breakwater to allow operation during the monsoon.

Also delayed is the pipeline to deliver gas from the latest LNG terminal to start up, Indian Oil’s 5mn mt/yr project at Ennore, which began commissioning in early 2019. It will supply 2mn mt/yr of gas to three nearby consumers, but a 1,240-km pipeline to deliver the remaining gas to further-flung consumers is unlikely to be completed for at least two years.

These factors largely explain why Indian LNG terminals are not operating at full capacity. In 2018, the four terminals then operational had 26.7mn mt/yr of nameplate capacity, but only 22mn mt/yr of LNG was imported. With Kochi and Dabhol operating well below capacity, the level of imports would have been lower still had Petronet LNG’s Dahej facility not operated at 106.5% of its then 15mn mt/yr capacity. The terminal’s capacity was raised to 17.5mn mt/yr in June 2019.

It could be argued that while the national gas transmission grid may have been delayed, most of its sections are now finished or under construction. Once the final trunk lines are completed, slotting in additional delivery points and building city gas distribution networks can proceed more quickly.

But that is not necessarily the case since distribution networks face the same issues – financial, regulatory, land access and so on – as transmission lines. This is a problem because city gas is seen as a key driver of future Indian gas demand. Grid power and fertiliser pricing means these markets remain problematic for gas, while its use in transportation, although still a priority, could decline as a result of the government’s policy to switch to electric vehicles from 2030.

City gas plans

There is no question the government is pushing the city gas programme. PNGRB has now awarded licenses covering 402 districts hosting 70% of the population. Most recently, in March, it issued letters of intent for 124 districts under the tenth city gas distribution (CGD) tender. The licensees must install 20.3 million piped gas connections by March 2029.

The preceding round covered 174 districts with commitments to connect 22.1 million customers. But while there has been a marked uptick in licensing, PPAC data shows that in April 2018 operating city gas networks served only 4.3 million domestic consumers, mostly in Gujarat, Maharashtra and Delhi.

Completing the national grid is key to expanding city gas use, with construction of the eastern pipeline a key element in this process. But even with the grid in place, implementing all or even most of the city gas networks by 2029 is a tall order.

By 2029 city gas is likely to account for more than its 16% of current Indian gas sales. However, given the likelihood of delays in implementing many networks, it is uncertain how much gas CGD consumers will buy, meaning the location and number of new LNG terminals is also uncertain.

The key factor determining which LNG import projects are successful is likely to be the presence, as at Kochi and elsewhere, of big industrial gas users or captive power plants nearby to act as anchor customers. These will provide the cash flow necessary to make initial loan repayments while city gas networks are built out.

Uncertain outlook

Given the importance of the city gas sector for future Indian gas use, the likelihood of infrastructure delays means gas use and LNG imports are likely to grow relatively modestly in line with BP’s and other recent projections.

Much stronger growth could only occur if gas-fired electricity generation is promoted. Well over half of India’s 24,867 MW of existing gas-fired plant is unused or under-utilised, with gas use in generation little more than half the 2011 level, although this may increase while spot LNG prices are low at around $4.5/mn Btu.

A sustained increase in Indian gas-for-power generation would require a shift to cost-reflective power pricing, probably together with significant carbon pricing to penalise coal use. If these conditions were met, gas use could soar within months compared with the years needed to build hundreds of city gas networks. However, market-based retail power prices remain a distant prospect.

This article is part of LNG Condensed Volume 1, Issue 6 - June 2019.

_f400x512_1562045302.jpg)

Volume 1, Issue 6 - June 2019

In this Issue:

India's gas infrastructure challenge

Egypt ramps up its LNG exports

LNG and the methane emissions challenge

Argentina - Hanging in the balance

Mozambique LNG

Korean Competition for GGT

and more!

LNG Condensed brings you independent analysis of the LNG world's rapidly evolving markets.

Covering the length of the LNG value chain and the breadth of this global industry, it will inform, provoke and enrich your decision making. Published monthly, LNG Condensed provides original content on industry developments by the leading editorial team from Natural Gas World.

LNG Condensed is your magazine for the fuel of the future.

Sign up to NGW Basic FREE now to receive LNG Condensed monthly (you will find every issue of LNG Condensed in your subscriber dashboard)