Indonesian LNG sector gains new impetus [Gas in Transition]

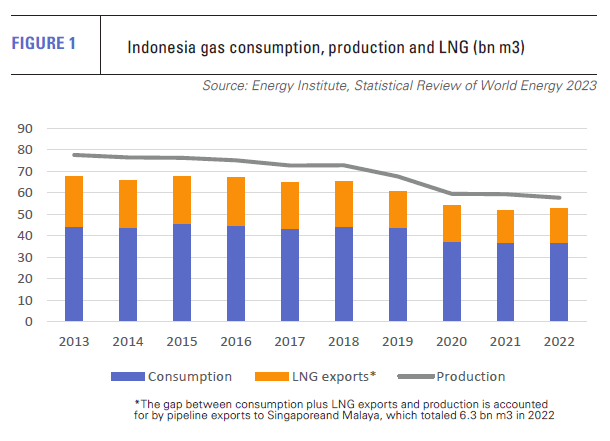

While only around half peak levels, Indonesia’s LNG exports rose last year, having declined almost every year since 2010 (see figure 1). Moreover, this year, after a period of lengthy project delays and low investment, the Indonesian LNG sector appears to be picking up.

The government is still concerned about ensuring sufficient gas supply to the domestic market, so much new capacity is likely to be ring-fenced for internal consumption, but it has stopped short of banning the development of new LNG projects.

Djakarta is balancing LNG production with domestic gas requirements by encouraging the sale of domestically-produced LNG within the country. It’s an uncommon approach, but makes sense when Indonesia’s archipelago nature is considered. Indonesia stretches 5,100 km east to west and 1,800 km north to south. It consists of five main islands, but over 18,000 islands and islets in total. Tangguh LNG, for example, is located about 3,000 km from the capital Djakarta.

The transport of gas in liquid form by ship is a far better option than a geography which defies construction of a national pipeline system.

Meanwhile, on the investment side, positive signs are that Chevron and Shell have sold their stakes in key projects to Eni, Pertamina and Petronas. The new partners should bring investment into the sector. Floating LNG (FLNG) schemes are also planned that will allow small reserves to be developed.

In addition, Train 3 of BP’s Tangguh LNG project started up officially in August, providing a welcome boost to the country’s LNG production capacity. Eni also announced a significant gas discovery in early October thought to hold around 5 trillion ft3 of gas in place, potentially adding another project to the LNG development list and reminding drillers of Indonesia’s continuing prospectivity.

Government sets gas growth target

The government appears to have adopted a more focused approach to its gas sector. Indonesian oil and gas production has fallen in recent years as existing fields have been exhausted and exploration investment has fallen. However, after months of debate, Indonesia’s coordinating minister for maritime and investment affairs, Luhut Binsar Pandjaitan, announced in June that the government had decided not to block new LNG projects, although it would still prioritise domestic supply.

Moreover, Energy Minister Arifin Tasrif said in July that the government wanted to exploit the country’s huge natural gas potential as a bridging fuel in the energy transition. As a result, the government has set a target of boosting national gas production from 5.3bn ft3/d in 2022 to 12bn ft3/d in 2030. Some of the anticipated production will come from projects already under development. Indonesia consumed 3.6bn ft3/d in 2022 with demand flat over the period 2020-2022.

Large-scale projects underway

The largest project currently under development is the Indonesia Deepwater Development (IDD) project in the Makassar Strait off Borneo. The first phase of IDD, named Bangka, came on stream in 2016, with an estimated 1 trillion ft3 believed to be in place and output now standing at 110mn ft3/d.

In July, Chevron agreed to sell its 63% share in IDD to Eni, which now holds 83%, with Sinopec and Pertamina owning the remaining equity.

Eni now hopes to fast track development of the Bangka, Gendalo and Gehem gas fields in phase two, which have combined recoverable reserves of 3 trillion ft3. Their development will be coordinated with production on Eni’s Jangkrik and North Ganal blocks in the Kutai Basin to supply the 11.5mn t/yr Badak LNG plant in Bontang in east Kalimantan.

The $7bn IDD project has been much delayed, with Chevron’s original development plan completed in 2008. The government must now approve a new development plan based on tying IDD’s production to Eni’s other fields. The relevant production sharing contracts (PSCs) expire in 2027 and 2028, so contracts and terms must also be renegotiated and production will not begin before 2027.

The $7bn IDD project has been much delayed, with Chevron’s original development plan completed in 2008. The government must now approve a new development plan based on tying IDD’s production to Eni’s other fields. The relevant production sharing contracts (PSCs) expire in 2027 and 2028, so contracts and terms must also be renegotiated and production will not begin before 2027.

The Gendalo and Gehem fields lie in water depths of up to 1,829 m, which creates technical challenges and will add to development costs, but production will be a lot more substantial than on Bangka at a combined 844mn ft3/d.

Abadi LNG – new momentum?

Indonesian state oil firm Pertamina and Malaysia’s Petronas agreed in July to buy stakes of 20% and 15% respectively in the Masela gas block from Shell, which will exit the project entirely, while Japan’s Inpex retains its 65% share. Gas from Masela, which is located offshore in the Tanimbar Islands close to the maritime boundary with Australia, will be supplied to the Inpex-operated Abadi LNG project, which will have production capacity of 9.5mn tonnes/year.

Apart from shipping gas to Japan, South Korea and other Asian customers, Inpex says that some of the gas could also be used for the domestic market. The company aims to enter the front-end engineering and design (FEED) phase in late 2024, with a final investment decision (FID) due two years later, at the same time as that on Masela, once the Japanese company has long-term supply contracts and financing in place. The entire project will require investment of close to $20bn.

Inpex had originally wanted to develop Masela as an FLNG project, but Indonesian President Joko Widodo insisted in 2016 on an onshore liquefaction plant to boost the domestic economic benefits of the project. In return, Djakarta offered a 27-year operating licence rather than 20 years.

In April 2023, Inpex submitted a new development plan that includes carbon capture and storage (CCS). Production is not likely to start until the early 2030s, although Indonesia’s Ministry of Energy & Mineral Resources has said that it could be as soon as the end of 2029.

The CCS part of the project is something of a pathfinder as Indonesia explores the technology’s potential and seeks to limit the carbon footprint of its LNG production. According to the government, the country could store about 400 gigatonnes of carbon in exhausted oil and gas reservoirs located both on and offshore, as well as in saline aquifers. It has also offered to store carbon for other East Asian countries.

Tangguh LNG train 3 starts up

The third train at BP’s Tangguh LNG plant in West Papua was completed in August, seven years after the FID was taken, in part owing to delays caused by the COVID-19 pandemic. The natural gas also proved high in carbon dioxide, hydrogen sulphide and mercaptans, which required “advanced treatment, such as acid gas removal and acid gas incineration, as well as a special molecular sieve design,” according to Italian engineering company Saipem. A CCS element is to be added to the project at a later date.

Train 3 adds 3.8mn t/yr of capacity taking total project capacity up to 11.4mn t/yr. The engineering, procurement and construction contract, including the construction of a new 1 km jetty and loading berth, was awarded to a consortium of Saipem, Tripatra and Chiyoda Corporation. Under a contract with Indonesian power company Perusahaan Listrik Negara, 75% of all production will be ring-fenced for sale in other parts of the domestic market.

Along with Badak LNG and the newly-expanded Tangguh LNG, Indonesia has three operating LNG projects with a total capacity of 23.9mn t/yr. The third plant is Donggi-Senoro, which has 2mn t/yr from a single train.

The Tangguh field accounts for 20% of the country’s gas production, but the completion of the third train requires field output to increase from 700mn ft3/d to 2.1bn ft3/d.

In December 2022, the BP-led consortium extended the Berau, Muturi, and Wiriagar PSCs that will supply the project by 20 years, so they will now stretch until 2055. The other stakeholders on the three blocks are MI Berau, CNOOC Muturi, Nippon Oil Exploration, KG Berau Petroleum, Indonesia Natural Gas Resources Muturi and KG Wiriagar Petroleum.

Floating LNG to tap Indonesia’s marginal gas fields

Genting Oil & Gas is to develop Indonesia’s first FLNG project with production capacity of 1.2mn t/yr. It has set up a subsidiary, PT Layar Nusantara Gas (PTLNG), to develop, own and operate the FLNG vessel, an onshore gas processing plant and associated pipeline in West Papua. The vessel will be located on the Kasuri block in which Genting holds a 100% interest.

The project involves the supply of 230mn ft3/d of natural gas to the FLNG facility, plus another 101mn ft3/d to an ammonia and urea plant to be built in West Papua, all from the Asap, Merah and Kido fields on Kasuri.

In September, Genting signed an agreement with Wison Heavy Industry of China for $43mn of long lead items for the project, such as the cold box, compressor and generator sets, ahead of the engineering, procurement, construction, installation and commissioning process. Wison is already undertaking the FEED study, which is expected to be completed by November 2023. If all goes well, first production could come on-stream by mid-2026.

If the Chinese company builds the vessel as expected, it will be the third FLNG that it has built and the world’s ninth. As Wison chairman Hua Bangsong pointed out, FLNG is a good fit with Indonesia’s archipelago nature and abundant marginal gas resources.

A second FLNG project is also planned. In September, Malaysia’s Bumi Armada signed a non-binding agreement with Pertamina and gas trading firm PT Davenergy Mulia Perkasa on a floating project on the Madura gas field and surrounding reserves, which are located between the islands of Madura and Java, near the city of Surabaya.

Bumi Armada and Pertamina will develop and operate the project, while the third partner will market the LNG. A timetable for development has not been released, but the developers have suggested that it would take three years from FID to first production and that talks with potential offtakers are already underway. Pertamina’s participation suggests that the government will support the project.