National Grid Chief says Labour Policy Makes No Sense

The chief executive of the UK’s National Grid has said it would make no sense to re-nationalise the company; he also said last week's worldwide ransomware attacks had had "no impact" on it. The firm May 18 reported 12-month operating profits to end March 2017 of £4.1bn ($5.3bn), flat year on year.

The company runs national gas and power grids in the UK, regional ones in the US Northeast, plus some other assets like the Grain LNG terminal.

Two days ago in its manifesto, the UK's main opposition Labour party said it would renationalise the company if it won the UK election on June 8.

NGrid CEO John Pettigrew told an analysts briefing on the results May 18 that the company had achieved "phenomenal efficiency savings" since it was privatised and was renowned worldwide as a safe operator: "So to spend billions of pounds on renationalisation doesn't look sensible to us." NGrid would work with whatever government is elected, he added: "But clearly we do not view this as a good idea."

Labour argues that NGrid and other energy networks have not reinvested enough in infrastructure. However in its results, NGrid pointed to a 13% year on year rise in capital investment to a “record” £4.45bn, although half (£2.25bn) was in its US regulated business – half of that on US gas upgrades.

Pettigrew also said that last week's worldwide ransomware attacks had had "no impact on National Grid."

Net profit after tax from continuing operations was £1.81bn, down slightly from £1.9bn in the year to March 2016. The latest figure was net of a recently completed sale of 61% of its UK gas distribution business (since renamed Cadent) from which NGrid said it would return £4bn to shareholders.

NGrid’s existing price control for UK gas and electricity transmission ends in 2020-21, said Pettigrew told analysts, and it hadn't yet begun talks with regulator Ofgem on issues relating to 'return on capital' issues. As regulator, Ofgem is able to disallow investments where it sees no value, so its role might be reduced under a Labour government that wants more investment.

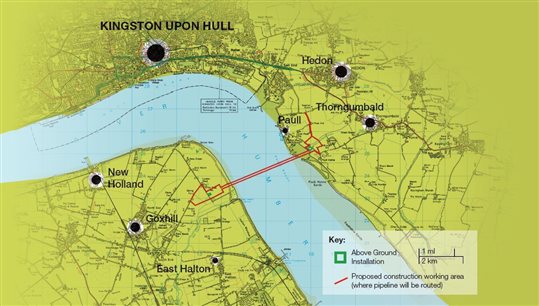

The company though upped investment in its UK high-pressure gas transmission grid (unaffected by the Cadent divestment) reflecting a higher spend on its ‘Feeder 9’ project to build a gas pipe under the Humber estuary (map below). New techniques were used to reduce construction costs, said Pettigrew.

National Grid CEO John Pettigrew (Photo credit: the company)

The company announced formation of a new division, National Grid Ventures, to include its interconnectors, Grain LNG and metering businesses. Grain LNG, one of Europe's largest import facilities in capacity terms, increased operating profit by £2mn to £74mn, due to an increase in LNG reloading and road tankering activities, and in 2016-17 completed its 100th road tanker reload.

NGrid unworried by UK gas security issues

Pettigrew said that UK gas storage costs had been falling typically by 6%-8% per year – a factor that has reduced investors’ appetite – and said NGrid’s position is that “gas storage should have access to as many markets as possible” but gave no indication that the company plans to investing itself.

Answering an analyst's question on gas security of supply, Pettigrew said NGrid has “no concerns on this” as it had explained in its recent Gas Outlook report; it will update its view in its Winter Outlook report.

NGrid said that construction will begin later this year on its 3rd new power interconnector project, each of 1GW: this 720km ‘North Sea Link’ to Norway would be operational by 2022. Meantime the 130km ‘Nemo Link’ to Belgium has already started construction and is planned to start up 2019. And a 230km IFA2 interconnector to France, approved by NGrid’s board late 2016, is expected to start construction early 2018 and be operational in 2020.

Humber estuary gas pipeline project (Map credit: National Grid)

Mark Smedley