LNG demand from shipping faces uncertain future [Gas in Transition]

The process may be slow, but shipping is changing and bringing with it modest increases in LNG demand. However, the level of uncertainty is high, owing to the adoption of dual-fuel engines, which allows the use of traditional marine fuels when price competitive, and, because the greenhouse gas (GHG) emissions reductions associated with LNG are under continual re-evaluation and challenge.

Classification society DNV puts the current global fuel market for shipping at about 280mn tonnes of oil equivalent (toe)/year. Quoting International Maritime Organisation (IMO) data, DNV says LNG consumption in shipping rose from 12mn toe in 2019 to 14.5mn toe in 2021 (14.6mn and 17.7mn tonnes of LNG respectively).

This comprises about 7% of total fuel consumption for ships above 5,000 GT (gross tonnage). However, more than 95% of the LNG consumed is boil-off gas used on LNG carriers (LNGCs) and therefore not traded fuel.

This comprises about 7% of total fuel consumption for ships above 5,000 GT (gross tonnage). However, more than 95% of the LNG consumed is boil-off gas used on LNG carriers (LNGCs) and therefore not traded fuel.

In a report published in September 2022, the International Council on Clean Transportation looked at the relationship between the GT of LNG capable ships and LNG demand in the maritime sector up to 2022 to estimate that global shipping demand for LNG would grow from 13.08mn t in 2019 to 36.2nm t in 2030. The estimate includes LNGCs.

Shell’s LNG Outlook 2023 provides a forecast for LNG demand in the marine sector, excluding LNGCs. It sees demand rising from around 3mn t/yr in 2023 to about 8mn t/yr in 2026. It noted an increase in 2023 of 41% to 355 operating LNG vessels and a jump to 521 for LNG vessels on order.

Data from Clarksons Research puts the current number of commercial vessels in service that are LNG-capable at 936 with an additional 875 ships on order.

How ready is LNG-ready?

Container shipping has been one of the fastest LNG adopters, but even so LNG-capable or LNG-ready vessels make up just 3.6% of the operational fleet, even if almost 30% of new ships on order will be LNG capable or ready. The container ship segment consumed about 59mn t of fuel in 2021.

With LNG prices having proved very volatile over the last 24 months, the impact on demand of both LNG-capable and LNG-ready ships has to be treated with caution. If LNG is not cost competitive, dual fuel ships will burn conventional marine fuels.

Moreover, LNG-ready ships use standard fuel oil and still need to be retrofitted with new equipment in order to run on LNG. They are designed to reduce the cost and cargo volume impact of conversion. Opting for dual-fuel engines is not a cheap choice, even if the ship is LNG ready, adding some 20% or more to the cost of a new or LNG-ready vessel.

LNG ‘readiness’ also comes in different degrees. The 2014-built Sajir was designed as LNG ready, but conversion by Hapag-Lloyd took nine months and the installation of a 6,700 m3 gas storage system took up an area equivalent to 350 containers. The retrofit, carried out in 2020, cost an estimated $35mn and the company said it was too expensive to proceed with additional conversions.

In the bulk carrier segment, the figures show LNG ships account for 0.9% of the operational fleet and 5.3% of newbuilds, but more than half of these vessels are LNG-ready, as opposed to LNG-capable. The same is true in the tankers and container ship segments (about 50% LNG-ready).

In contrast, in the car carrier segment, 1.7% of the operational fleet is LNG capable, but a huge 83% of newbuilds will be LNG capable.

Changing fleet

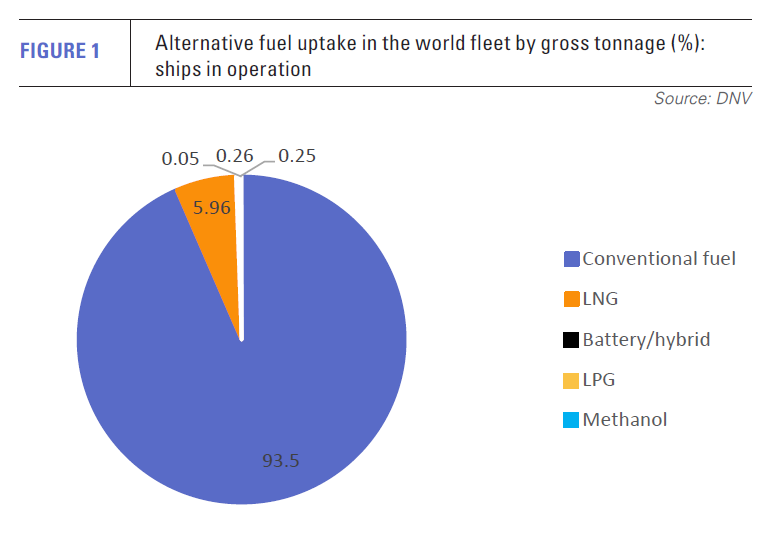

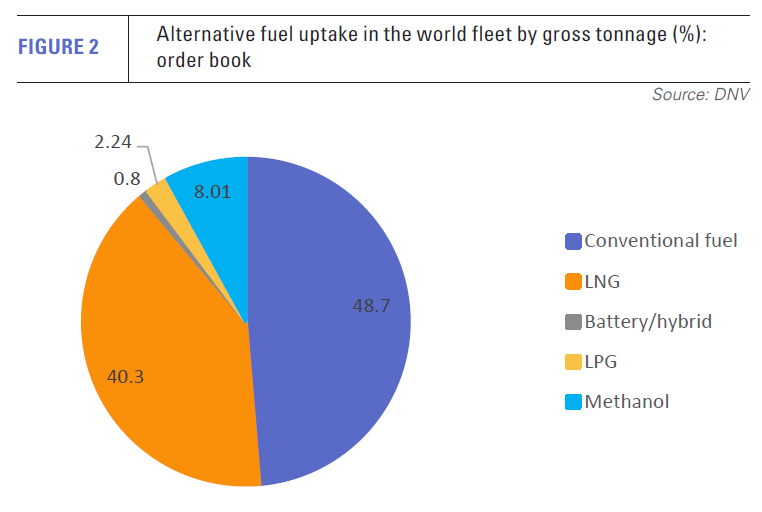

In its forecast to 2050, DNV also provides data on the uptake of alternative fuels. Based on gross tonnage – a better measure for fuel consumption than the number of ships – 93.5% of vessels in operation use conventional fuel, while 51.3% of ships on order will be capable of using alternative fuels, a figure up from 33% last year (see figures 1 & 2). Of the new orders, 40.3% can use LNG, so the fuel still dominates in terms of alternative fuel options for ship owners.

According to Danish Ship Finance’s (DSF) May 2023 Shipping Market Review, the order book represents about 10% of the total fleet. However, there are far fewer ships on order than compared with the last boom period in new shipbuilding, which took place in the years leading up to 2008. Nonetheless, 2022 “saw the strongest investor appetite for new vessels since 2008”, driving new building prices in April to among the highest 15% seen since 2000.

However, the report says that a potential surplus is building up in shipping segments with large order books, including LNGCs, LPG carriers and containerships. The period of high returns is waning and contracting activity failed to maintain its momentum in the first quarter of this year. This is likely to reduce new ships orders and thus the current pace of fleet renewal.

However, the report says that a potential surplus is building up in shipping segments with large order books, including LNGCs, LPG carriers and containerships. The period of high returns is waning and contracting activity failed to maintain its momentum in the first quarter of this year. This is likely to reduce new ships orders and thus the current pace of fleet renewal.

Ship building tends to be cyclical rather than linear with periods of oversupply increasing scrapping rates and preceding periods of new building.

Few rewards for first movers

Moreover, the report says there are few signs that investors renewing their fleets with dual-fuel vessels are being rewarded. It says: “the ability to burn sustainable fuels that are not yet available seems a problematic investment prospect in the short term, since it may yield a negative return on invested equity until the markets start rewarding such capabilities.”

The report says, “inactivity currently seems the most profitable strategy”.

LNG, of course, is available. There are 45 LNG bunker vessels in operation worldwide, according to DNV, a third of which have a capacity of 10,000 m3 or more. In addition, 11 new bunker vessels with capacity over 10,000 m3 are on order for delivery in the next few years.

The problem for LNG is the difference in price between LNG and conventional fuels and the lack of reward for using a lower carbon fuel.

The DSF report says those segments where fleet renewal is currently fastest – containers, LPG and LNG – can expect periods of lower freight rates and declining second hand prices in coming years, owing to the likelihood that they will experience periods of surplus vessel capacity. Container ships make up the largest proportion of new orders at 30%, followed by LNGCs with 25%.

Nonetheless, the report says 47% of new vessels on order will have dual-fuel engines and various energy saving devices, such as wind assistance or air-lubricated hulls. For new orders placed in 2022, 60% will have dual-fuel engines, despite the likelihood that the short-term impact on invested equity will be negative.

Methanol gains ground

The next largest alternative fuel segment behind LNG is methanol, which accounts for just 0.05% of GT in operation, but 8.01% of new orders. DNV says that while there are ongoing demonstration projects for ammonia-fuelled ships, there are none in the official order book. There are five ships on order which could be fuelled by hydrogen, but they are all small and hydrogen drops out of the data when GT is considered.

Significantly, Maersk, one of the world’s largest container shipping lines, has announced orders for a number of dual-fuel ships with methanol rather than LNG. The latest order in July was for six 9,000 TEU mid-sized container ships for delivery in 2026-27 to be built by China’s Yangzijiang Shipbuilding Group. The announcement brings the number of methanol-capable vessels on order with Maersk to 25, a quarter of all methanol-capable ships under construction.

But, as with dual-fuel LNG ships running on standard marine fuels, these methanol-capable ships are unlikely to run on methanol until it is much cheaper and more available. Maersk has signed memorandums of understanding with nine methanol producers, but admits that much more will be required to make the fuel readily viable.

With more LNG capacity coming online and production already at scale, and with oil prices on the rise as Saudi Arabia extends its voluntary output cuts, LNG looks a better option both in terms of availability and likely future pricing.

LNG’s low-carbon status under continual challenge

The reason Maersk has opted for methanol is that the company does not see LNG delivering GHG emissions reductions sufficient for its own net zero carbon goals and those set by the long-anticipated IMO 2023 strategy, adopted in July.

LNG’s carbon profile remains an area of continued uncertainty and one which will impact how the fuel is treated as shipping is brought into the EU’s Emissions Trading System. Carbon pricing of marine fuel markets may help LNG vis-à-vis oil fuels, but the real benefits will fall to zero carbon fuels, making them the bar by which a ship can be judged future proof.

Meanwhile, gas’s GHG impact continues to be reevaluated. A new study published in the journal Environmental Research in July, entitled Evaluating net life-cycle greenhouse gas emissions intensities from gas and coal at varying methane leakage rates, comes down heavily on gas, arguing that, at certain rates of methane leakage, it is no better than coal.

It says that global gas systems with a 4.7% leakage rate over a 20-year timeframe or 7.6% over a 100-year timeframe have life-cycle GHG emissions intensities on a par with coal.

The report says that studies find methane leakage rates ranging from 0.65% to 66% in numerous US oil and gas basins and wide-ranging methane leakage from gas has been observed globally. The report adds that US and international studies focus on upstream methane emissions and do not account for methane leakage from remaining parts of the gas value chain.

Equally, the findings also show that, if methane leakage is low, gas supply chains can have significantly lower emissions intensities than coal, where methane intensities also vary considerably across different supply chains and types of coal mine.

The general takeaway will undoubtedly be ‘gas is no better than coal’, and LNG in shipping will suffer as a result, even though coal has nothing to do with maritime transport.

The report’s real message is that the focus should be on leakage detection and control. As its concluding sentence says: “Visibly tracking and quantifying the extent of climate damage done by leaking gas can help public and private decision makers prioritise and accelerate methane emissions controls so that global gas assets emit GHGs well below coal.”

However, the fact is that LNG’s environmental credentials have been under long-term fire. Different studies have provided different findings. According to industry organisation SEA LNG, the use of LNG as a marine fuel, depending on engine technology, can deliver emissions reductions of up to 21% on a well-to-wake basis compared with conventional marine fuels.

However, the fact is that LNG’s environmental credentials have been under long-term fire. Different studies have provided different findings. According to industry organisation SEA LNG, the use of LNG as a marine fuel, depending on engine technology, can deliver emissions reductions of up to 21% on a well-to-wake basis compared with conventional marine fuels.

However, the World Bank has found that even in a temporary role, the use of LNG in sea transport would reduce GHG emissions by “a modest amount at best” and, at worst, “result in a peak GHG disbenefit of 9% by 2030.”

Broadly, the pendulum appears to be swinging towards the World Bank’s viewpoint. The IMO’s 2023 Greenhouse Gas Strategy agreed to reach net-zero GHG emissions from international shipping by around 2050, and to develop a marine GHG fuel standard and a maritime GHG emissions pricing mechanism, which could enter force in 2027.

According to the World Bank, in this policy context, environmental, economic and financial reasons “rule out a major role for LNG in shipping’s decarbonisation,” suggesting that in the current high price environment the window of opportunity for LNG as a shipping fuel may be closing.