Mitsui & Co. completes acquisition of Texas shale gas asset

Japan’s Mitsui & Co. announced on June 24 the completion of its acquisition of a shale gas asset in Texas from exploration and production companies Sabana and Vanna. It did not disclose the value of the deal.

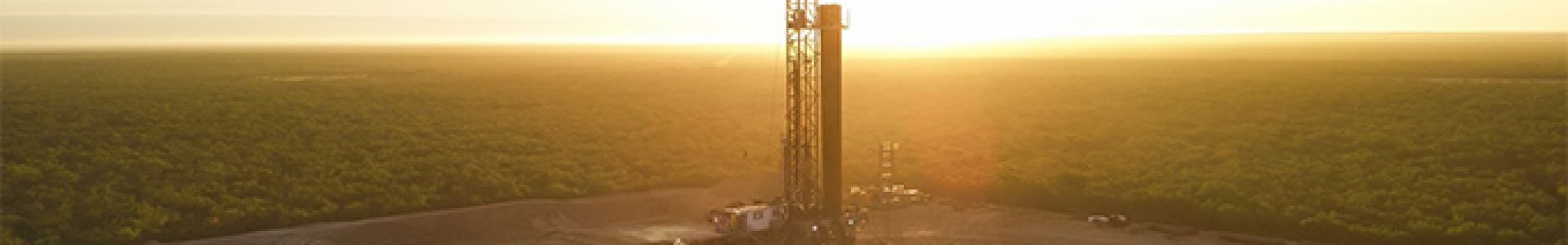

This asset, named Tatonka, spans 46,500 acres and provides access to the Gulf Coast industrial area, which includes LNG export terminals and ammonia plants.

Mitsui E&P USA, the US subsidiary of Mitsui & Co., will drill wells to evaluate well performance and develop and operate the asset, aiming for full-scale development after 2026. The strategic location of the Tatonka asset positions Mitsui to capitalise on the growing demand for natural gas in the US, driven by new LNG projects and increased electricity consumption.

In addition to this acquisition, Mitsui & Co. is actively promoting the liquefaction and export of US natural gas to global markets, as well as methanol production businesses using natural gas as feedstock. This expansion aligns with Mitsui’s broader strategy to enhance its presence in the US energy market.

Last year, Mitsui & Co. acquired a 92% working interest in another unconventional gas asset in Texas from Silver Hill Energy Partners, further solidifying its commitment to growth in the region.

The company also has a stake in Sempra’s Cameron LNG export plant in Louisiana.