Major energy exporters race to lead in global hydrogen trade

The time is ripe for the world's major energy exporters to accelerate the energy transition, and mastering the hydrogen trade could make a difference, says Wood Mackenzie, a Verisk business (Nasdaq:VRSK).

The global energy market was worth an eye-watering US$2 trillion in 2020, contributing to more than 9 billion tonnes of carbon dioxide equivalent (CO2e) emissions. In the same year, the top five energy exporters – Saudi Arabia, Russia, Australia, the United States of America, and Indonesia – produced more than half of all energy traded.

|

Advertisement: The National Gas Company of Trinidad and Tobago Limited (NGC) NGC’s HSSE strategy is reflective and supportive of the organisational vision to become a leader in the global energy business. |

Wood Mackenzie research director Prakash Sharma said: “The global energy trade is set to see its largest disruption since the 1970s and the rise of the Organization of the Petroleum Exporting Countries (OPEC).

“In addition to investing in renewables to slash emissions and enhance energy security, countries and industries are now looking to electricity-based fuels and feedstocks, and hydrogen could be the gamechanger. A key differentiator is hydrogen’s massive potential in traded energy markets. Low-carbon hydrogen and its derivatives could account for around a third of the seaborne energy trade in a net zero 2050 world.”

Between now and 2050, Wood Mackenzie forecasts global demand for hydrogen to increase between two- and six-fold under our Energy Transition Outlook and Accelerated Energy Transition (AET) scenarios. Under our AET-1.5 scenario (1.5 °C warming), low-carbon hydrogen demand reaches as much as 530 million tonnes (Mt) by 2050, with almost 150 Mt of that traded on the seaborne market.

Low-carbon hydrogen import demand from Northeast Asia and Europe could account for about 80 Mt, equivalent to 55% of seaborne hydrogen trade, and 23 Mt (16% of total seaborne energy trade), respectively.

Several countries are hoping to benefit from developing export-oriented hydrogen megaprojects, with blue and green hydrogen projects being developed in Russia, Canada, Australia, and the Middle East. In the burgeoning green hydrogen space, nearly 60% of proposed export projects are located in the Middle East and Australia, principally targeting markets in Europe and Northeast Asia. Over the last 12 months, there has been a 50-fold increase in announced green hydrogen projects alone.

Project developers, lenders and buyers will be drawn to locations with a proven track record of exporting natural resources, suitable conditions for low-cost renewable electricity and the potential for large-scale carbon capture.

Several countries are hoping to snatch a slice of the hydrogen trade pie. Saudi Arabia, Brazil, Chile, Oman and Kazakhstan have all announced megaprojects targeting the export market, while others, such as Russia and Canada, have vast low-cost gas resources and plenty of carbon capture and storage (CCS) capacity.

Vice Chairman Gavin Thompson said: “While no two hydrogen export projects look the same, the most obvious difference in proposed projects is between blue and green hydrogen. But portraying this as an either-or choice is an over-simplification.”

While current costs of green hydrogen production are typically more than three times higher than those of blue hydrogen, green hydrogen costs are expected to fall as electrolyser manufacturing technology improves and renewable electricity costs decline. An expected drop in costs will support a longer-term pivot from blue to green hydrogen. However, each market has unique characteristics and cost declines will not be uniform.

Thompson said: “The reality is that the world needs both to achieve the required pace of global decarbonisation. Blue hydrogen production has a scalability advantage over green hydrogen at present and can already be developed in the requisite volumes, though lead times are longer.

“Most proposed projects are currently a combination of the two. A blue hydrogen exporter in Australia or the Middle East, for instance, could establish a market position while expanding into green hydrogen as costs decline over time and capacity becomes available. Producers could thus build out their low-carbon hydrogen supply chains as green hydrogen becomes more competitive over time.”

Suppliers with access to major, low-cost gas resources and carbon capture and storage (CCS) have a natural advantage for blue hydrogen exports. Regions such as the Middle East, Russia, and the United States, with competitive onshore drilling costs, appear best placed to develop an interregional export position. Countries able to exploit existing ammonia infrastructure will also be on the front foot.

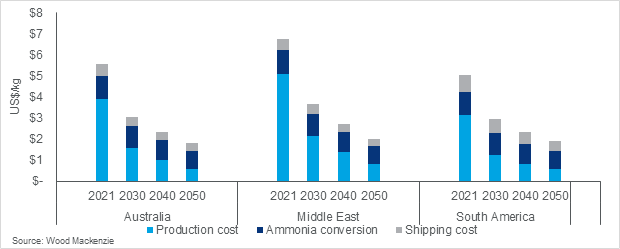

Similarly, suppliers with access to low-cost renewables will tip the scales when it comes to green hydrogen production. Based on Wood Mackenzie’s analysis of future costs, Australia and the Middle East sit in the top echelons for solar irradiance and offer massive green hydrogen potential. With conversion and transport costs making up as much as two-thirds of the delivered cost of the interregional hydrogen seaborne trade, proximity to market will also be important. For supply to Northeast Asia, for instance, suppliers in Australia would appear to be ahead of the pack.

Delivered cost of green hydrogen to Northeast Asia, US$/kg (real terms) an illustration of likely trade routes

Note: Wood Mackenzie’s proprietary model examines costs for green, blue, grey and brown hydrogen from 2020 to 2050 for 24 markets. For simplicity, we present the green hydrogen delivered cost to Japan from potential suppliers, assuming a range of electricity prices, utilisation hours and system sizes. The chart shows ammonia as the ‘carrier method’ for shipping green hydrogen for use in power generation. If other carrier methods – liquid hydrogen or a liquid organic hydrogen carrier – are used for shipping and if the end-use requires reconversion, mid-stream costs may change significantly.

Sharma said: “Australia, in particular, stands out from the crowd in its track record of exporting a diverse set of natural resources and minerals, sheer physical scale, solar and wind resources and substantial potential for large-scale CCS.”

For Australia – as well as other major exporters – the opportunity to produce green hydrogen will help transform its energy export portfolio and align it with the changing needs of its trading partners. And as with Australia’s coal, iron ore and LNG industries in the past, buyers across Asia seem willing to invest and help develop it.

Sharma said: “A one-size-fits-all approach will not work. In a nascent market, hydrogen participants will need to adopt robust but flexible strategies and business models that support a potentially transformative development in the global energy transition. Today, a number of countries have the opportunity to harness their resources and, through hydrogen, become dominant exporters and players in low-carbon energy trading.

Thompson said: “Nonetheless, while the scale of these countries’ ambition and success will affect global energy systems in an unprecedented way, the irony remains that the dynamics of the future global trade in hydrogen are likely to look similar to those of traditional fossil fuels. Northeast Asia, including China, and Europe will be the big importers of hydrogen; Australia, the Middle East and, possibly, Russia and the US have the greatest potential to be big exporters.”

The statements, opinions and data contained in the content published in Global Gas Perspectives are solely those of the individual authors and contributors and not of the publisher and the editor(s) of Natural Gas World.