Ineos Completes Shale Deal

UK-based Ineos said November 1 it has completed an acquisition of Total's interests in some UK onshore shale gas licences held jointly with IGas. A day ago, it announced completion of an unrelated transaction with BP.

Total though is not exiting the UK shale gas business, in contrast to French Engie which did eight months ago when it sold its interests to Ineos.

IGas, also UK-based, said there is no change to its own financial position or equity interests resulting from this transaction, and that Total's obligations to carry IGas in respect of PEDL 139 and 140 have been taken over in full by Ineos.

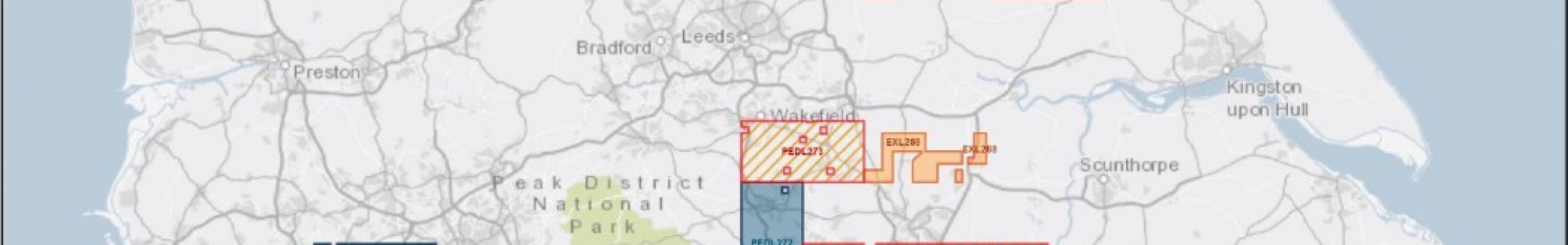

Privately-owned Ineos said it has acquired Total’s entire 40% interest in PEDLs 139 & 140, and a 30% interest in PEDL 273, 305 & 316 (so three-fifths of Total’s current 50% holding). Ineos Shale chief Ron Coyle said: “Our acquisition of these assets represents an important development for Ineos Shale," adding: "Shale gas represents an exciting opportunity for the UK, and has the real potential to bring much needed jobs and investment to local communities. The continuing growth of Ineos’s portfolio of licences means we will be at the very forefront of this transformational industry”. Ineos is currently defending its right to use injunctions against protesters in the English High Court.

IGas CEO Stephen Bowler said: “This transaction comes at an exciting time for IGas and the wider UK shale industry and we are very pleased to welcome Ineos as a partner into these blocks, and alongside Total in our 14th round licences." IGas has not, as yet, applied to conduct any fracking as part of its shale gas exploratory drilling where it is operator. Equity licences in the five licences post-transaction are below.

Graphic credit: Ineos

Separately Ineos said October 31 it had completed its acquisition of the North Sea Forties Pipeline System (FPS) and Kinneil oil terminal from BP.

Ineos described FPS as "a strategic UK asset that delivers almost 40% of the UK’s North Sea oil and gas output" and said it had strengthened its own long term oil and gas activity following the 2015 acquisition of LetterOne's Breagh and Clipper South interests, and Ineos' $1.05bn takeover of the Dong E&P business announced this May and completed September 2017.

Ineos said that 20% of the oil that passes down FPS feeds its Petroineos oil refinery that in turn provides more than 80% of Scotland’s transport fuel.

Mark Smedley