LNG “saves the day” in 2022: IGU

“LNG saved the day and supplied more than just fuel, it provided energy security and kept the lights on” in Europe in 2022,” the president of the International Gas Union (IGU), Li Yalan, said in introducing the organisation’s World LNG Report in mid-July. She added that LNG provides flexible energy that “will be necessary for the world to continue securely on its energy transition journey.”

The report provides a comprehensive review of the global LNG industry and markets after the most turbulent year in its history. It also offers important insights as the gas industry prepares for delivering reliable, flexible, efficient, secure, and sustainable energy for the years ahead.

Following Russia’s invasion of Ukraine, the LNG industry demonstrated incredible flexibility and agility, delivering an additional 66% of LNG to Europe in 2022 to replace the lost Russian pipeline gas.

This demonstrates that the LNG market is becoming increasingly globalised, making it possible to re-route massive volumes of energy to wherever is needed in a matter of months.

The key findings are:

-

Global LNG trade grew by 6.8% in 2022, reaching a new record of 401.5mn tonnes and according to the International Energy Agency (IEA) its value surged to an all-time high in 2022 to $450bn.

-

By April 2023, the global LNG trade connected 20 exporting markets with 48 markets with importing infrastructure.

-

In 2022, global liquefaction capacity grew by 4.3% to a total of 478.4mn t/yr.

-

About 75% of this increase came from the US, which now has the largest operational liquefaction capacity worldwide, at 88.1mn t/yr.

-

The volume of sanctioned liquefaction capacity declined to 25.2mn t/yr compared to the 50mn t/yr in 2021.

-

But as of April 2022, 136.2mn t of new liquefaction capacity was under construction or approved for development.

-

2022 also saw record new regasification capacity approved, and some brought online, in record time in Europe, notably Germany.

-

More than 10 European markets initiated new regasification terminal construction plans with 26 projects totalling 104.5mn t/yr.

-

Nearly 70% of the new capacity will come from floating terminals, which can be brought online faster and relocated when needed.

-

Very high prices at the European market entry – with TTF reaching a record high at $93.8/mn Btu on August 26, 2022 – made the massive redirection of LNG flows from Asia to Europe possible and balanced the short-term market, while also causing demand destruction in some Asian markets.

-

The traditionally higher Asian spot market price benchmarks traded at a discount to the European market for the first time for 85% of the February 2022 to January 2023 period.

-

Asian demand reduced significantly in most locations, with the two fastest growing LNG markets in recent years, China, and India, reducing imports by 19.3% and 17.7% respectively.

The 2022 crisis demonstrated that LNG plays a crucial role in security, reliability and sustainability of energy around the world, but long-term policy clarity is necessary for gas project development and rebalancing the markets.

While prices moderated closer to historically average levels at the start of 2023, they remain elevated with an ongoing risk of a return to 2022 conditions. The IGU warns that the crisis is not yet over. This is echoed by the International Energy Agency (IEA). Uncertainty remains high and the market is still out of balance. It recommends that “it is imperative that governments around the world better define their long-term energy security plans – both in the coming two or three years and after 2030 as the world will continue to demand more energy.”

As Yalan observed, project designs are increasingly implementing future-proofing to minimise operational emissions and enable deep decarbonisation going forward. She said “I look forward to closely following the evolution of the great recent trend of emissions reporting transparency by the industry players who have done an incredible job in continuously driving down emissions throughout the value chain.”

Impact of the crisis on the LNG industry

The energy crisis caused massive upheavals in energy flows but also energy security. This and the massive reduction in Russian gas supplies to Europe at a time of tight supplies sent natural gas prices to highs they had never seen before, driving consumers to switch to oil and coal wherever possible.

In Europe LNG ultimately saved the day. Europe imported over 66% additional LNG in 2022, compared with 2021 to offset the shortage, with 44% of its total LNG imports coming from the US.

Australia retained its position as the largest exporter in 2022 with a total of 80.9mn t of LNG exports, with US second at 80.5mn t and Qatar closely behind at 80.1mn t.

Growth in LNG exports in 2022 was largely driven by the US with an increase of 10.5mn t. In April 2023, the US exported more LNG than ever on a monthly basis, even after increasing exports by 16% in 2022, and is still constructing more liquefaction terminals.

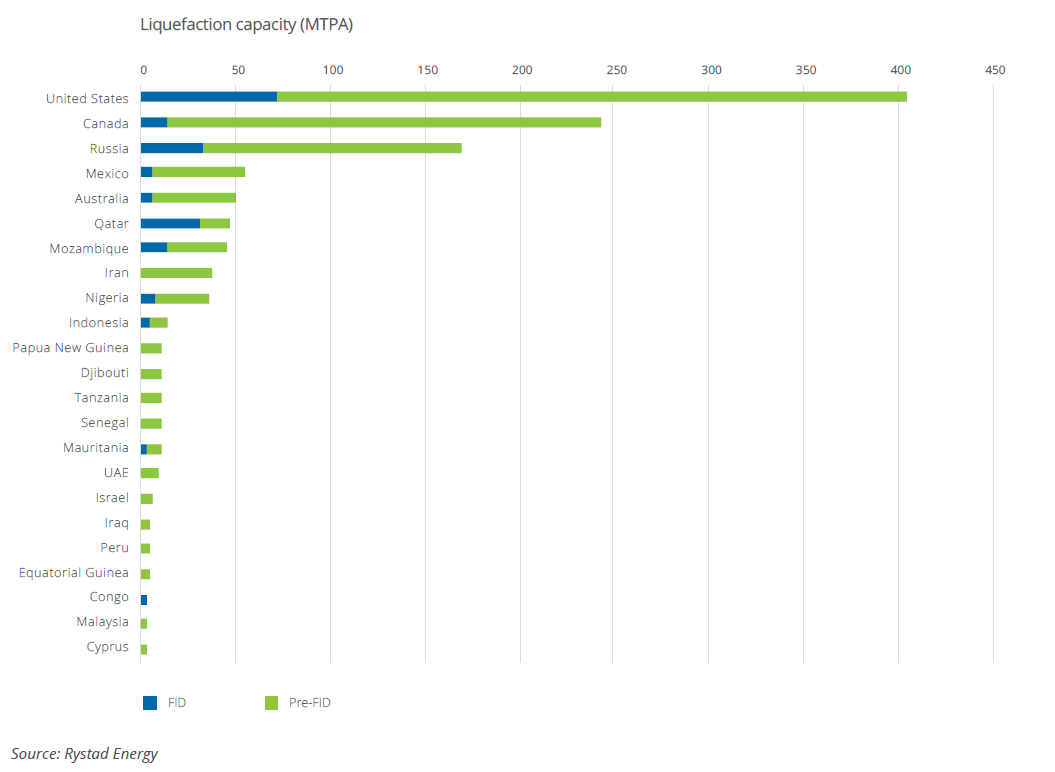

Increasing demand for LNG has led to fast-tracking of liquefaction capacity expansion plans and project FIDs, especially in the US (see figure 1). New capacity expected to be sanctioned this year is likely to be well-over twice the capacity approved in 2022.

Figure 1: Global FID and pre-FID liquefaction capacity by market, end-April 2023

The crisis also led to a massive expansion of regasification facilities, with more than 10 European markets – including Germany, the Netherlands, Finland, France, Croatia and Italy – having initiated the construction of new capacity. The EU’s total LNG regasification capacity is expected to grow from about 5mn t in 2022, up to more than 75mn t by 2025.

According to IGU, in 2022, the volume of approved liquefaction capacity declined to 25.2mn t compared to the 50mn t of capacity approved in 2021. In IEA’s view activity was lower than many anticipated, due in part to rising construction costs and in part to continued reluctance among potential buyers to commit to new long-term LNG contracts in the face of long-term demand uncertainty and high prices.

However, by early July 2023 about 45.25mn t/yr long-term contracts had been signed worldwide, led by China. In fact, Rystad Energy states that China’s LNG imports are expected to double over the next ten years. India has just signed long-term LNG import deals with ADNOC LNG and TotalEnergies, as it races to raise the share of gas in its energy mix to 15% by 2030 from 6.2% currently. Fears of future energy shortages are prompting many buyers to lock-in LNG supplies.

For similar reasons, spot LNG trade is shrinking. The share of spot LNG fell to 27% in 2022 in comparison to 31% in 2021, except perhaps in Europe. Its gas and climate policies and uncertainties about the longer-term role of gas in its energy mix, do not encourage European utilities to enter into long-term gas purchase contracts. Most long-term contracts signed this year by European companies involve oil companies and LNG portfolio players that are not confined to European energy markets, but also have access to Asian markets.

Oil and gas majors are confident that LNG will be a growing market all the way to 2050 and, on that basis, they plan to accelerate their LNG investments. That is what BP’s New Momentum scenario, designed to capture the broad trajectory along which the global energy system is currently travelling, is showing. That is also the projection in Shell’s LNG Outlook.

LNG outlook

Shell published its 2023 LNG Outlook in February. Its executive vice president for energy marketing, Steve Hill, said “the war in Ukraine has had far-reaching impacts on energy security around the world and caused structural shifts in the market that are likely to impact the global LNG industry over the long-term.” He added that it has also underscored the need for a more strategic approach through longer-term contracts to secure reliable supply to avoid exposure to price spikes.

For the next four years, there will be significant LNG supply additions, while demand is expected to remain robust, keeping prices relatively high. But Shell warns that without new investment in additional supply, another supply-demand gap could emerge after that.

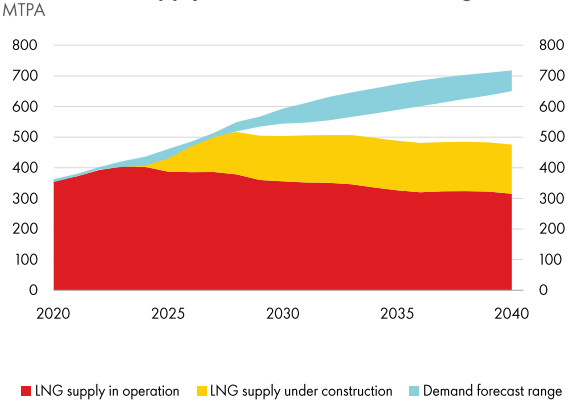

Shell expects LNG demand to carry on increasing to reach between 650 and 700mn mt/yr by 2040 (see figure 2).

Figure 2: Global LNG supply-vs-demand forecast

Source: Shell LNG Outlook 2023

According to Shell projections, LNG supply under construction is enough to get the world to just under 500mn t/yr by 2040. This leaves a gap of 150 to 200mn t/yr to be supplied by new, but yet uncommitted, projects.

This contrasts with IEA’s Net Zero by 2050 scenario that requires LNG demand to fall to 200mn t/yr by 2040. But that is based on back-casting, indicating what needs to be done, but it is not supported by realities. With China, and other Asia developing economies such as India, putting considerable weight on economic growth and energy security, in parallel with massive growth in renewables, LNG demand in Asia is likely to carry on rising beyond 2040.

Based on this forecast, Shell recommends that more investment in liquefaction projects is required to avoid a supply-demand gap that is expected to emerge by the late 2020s. Certainly the oil and gas majors appear to agree, making LNG increasingly central to their future business. A good example is ExxonMobil’s decision early July to set out a clear timeline for its Rovuma LNG project in Mozambique, with increased capacity to 18mn t/yr. This is important – the volatility in energy prices over the last two years shows how quickly the energy market can destabilise without sufficient reliable supply.

Jean Abiteboul, president Group of Liquefied Natural Gas Importers (GIIGNL), said: "the challenge for the future will be to establish those market conditions that will trigger LNG investments, which, in an increasingly growing LNG market environment, are ever more necessary to guarantee security of supply at an affordable price."

Shell also recommends that diverse new technologies to reduce emissions from gas and LNG supply chains will help to consolidate LNG’s role in the energy transition.

Europe and the US plan to scrutinise the carbon footprint and methane emissions of future gas sources, including LNG, putting additional pressure on LNG producers and suppliers to focus on limiting emissions from their operations. Measures to use renewable electricity at liquefaction plants, cut flaring, reduce methane leaks and other operational emissions, and enable carbon capture are becoming increasingly important.

IGU warns that “while prices moderated closer to historically average levels at the start of 2023, they remain elevated with an ongoing risk of a return to 2022 conditions. Meanwhile, the European reliance on the LNG spot market remains strong (around 70% of the continent's imports in 2022 are estimated to have been sourced from the spot market) and this would increase the volatility of European gas prices.” Despite this price easing, the risk of a return to high prices remains elevated.

The IEA shares this view in its Global Gas Security Review 2023 published in July, warning that “full storage sites are no guarantee against market volatility during the winter,” adding that “Major uncertainties remain ahead of the upcoming heating season.” It also forecasts that “Global gas demand is expected to remain broadly flat in 2023 and return to moderate growth of 2% in 2024, supported by the expansion of economic activity,” especially in Asia.

Challenges

Bloomberg is warning that “a record-breaking wave of investments into US LNG may be running out of steam as global competition and a push for cleaner energy is finally catching up.”

There is a view that the rise of renewables will impact LNG demand as early as 2030, as will the International Maritime Organization’s decision in July to implement stricter emissions standards.

However, the 2023 Statistical Review of World Energy published by the UK's Energy Institute in July, showed that energy transition is happening at a slow pace, with no perceptible impact on the demand for fossil fuels. Natural gas and LNG will be needed for a long-time to come. The developments in 2022 reinforced that. They demonstrated LNG’s essential value as a flexible, reliable, and available energy resource for a secure energy transition

According to Bloomberg, more than 36mn t/yr of new LNG export capacity has been approved for construction so far this year, the highest ever for the US. The latest project, NextDecade’s $18.4bn Rio Grande facility in Texas, that also includes emissions reduction provisions, was sanctioned mid-July. But Bloomberg is also warning that “the window for additional US LNG projects is closing.” BNEF believes that all “top pick” US projects have already been approved.

While Europe is still in the process of replacing Russian pipeline gas, mostly with LNG, it is also looking to reduce fossil fuel use by 30% by 2030 and carry on reducing it all the way to net-zero by 2050.

Qatar is aggressively selling LNG from its massive 49mn t/yr expansion, coming online by 2027, putting it in direct competition with some of the proposed American plants planning to start around that time.

Bloomberg warns that projects that have not secured financing and begin construction in a year or two, would find it difficult to start production this decade. The longer it takes the fiercer competition for market share is likely to be.

But LNG provides energy security and supports transition, as it replaces coal and oil, accelerates integration of renewables, and paves the way to its own decarbonisation.

GIIGNL, representing LNG importers, believes that with global LNG imports rising 60% in 2022 - as Europe rushed to replace Russian pipeline gas - additional investments in LNG are now needed more than ever to ensure security of supply.

Jean Abiteboul, president GIIGNL, pleaded that the “pivotal role of LNG in the energy transition should be acknowledged by political decision makers and other stakeholders, in order to avoid counterproductive pressure on investors and lenders that could hurdle the financing of additional LNG projects. Such investments are necessary to ensure a sustainable but also a reliable and socially acceptable energy mix.” With LNG needed in the longer term, this is essential.

)