[NGW Magazine] Iran needs $500mn to cut flaring

This article is featured in NGW Magazine Volume 2, Issue 17

By Dalga Khatinoglu

Iran says €500mn is needed to cut flaring at the South Pars gas field’s processing plants, which now stands at about 3.5-4bn m³/yr. South Pars is the world’s biggest non-associated gas field, of which a third (14 trillion m³) is in Iran. It is divided into 24 phases and has 13 processing plants.

Signing a contract with French Sofregaz, the director of South Pars Oil and Gas Company (POGC) Mohammad Meshkinfam said September 6 that about 75% of global flaring happens in ten countries, of which Iran ranks third, with 10% of the total. The second processing plant, for which Sofregaz won the flaring reduction contract, processes 20bn m³/yr from phases 2 and 3. He said that the payback period of investment would be less than a year.

According to the World Bank, Iran’s gas flaring rose from 12.1bn m³ in 2015 to 16.4bn m³ in 2016. Part of the rise in flaring is due to the re-opening of oil wells after sanctions were lifted in January 2016 and another part is related to the commissioning of new plants at South Pars. About a third of Iran’s associated gas production from oil fields is flared.

Meshkinfam said that completing phases 11, 13 and 21-24 at South Pars would cost some $20bn on top of the $70bn spent already. He added that €500mn would be allocated to curb flaring totally. There are now 10 plants active in South Pars, with three more in the next three years.

More compression to come

Three years after launching two gas compressors at South Pars gas field’s ninth processing plant to cut flaring by 250mn m³/yr, Iran is preparing to commission four more compressors there.

The plant takes gas from Phase 12, the biggest phase of South Pars with nominal output of 30bn m³/yr production capacity. So far it has only produced 23.7bn m³/yr according to an official document, obtained by NGW. Iran drilled fewer wells than the initial plan due to early pressure fall in that section of field.

“One of the gas compressors will become operational soon, and three more before November 2017,” the head of South Pars Phase 12 project Mohammad Mehdi Hashemi told local Fars News Agency September 4. Hashemi added that another six compressors are needed to collect propane as well.

The head of health, safety and environment at Pars Special Economic Energy Zone Bahram Dashtinejad told NGW that the amount of gas flared in the first five processing plants of South Pars (which process 90bn m³/yr from phases 1-10) was about 2.9bn m³/yr in 2008, but this was down to 415mn m³/yr in 2015. “However, the amount flared at the newly launched South Pars processing plants 6,7 and 9 rose from 0.23bn m³/yr in 2014 to 2.994bn m³/yr”.

Last year Iran added 25bn m³ to South Pars output and when all 24 phases are functioning, the total will be about 255bn m³/yr. Iran says its gas production level since March 21 has gone up 15% to 68bn m³.

Caspian gas another decade away

An Iranian official has said that the country needs at least ten years to extract first oil and gas from Caspian fields.

A month after Iran’s oil minister announced that no foreign company is interested in participating in Iran’s oil and gas projects in Caspian Sea, the head of engineering affairs of Khazar Exploration & Production (Kepco) Masoud Matinfard told state-run Shana September 4 that Iran has faced challenge in Caspian projects owing to the depth of the sea, out of date technology, and access to free water as well as the high cost of any oil and gas it could produce.

If Iran were to start developing projects in the Caspian Sea today, the first oil and gas are ten years away, he said. “Iran has delayed a lot and now it should accelerate the development of projects, at least in exploration operations.”

Iran established South Caspian Study Group in 1999, composed of Kepco, Anglo-Dutch Shell, Lasmo (now Eni) and Veba Oil to study Iran’s sector of Caspian Sea. After 22 months, 86 geological structures were explored, 46 of which were in better conditions. Eight were finally selected for a comprehensive study for exploration and production.

In recent years, Iran negotiated with Russian Lukoil, Norwegian Statoil and Danish Maersk Group to convince them to participate in Caspian projects, but no result was achieved. The water in the Iranian side of Caspian Sea can be 1 km deep, compared with the Azeri side where it is often only a few hundred metres.

Iran carried out 3-D seismic operations in 4,000 km2 of the Caspian Sea in blocks 6, 7, 8 and 21 between 2003 and 2005, but after the Pejvak seismic vessel caught fire in 2005, Iran hasn’t conducted any further seismic operations there.

Azeri geologists have looked at the Iranian side of the sea as well: once before the fall of the Soviet Union, and again in 1994 and 1995, but to no avail. Until 2011 the existence of oil and gas reserves in Iran's share of the Caspian Sea was unclear.

Iran has offered four projects in the Caspian Sea to foreigners for exploration and development: blocks 24, 26 and 29 and the Sardar-e Jangal oil field.

Iran announced in 2012 that while drilling a 1,000-metre well below the surface of the Caspian Sea it found a gas field at 700 m. A year later, Tehran announced the field (Sardar-e Jangal) was in fact an oil field with a gas layer. The rig is being repaired after a year at block 6.

Sardar-e Jangal is at block 6. It measures 24 km by 6 km in 750 m water depth. Iran has drilled two exploration wells and reportedly the field holds 2bn barrels of in-situ crude oil, with an API of 39. Blocks 24 and 29 are about 130 km north of the port of Nowshahr at depths of 600-800 m and cover 200 km².

Block 26 is 100 km north-east of the port of Anzali port at a depth of 850-900 m and covers 384 km².

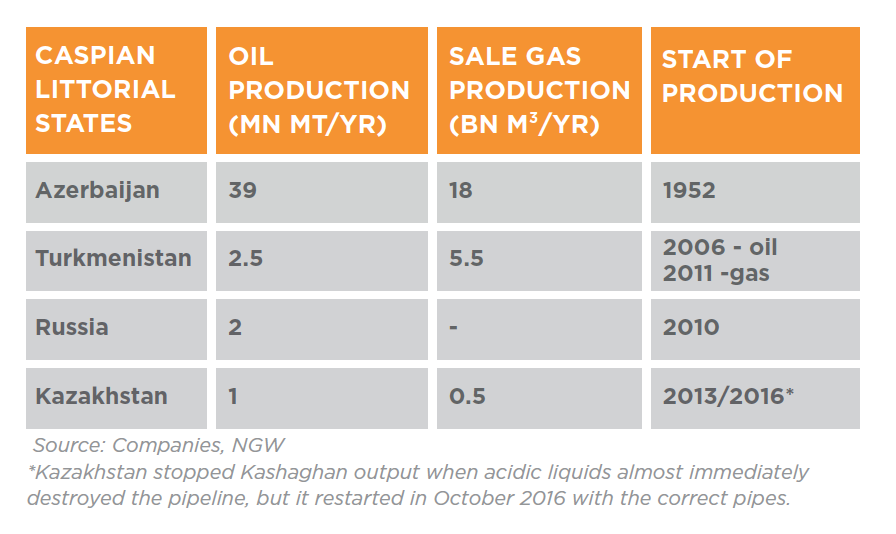

Iran is the only Caspian littoral country that doesn’t extract oil and gas from Caspian Sea.